At the finish of October 29, TRON founder Justin Sun withdrew billions of bucks in money from the Aave Lending Protocol (AAVE) for unknown good reasons.

According to blockchain information, Justin Sun has withdrawn above two.one billion USD ETH, one.one billion USDC, 681 million USD WBTC, 188 million USDT and 45 million USD TUSD, for a complete worth of four.two billion USD, from the Aave Loan Protocol (AAVE) overnight.

A handful of fast calculations on how considerably Aave’s Justin Sun this morning.

ETH – $ two,116,753,700

USDC – $ one,184,244,117

WBTC – $ 681,409,607

USDT – $ 188,079,787

TUSD – $ 45,116,588Total $ four.2B

– Steven (@Dogetoshi) October 29, 2021

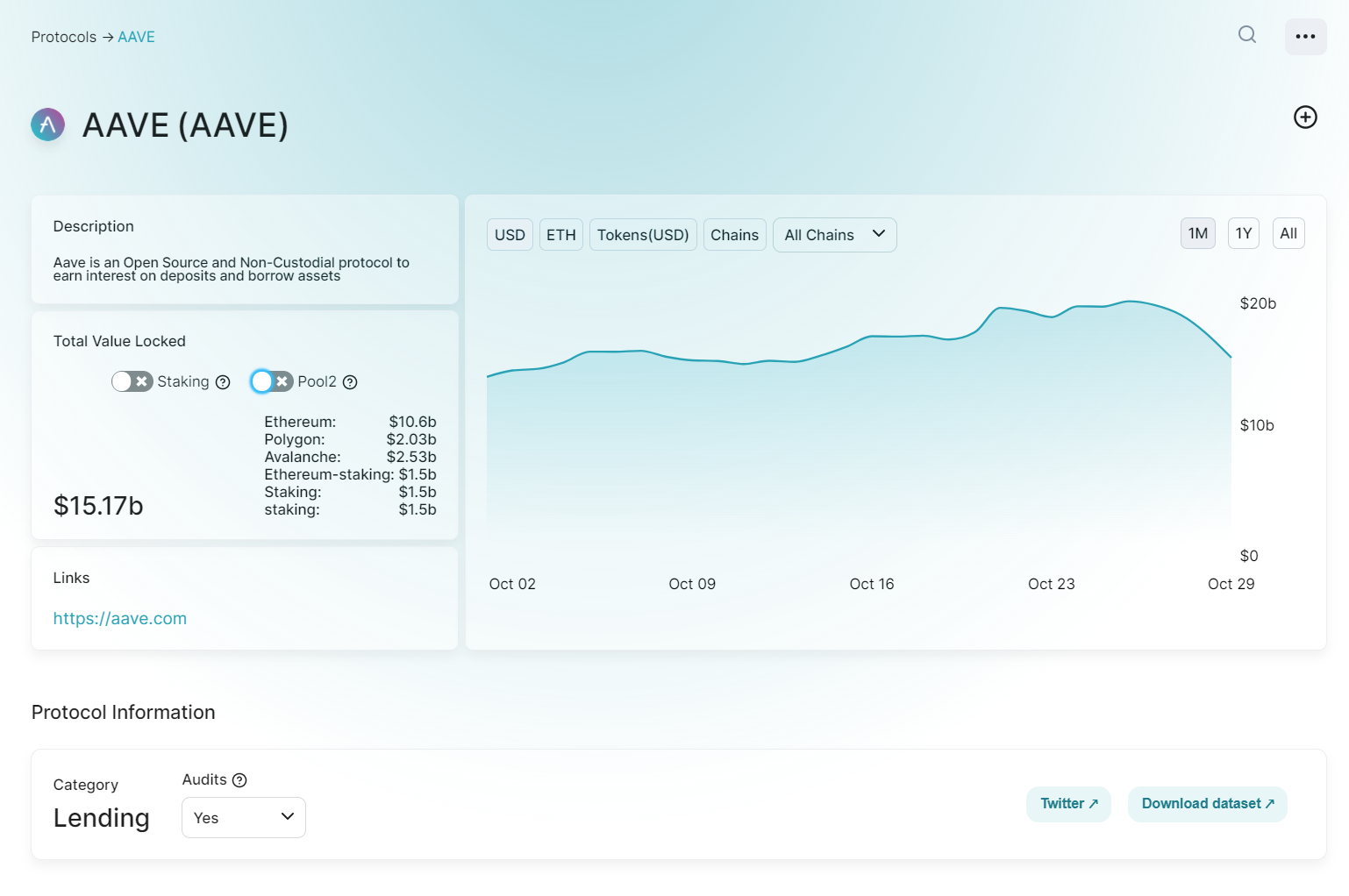

The influence of this “leak” is obviously proven by way of the important worth statistics (TVL) on Aave. From the TVL of USD 18.48 billion on October 28, the project’s TVL as of October 29 is only USD 15.one billion.

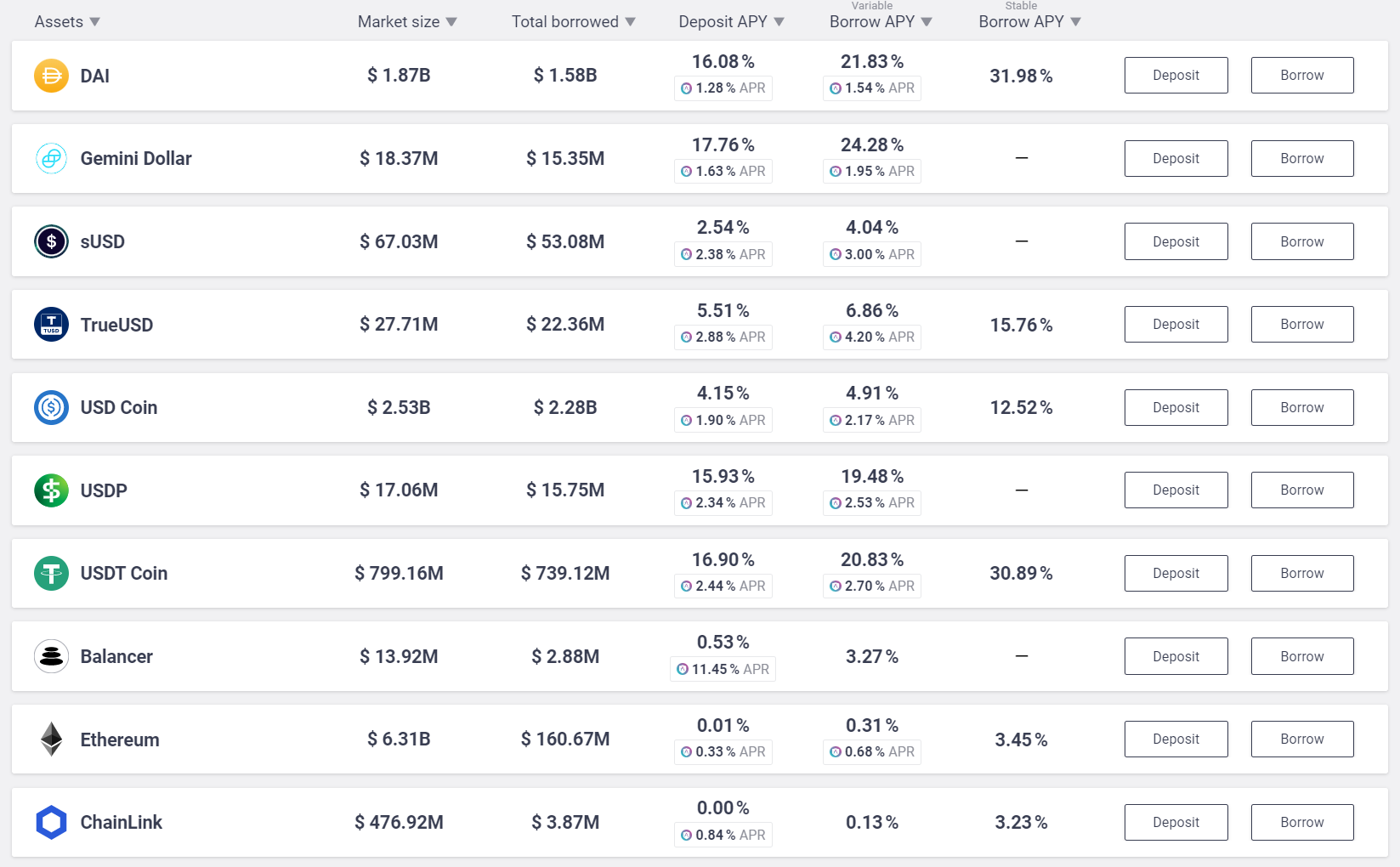

With liquidity draining so quick, APR yields on Aave have skyrocketed. Compared to a every day APR of only six.five%, Aave’s APR at press time has jumped to almost 25%, attracting a lot of other people to move money into Aave.

The selling price of the AAVE token was not considerably impacted by the over occasions, except for the current pump thanks to its listing on the Korean exchange Upbit.

It is even now unclear why Justin Sun withdrew this kind of a massive quantity of funds from Aave. However, on the evening of October 29, Aave announced that it would suspend the lending perform of particular pools as a precaution due to issues about protection holes.

The probability of a vulnerability in Aave is even additional founded, stemming from the current dispute concerning the growth crew Yearn Finance and Aave, the two principal DeFi protocols on Ethereum.

Notably, following the current $ 130 million flash loan assault on Cream Finance, a lending platform in the Yearn ecosystem, developers at Aave claimed that Yearn did not care about consumers when they left. had previously been visited by hackers twice in 2021. In response, a major developer at Yearn Banteg “half-opened” that Aave should not be “bold” when they themselves have a vulnerability that can influence the whole quantity of funds they have. the venture is managing.

Watching this battle concerning Aave and Yearn is like viewing your dad and mom get divorced.

Pain, guys. Ache. pic.twitter.com/1xy6LCDlUT

– ️🩸Fiskantes in Lisbon until finally November 15 (@Fiskantes) October 29, 2021

Yearn Finance founder Andre Cronje himself also confirmed that Aave is also at threat of encountering the exact same protection vulnerability as Cream Finance.

Aave core following a 24-hour libel marathon about the want to exploit the cream, when Aave is vulnerable to the exact same exploit. How is the disclosure of risky money going to your consumers? 2nd complete protocol exploit. Tell me yet again how considerably greater your security is. https://t.co/OahM8BJS9w

– Andre Cronje 👻 (@AndreCronjeTech) October 29, 2021

“24 hours after the Cream attack, the Aave team is still mocking Yearn, while Aave itself may be exploited by the same vulnerability. Have you informed the user of the amount they would be affected? Are you sure your security is better than the our?”

This is not the only controversy in the Ethereum DeFi neighborhood these days. As reported by Coinlive, developer OlympusDAO not long ago announced a suspension of perform with the venture following a conflict with a further fork venture.

Synthetic currency 68

Maybe you are interested: