Parallel to the employees restructuring just lately, now Lithium Finance announced its subsequent roadmap, in which the undertaking focuses on setting important ambitions for 2022. The newly launched roadmap serves as a guidebook to action for this illiquid asset pricing oracle protocol.

Lithium just lately appointed a new CTO, Ryan Au and his workforce contributed a great deal to the latest undertaking framework. With these optimistic advances, the Lithium workforce strategies to release the testnet in the 2nd quarter of this yr. Since transparency is a prime priority, merchandise updates will consider result on time.

Also, continue to keep in thoughts that requesting rewards from pre-staking system of the undertaking will start off in the starting of the 2nd quarter, following which Lithium will launch the beta of the mainnet in the third quarter and the mainnet will be energetic in the fourth quarter of 2022. For much more particulars on pre-staking rewards, study right here.

In 2022, the undertaking will concentrate on supplying solutions and taking care of the initially consumers. This is what CEO Kelvin Lam has pointed out in latest occasions. To accomplish this, the workforce will function really hard to lay the basis of Lithium’s Oracle in the most productive way to assess person assets and make sure the infrastructure that will facilitate development. This new roadmap is just a tiny milestone on the extended journey of the undertaking and the workforce has the self-confidence to make their vision a actuality.

Lithium Finance Information

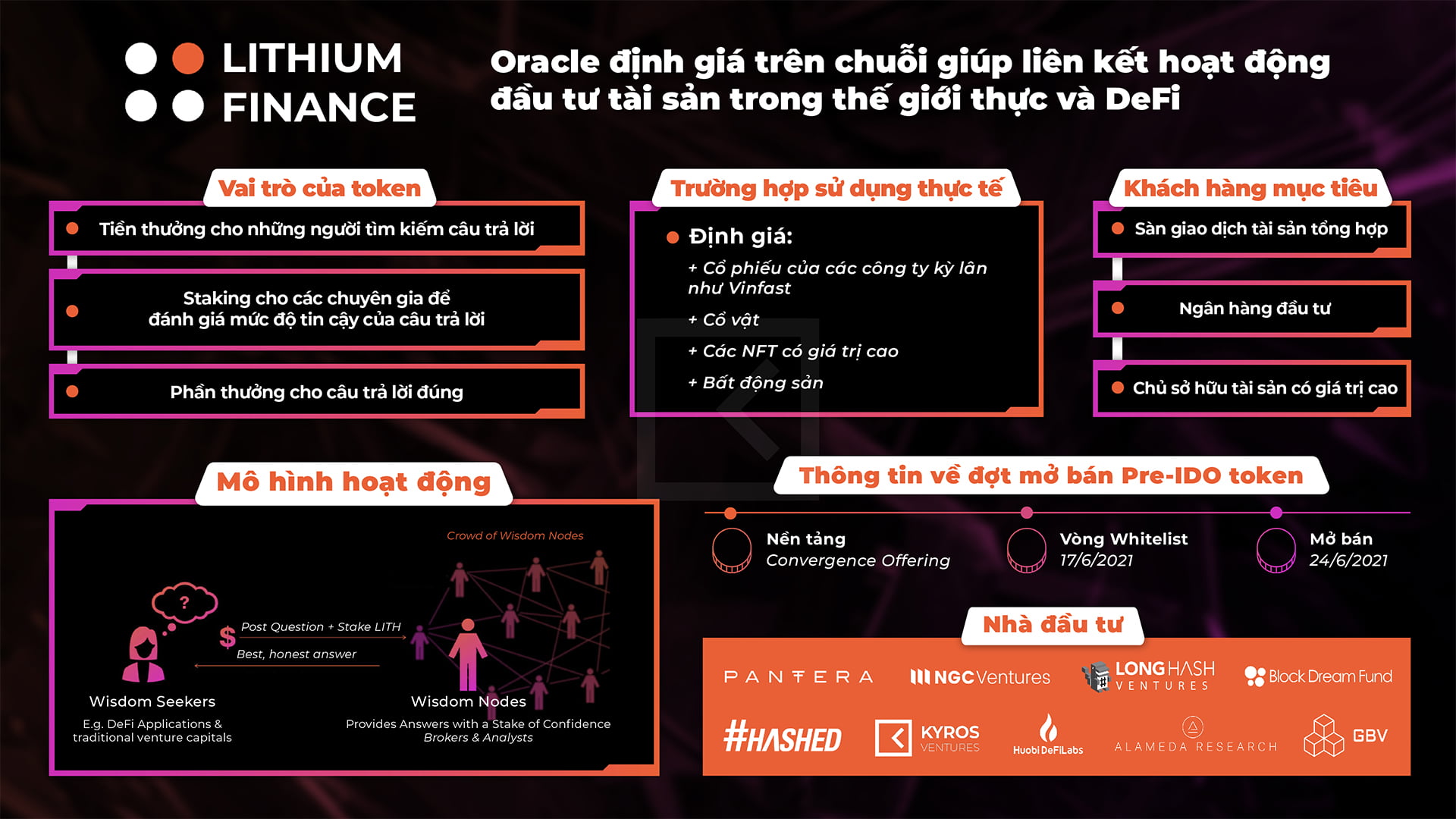

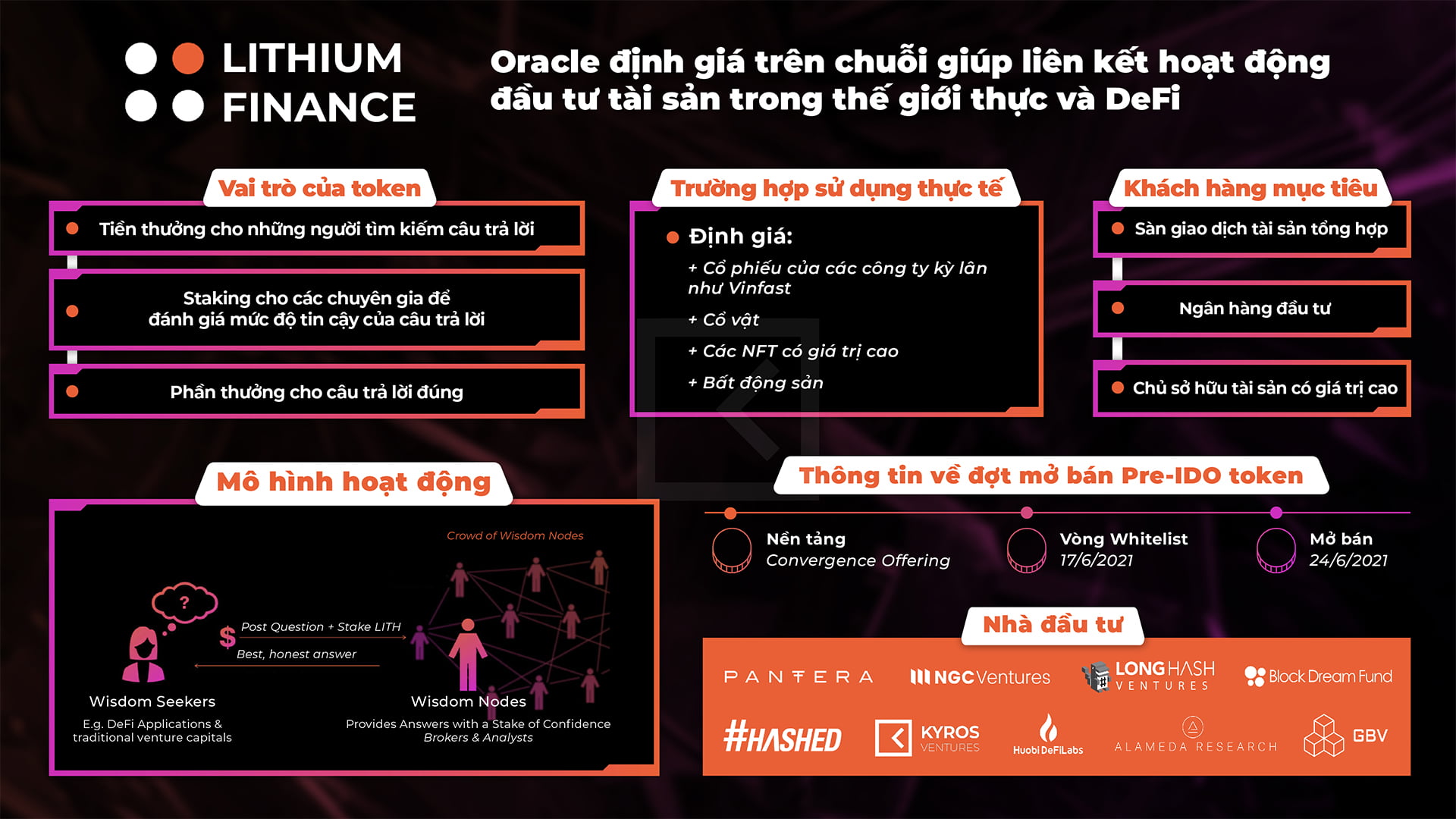

Lithium Finance is an Oracle pricing information platform that allows the pricing of illiquid assets. Lithium Finance supplies consumers with accessibility to restricted key market place (OTC) price tag information normally held by brokers, senior executives or M&A industry experts with a lot of many years of practical experience. Lithium Finance is a platform that promotes the sharing and privacy of public information. The undertaking will reward consumers who deliver straightforward details and punish these who deliver incorrectly priced information. From there, the market place will have accessibility to the rates of all really hard-to-worth assets this kind of as pre-IPO stocks, personal equity and other illiquid assets.

Join the Lithium Finance Vietnam neighborhood to not miss any essential information: Notification channel | Community for discussion

Maybe you are interested:

Note: This is sponsored information, Coinlive does not right endorse any details from the over report and does not promise the veracity of the report. Readers ought to carry out their personal study in advance of producing selections that influence themselves or their companies and be ready to consider obligation for their personal possibilities. The over report is not to be viewed as investment suggestions.

Parallel to the employees restructuring just lately, now Lithium Finance announced its subsequent roadmap, in which the undertaking focuses on setting important ambitions for 2022. The newly launched roadmap serves as a guidebook to action for this illiquid asset pricing oracle protocol.

Lithium just lately appointed a new CTO, Ryan Au and his workforce contributed a great deal to the latest undertaking framework. With these optimistic advances, the Lithium workforce strategies to release the testnet in the 2nd quarter of this yr. Since transparency is a prime priority, merchandise updates will consider result on time.

Also, continue to keep in thoughts that requesting rewards from pre-staking system of the undertaking will start off in the starting of the 2nd quarter, following which Lithium will launch the beta of the mainnet in the third quarter and the mainnet will be energetic in the fourth quarter of 2022. For much more particulars on pre-staking rewards, study right here.

In 2022, the undertaking will concentrate on supplying solutions and taking care of the initially consumers. This is what CEO Kelvin Lam has pointed out in latest occasions. To accomplish this, the workforce will function really hard to lay the basis of Lithium’s Oracle in the most productive way to assess person assets and make sure the infrastructure that will facilitate development. This new roadmap is just a tiny milestone on the extended journey of the undertaking and the workforce has the self-confidence to make their vision a actuality.

Lithium Finance Information

Lithium Finance is an Oracle pricing information platform that allows the pricing of illiquid assets. Lithium Finance supplies consumers with accessibility to restricted key market place (OTC) price tag information normally held by brokers, senior executives or M&A industry experts with a lot of many years of practical experience. Lithium Finance is a platform that promotes the sharing and privacy of public information. The undertaking will reward consumers who deliver straightforward details and punish these who deliver incorrectly priced information. From there, the market place will have accessibility to the rates of all really hard-to-worth assets this kind of as pre-IPO stocks, personal equity and other illiquid assets.

Join the Lithium Finance Vietnam neighborhood to not miss any essential information: Notification channel | Community for discussion

Maybe you are interested:

Note: This is sponsored information, Coinlive does not right endorse any details from the over report and does not promise the veracity of the report. Readers ought to carry out their personal study in advance of producing selections that influence themselves or their companies and be ready to consider obligation for their personal possibilities. The over report is not to be viewed as investment suggestions.