The cryptocurrency market place has gone by way of numerous development cycles with unique driving trends. The query is: what will be the subsequent trend?

Finding the trend that will drive the cryptocurrency market place subsequent season – Part four (conclusion): RWA

Finding the trend that will drive the cryptocurrency market place subsequent season – Part four (conclusion): RWA

Preamble

Real World Asset is not a new subject but it is by no means previous, it is an modern application strategy that the DeFi neighborhood often wishes to come to be actuality quickly. In this short article, we will check out this subject in detail to see irrespective of whether it is really worth aspiring to or not.

Real World Asset (RWA) – The finish of the cryptocurrency market place.

What is Real World Asset (RWA)?

Real World Asset (RWA) is defined as genuine-existence assets that are published on the blockchain by means of coding in the type of fungible tokens or non-fungible tokens (NFTs). The approach of encoding genuine-existence assets into tokens is identified as Tokenization.

After the tokenization approach, these assets are disseminated and applied in the DeFi natural environment equivalent to other on-chain assets.

RWA classification

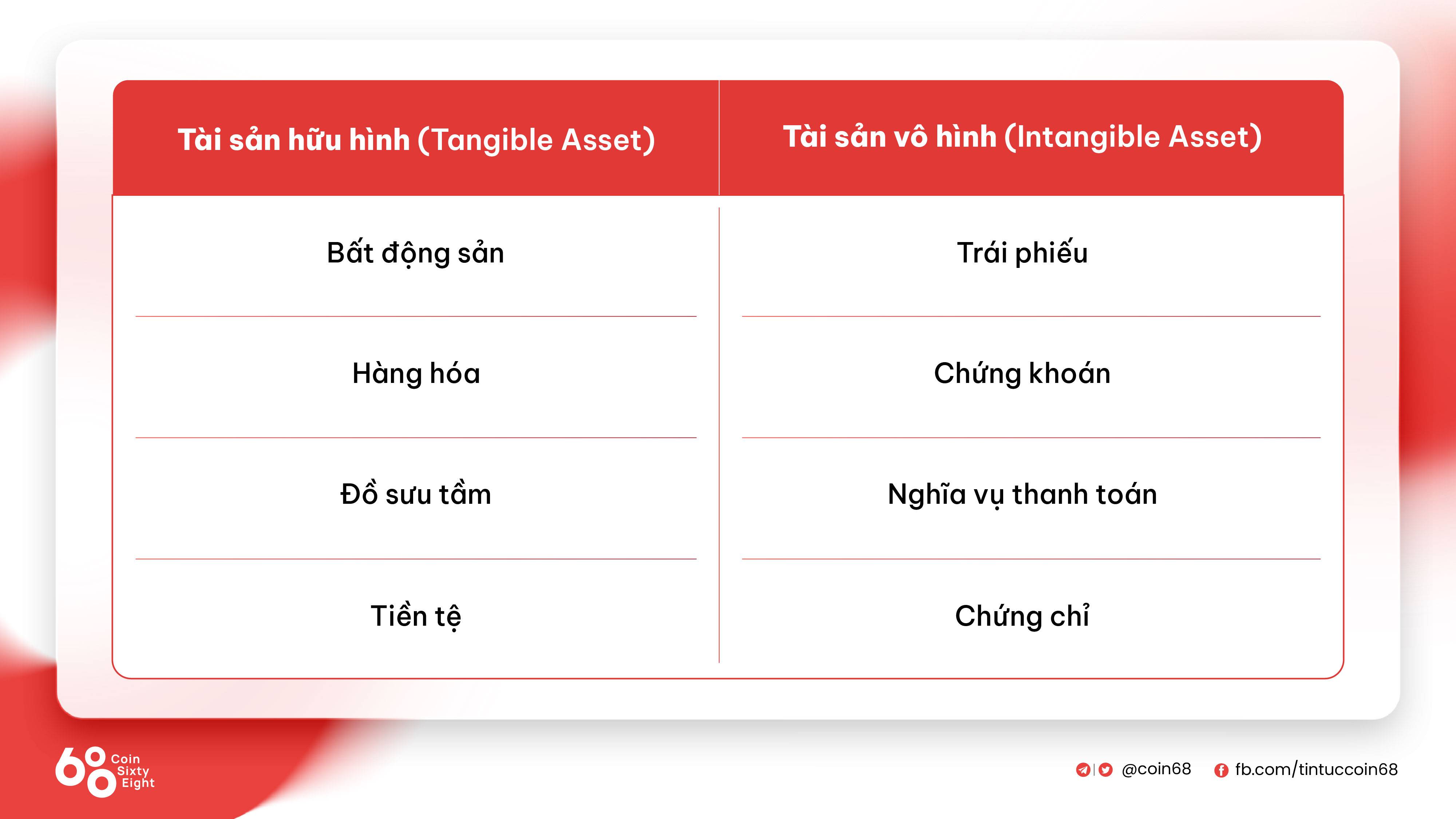

To classify RWA we can divide them into two broad classes: tangible and intangible. Then, inside every class, even more divide the appropriate fields. Below is a reference classification:

- Properties: homes, land, warehouses…

- Raw elements: Gold, silver, diamonds, gems, oil, minerals…

- Collectibles: photographs, postcards, antiques…

- Currency: This sort of RWA that we have been employing for a lengthy time without having realizing it, is the legal currency of nations. For instance: USD (USDT, USDC)

- Bonds: issued by government or personal groups

- Stock: Company stock codes

- Certificates: inventions, patents, certificates, copyrights…

RWA working model

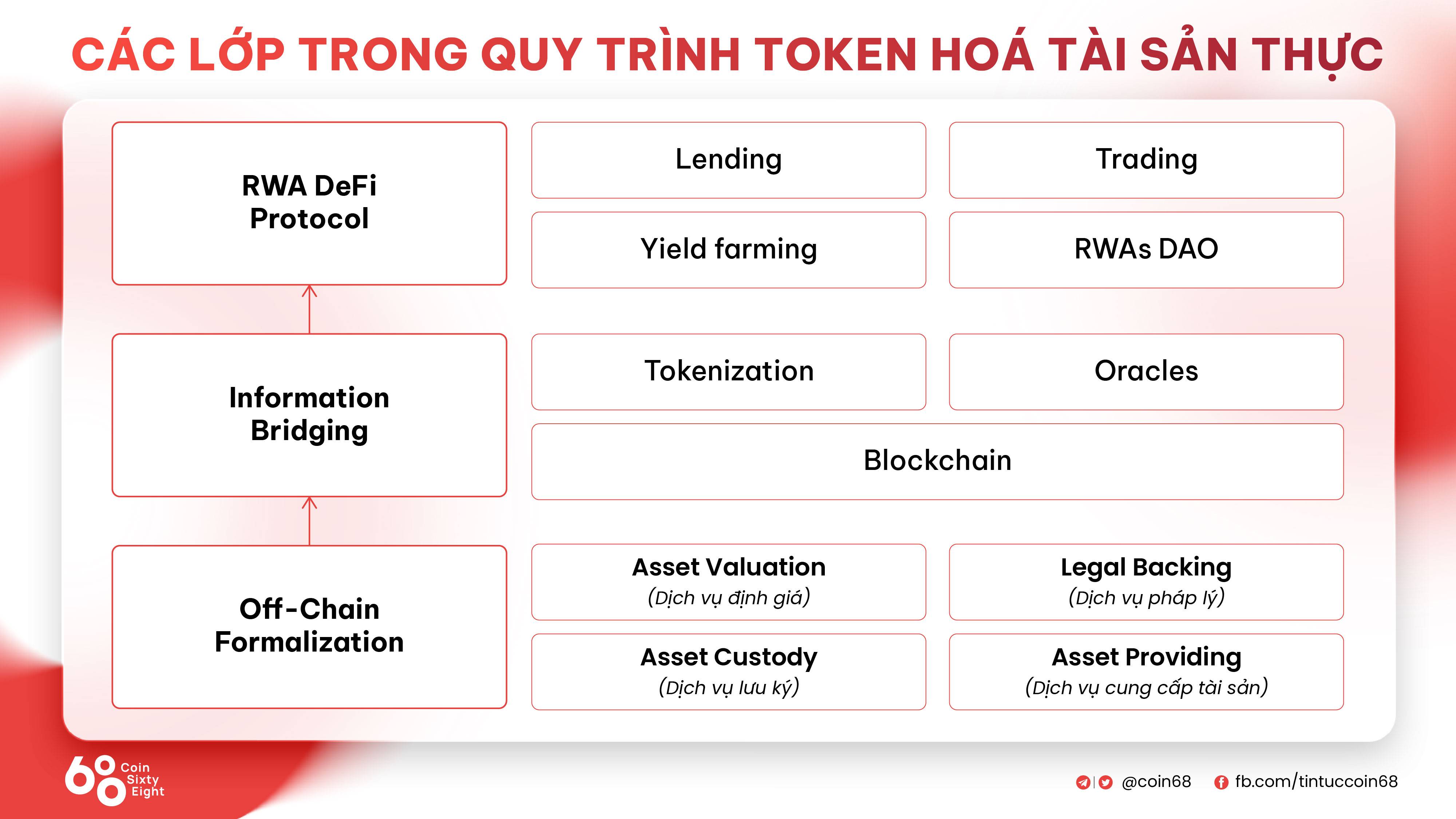

To transfer a genuine asset into DeFi, you require to comply with three key techniques:

- Off-chain formalization

- Information bridge

- Flow in DeFI (RWA DeFi protocol)

Layers in the approach of tokenizing genuine assets

Layers in the approach of tokenizing genuine assets

Step one: Off-chain formalization

Resources posted on the chain could be offered by persons or entities that specialize in giving sources. For instance, genuine estate exchanges, gold and silver centers, valuable stones,… this kind of entities are identified as Asset Providing.

The assets are then valued and deposited. Custodial providers are accountable for caring for and preserving assets so that they are physically and legally intact. All genuine-existence pursuits connected to this residence are also supported by a fourth element, the legal services suppliers. They are accountable for making sure that all pursuits comply with the law and are protected by law. When a dispute takes place, the events will appreciate the rewards in accordance to regulatory guidelines and law.

Step two: Connect the data

This is the stage to website link asset worth from off-chain to on-chain.

Tokenization: Depending on the nature and objective of use, assets are tokenized into fungible tokens or non-fungible tokens (NFTs). This stage is carried out by a unit specialized in giving tokenization providers with the assistance of blockchain platforms (Ethereum, Polkadot, Polygon, Onyx). Asset data soon after tokenization will be immutable and transparent on-chain.

Oracles: An indispensable element in the RWA ecosystem. Oracles aid on-chain protocols remain mindful of genuine-existence fluctuations. For instance, what is the recent value of gold and oil, what is the value of tokenized stock codes. Chainlink is at this time even now the foremost title in the area of Oracles.

Step three: DeFi RWA Protocol

The ultimate stage soon after tokenizing genuine-existence assets is to place them into circulation in the DeFi natural environment. Here the totally free market place will be branched into many distinct fields. The two most critical regions at the minute are:

- Lending: RWA-based mostly lending and borrowing protocols.

- Trading: Platform that aids consumers trade RWA.

There is also Yield Farming, platforms that make it possible for consumers to earn revenue by depositing their assets into the protocol, or RWA DAO, a collective governance board of genuine assets. For instance, they purchase a property with each other, determine on the rental value, and then share the revenue from that rental small business.

It can be observed that bringing assets from genuine existence to the chain is very difficult, primarily for assets with numerous legal constraints and substantial worth this kind of as genuine estate. But why do massive organizations proceed to enthusiastically assistance and assistance this trend? We will study about the rewards that RWA aims to attain in the subsequent part.

Benefits that RWA aims for

If you appear even more, past the decentralized monetary market place, you can see that every thing blockchain is attempting to do is a useful application in all factors of genuine existence.

Not only constrained to finance, but also to other sectors of society this kind of as healthcare, schooling, transportation, gaming… Real World Asset (RWA) is a piece of the puzzle that promotes the approach of Social blockchainization This.

Borderless trading market place

In the common monetary market place, you will have issues paying for genuine estate, stocks or government bonds from a nation the place you do not reside.

But soon after posting it on-chain, with a number of clicks from household you can instantly personal a villa in the Bahamas.

Of program, owning assets on-chain, but the method for obtaining assets locally we most likely will not talk about right here.

The borderless trading market place facilitates the movement of capital on a worldwide scale alternatively of getting constrained locally to every geographical spot as is at this time the situation, as a result assisting to broaden funds movement and enhance the liquidity clause.

Increase efficiency in the use of capital

DeFi has opened up a new monetary market place that operates alongside common finance. Users have the total correct to decide on which market place is far more valuable for them, as a result making competitors involving the entities of the two markets. Competition generates improvement and consumers advantage from it.

To recognize greater, let us appear at the following instance: A organization requires to increase capital for approaching small business pursuits. They want to home loan the total factory and warehouse to borrow capital. The bank’s loan curiosity fee is twelve% per annum and that of the DeFi RWA protocol is eight% per annum. Users can absolutely decide on to tokenize collateral and home loan it on-chain to appreciate reduced curiosity charges.

It need to also be extra that this is a simulation beneath perfect situations, when DeFi operates securely and friction in the total approach (from tokenization to home loan, to withdrawing funds from DeFi to banking institutions) has been drastically minimized.

Improve processes and procedures

One of the benefits provided by DeFi is “independence from third parties”. Transactions on the blockchain are created involving men and women by means of intelligent contracts. Therefore, it aids cut down numerous complicated processes this kind of as common finance.

For instance, in the common planet, when you require to home loan assets to get a financial institution loan, you require to go by way of many legal procedures:

- Prepare the loan application

- Demonstrate the objective of employing capital

- Demonstrate monetary capability (supply of revenue, no lousy debt)

- Test and evaluation of collateral pursuits

- Mortgage of secured residence

- Other dispensing and periodic inspection procedures

With RWA you just require to personal the assets in your wallet and carry the loan protocols for approval and you happen to be performed. In a way, probably this simplification of the approach will aid consumers conserve expenses all through the total approach.

Instead, legal procedures are produced to safeguard the events concerned, and RWA simplifies all the paperwork, that means that consumers will be absolutely accountable for this kind of hazards. Trust is positioned in intelligent contracts and self-custody of users’ assets.

Increase liquidity

Total worldwide asset worth. Source: Binance Research

Total worldwide asset worth. Source: Binance Research

The worth of the worldwide asset market place is estimated to attain $900 trillion, whilst the total cryptocurrency market place is at this time only really worth about $one trillion. Once the RWA door is opened, the movement of funds into DeFi will be massive, as a result expanding the capitalization and liquidity of the total market place.

But every thing will be constrained to “counting crabs in the hole” if the RWA fails to show its excellent benefits.

Create new financial versions

A excellent instance of the new financial model produced by RWA is the fragmentation of the genuine estate sector. In genuine existence, co-owning a property involving strangers is very complicated: this normally only comes about if a group of acquaintances contribute capital and then allow a representative consider the title.

Until on-chain due to its Trustless nature, outsiders will not require to believe in anybody, they just require to believe in the intelligent contract. Fragmentation protocols divide the property into distinct components and promote them to individuals who want to purchase. On the other hand, the protocol rents the property in genuine existence and pays the revenue to the purchasers of the fragments. You can obtain out far more in the RealT task.

Yield farming versions will also quickly flourish in this market place. You personal RWA but have not discovered a way to revenue from individuals assets, the Yield Farming Protocol will aid you do so.

Insurance will also be a prospective piece of the puzzle. To protect against legal hazards and disputes, consumers can invest in insurance coverage for their on-chain assets.

Furthermore, numerous new financial versions will seem in the long term that we will have to wait to proceed exploring.

Challenges for RWA

Legal guidelines

Clearly this is a single of the largest difficulties for Real World Asset. While cryptocurrency is also even now triggering controversy between worldwide lawmakers, bringing genuine assets into DeFi is a incredibly futuristic venture.

Activity…