The previous half 12 months of the cryptocurrency sector will need to have introduced buyers a variety of feelings. The market constantly achieves many milestones of the very best worth in historical past, in addition to the world turning into extra open to Bitcoin specifically and the cryptocurrency market basically. This might be the inevitable results of a very long time of belief and constructing effort of each crypto tasks and buyers.

Currently, the market has begun to chill down after the new development prior to now 6 months. However, this might not be a extra acceptable time to look again collectively after a interval of fast development of Bitcoin and its associates.

Let’s look again on the market with Kyros Ventures by way of the predictions of the Vietnamese crypto investor neighborhood in “Vietnam Cryptocurrency Market Report 2020” Please.

Overview of the whole market and Bitcoin

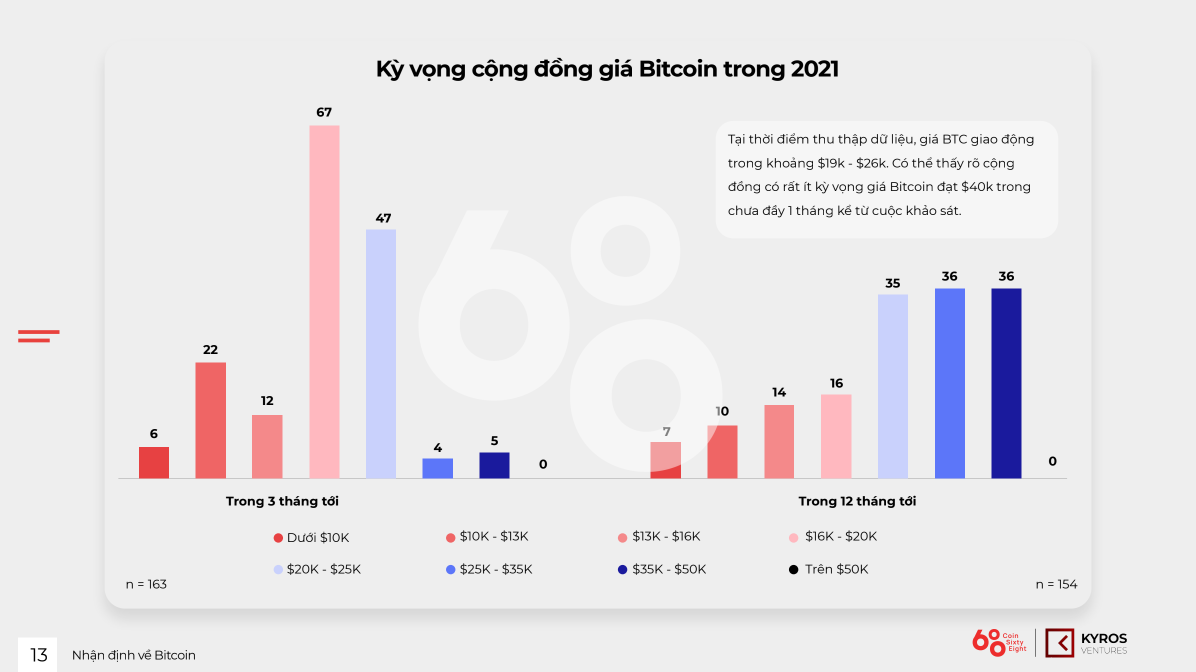

In “Vietnam Cryptocurrency Market Report 2020“, the neighborhood has a constructive view of Bitcoin in 2021, however most don’t anticipate Bitcoin to achieve the 50k worth area in Q1, however are extra inclined to the long-term worth improve. However, the world’s No. 1 cryptocurrency has as soon as once more achieved what few would anticipate, leaping from $35,000 in the beginning of the 12 months to a peak of $61,800 within the first week of March.

The sudden fast worth improve of Bitcoin was led by a number of occasions:

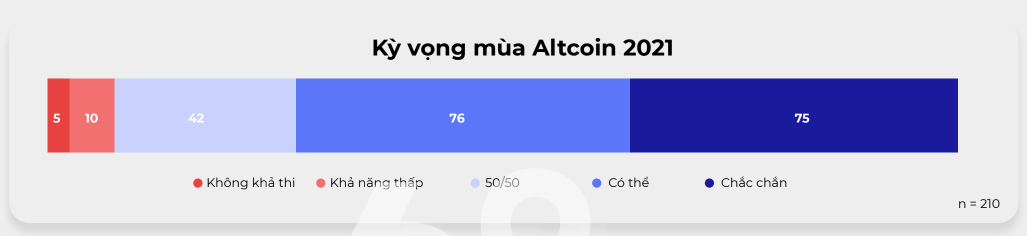

Bitcoin acquired a giant increase however Altcoins had a good greater increase. We can simply observe this by way of the Bitcoin Dominance indicator. During the new development part of the whole market, Bitcoin constantly misplaced its market share to Altcoins. This can also be the expectation of nearly all of the Vietnamese investor neighborhood available in the market report of Coinlive and Kyros Ventures.

In the report, the highest 3 candidates anticipated to threaten Bitcoin’s place are:

- Ethereum

- DeFi tasks basically

- Proof-of-Stake (PoS) blockchains

In truth, this prediction was right, Ethereum grew strongly and continued to take care of the No. 2 place, the No. 3 place was constantly swapped by blockchain POS names comparable to Binance Smart Chain, Cardano, Polkadot, and many others.

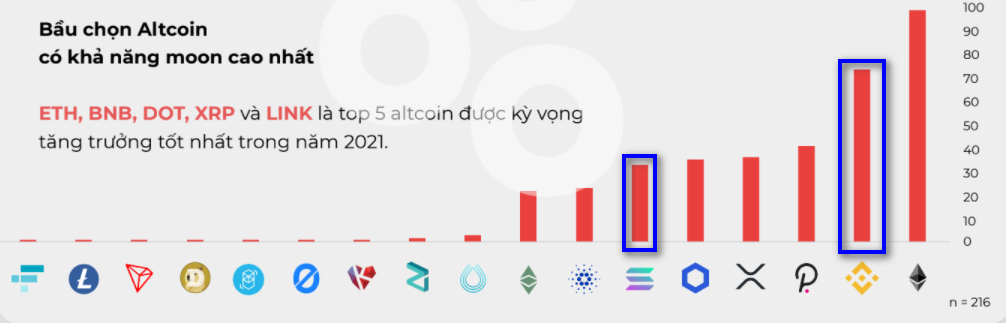

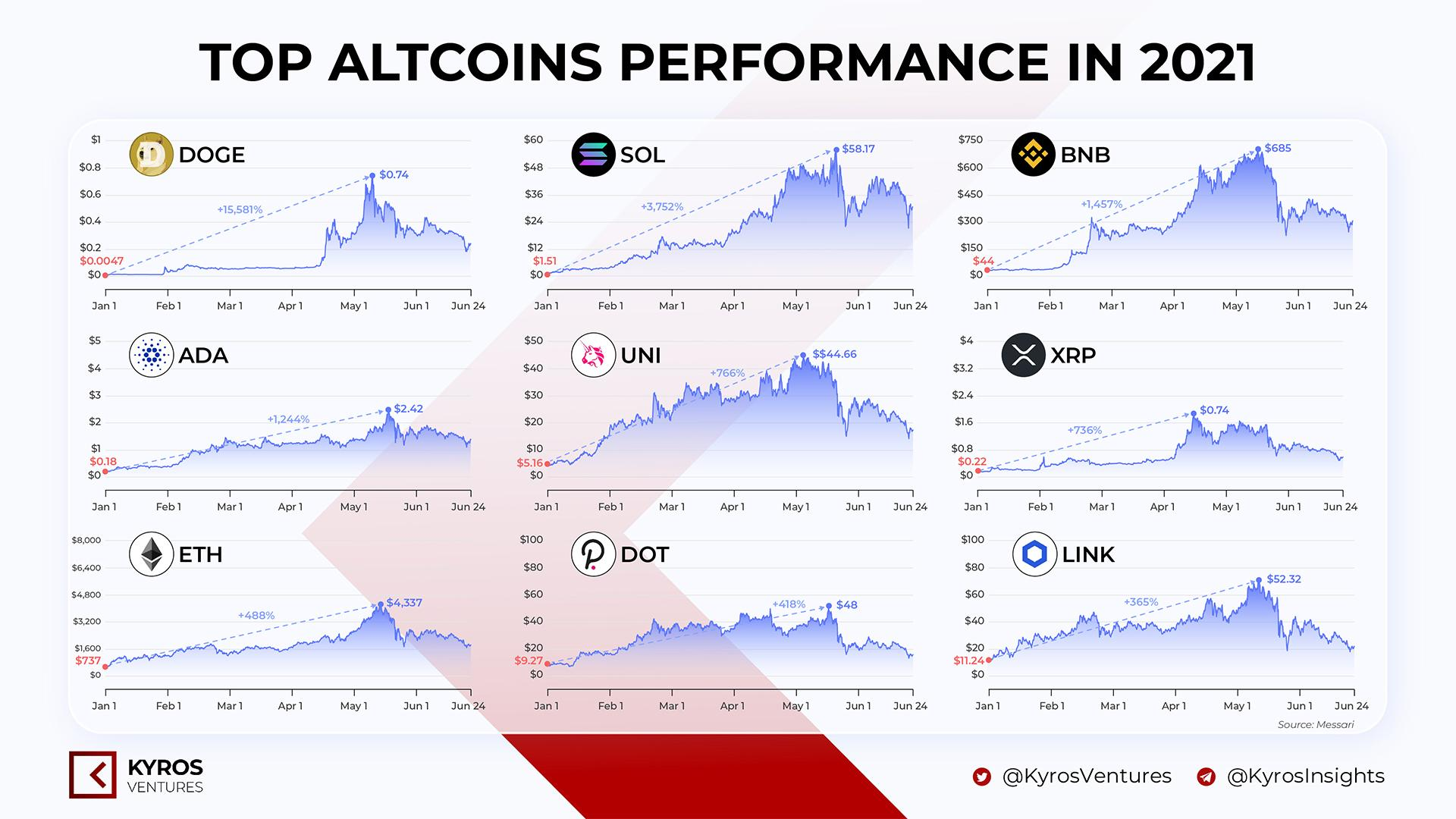

At the identical time, Ethereum (ETH), BNB, Polkadot (DOT), Solana (SOL) and Cardano (ADA) are additionally the names which have been anticipated by the Vietnamese neighborhood to “moon” essentially the most, and certainly had a season. profitable development past the creativeness of many.

Altcoin Market Key Highlights

The development of the Altcoin market in 2021 is led by the next key tendencies:

– NFT Trend

– The explosion of blockchain POSs

– DeFi continues to develop strongly

NFT Trend

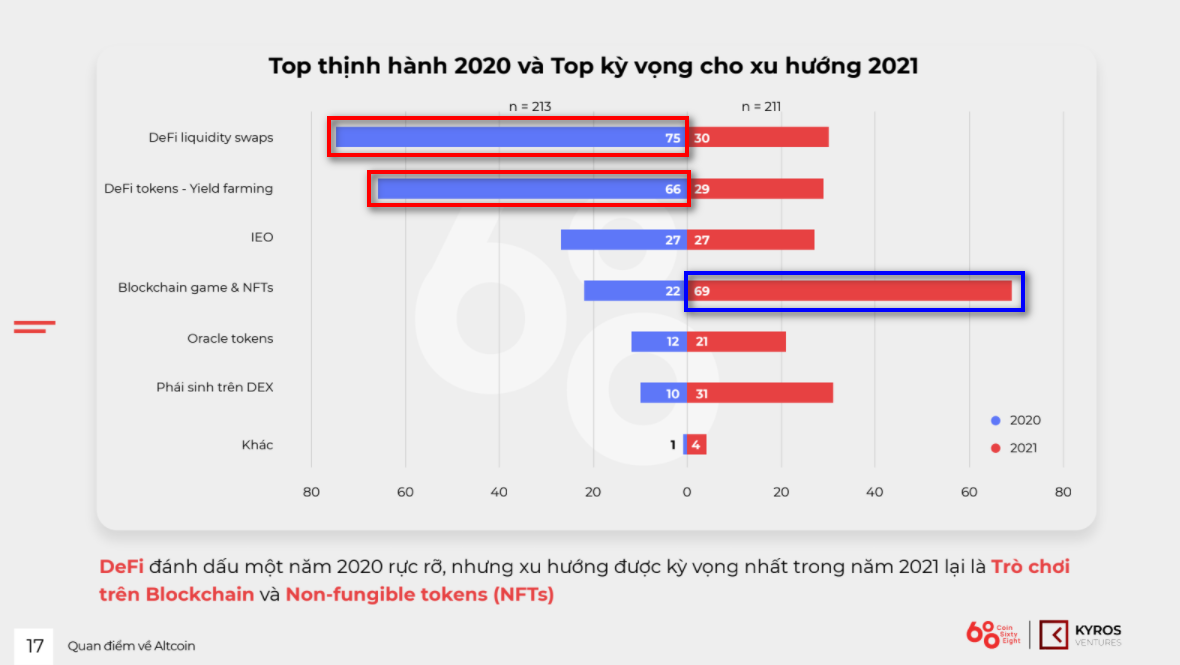

In the report of Kyros Ventures, the survey outcomes are considerably shocking at the moment as a result of DeFi is the most well-liked section in 2020 however NFT and blockchain video games are the segments most anticipated by the Vietnamese neighborhood. in 2021. And because of this, the NFT actually had a giant increase.

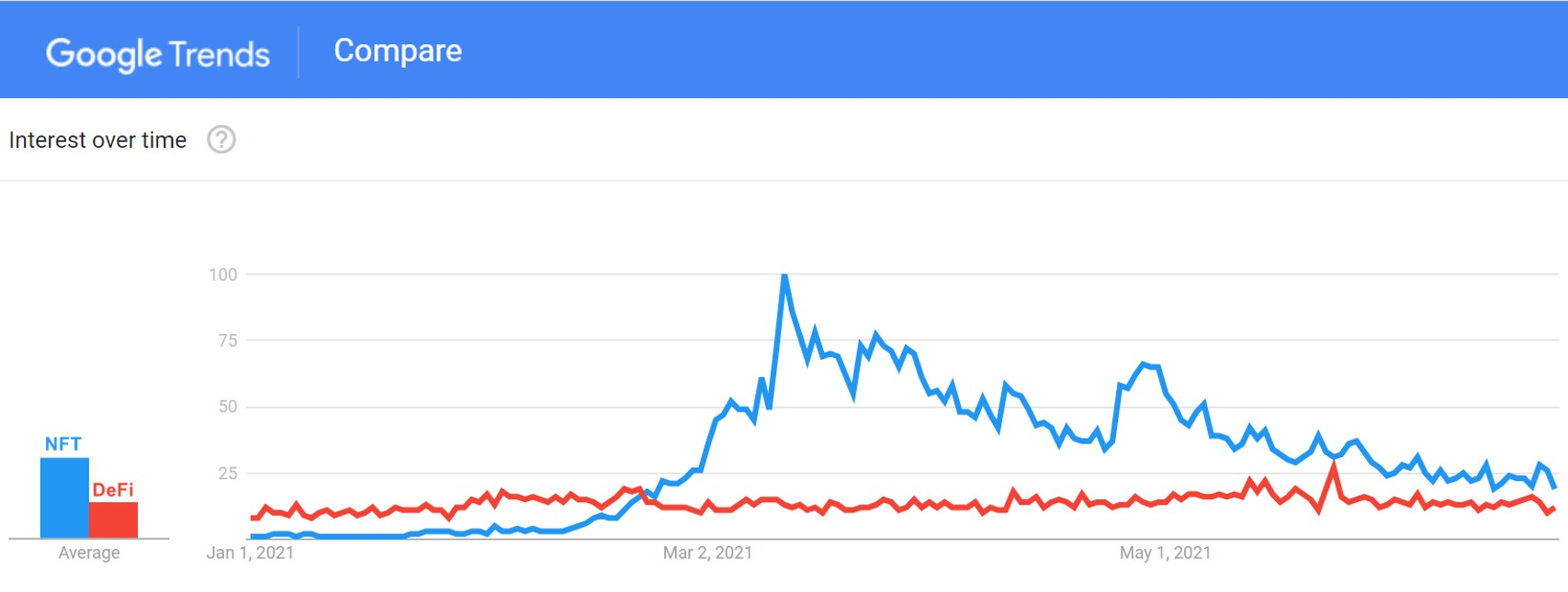

Statistics of Google Trends reveals that the search pattern for NFT began to extend strongly in early February 2021 and rapidly surpassed the search pattern for Defi.

According to information supplied by Non FungibleIn the previous 6 months, the NFT market has had a complete trading quantity of greater than 900 million USD. The trading quantity began to speed up in February 2021 to achieve USD 168 million and is almost 6 occasions larger than the trading quantity of January. NFT trading quantity has continued to be maintained at a steady stage since May. 2 onwards.

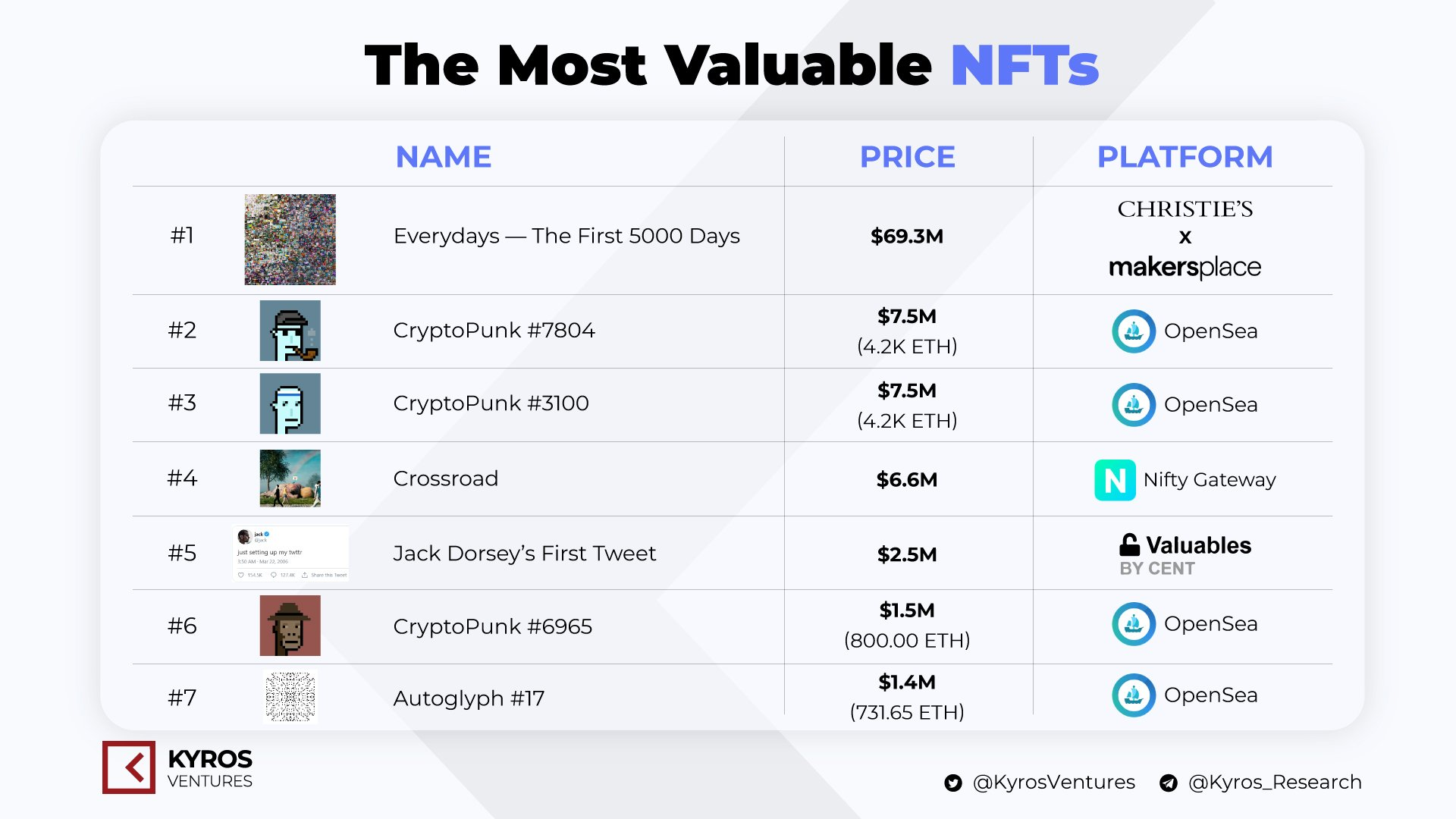

Besides, the costliest NFTs ever traded additionally came about throughout this increase interval. The sub-character is:

Not stopping there, Binance out of the blue introduced that it could launch the Binance NFT Marketplace on June 24, making many individuals anticipate so as to add development impetus to the NFT pattern.

The Explosion of Blockchain POSs

The sudden rise of the NFT discipline to “peak” had an sudden consequence. The purpose is that almost all of NFT tasks are constructed on Ethereum, inflicting a considerable amount of Ethereum transactions to be all about NFT transactions, making this blockchain congested. The value of fuel on Ethereum has since change into too costly, creating an enormous barrier for customers to come back to decentralized purposes constructed on it. At its peak, Ethereum charges had been within the tons of of {dollars} per transaction.

Therefore, the brand new blockchain POS has acquired great development, represented by names like Binance Smart Chain (BSC), Solana (SOL), Polygon (MATIC), Avalanche (AVAX), Near (NEAR), … All of those Layer 1 options share a typical aggressive benefit over Ethereum: low fuel prices and considerably quicker transaction processing speeds.

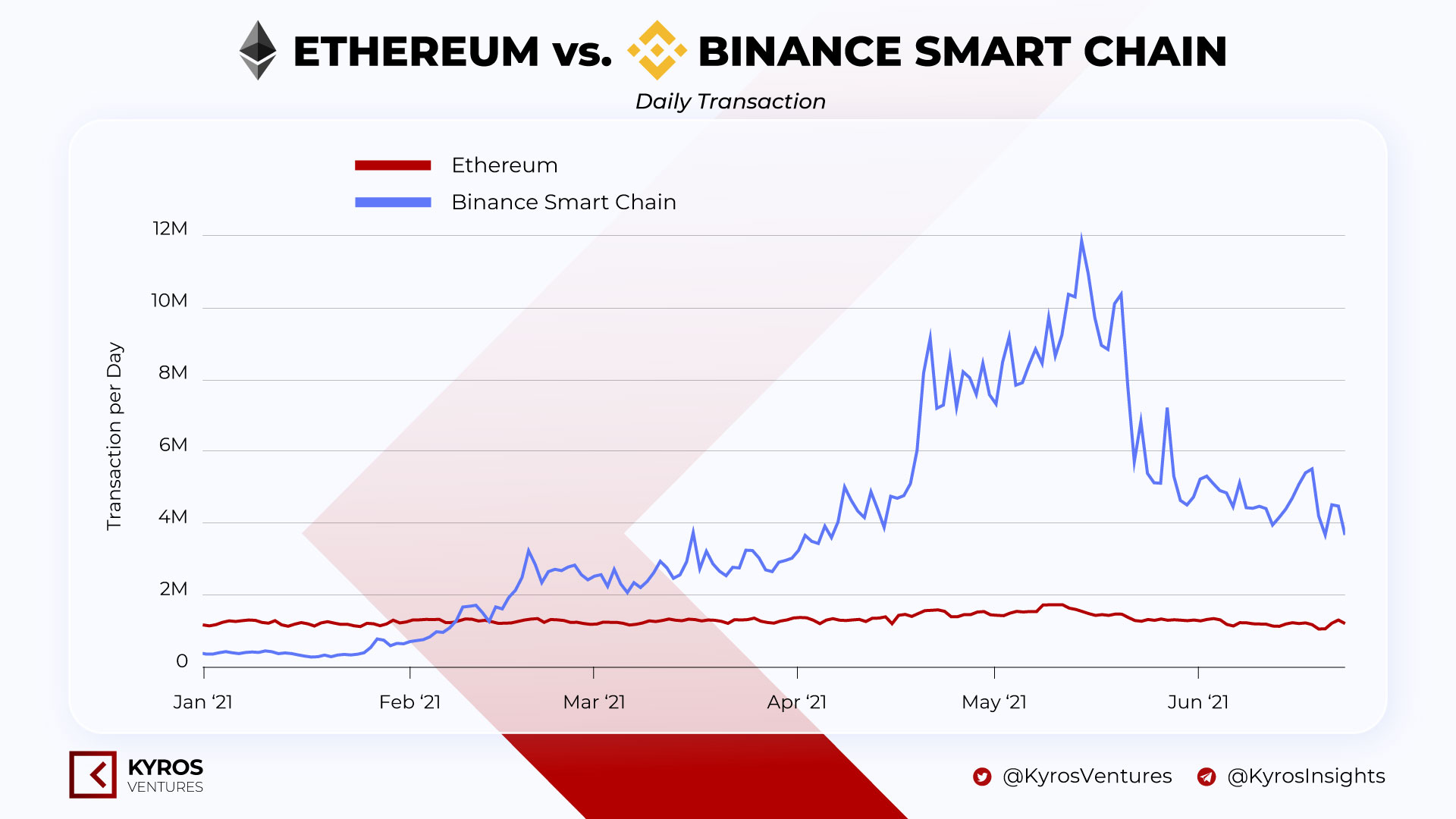

In which, BSC is essentially the most talked about title and is predicted to change into a brand new competitor to compete with Ethereum. The ecosystem of BSC began to take off and speed up strongly in a really brief time.

According to the statistics of DappRadar, greater than 800 dApps have been constructed on it. This has helped the BNB token obtain a report 1500% development, from $40 to just about $700 in a brief time frame.

As was additionally identified within the Kyros report, when BNB got here in 2nd place within the listing of Altcoins with essentially the most “moon” potential. Besides, Solana, a reputation showing on this listing, can also be accelerating the method of constructing and perfecting the puzzle items in its ecosystem and attaining a worth development of greater than 36 occasions.

The actuality has proven that the above prediction is right, when the expansion and improve within the software of the above platforms has created a wave of promotion of their very own cash, in addition to “belonging” tokens to develop quickly. .

DeFi pattern continues to “popular”

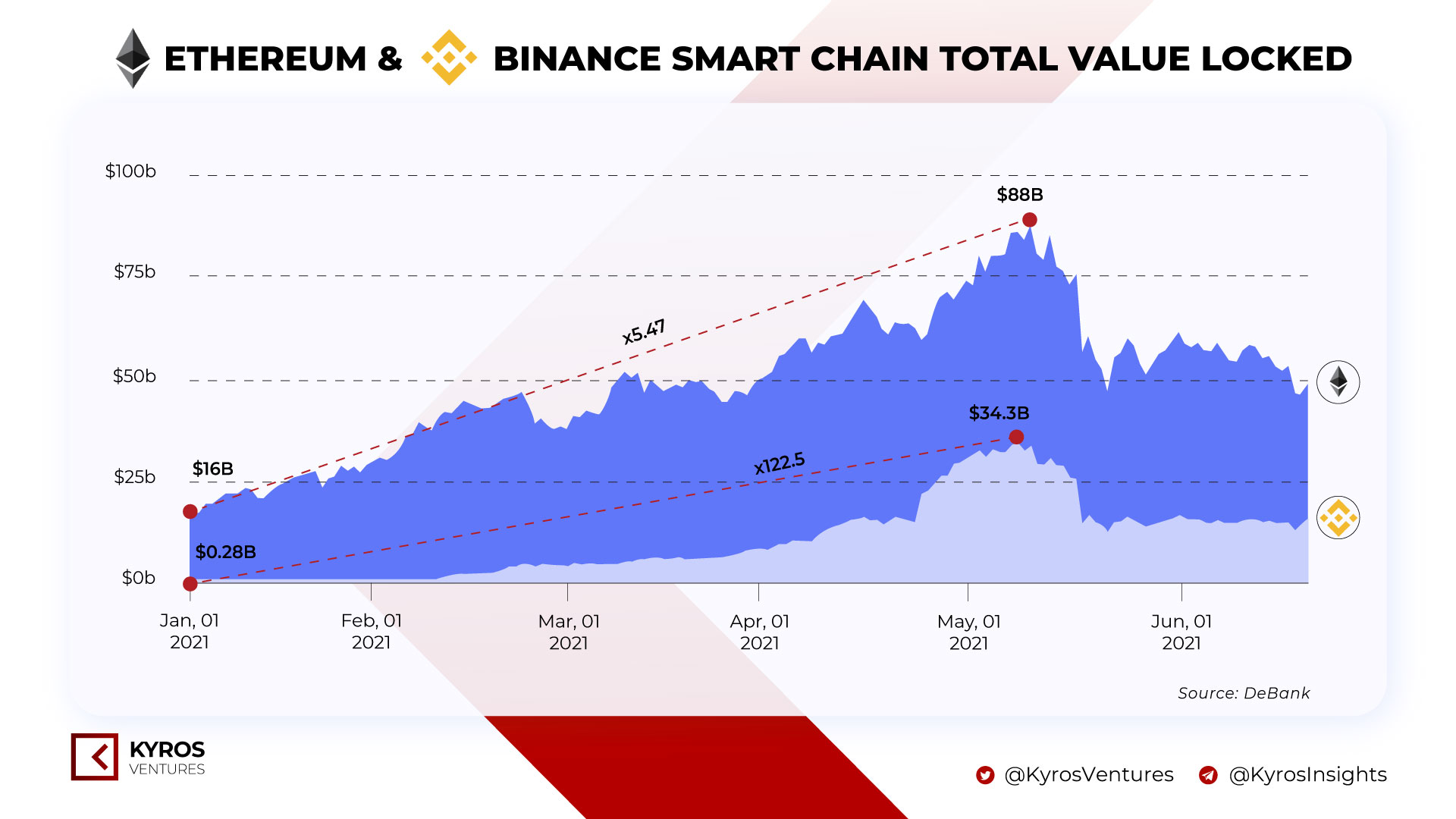

DeFi is a section that has triggered the cryptocurrency market to alter quickly within the second half of 2020. In the primary six months of 2021, this pattern is fueled by the general development of the market in addition to of the techniques. new layer 1 ecology. A easy metric that proves that is that the Total Value of Locked (TVL) of DeFi tasks on Ethereum elevated 5 occasions and on BSC elevated greater than 80 occasions within the first 5 months of the 12 months.

DEX stays the most well-liked array in DeFi. According to information recorded from CoinGecko, the group of DEX tokens nonetheless accounts for almost 50% of DeFi’s whole capitalization. The main contributors are Uniswap, SushiSwap (on Ethereum) and PancakeSwap (on Binance Smart Chain).

Interestingly, all of those names are on the listing of essentially the most favourite DeFi platforms within the Kyros Ventures report.

Mutations “beyond all expectations”

However, it should not be forgotten that it is a cryptocurrency market the place something is feasible. Kyros’ prediction in addition to that of the neighborhood can’t be 100% correct. The following are fascinating “variables” of the crypto trade within the first half of 2021, the product of an uptrend season that actually shocked many individuals.

Polygon’s mutant development

Polygon (MATIC), a scaling resolution on Ethereum can also be an sudden phenomenon of the Vietnamese investor neighborhood. Thanks to nearly zero network prices and the help of many huge gamers, the Polygon wave rapidly blossomed on the finish of April. In simply over half a month (late April 2021 to mid May 2021) ), the token worth of Polygon has elevated 5 occasions. At its mid-May peak, there was nearly $8 billion in worth locked on Polygon’s platform, second solely to Ethereum and BSC.

Trending memecoins

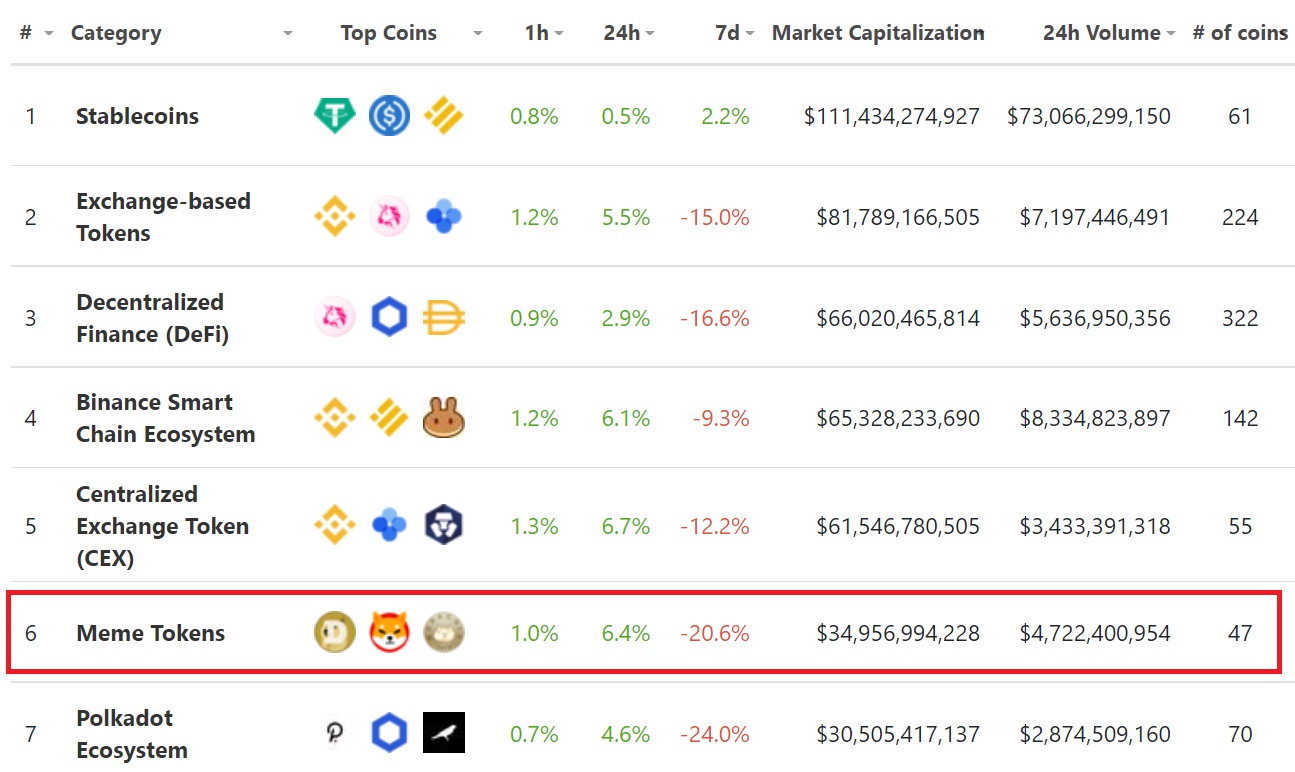

Memecoins, animal cash or “junk coins” additionally grew to become a giant pattern within the cryptocurrency market in early May 2021, and this was in all probability the most important shock for the investor neighborhood. The driving pressure of this pattern is the results of the uptrend season, resulting in optimism in addition to FOMO of each new and previous buyers, plus the “catalyst” of Elon Musk brazenly supporting Bitcoin on Twitter. mine.

The considerably insane development of Dogecoin triggered the wave of Memecoin, the “junk coin” that began in May and created a resonance impact that made the market seem a collection of canine, cat and animal cash, presumably together with Shiba Inu, Hoge Finance, YooShi, Woofy, AquaGoat, and so forth. Many buyers began fomo and pushed the market capitalization of Memecoin previous 50 billion USD, making memecoin a section with market capitalization within the prime of the market, though it’s now previous the height interval on the finish of the month. 4 – early May.

The time when the memecoin pattern grew to become essentially the most blossoming was additionally the time when the whole cryptocurrency market started to enter a correction part.

The market out of the blue acquired a giant correction

In addition to Bitcoin rising sooner than anticipated, the correction of greater than 50% in mid-May additionally shocked the crypto neighborhood. Bitcoin worth fell to the worth vary of $ 3,000, Altcoins additionally started to obtain a big drop of 70-90% in worth. In simply over half…