After discontinuing the “Limited Impermanent Loss (IL)” function, Bancor was met with a great deal criticism from the neighborhood. Furthermore, current information is not quite good for this undertaking.

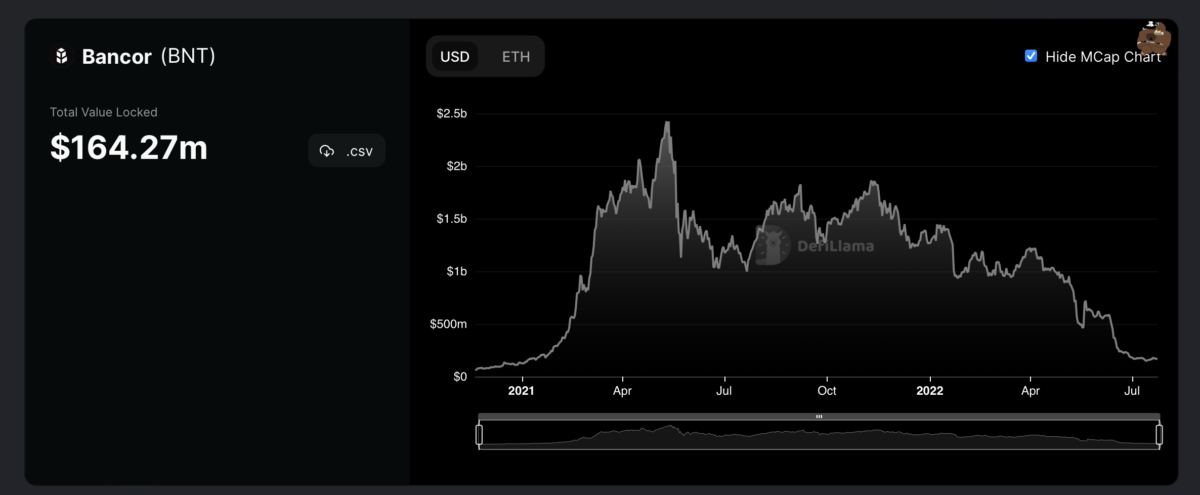

TVL fell all the time

After the liquidity crisis erupted in early June, Bancor suspended the “Limit Impermanent Loss” function. The undertaking explains that this stage is required to guard the Bancor neighborhood, specifically soon after Celsius has repeatedly withdrawn liquidity from the DEX due to liquidity and debt difficulties.

>> See additional: Bancor discontinues “Limit Impermanent Loss” function – Twitter neighborhood keeps waving

At the time of creating, in accordance to information from Defillama, it is $ 165 million, down about thirty% given that the undertaking announced its choice to suspend IL Protection.

It is really worth mentioning right here that most of the other DEXs recovered in the TVL index in parallel with the marketplace trend. However, Bancor has not nonetheless viewed the finish of the escape wave.

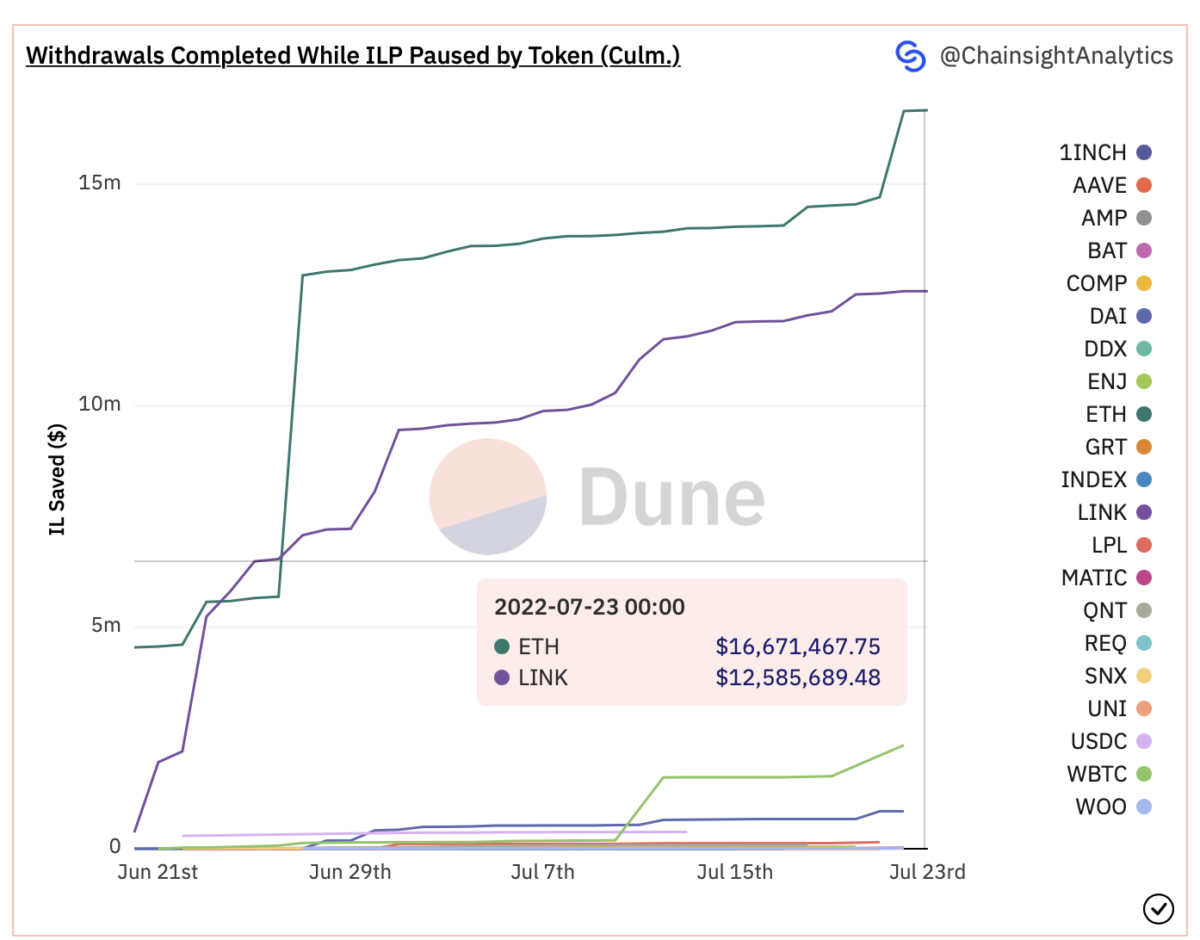

The greatest volume of income withdrawn by Bancor (soon after the suspension of the IL safety perform) came from two assets, Ethereum and Hyperlink.

Latest update from the group

This morning, Bancor’s Twitter webpage also posted the hottest updates on several alterations in the close to long term.

Bancor Update – Week of July 18, 2022

– Protocol recovery templates

-Optimization of commissions and liquidity

– Evaluation of integrations and goods that create commissions

– Protocol examination dashboard

-The surge in DAO participationDetails:https://t.co/zMM6q7XS68

– Bancor (@bancor) July 22, 2022

“Some alterations for the week of July 18, 2022:

Protocol recovery model

Burn charge mechanism and liquidity optimization

Re-assess goods and integrate additional income-producing functions

Set up information monitoring tables

Implement a additional successful DAO governance model “.

As can be viewed, Bancor is prioritizing BNT token burning in excess of the volume of costs collected, but the price tag to pay out is that the volume of liquidity supplier (LP) costs will be decreased.

Synthetic currency 68

Maybe you are interested: