The purpose DeFi is booming is since it can deliver ordinary monetary entities and firms into the globe of cryptocurrencies, leveraging blockchain technologies to include decentralization functions, unsecured positive aspects, and other consumer positive aspects. One of the prosperous simulation tasks of banks’ operations is AAVE. In today’s publish, let us get a search at the AAVE in the to start with half of 2022!

Learn much more about the AAVE

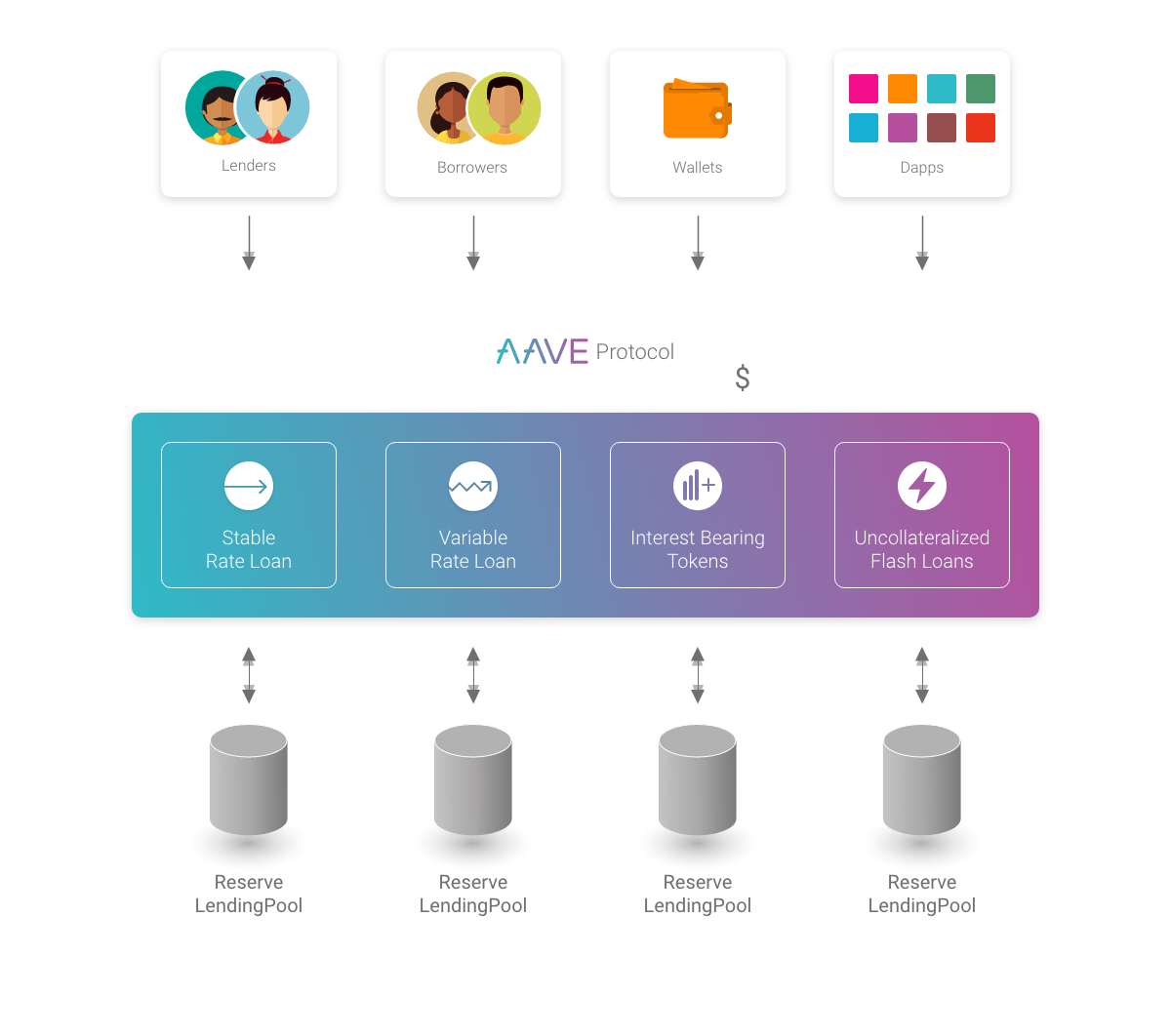

If you will not know, AAVE is a venture in the Lending – Loan section. The working mechanism of AAVE is pretty comparable to that of a usual financial institution. You can participate in the protocol as a depositary (an asset supplier) or as a borrower (borrower). AAVE is an intermediary that controls the income movement deposited by depositors and does business enterprise (loan) to create revenue, component of the revenue will be divided amongst depositors, component will belong to the protocol.

Recent significant updates

In the to start with half of 2022, AAVE aims to proceed bettering the product or service, with the launch of testnet and mainnet of AAVE v3.

AAVE v3 is made to make AAVE the most impressive, state-of-the-art, safe and productive DeFi protocol. V3 is described as an supplying of better capital efficiency, better safety and cross-chain performance.

Some of the new functions in V3 contain:

High efficiency mode: It will allow end users to maximize collateral on AAVE, resulting in greater revenue.

Isolation mode: Limit the possibility and possibility to the protocol from the newly additional assets to the protocol by only permitting the loan up to a particular quantity.

Improvements in possibility management: Provides further safety for the protocol by way of several possibility limits and other equipment

Specific functions for L2: Layer two network particular models to strengthen consumer knowledge and dependability

Portal– Allows information to movement seamlessly amongst Aave V3 marketplaces on diverse networks (note that this characteristic will only be offered on mainnet distribution)

Community contribution: Facilitate and motivate local community use by way of a modular and nicely-organized code base.

Gas optimization: Gas expenses of all functions are diminished by around twenty-25% on a big scale.

Metrics accomplished by the protocol

Information on the complete blocked worth (TVL)

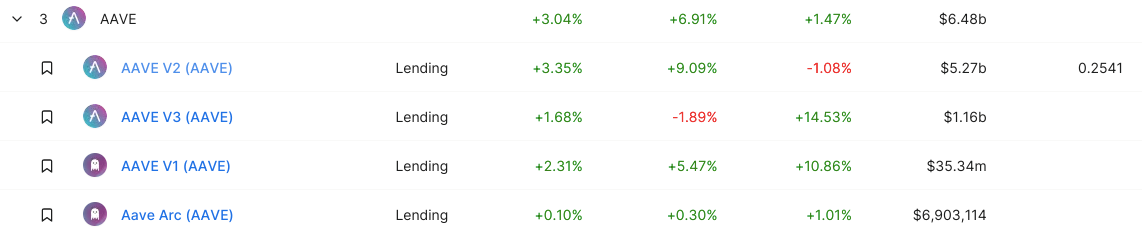

TVL on AAVE is split individually for every edition:

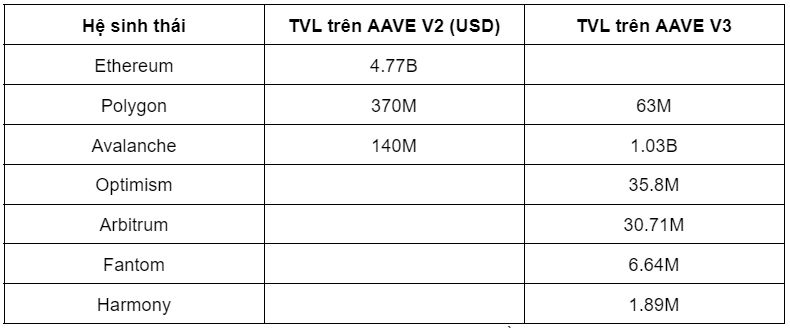

As you can see, AAVE’s TVL focuses primarily on V2 and V3, the figures of V1 and AAVE Arc are not sizeable. Therefore, we will target on analyzing how AAVE will work on V2 and V3.

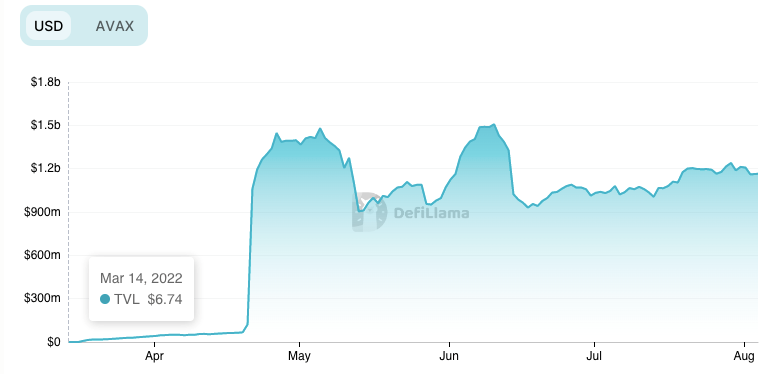

Therefore, from the starting of 2022 to the existing, TVL on AAVE V2 has dropped from about $ 13.four billion to just $ five.three billion, which is a reduce of 60.four%. In contrast, due to the fact the launch of the core network (March 2022), TVL on AAVE V3 has gone from about $ 67 million (as of April) to practically $ one.two billion, equivalent to a practically 18-fold raise.

Therefore, the reduce of TVL in AAVE V2 is brought on by the decline of the market place problem (the selling price of the coins / tokens has collapsed, also creating the TVL pegged to the worth of individuals coins on AAVE to reduce), but a component of TVL from V2 is been misplaced. ported to V3 to get benefit of new functions.

Therefore, even though the target of AAVE’s advancement is nonetheless on Ethereum, we can also see that the venture has expanded to quite a few other ecosystems, which includes sizzling chains this kind of as Polygon, Avalanche, Optimism, and so on. Arbitrum. This move by AAVE in my view has two meanings:

Dominate a new market place

Normally, every ecosystem to be created has to establish ample pieces of the puzzle (AMM, Lending, Launchpad, Yield Farming …). New ecosystem tasks are typically nascent and very easily conquer. Therefore, AAVE has quickly expanded to conquer new markets, making sure that no matter which ecosystem explodes, AAVE will also advantage.

Looking for a far better market place

It is no coincidence that AAVE’s expanded record has three Layer-two connected names: Arbitrum, Optimism and Polygon. Ethereum, in spite of the quite a few updates, is nonetheless very highly-priced, specifically “peak”. The implementation of AAVE on Layer-two and the new ecosystem is also a check phase to uncover a much more productive market place.

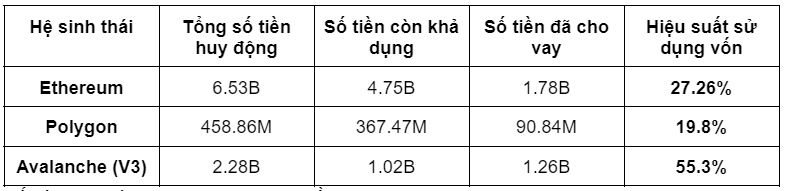

Effective use of capital

AAVE operates beneath a banking business enterprise model, so capital efficiency is pretty significant.

Funds mobilized by end users and investment money are the minimal-expense supply of capital, although loan capital is the revenue-making supply of capital (the curiosity charge is increased than the curiosity charge payable for the mobilized capital). Therefore, the increased the loan quantity / mobilized quantity ratio, the far better the capital efficiency.

However, due to the fact it is a protocol that operates in accordance to a home loan loan model mixed with liquidation and the cryptocurrency market place is pretty volatile, the ratio amongst the loan quantity and the complete quantity mobilized are unable to be also higher since it would possibility a mass liquidation. . In my view, to be thought of efficient, lending protocols have to keep a minimal charge of 50%.

Together, we will analyze AAVE’s capital efficiency on the most significant ecosystems:

Note: If you have any inquiries about the information, I will make clear that the TVL I pointed out from DefiLlama over is calculated based mostly on the offered quantity only, not the complete quantity and loan quantity..

Therefore, AAVE’s loan functionality on Avalanche is very outstanding when it reaches fifty five.three%, followed by Ethereum and Polygon. However, as the percentage of equity on Ethereum represents the vast majority, so in basic AAVE this time period is underperforming.

The purpose for this problem, in my view, is primarily due to the market place fluctuations in the previous time. When a series of cryptocurrencies is significantly diminished, it will involve liquidation possibility, in purchase to minimize liquidation possibility, borrowers have to pay out most of the debt => the complete loan quantity decreases considerably. Furthermore, the outflow of cash from the market place to stablecoins also lowers the demand for loans.

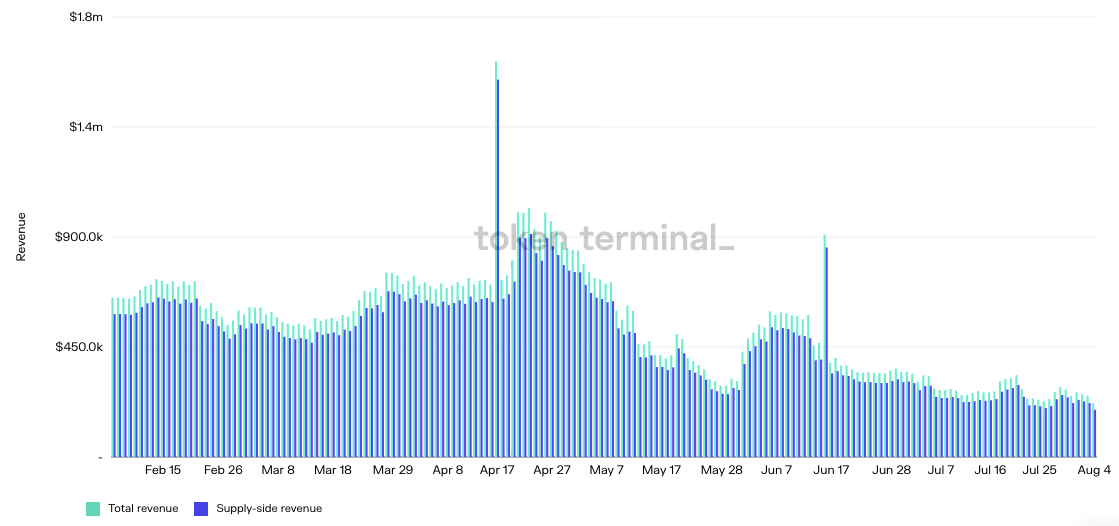

Revenue of the protocol

To analyze AAVE income, we will use Token Terminal information

To make it less complicated for you to have an understanding of, I’ll make clear a tiny much more:

– Total income: it is calculated based mostly on the complete curiosity paid by the borrower (borrower) for the protocol.

– Enter on the provide side: it is calculated on the basis of the complete quantity of curiosity that the protocol have to pay out to the asset companies (or lenders).

Therefore, the real income earned by AAVE = complete income – provide side income

Upon comparison, I observed that these AAVE income will reduce by all around USD 50,000 / day on regular, which equates to all around USD one.five million / month. Of program, you can see that in the time period from May back right here, AAVE’s income in basic has dropped very a great deal, reaching only all around twenty,000 – thirty,000 USD / day.

As I analyzed over, at present the demand for loans in the market place is very modest, so the reduce in AAVE’s income and revenue is pretty much sure. However, if it is ready to keep the over income degree even in tricky occasions, it is not also tricky for AAVE to survive the downtrend.

summary

From the over evaluation, we can draw some conclusions for AAVE as follows:

Primarily, AAVE is nonetheless focusing on product or service improvement and at the very same time striving to dominate the market place by setting up a number of chains.

This has the benefit of expanding the coverage of the protocol, generating end users much more mindful of the brand and utilization of the protocol, and any ecosystem that has exploded positive aspects from AAVE. However, the downside will be that TVL above the protocol is widespread, demands a cross-chain answer to help, as nicely as staying vulnerable to assault. Recently, AAVE proposed to withdraw from Fantom also for safety factors.

Secondly, AAVE V3 exhibits much more favourable moves.

The stats on the V3 are rather steady in spite of the market place decline. This is probable a favourable stage for AAVE in the previous as it has proven enhancements in V3 to aid retain end users and raise capital efficiency.

Third, AAVE wants to strengthen capital efficiency.

Although V3 has favourable indications, nevertheless, AAVE V2 nonetheless accounts for a big percentage of TVL, and as we have analyzed, the capital efficiency of the protocol is not higher. This comes from aim factors (the market place goes down, quite a few persons need to have to pay out off their loans to stay away from liquidation the demand for loans decreases …), but it is not possible not to admit that AAVE has not nonetheless had an efficient answer. to stimulate borrowers (reduced curiosity prices on loans, beautiful incentive plans this kind of as retroactive ones, and so on.)

Fourthly, the AAVE nonetheless exists, so we have a proper to hope.

Unlike other endangered tasks, AAVE’s income is nonetheless favourable and income is nonetheless steady.

This is the premise for hoping that AAVE will proceed to exist, produce and defeat rivals in tricky occasions, only to explode when the “uptrend” of the market place returns.

Fifth, the AAVE token wants an further use situation.

Similar to Uniswap’s UNI, AAVE at present has a couple of use circumstances. The AAVE is primarily made use of for administration (governance), a component of the tariff is diminished (when making use of AAVE as collateral), a component of the AAVE is burned in accordance to the protocol income … In my view, these do not they are a pretty beneficial use – circumstances for a token. AAVE wants a tiny much more to explode.

So, we “looked back at the AAVE” collectively. What is your view on this protocol? Which venture would you like me to publish much more about? Leave a comment! See you guys in the upcoming posts!

Poseidon

See other posts by the writer of Poseidon: