What is Parasset?

Parasset is a new synthetic asset issuance protocol based on the core product of NEST (an oracle solution with on-chain access from the ETH ecosystem). Parasset realizes value creation, allowing existing native resources to be used to make parallel token pairs.

This is carried out by minting P-asset on Parasset using NEST, like minting ERC20 tokens like pETH, pUSD. P-asset users can take part in the NEST protocol’s price list, and the P-assets may also be used for different functions, such as liquidity, engaging in the profits of the protocol. Other DeFi, leverage…

What problem was Parasset made to fix?

Downtime risk denotes the period of time from the initiation of the mortgage before the tripping of liquidation.

Liquidation risk refers to the ability to moderately liquidate assets less than the collateralized ratio. Price motion is broadly valid in the long term (and can fluctuate in the short term, making liquidations ineffective ), and a downtime is when price hits the liquidation line.

Stability risk refers to changes in the value of security, strong fluctuations will cause users’ security to be liquidated.

How does Parasset fix the above issues?

Parasset is utilizing NEST oracle that’s completely decentralized. It is certain to be decentralized and there’s absolutely not any possibility of price manipulation. Borrowers, liquidators, and insurance companies have a clearer range of risk and equity. Fast minting and higher asset efficiency make concurrent assets secure in cost relative to the underlying assets. Together with the insurance pool layout, the danger mechanism is more complete.

The hazard mechanism has an significant role in financial development and Parasset’s insurance fund was created to safeguard liquidity providers to be able to eliminate and handle liquidation risk as far as possible. With the dawn of insurance funds, liquidity suppliers enjoy security by paying underwriting fees. The yield on the underlying asset’s stability fee also represents a responsibility to the machine. The stability fee is partially dependent on the security ratio (downtime risk) and partially by the complete collateral ratio, like the proportion of total ETH collateral to overall liquidity, and may also refer to volatility, which takes into consideration liquidity and size of liquidation. In this way, the insurance fund can get an extremely high rate of interest on the natural balance based on the size. Insurance funds can’t cover themselves, and taking on the risk of an insufficient market, can shed money.

How does Parasset work?

Parasset functions on contracts to make parallel assets, the machine creates corresponding debt positions and liquidation thresholds. Before the debt position is liquidated, the minter can withdraw the corresponding stable level for security at any time.

Once the security price is under the liquidation threshold, everyone can activate the liquidation. Users can add security at any time and join the exact same debt position with additional security.

Anyone can deposit funds to the insurance pool, and calculate the share in line with the net worth following deposit. Insurance funds are designated to be used on the redemption date and they’re interpreted at net worth. Users can re-mint the initial debt position and fix the liquidation threshold at precisely the exact same time.

Users can deposit 1USDT from the insurance fund to get 1PUSD, or deposit 1PUSD in exchange for 1USDT. Stability fees are calculated based on the block and equilibrium fees will be charged for each minting, salvation, replenishment and liquidation.

The main purposes of Paraasset

- Issuing synthetic assets.

- Insurrance.

- Decentralized exchange.

Basic information about ASET token

- Token Name: Parasset

- Ticker: ASET

- Blockchain: Ethereum

- Token Standard: ERC-20

- Contract: Updating

- Token Type: Utility

- Total Supply: 100,000,000 ASET

- Circulating Supply: Updating

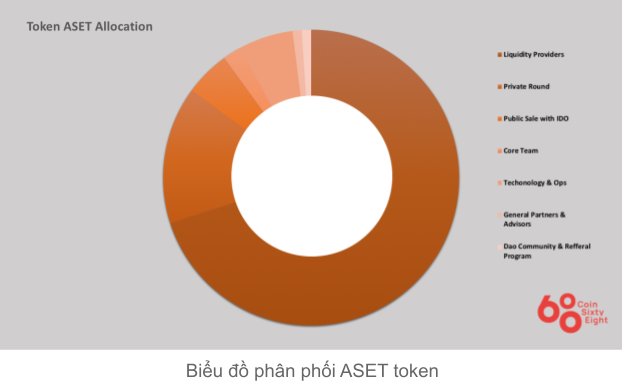

Token Allocation

- Liquidity supplier : 70%

- Private Sale: 15%

- Public Sale: 5%

- Core Team: 2%

- Technology and operations: 6%

- Partners and advisors: initial%

- DAO community and youth program: initial%

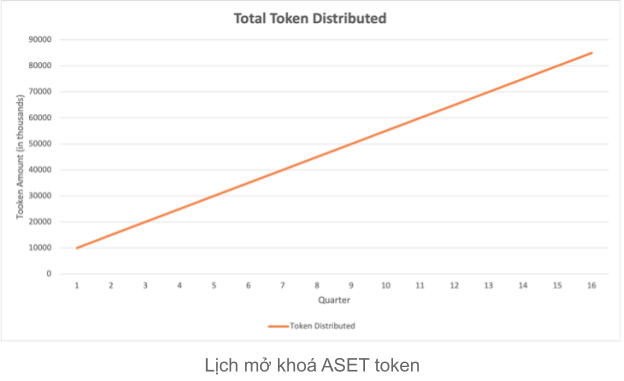

Token Release Schedule

What is ASET token used for?

Staking rewards.

Administration.

ASET token storage pocket

ASET is an ERC20 token, so you’ll have a great deal of wallet choices to store this token. You can pick from these wallets:

- Floor wallet

- Popular ETH pockets: Metamask, Myetherwallet, Mycrypto, Coin98 wallet

- Cold pockets: Ledger, Trezor

How to make and own ASET token

Updating

Where to purchase and sell ASET tokens?

Updating

Roadmap

What is the future of this Parasset job, if I invest in ASET token or not?

Parasset is a synthetic asset issuance protocol which derives data in the Nest protocol. The highlight of the project in comparison to other projects is that it’s an insurance pool to decrease the possibility of asset liquidation for participants. Through this report, you should have somewhat grasped the basic information regarding the project to create your own investment choices. Coinlive is not liable for any of your investment choices. Wish you success and earn a whole lot of profit from this possible market.