What is Pickle Finance (PICKLE)?

Pickled Finance is a decentralized protocol designed to make use of agricultural incentives, vaulting and governance to convey stablecoins nearer to the worth of the cash they’re anchored in.

How does Pickle Finance work?

Pickle Finance has 2 foremost features:

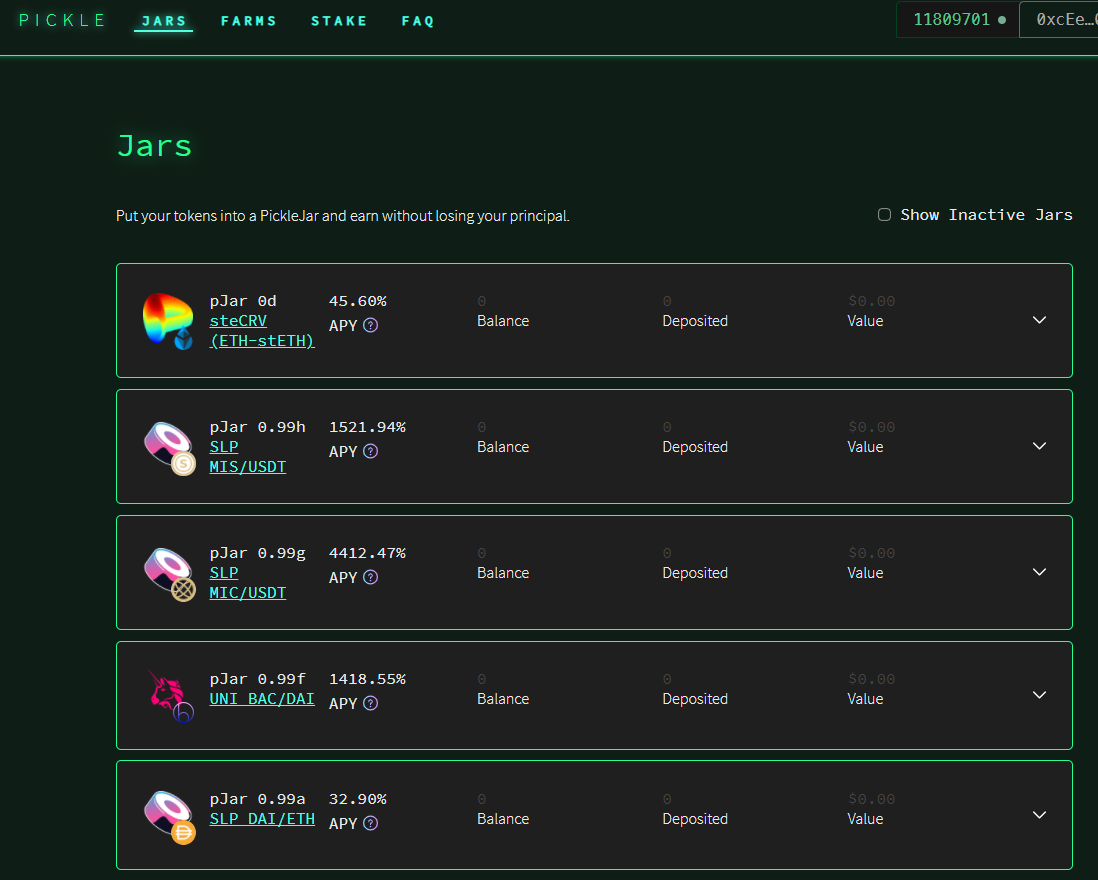

jars of pickles

Pickle Jars permits customers to deposit tokens in liquidity swimming pools reminiscent of Uniswap or Curve after which implement methods to maximise depositor returns.

For instance, 0.69 Jars, robotically collects Uniswap UNI tokens distributed to Uniswap liquidity suppliers, sells the ensuing UNI tokens, and purchases a number of Uniswap LP tokens on behalf of customers. If a consumer is a “normal” liquidity supplier on Uniswap, LP token staking in Uniswap, the consumer must carry out the method manually: wait a couple of weeks till the UNI tokens are collected. Pickle automates this course of and shares fuel prices equally amongst all customers, thereby reaching important economies of scale.

Note that when collaborating within the Pickle, customers shorten UNI as a result of they promote them to extend their ETH – DAI / USDC / USDT. If customers need to maintain UNI tokens, this isn’t the appropriate technique.

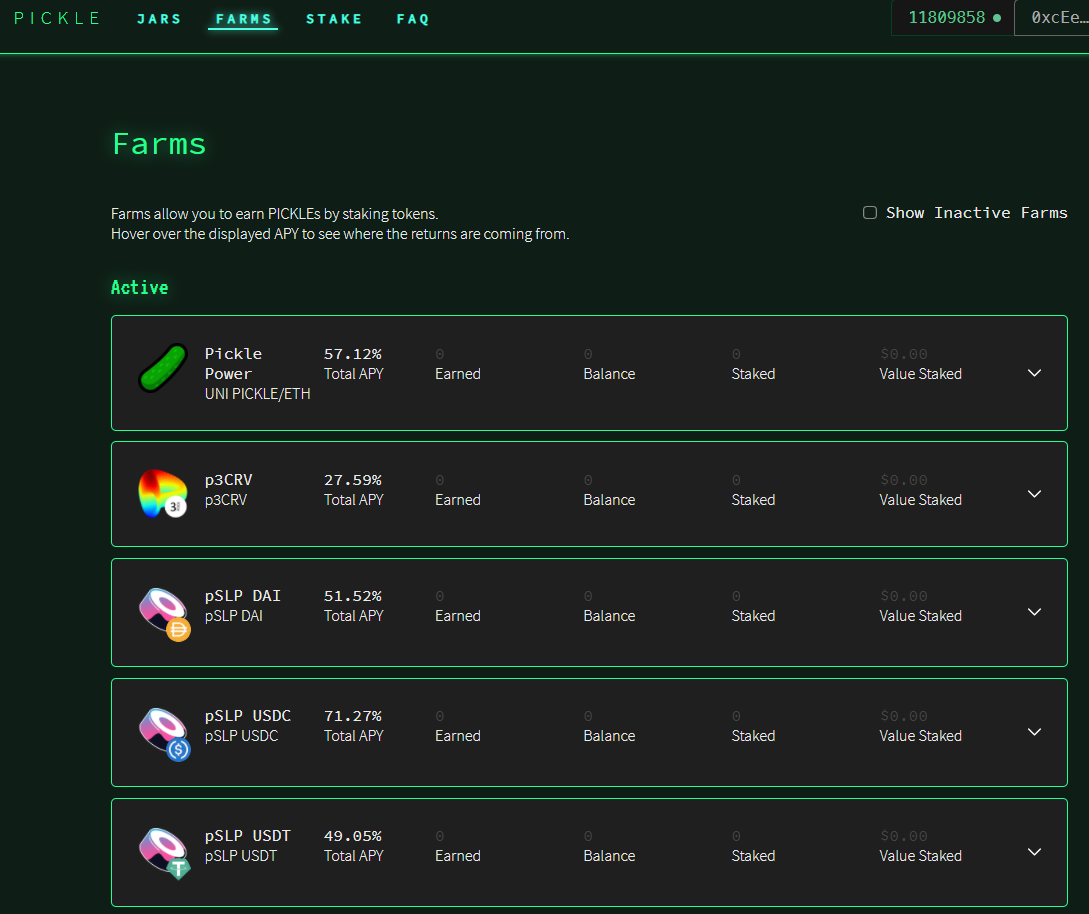

Pickle farms

Farms permits customers to farm PICKLE token rewards primarily based on the staking of various sources.

Each farming pool requires a distinct token to take part in staking.

The first farmin pool is the Pickle Power Pool, which requires the staking of Uniswap PICKLE / ETH LP tokens.

The remainder of the breeding swimming pools require staking of pTokens obtained from the useful resource depot in Pickle Jars.

Basic details about the PICKLE token

- Token identify: Pickle Finance

- Ticker: BRINE

- Blockchain: Ethereum

- Token customary: ERC-20

- To contract: 0x429881672b9ae42b8eba0e26cd9c73711b891ca5

- Token sort: Utility

- Total provide: 1.464.765 SOTTACETO

- Circulating provide: 953.186 SOTTACETO

Token allocation

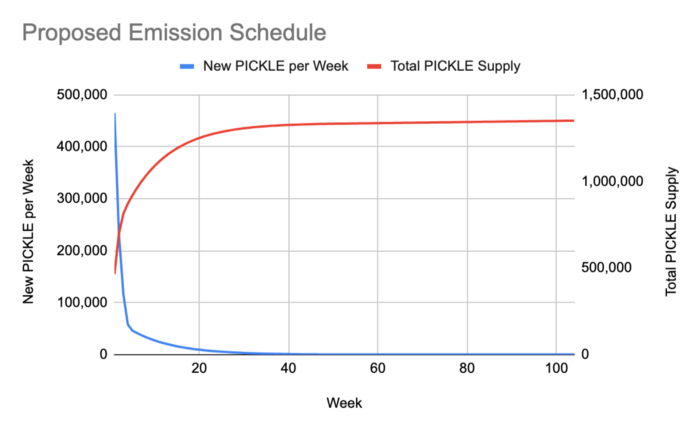

Unlike different wealth administration protocols like yearn.finance (Yearn.Finance’s YFI token has a set provide) Pickle has an inflationary provide. As could be seen from the availability program, a lot of the PICKLE tokens (1.3 million) can be distributed, after which there can be fixed inflation of 1.29% per yr.

This implies that Pickle has an efficient mechanism to encourage behaviors that the challenge considers vital. Currently, 70% of the brand new PICKLE tokens are distributed to PICKLE-ETH liquidity suppliers on Uniswap to create deep liquidity and 30% are used to incentivize Jars.

What is the PICKLE token for?

- Administration.

- Stakeout.

- Rewards up for grabs.

PICKLE token storage pockets

PICKLE is an ERC20 token, so you’ll have many pockets choices to retailer this token. You can select from the next wallets:

- Floor pockets

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 pockets

- Cool wallets: Ledger, Trezor

How to earn and personal PICKLE tokens

- Provide liquidity to the PICKLE-ETH pair to obtain PICKLE token rewards.

- Buy straight on the inventory trade.

Where to purchase and promote PICKLE tokens?

Currently, PICKLE is traded on many alternative exchanges with a complete every day trading quantity of roughly $ 5.3 million. Exchanges itemizing this token embody: Uniswap, OKEX, Sushiswap, MXC, Gate.io …

What is the way forward for the Pickle Finance challenge, ought to I spend money on PICKLE tokens or not?

General Pickled Finance is a revenue aggregator that helps to convey secure cash again to their pegged worth. Through this text, you should have by some means grasped the fundamental details about the challenge to make your funding selections. Coinlive just isn’t answerable for any of your funding selections. I want you success and earn rather a lot from this potential market.

.