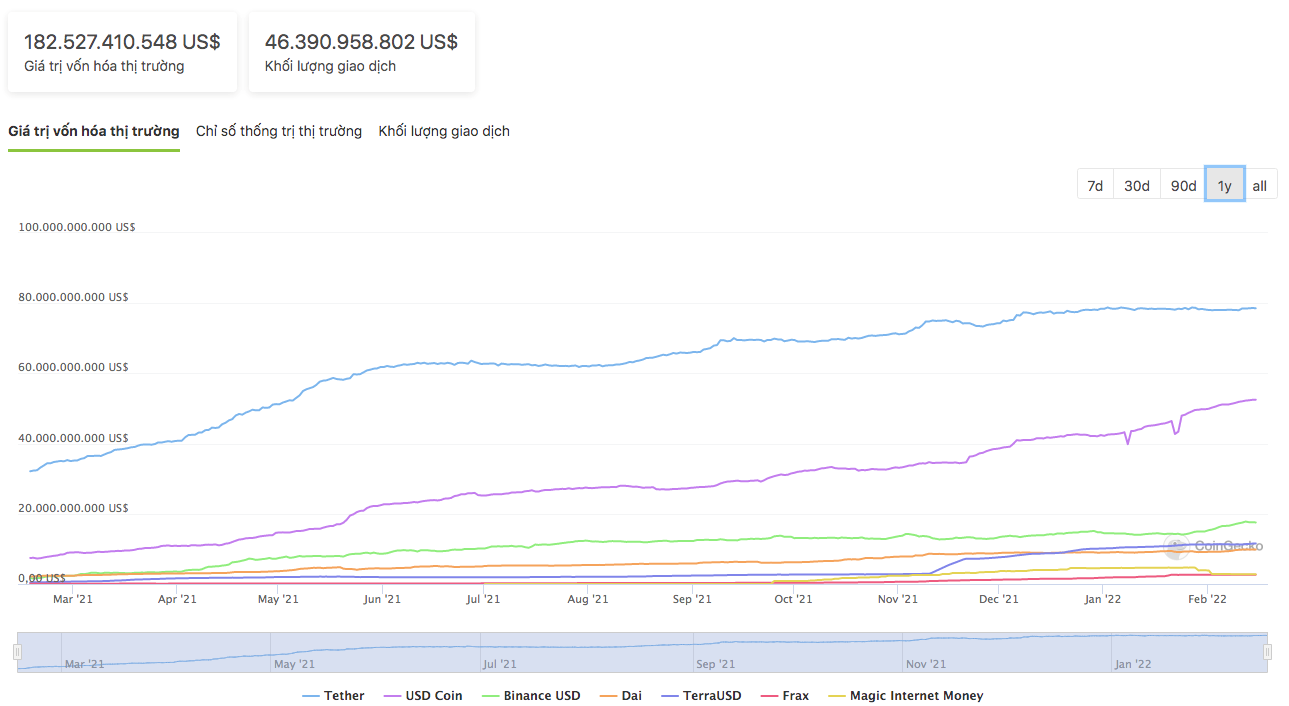

Stablecoins have extended been in contrast to the “life blood” of the cryptocurrency market place. Almost all market place pursuits demand the use of stablecoins, from trading, DeFi farming / staking, to obtaining NFTs, GameFi, and so on. Therefore, with the explosion of the cryptocurrency market place in latest occasions, the complete capitalization of stablecoins has also seasoned remarkable development.

If at the starting of 2021 the complete capitalization of the major stablecoins is all over 27.four billion bucks, at the starting of 2022 this amount reached nearly 171 billion bucks, equal to an raise of 524%.

In addition to effectively-recognized stablecoins this kind of as USDT (Tether), USDC, BUSD or DAI, in the 2nd half of 2021 the market place has witnessed an explosion of algorithmic stablecoins, also recognized as “algorithmic stablecoin”. In this posting we will understand and decipher the functioning mechanism of these algorithmic stablecoins.

Three stablecoin complications

The stablecoins have been produced with the aim of keeping “stability”. However, based on the ensure, the working mechanism and the goals, just about every form of stablecoin will have distinctive strengths / drawbacks. All in all, stablecoins presently encounter 3 major complications that will need to be solved concurrently, like:

- Decentralization

- Stabilization

- Effective use of capital

Decentralization

Stablecoins like USDT, USDC or BUSD are also dependent on 1 institution, so if there is a dilemma (legal, organizational employees or other …), these stablecoins can get rid of stability (rate drops) and injury the whole market place. . Decentralization of stablecoins grew to become more and more talked about as DeFi exploded and DAI appeared.

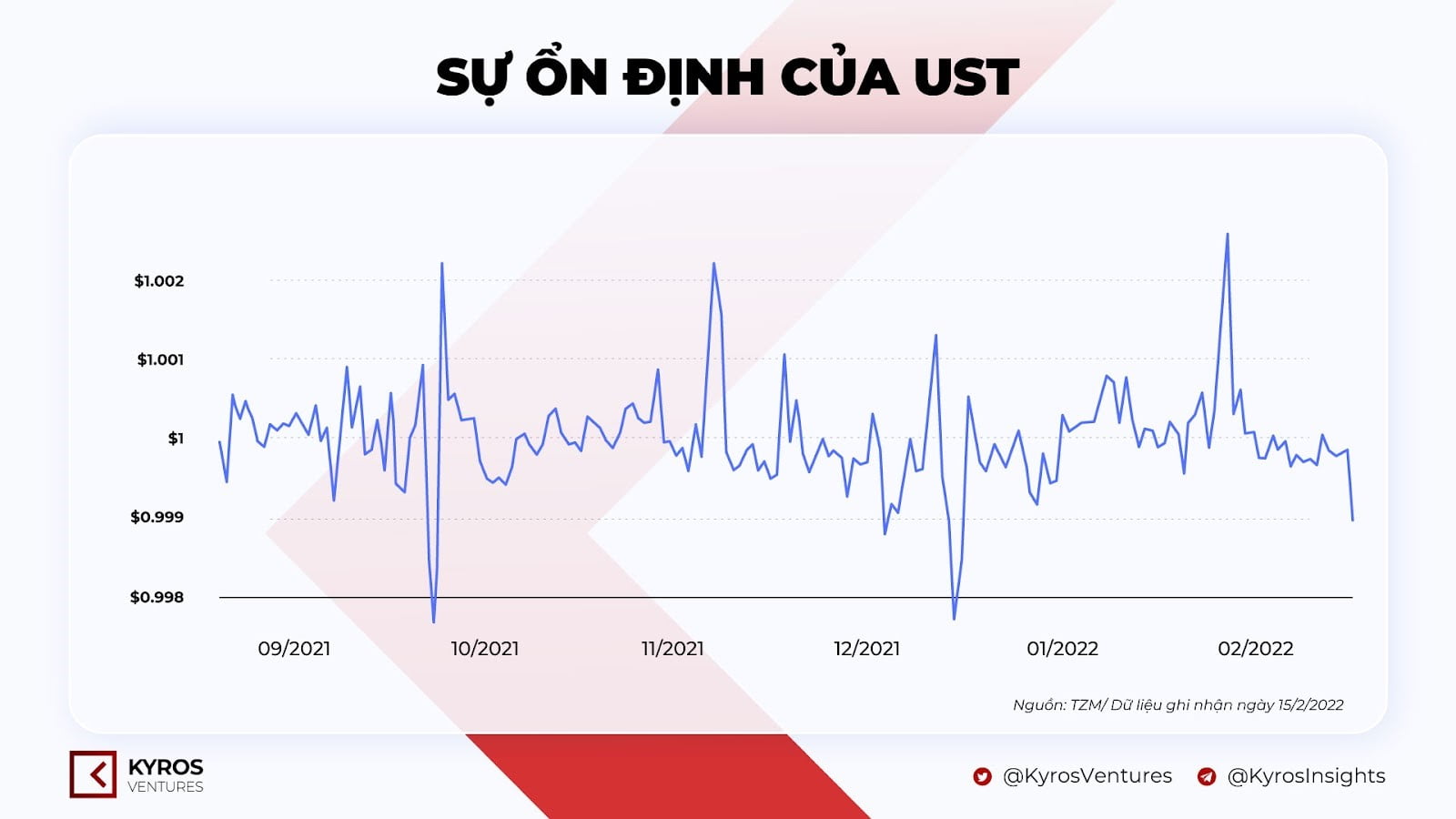

Stabilization

In the historical past of the market place, there have been occasions when stablecoins are “unstable”. USDT, UST or several other stablecoins have had trading occasions of significantly less than one USD due to Fud, Panic Sell … Maintaining stability all over the closing rate is a prerequisite for the existence and improvement of a stablecoin.

Effective use of capital

Basically, when issuing stablecoins, just about every venture desires a sure volume of assets (fiat, cryptocurrency …) to be protected. At that time, the powerful use of the capital is established. Specifically: to difficulty one USDT, one USDC, one FRAX…, how several ensures does the venture will need?

Solving all 3 of these complications concurrently is a challenge for stablecoin tasks. If the venture is in the direction of stability, the operational mechanism desires several ensures, also sacrificing decentralization. Conversely, when the venture moves in the direction of decentralization, capital efficiency, in several circumstances, can be at danger of stability. This is a challenge as effectively as an possibility for stablecoin tasks, primarily Algorithmic Stablecoin.

well-liked stablecoins

To greater comprehend Algorithmic Stablecoins, initially of all, we will need to briefly comprehend some of the stablecoins presently on the market place.

Depending on the criteria, we have several distinctive strategies to classify stablecoins.

When based mostly on ensures, stablecoins can be divided into:

- total reserve stablecoins: it is a stablecoin with reserve assets equivalent to the issued stablecoin. For illustration: USDT, USDC …

- partial reserve stablecoins: it is a kind of stablecoin that has portion of its reserve in secure coin and the rest is absorbed by way of a different token (generally the venture governance token). For illustration, FRAX and FXS.

- Over-collateralized Stablecoins: A kind of stablecoin with a reserve asset better than the difficulty worth. For illustration: GO, GO …

- stablecoin without having reserve: it is a kind of stablecoin that has no reserve assets but employs algorithmic mechanisms to equalize charges. Example: Cash basis

If based mostly on the rate equilibrium mechanism, stablecoins can be divided into:

Redeem and Expand: employs the will need to revenue from arbitrage and an exchange mechanism in between stablecoins and collateral to equalize charges.

For instance:

- If USDC in the market place is at $ .9 < $ 1, gli utenti possono acquistare USDC sul mercato, quindi scambiarlo di nuovo con USD => make a revenue. The obtaining force returned the USDC to $ one.

- If USDC on the market place is at $ one.05> $ one, the issuer or consumer can use USD as collateral and acquire it in USDC => promote it on the market place for $ one.05 => make a revenue. The sale forces USDC back to $ one.

This is 1 of the critical mechanisms for stabilizing stablecoin charges.

Stablecoin CDP: it is produced by locking the safety sources in the protocol (generally cryptocurrencies). DAI is the common stablecoin in this kind.

Algorithmic: use a blend of added algorithms to assistance rate balancing.

Some common algorithmic Stablecoins

Seigniorage

The word “seigniorage” in common finance indicates the variation in between the encounter worth of revenue and the expense of manufacturing. If you print $ one and the print expenditures $ .03, seigniorage is $ .97.

Seigniorage stablecoins normally have a multi-token model:

- Stablecoin

- Share Token for Shareholders

- The bond tokens signify the debt of the protocol

The mechanism of operation of this kind of stablecoin is as follows:

- Stablecoin price> one USD: Stock token is made use of to raise stablecoin token provide => rate falls once more

- Stablecoin Price <1 USD: Issue of a redeemable Bond token as an incentive for traders when the price falls below the target price.

In case the Stablecoin price < $ 1, l'utente acquisterà token obbligazionari in cambio di stablecoin (al ritorno al prezzo di chiusura) => will earn profit by purchasing stablecoins at a discounted price (based on the purchase of bond tokens).

Relining

Rebase is a mechanism that helps algorithmic stablecoins maintain the $ 1 price by adjusting the token’s circulating supply.

- > $ one: Increase the token provide

- <$ 1: decrease in token supply

- = $ 1: keep nguyên token supply

Rebase only changes the amount of tokens you have in hand but still retains the total value, instead of having a volatile price, here you will have fluctuations in the number of tokens held.

Fractional segmentation model: This model has been applied by the Frax project and is very successful (we will analyze it more closely in the next section).

The Earth model: combines the use of seigniorage and contraction algorithms with LUNA tokens to balance prices.

Analysis of some typical Algorithmic Stablecoin projects

FSO and Luna

UST is a stablecoin in the form of a full reserve and operates according to the mechanism of the algorithm. The value of UST will be guaranteed by LUNA.

The FSO price stabilization mechanism

To keep UST at ~ $ 1, price movements will be converted to LUNA from Earth using seigniorage and contraction phases.

Seigniorage Phase: Occurs when UST> $ one

Example: When UST on the market place reaches $ one.05, consumers can use LUNA to burn up mints on UST. At this stage, the consumer can trade $ one of LUNA for $ one UST and promote it on the market place for one.05 to make a revenue. This produced solid offering stress which pushed UST’s rate back to $ one.

Seigniorage will raise UST’s provide, when LUNA’s provide will lessen.

The burnt MOON will be divided into two components:

- A portion of LUNA is incorporated in the local community treasury

- A portion of LUNA is assigned to the validators

The seigniorage phase will raise the worth of LUNA:

- (one) Usually, the LUNA positioned in the Community Treasury is voted in favor of the venture, for illustration by burning the full. Therefore, you can normally see Earth continually burning a big volume of MOON.

- (two) Validators are rewarded with LUNA, mixed with (one) LUNA rate raise => extra LUNA owners want to aim to develop into Validators => decreasing LUNA’s provide on the market place.

Contraction phase: Occurs when UST <$ 1

For example, UST trades on the market for $ 0.95. At that point, the user can buy UST from the exchange (for $ 0.95), enter the protocol in exchange for LUNA at the rate of $ 1 UST to get $ 1 worth of LUNA and make a profit. This creates buying power for UST in the market => UST rate slowly returns to $ one.

This time period will cut down UST’s provide, raise LUNA’s provide, generate a brief phrase LUNA income force => negatively influence LUNA hodlers or LUNA validators.

Balanced answer and additional worth for LUNA

In reality, the Contraction phase will entail huge losses to the Validators and LUNA Holders, in individual to the validator (the amount of LUNA tokens holds a good deal, the blocking / unblocking time is extended …).

To treatment this, to sustain Validator, Terra has taken several measures this kind of as:

- Award validators with LUNA through the seigniorage phase.

- Participation in the gasoline tax and transaction tax for Validator.

- Airdrop bonus of new tasks on the ecosystem for the staking of LUNA.

So far, it can be mentioned that Terra is even now effective and generates good worth for LUNA holders. The amount of LUNA episodes has improved appreciably in latest occasions.

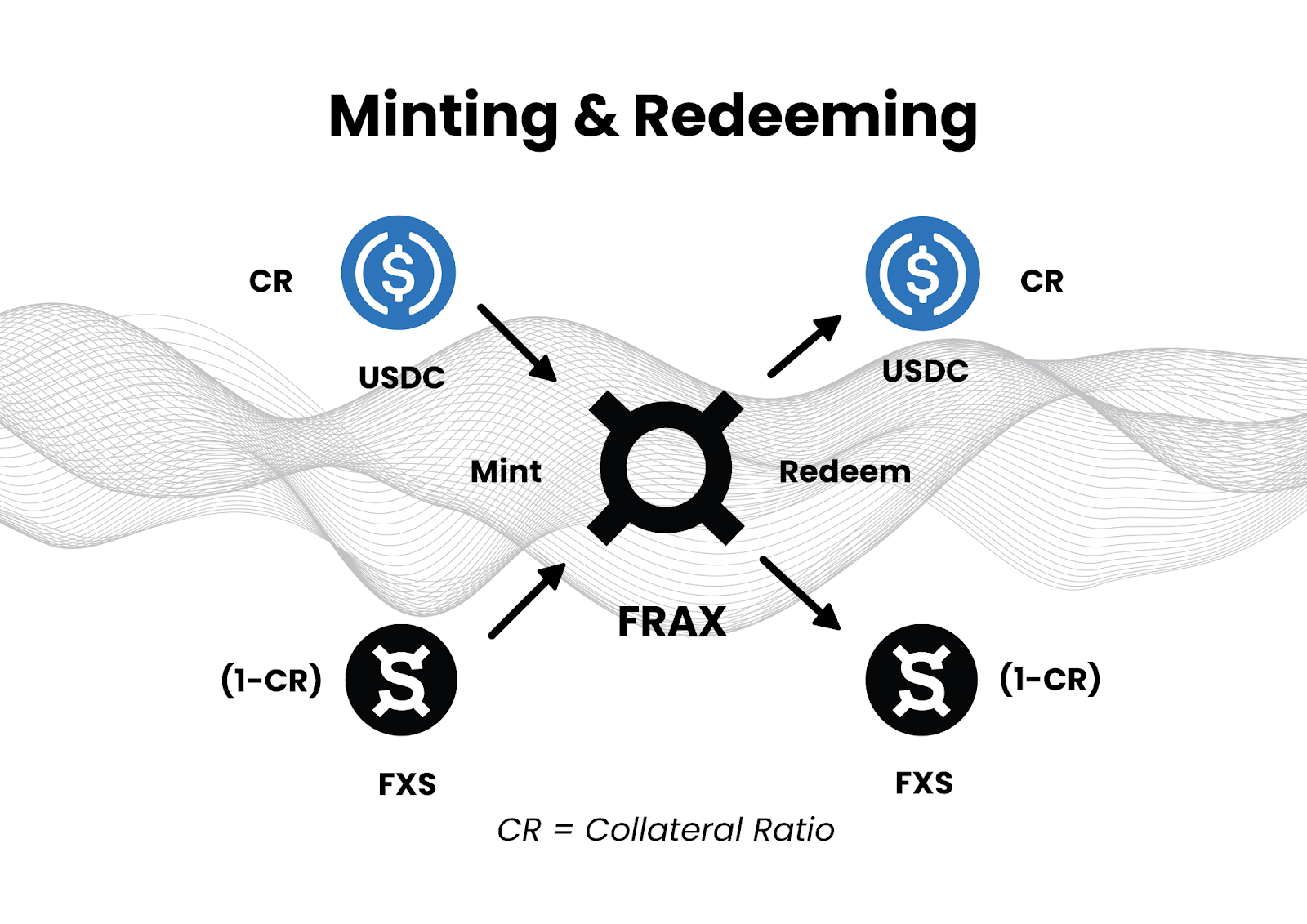

FRAX and FXS

Frax is the initially fractional algorithmic stablecoin method. Frax protocol is built with two tokens:

- Stablecoin FRAX

- Administration token FXS

The two-token method makes it possible for FRAX to be backed by each collateral and an algorithm (FXS burn up and repurchase mechanism). FRAX is produced when collateral and FXS are deposited into the Frax protocol contract. The volume of collateral expected to mint one FRAX is established by the collateral ratio. The Frax Mortgage Rate determines the partnership in between the collateral ratio (CR) and the algorithm that generates the FRAX worth of $ one.

FRAX’s rate stabilization mechanism

FRAX can normally be minted and redeemed by the method for $ one. This makes it possible for for FRAX arbitrage on the open market place.

- If FRAX> $ one, arbitrage possibility to mint FRAX tokens by inputting $ one well worth into the method for just about every FRAX and offering minted FRAX for> $ one on the open market place. Whenever to generate a new FRAX, the consumer ought to enter a worth of $ one into the method. The variation is basically the ratio of the collateral to the FXS that make up that $ one worth.

When FRAX reaches the a hundred% ensure charge (a hundred% of the worth is entered into the method so that the FRAX mint is a ensure). Then the protocol will move to the fractional phase, portion of the worth that enters the method through the minting approach will develop into FXS …