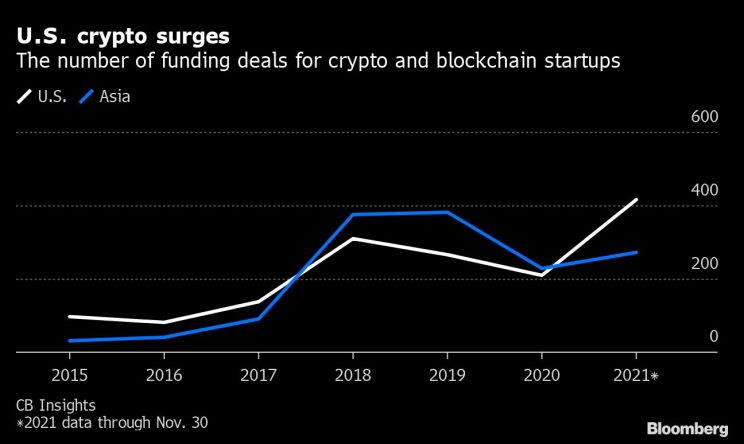

For the initial time in 4 many years, venture capitalists are favoring extra cryptocurrency and blockchain startups in the US than in Asia.

While China was the moment viewed as a cryptocurrency “capital”, the most current 2021 restrictions on tech firms have diminished the amount of cryptocurrencies and blockchain startups. CB Insights analyst Chris Bendtsen stated:

“Basically, we don’t see any transactions in China. In Asia alone, only the companies are actually based in Hong Kong, India and Singapore ”.

Beijing banned cryptocurrency mining and banking in mid-May and then banned all transactions in September, a lot of firms had to near or depart China to uncover a great regulator. Popular exchanges involve Huobi, KuCoin, Binance , BTC.com and Bitmain. Even the greatest mining pools in the planet give up and block Chinese IPs. China’s main crypto information internet site is also down, CoinGecko and CoinMarketCap are blocked by firewalls.

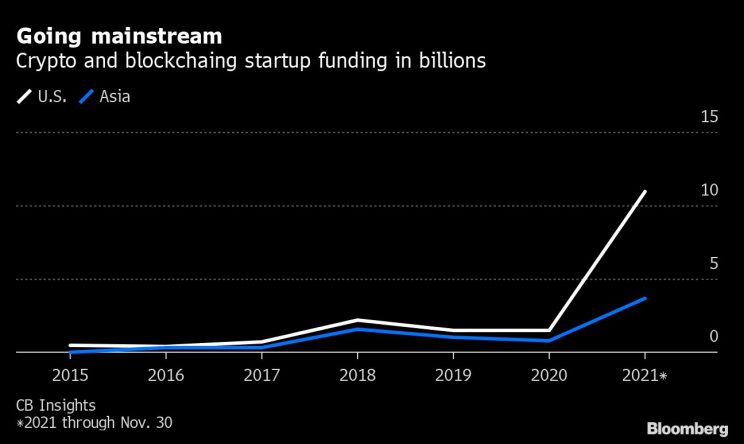

But as China progressively misplaced industry share, on the other side of the front line, traders in the US enhanced drastically. The fourth quarter of 2021 was the greatest quarter ever for industry participation. Globally, the worth of venture capital investments in the field grew from $ three.one billion in 2020 to $ 21.three billion as of November thirty, extra than 6 occasions.

The amount of investment offers in China has extra than halved considering that 2020, to 41 this yr. Meanwhile, the complete worth of funding for cryptocurrency and blockchain startups in the nation also dropped by about a third to $ 214 million. In the United States, the amount enhanced extra than 7 occasions to attain $ ten.9 billion by way of 417 offers.

In truth, the greatest investment money in the United States are working exceptionally actively with high quality investments in tasks originating in the United States. Not to mention the revenue facet from US companies’ Bitcoin mining stocks is extra appealing than BTC. The platforms “tagged” with China demonstrate a clear regression with respect to the standard image.

For illustration, investment money really worth billions of bucks. Typical of Andreessen Horowitz in Silicon Valley ($ two.two billion fund), Paradigm ($ two.five billion fund) and Hivemind Capital Partners ($ one.five billion fund) with Algorand (ALGO) as a method companion.

Additionally, crypto tasks that demand “huge” capital this yr can be cited as FTX ($ one.four billion), Sorare ($ 680 million), Solana ($ 314 million), Avalanche ($ 230 million) bucks), Arbitrum ($ 120 million) and OpenSea ($ a hundred million).

However, all these investment mobilizations have one particular factor in prevalent: “say no” to China. This is a signal that China’s crackdowns have manufactured the country’s cryptocurrency field significantly less appealing. From there, set up a reliable basis to restrict the country’s affect on the all round advancement of the complete industry.

Synthetic Currency 68

Maybe you are interested: