What is Project Synthetify (SNY)?

Synthetify Inspired by the growth of a derivative (artificial strength ) platform Synthetix constructed on Solana’s Blockchain. The protocol enables the production, exchange and (burning) of price-based artificial assets powered by a decentralized system of oracles. On Synthetify, founder and exchange of artificial assets is performed based on the source public debt pool (Public Debt Liquidity Pool) allows for almost unlimited liquidity and no slippage even in massive transactions. Participants debt pool Earn proportional exchange fees for acting as a counterparty in transactions. Debt pool participants will need to always hold enough Synthetify token (SNY) token security to guarantee platform stability.

Highlights of the job

- The trade bandwidth increased significantly as a result of the Solana blockchain that can now process more than 50k trades per second.

- Transaction affirmation is nearly instant. The average affirmation time on the Solana network is 0.6 seconds.

- Almost zero transaction fees. The average transaction fee is about 0.0001 USD.

- Eliminate Oracle arbitrage as a result of regular updates Oracle pushes updates to the blockchain every couple of seconds.

- List less liquid tokens and control the debt pool by introducing a maximum source for each aggregated asset.

Synthetic Assets

Synthetic assets created on the Synthetify exchange will closely monitor the purchase price of the underlying asset provided by decentralized organizations. All synthetic assets are based on the SPL standard and will operate like the other tokens on Solana, which will allow more use on other platforms such as AMM with almost zero integration. There’s friction. Debt pool participants will need to burn aggregate assets to increase their mortgage rates or to release security.

Protocol features

Staking

Users lock their SNY tokens and mint (mint) the aggregated advantage with debt known as Stakers. Traders benefit from trading on Synthetify Exchange by accruing proportional exchange fees from every trade. All Stakers have to keep a sufficient proportion of their security or part of their security can be liquidated to guarantee network security. The collateral is dependent upon the purchase price of this SNY token, and the debt is calculated based on their own debt ratio across the entire platform.

Deal

Traders use Synthetify to swap between different synthetic assets. Traders don’t need SNY tokens to execute transactions, but holding SNY reduces asset swap fees. Only swaps involving artificial assets on Synthetify are permitted based on current prices provided by Oracle. Some resources with limited distribution can be minted.

Liquidation of resources

To guarantee the stability of this system, Staker can be liquidated and part of the security will be transferred to the Liquidator in exchange for the return of a part of Staker’s debt. Liquidation contains penalties of 80% going into the Liquidator and 20% to an account owned by Exchange to enhance the stability of this platform.

How Synthetify (SNY) Works

In that the Synthetify protocol, collaterals are pooled together to behave as a mutual debt pool for many minted assets (e.g., artificial assets such as sUSD and sBTC). It enables users to trade between Synths with no direct counterparty when solving liquidity issues and slippage. (The volatility in the purchase price of an asset makes its holder wish to sell or own it in expectation of an increase or reduction in the asset price.)

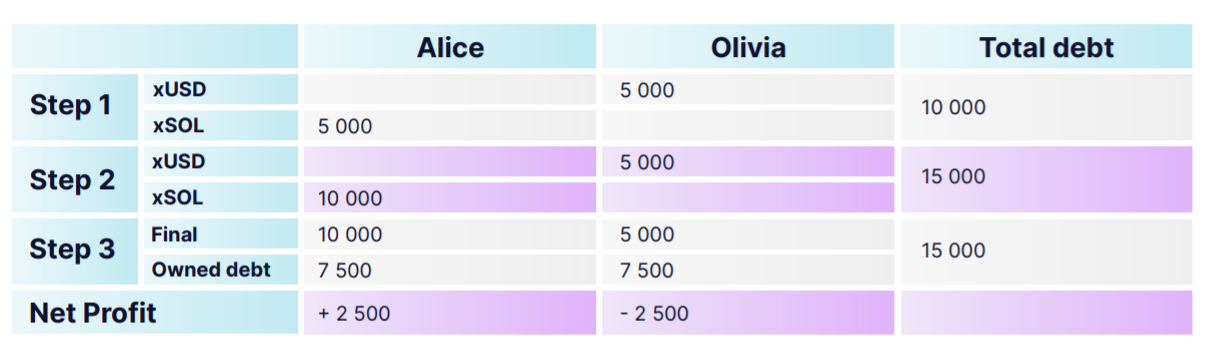

For instance:

Step 1: Both Alice and Olivia have the identical amount of debt (50 percent ). The entire debt equals 10k dollars. Olivia holds 5000 USD as xUSD tokens and Alice holds 5000 USD in xSOL as artificial assets.

Step 2: The cost of xSOL doubled making Alice’s balance worth $10k, which brought the whole debt to $15k. Olivia still retains xUSD and the value of the token hasn’t changed.

Step 3: Both Alice and Olivia are still responsible for the whole debt of the protocol, 50 percent each. Debt increases by $5,000, so Alice and Olivia’s debt increases by $2.5 million. When fitting the debt positions possessed by Alice and Olivia, Alice ends up with a gain of $2.5k and Olivia loses $2.5k as her debt increases this sum.

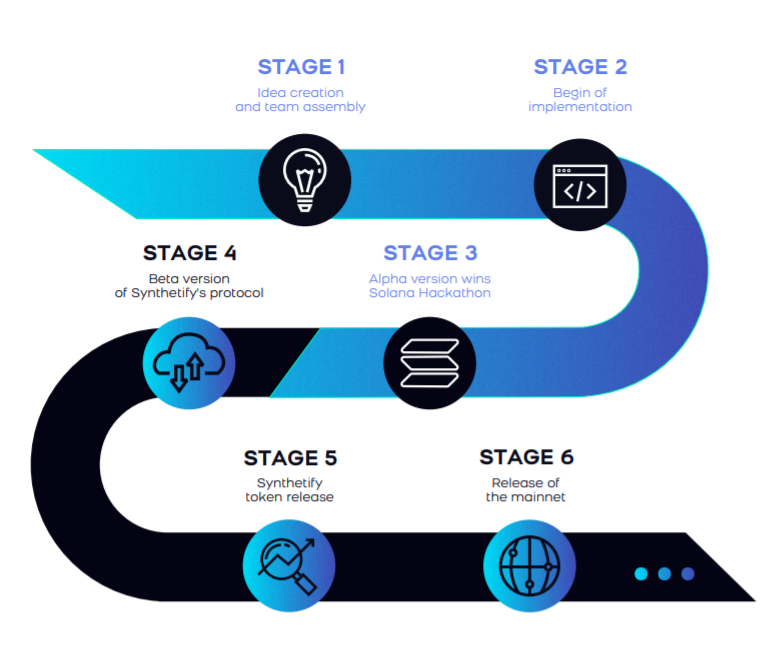

Roadmap

- State 1: Form a team and start an idea.

- Phase 2: Deploy product development.

- Stage 3: Solana Hackathon’s award-winning Alpha.

- Stage 4: Release beta.

- Stage 5: Synthetify token statement (SNY).

- Stage 6: Launch Mainnet.

What is Synthetify Token (SNY)?

Synthetify (SNY) is meant to be used for these purposes:

- As security to make synthetic assets on Synthetify. .

- Discounts on swaps on Synthetify.

- In the future SNY will signify the voting in governance choices.

Some basic information regarding Synthetify token (SNY)

- Token Name: Synthetify Token

- Ticker: SNY

- Blockchain: Solana

- Standard Tokens: SLP

- Contract Address: upgrading

- Supply of flow: upgrading

- Total distribution: 100,000,000 SNY

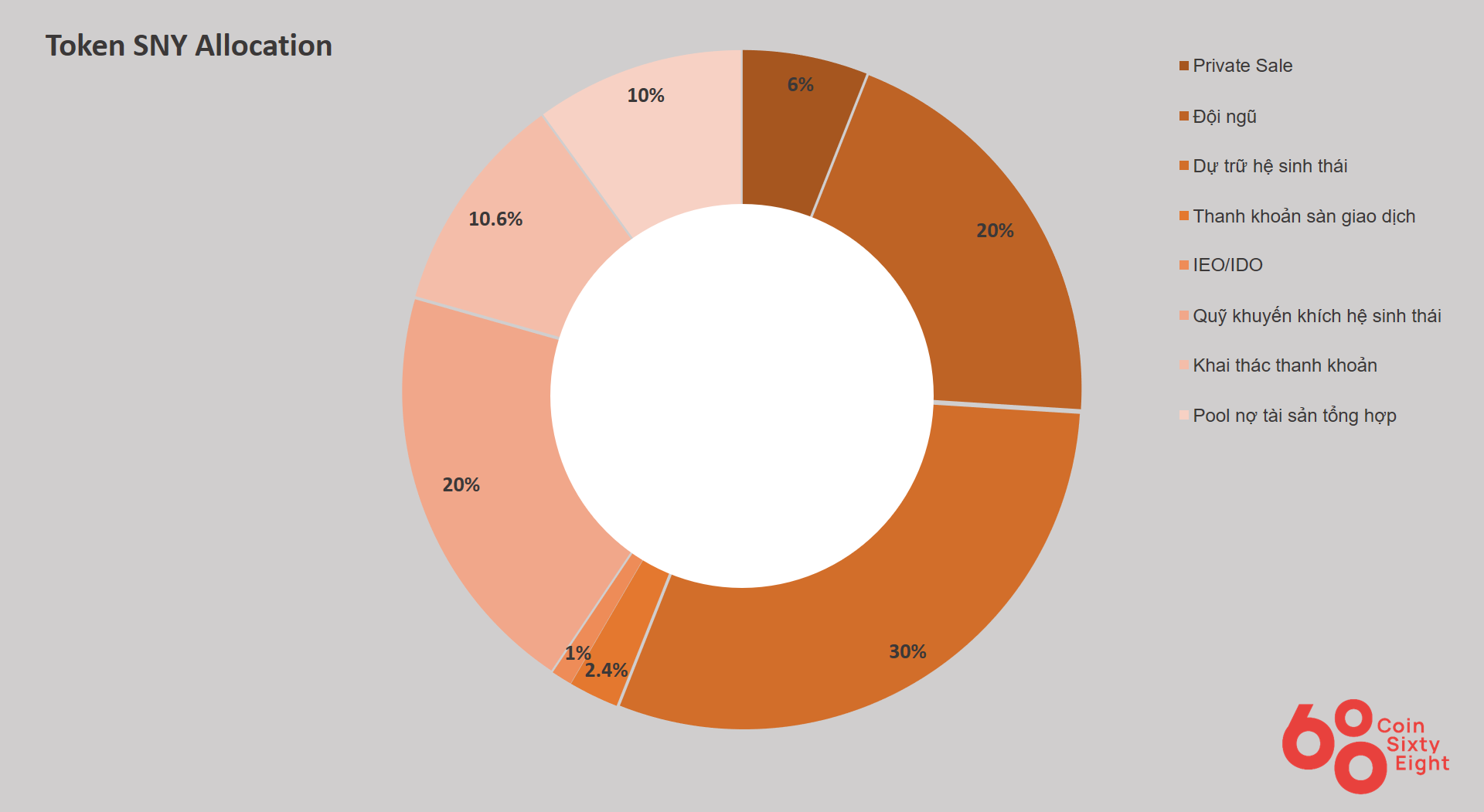

Synthetify Token Allocation (SNY)

- Private Sale: 6%

- Team: 20%

- Ecosystem Reserve: 30%

- BILLIONExchange account: 2.4%

- IEO/IDO: first%

- Ecosystem Incentive Fund: 20%

- Liquidity Mining: 10.6%

- Pool debt aggregate assets: tenpercent

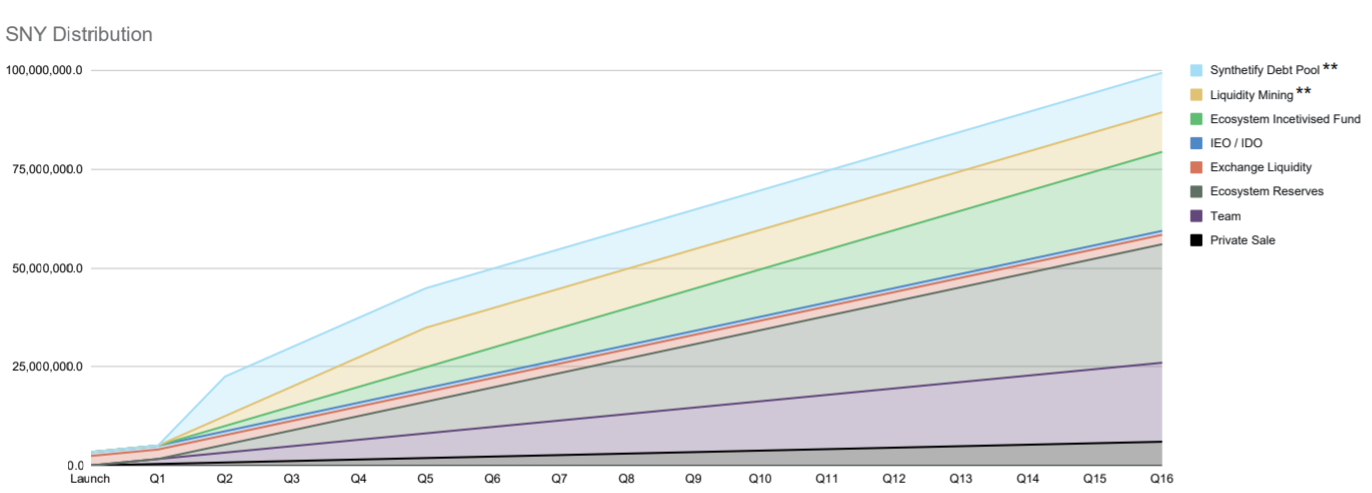

In the future, aggregate assets will print inflation rates

* Synthetify Debt Pool liquidity and token unlock date estimated and dependent on Synthetify platform launch date

Synthetify (SNY) project development group

Updating

Partners and investors

Earn and personal Synthetify tokens (SNY)

SNY will be IDO on Raydium AcceleRaytor on June 29, 2021.

- Total number of tokens raised: 700,000 SYN (0.7% supply war), without a lock.

- Fixed cost: 1.5 USDC for 1 SYN

- Total call capital: 1,050,000 USDC

- Paradigm: Lottery distribution

- Distribution for winning tickets: 100 USDC (66.666666 SYN)

- Total tickets: 10,500

- Open Pool: 12:00 UTC on June 29, 2021 (ie 19:00 Vietnam)

- Pool heap: 16:00 UTC on the same day, (ie 23:00 Vietnam)

- Pool opening period: 4 hours

- Time deadline minimum stake 100 RAY before 19:00 on June 22, 2021

Details are available here: https://raydium.medium.com/synthetify-launching-on-accelerraytor-3755b4903f88

Synthetify token storage pocket (SNY)

SNY is an SLP standard token, you can save two hot pockets now, Sollet Wallet, Solflare and Coin98 Wallet.

Similar jobs

Synthetix (SNX), Horizon (HNZ), PerlinX (PERL),…

outline

Synthetify is the platform which won the 3rd prize in the 1st Solana Hackathon and the 2nd prize in the 2nd Solana Hackathon. Synthetic Asset Protocol is an indispensable foundation in the software that govern any Blockchain ecosystem to help individuals. Users have the chance to profit on the arbitrage of resources without immediately owning them. All information from the guide is information compiled by Coinlive and doesn’t constitute investment advice. Coinlive is not liable for any direct and indirect risks. Good fortune !

.