Konomi Oracle will be paid in the kind of no cost use of Oracle in conjunction with NFT Bonds. To get benefit of Konomi’s no cost Oracle services, end users only require to acquire the authentic Bond NFT from the Konomi site. Bond NFT is Konomi’s initially bond item that enables end users to acquire and trade NFTs on the secondary marketplace and get pleasure from the financial worth of the bond as if it had been a regular bond.

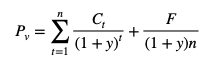

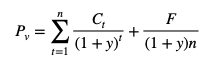

For illustration, if Jack decides to use Konomi Oracle these days, he will require to enter the Bond NFT money flows into the application, as effectively as the encounter worth and shelf existence. Each bond NFT will have a exceptional code related to that of a Treasury bond and will be marked with the bond’s curiosity payment date, the quantity of curiosity paid … Currently, the parameters are Cash Flow> = 0kono, encounter value> = 12000kono, t> = twelve and y = thirty% (the values will transform in accordance to marketplace fluctuations). Now, assuming Jack fills in C of 100kono, F of 15,000kono, and F of 15 months, the following equation for Pv, the original bond value, is = 10821.72Kono.

y = yield to maturity (three%)

C = money movement (> = )

F = encounter value> Cost

After 15 months of termination, Jack will acquire a regular monthly bonus of one hundred Kono for the initially 14 months and a ultimate bonus of twelve,one hundred Kono for the 15th month, in addition to the Oracle services. Jack, the authentic proprietor of the bond, can promote the NFT at any time on the secondary marketplace at any value, immediately after which Jack nevertheless has entry to Oracle but the earnings produced by the NFT will be passed on to the existing proprietor of the NFT.

Konomi will invest 75% of the proceeds from the NFT bond sale to shell out bondholders, the remaining twenty% will be employed as Oracle’s decentralized governance reserve to shell out validators, and the remaining five% to reward improvement teams.

About Konomi Network

Konomi network is a finish remedy for asset management electronic funds crossed chain. Konomi is created on Polka dot Substrate, the task was born with the aim of supporting additional assets in the Polkadot ecosystem. Users can deal with, exchange assets and earn curiosity by way of Defi goods. Konomi has also launched its native token to initiate liquidity and decentralized governance.

Maybe you are interested:

Note: This is sponsored information, Coinlive does not straight endorse any info from the over short article and does not ensure the veracity of the short article. Readers really should perform their very own analysis just before creating choices that have an effect on themselves or their corporations and be ready to get duty for their very own options. The over short article really should not be regarded as investment information.

Konomi Oracle will be paid in the kind of no cost use of Oracle in conjunction with NFT Bonds. To get benefit of Konomi’s no cost Oracle services, end users only require to acquire the authentic Bond NFT from the Konomi site. Bond NFT is Konomi’s initially bond item that enables end users to acquire and trade NFTs on the secondary marketplace and get pleasure from the financial worth of the bond as if it had been a regular bond.

For illustration, if Jack decides to use Konomi Oracle these days, he will require to enter the Bond NFT money flows into the application, as effectively as the encounter worth and shelf existence. Each bond NFT will have a exceptional code related to that of a Treasury bond and will be marked with the bond’s curiosity payment date, the quantity of curiosity paid … Currently, the parameters are Cash Flow> = 0kono, encounter value> = 12000kono, t> = twelve and y = thirty% (the values will transform in accordance to marketplace fluctuations). Now, assuming Jack fills in C of 100kono, F of 15,000kono, and F of 15 months, the following equation for Pv, the original bond value, is = 10821.72Kono.

y = yield to maturity (three%)

C = money movement (> = )

F = encounter value> Cost

After 15 months of termination, Jack will acquire a regular monthly bonus of one hundred Kono for the initially 14 months and a ultimate bonus of twelve,one hundred Kono for the 15th month, in addition to the Oracle services. Jack, the authentic proprietor of the bond, can promote the NFT at any time on the secondary marketplace at any value, immediately after which Jack nevertheless has entry to Oracle but the earnings produced by the NFT will be passed on to the existing proprietor of the NFT.

Konomi will invest 75% of the proceeds from the NFT bond sale to shell out bondholders, the remaining twenty% will be employed as Oracle’s decentralized governance reserve to shell out validators, and the remaining five% to reward improvement teams.

About Konomi Network

Konomi network is a finish remedy for asset management electronic funds crossed chain. Konomi is created on Polka dot Substrate, the task was born with the aim of supporting additional assets in the Polkadot ecosystem. Users can deal with, exchange assets and earn curiosity by way of Defi goods. Konomi has also launched its native token to initiate liquidity and decentralized governance.

Maybe you are interested:

Note: This is sponsored information, Coinlive does not straight endorse any info from the over short article and does not ensure the veracity of the short article. Readers really should perform their very own analysis just before creating choices that have an effect on themselves or their corporations and be ready to get duty for their very own options. The over short article really should not be regarded as investment information.