[ad_1]

What is the Kava Swap Project (SWP)?

Kava Swap is AMM with Cross-chain performance developed on the Kava Blockchain platform. As everyone knows, Kava Blockchain is predicated on Cosmos SDK. This means that you can reap the benefits of liquidity aggregation from varied Blockchains comparable to Binance Smart Chain, Ethereum and their current DeFi functions.

Kava Swap is among the high three structural platforms that make up the Kava Blockchain ecosystem, the opposite two names being Kava Protocol and Hard Protocol.

The position of Kava Swap for the Kava and Hard platform

Roles for the Kava Blockchain platform:

- Seamless exchanges between property on the Kava platform

- Trade cross-chain property between Kava, Ethereum, Binance Smart Chain, and many others.

- Exchange reward tokens (from Kava’s Lending / Browing, Yield Farm apps) into every other forex out there on the platform.

Kava Swap is among the three pillars of the Kava DeFi ecosystem that may drive the huge development of current functions. Each utility distributed on the Kava platform is mixed with different functions.

- Kava CDP permits customers to create stablecoins, which may then be staked into the HARD cash marketplace for revenue.

- Money Market Products Kava Lending and Hard Protocol

- Kava Swap creates liquidity and money move from the above functions.

Outstanding options of Kava

- To alternate – Seamless trading or swapping between property with assured liquidity

- Liquidity of the supply – Turn your digital property into productive property by offering a provide as capital – offering liquidity to the swimming pools utilized by AMM when trading between property.

- To acquire – Liquidity suppliers earn commissions from merchants and Kava Swap tokens by administering the platform by way of SWP tokens.

The Kava Swap Building Process

- Version 1: helps trading between BTC, XRP, BNB, BUSD, USDX, KAVA, HARD and SWP. Corresponding liquidity swimming pools will probably be created for every pair of marketable property to which liquidity suppliers can contribute. In model 1, the addition of latest property and help for brand new liquidity swimming pools will probably be out there by means of on-chain governance votes.

- Version 2: bundles all of the options into the Kava API the place it may be simply built-in into any crypto person enabled utility permitting its customers to trade and put their capital to work as a dealer offering liquidity. This launch can even embody some administrative and extensibility enhancements.

- Version 3: Smart liquidity bridge between Binance Smart Chain and the Ethereum ecosystem. Users will have the ability to allocate capital to liquidity swimming pools to have the ability to trade in numerous ecosystems, DEX and AMM.

- Version 4: Smart execution for extra swaps and ecosystem bridges the place Kava Swap can direct liquidity to quite a lot of DeFi functions and monetary providers.

Roadmap

June 30, 2021 – Block the Kava Swap code

- All the interior code of the Kava Swap module will probably be fully revised internally and “frozen”, permitting you to not add new options whereas beginning inside and exterior checks.

July 12, 2021 – Kava Swap encourages testnet

- Encourage customers to hitch tesnet

July 14, 2021 – Kava Swap audit accomplished

- Complete inside and exterior audits

July 21, 2021 – Decision on streaming

- Based on the suggestions from inside and exterior evaluations, along with the outcomes of the tesnet incentive, the choice to “Go Live” with Kava Swap for the Kava Validator neighborhood will probably be made.

8/12/2021 – Mainnet launch

- Launch of the discharge of Kava Swap for the manufacturing Kava DeFi platform. Next, a collection of administrative suggestions will probably be made to allow varied options of Kava Swap, making certain most distribution safety.

What are SWP Tokens?

SWP is the token of the Kava Swap platform. The traits of SWP are much like the present AMMs.

Some primary details about the Kava Swap (SWP) token

- Token title: Kava alternate token

- Ticker: SWP

- Blockchain: Kava Blockchain

- Standard tokens: updating

- Contract tackle: updating

- Circulation provide: updating

- Initial provide: 250,000,000 SWP

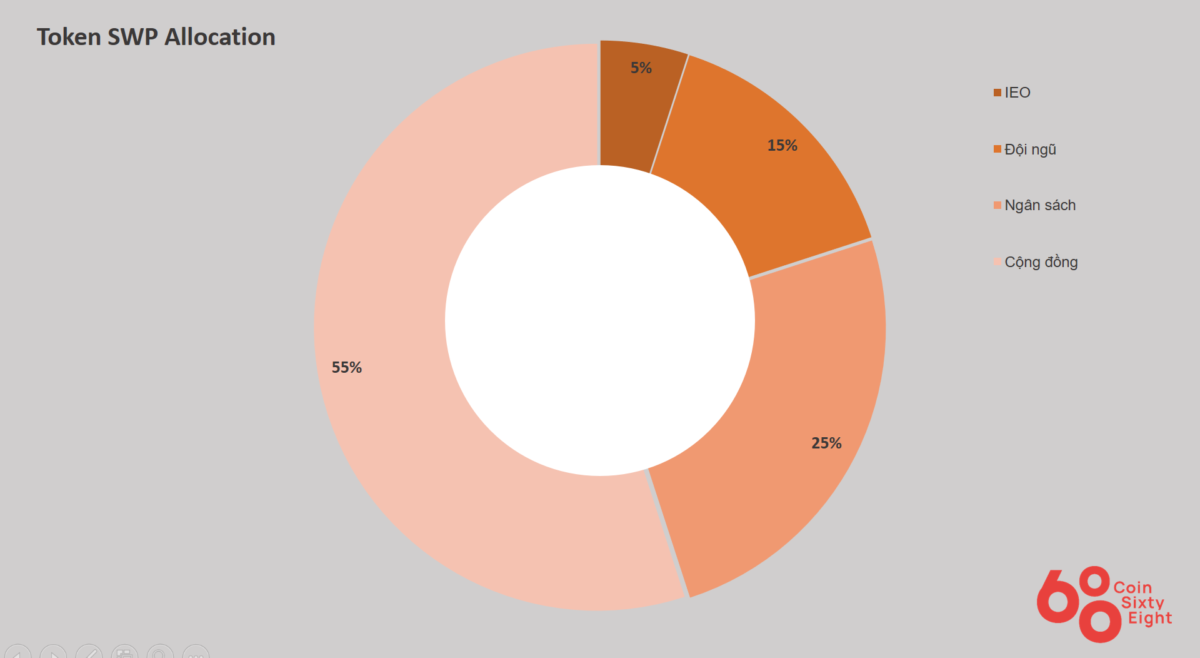

SWP Token Allocation

250 million Kava Swap Tokens will probably be minted upon initialization and will probably be accessible for a interval of 4 years. The preliminary allocation of the SWP token is as follows:

- IEO: 5%

- Team: 15%

- Budget: 25%

- Community: 55%

Project growth workforce

Updating

Partners and traders

Updating

How to earn and personal tokens

The Kava Swap IEO will happen quickly, keep tuned to the Coinlive channels for the newest updates.

Token storage pockets

Updating

The way forward for the Kava Swap mission, ought to I put money into SWP tokens?

Kava Swap is among the pillars of the DeFi utility that make up the Kava Blockchain ecosystem. Hard Protocol acts because the Yield Market, the mission will act because the Liquidity Hub. Users can use Kava to maximise their income on the Kava blockchain network. All data on this article is researched by Coinlive and doesn’t represent funding recommendation. Coinlive isn’t chargeable for any direct and oblique dangers. Good luck!

.

[ad_2]