The reduction-generating provide of Bitcoin has risen to its highest degree considering the fact that the collapse of COVID-19, creating BTC to collapse in just the to start with two months of 2020.

Although more than 75% of Bitcoin wallet addresses are rewarding regardless of BTC’s sharp correction in early April, in the context of Bitcoin’s continued “sinking” to the $ 37,000- $ 39,000 mark, the reduction-generating Bitcoin provide has registered a drop. drastically in the previous handful of weeks.

According to the most up-to-date information from the blockchain analytics platform CryptoQuant, the index is now hovering all around seven.six million BTC, marking the highest degree ever considering the fact that the to start with half of 2020. Notably, this is the commence of the speedy collapse. of Bitcoin when it fell straight from the over USD ten,000 to under USD five,000 rate place mostly impacted by the COVID-19 pandemic.

The reduction-generating offer you has reached its highest degree considering the fact that the collapse of COVID.

from @GrizzlyBTCloverVerify👇https://t.co/3g7rOanHsw

– CryptoQuant.com (@cryptoquant_com) April 28, 2022

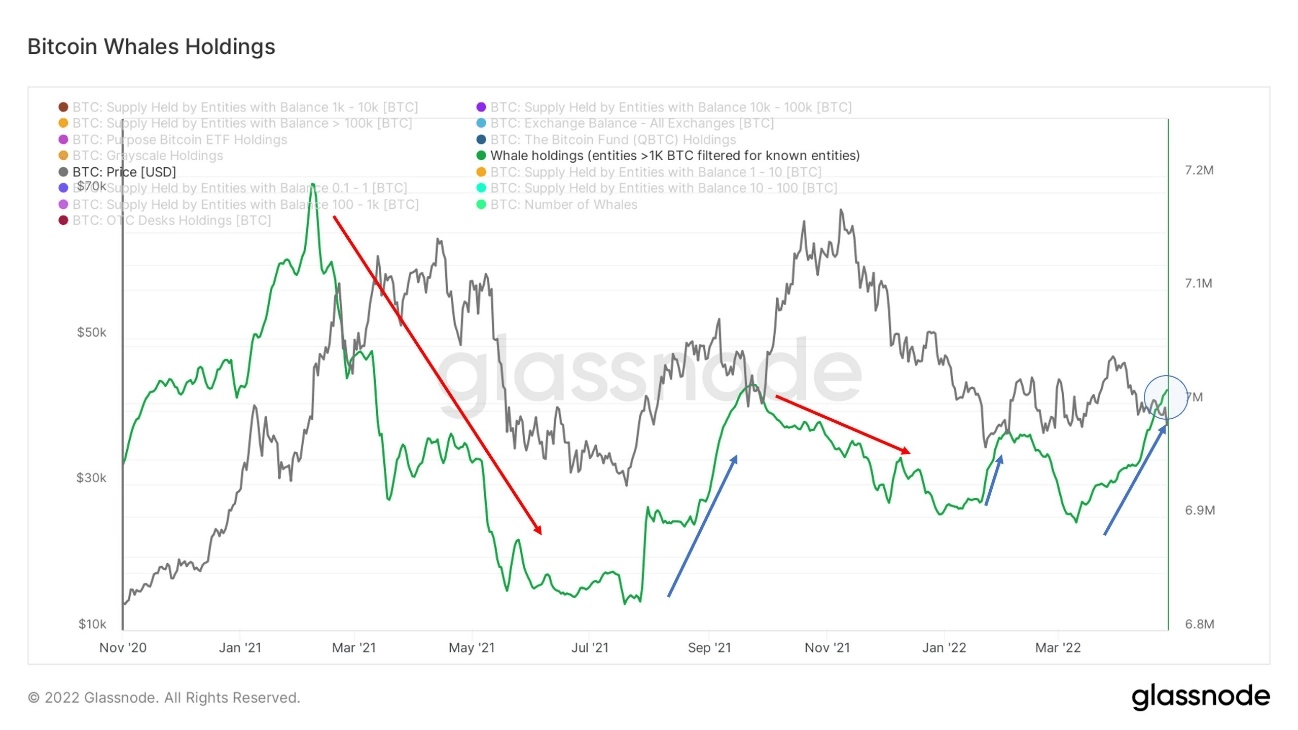

But when Bitcoin’s rate might be struggling, that does not quit traders with substantial positions from steadily expanding their pockets. Data on Glassnode exhibits that the variety of Bitcoins held by whales with a stability of at least one,000 BTC has risen to the ideal degree considering the fact that September 2021. Interestingly, the cumulative move more than the previous week has stored steadily expanding.

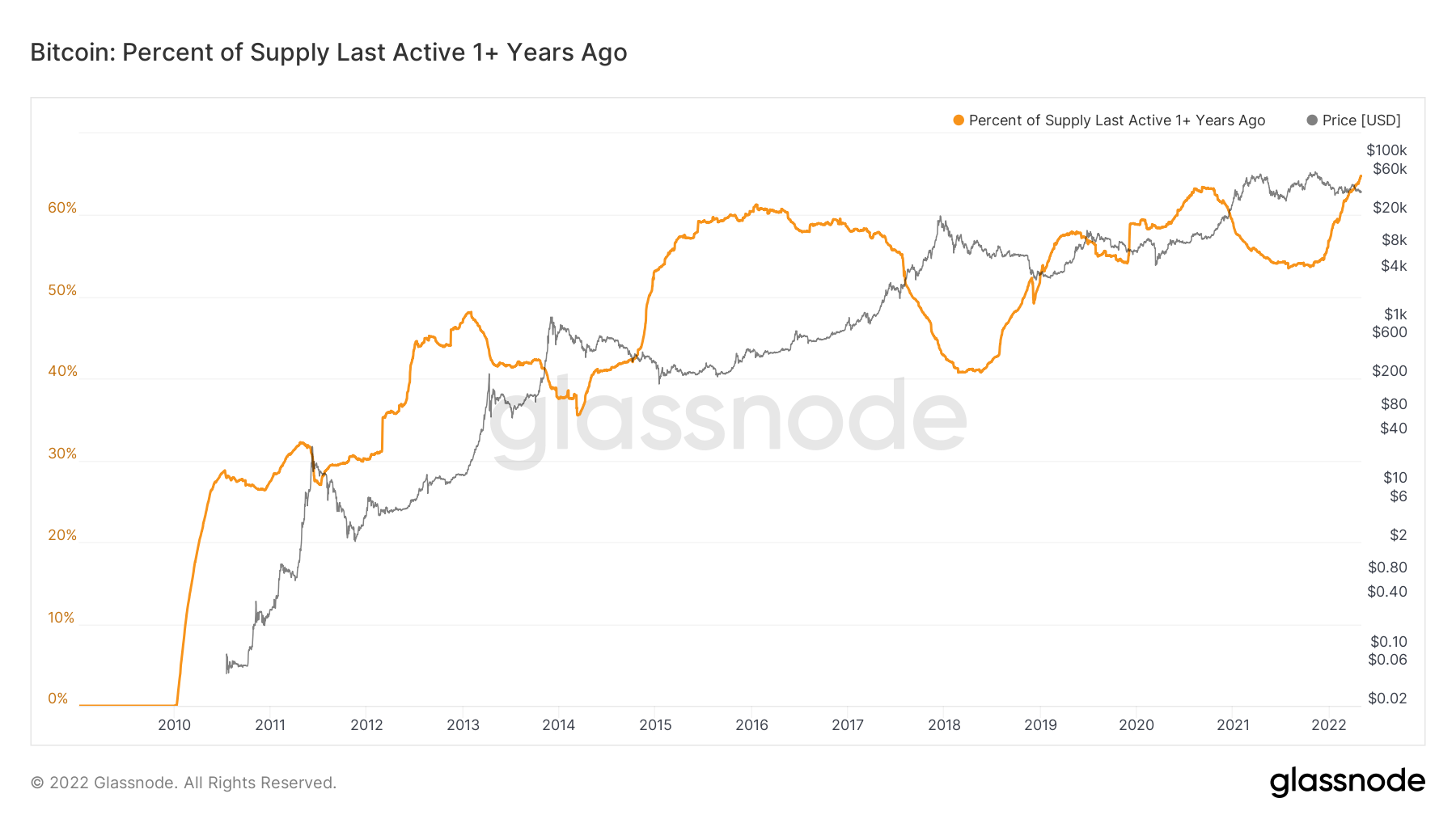

On the other hand, Bitcoin’s a single-12 months inactive providing percentage has also just set a new ATH at 64.81%. For comparison, in February 2022 the index was all around 61.seven%, when 54.five% was the beginning level for 2022.

In essence, a substantial circulating provide of Bitcoin that does not move for a lengthy time produces illiquidity in the marketplace. So only a relative sum of Bitcoin purchased in a flash will trigger excessive fluctuations in the rate of BTC in a constructive path. Therefore, taking into consideration the present scenario combining the accumulation trend and investor self-confidence in lengthy-phrase retention, the likelihood of a powerful BTC recovery in May is nonetheless attainable.

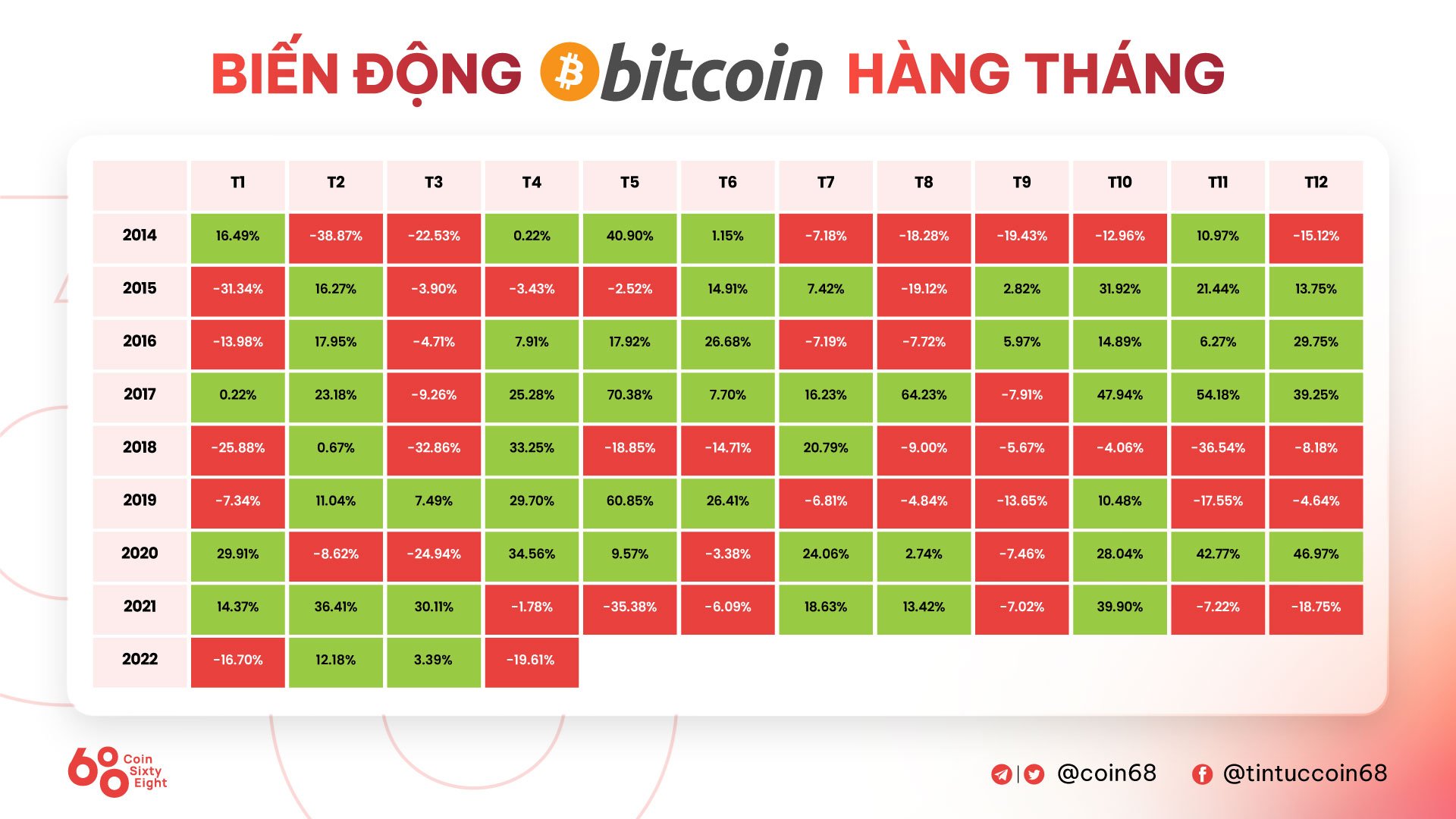

Compared to historical month to month rate movements, May will ordinarily be a time when Bitcoin feels “transpiring” with fairly sizeable development.

However, traders will need to be pretty wary of the Fed’s challenge. Because in mid-April, President Jerome Powell announced that the Fed could increase curiosity prices to .five% in the subsequent May adjustment, the key trigger of the breakdown. Bitcoin rally at that time.

Summary of Coinlive

Maybe you are interested: