Terra’s UST assure fund, Luna Foundation Guard, abruptly announced that it was “lending” a significant volume of Bitcoin to “borrow” 750 million UST.

As reported by Coinlive, the UST stablecoin algorithmic model of the Earth ecosystem (LUNA) had an “unstable” Sunday when the price tag of LUNA plummeted, leading to the FSO to reduce the USD one (de-peg) threshold at instances. up to .9857 US DOLLAR.

It is probable to summarize what occurred on the morning of May eight as follows:

- A significant volume of UST was offered off on Curve

- The rumors spread speedily on Twitter

- It earns UST two billion taken from Anchor

- The price tag of LUNA has collapsed

- UST is depeg at .987

- The price tag rose once more to .995 soon after Do Kwon reassured the local community

- Jump Fund sells assets to purchase UST

However, this is likely not sufficient as up until eventually now UST is nonetheless struggling all over the .995 place but was unable to return to the outdated .999 price tag degree ahead of staying de-peged.

At noon on May 9, the Luna Foundation Guard (LFG), a reserve fund developed to safe UST’s price tag, announced that it would promote $ 750 million really worth of Bitcoin into the fund to purchase back UST 750 million. This UST is committed to purchasing back BTC as soon as the marketplace has stabilized.

four / As a consequence, the LFG Council voted to complete the following:

Lending $ 750 million in BTC to OTC trading companies to assist defend the UST peg.

– 750M UST loan to accumulate BTC as marketplace situations normalize.

– LFG | Moon Foundation Guard (@LFG_org) May 9, 2022

However, LFG’s announcement calls the transaction “loan” and “loan”, exclusively that LFG will lend a $ 750 million OTC unit in its Bitcoin and in return, UST 750 million will be “borrowed”. It is not clear who this OTC organization is.

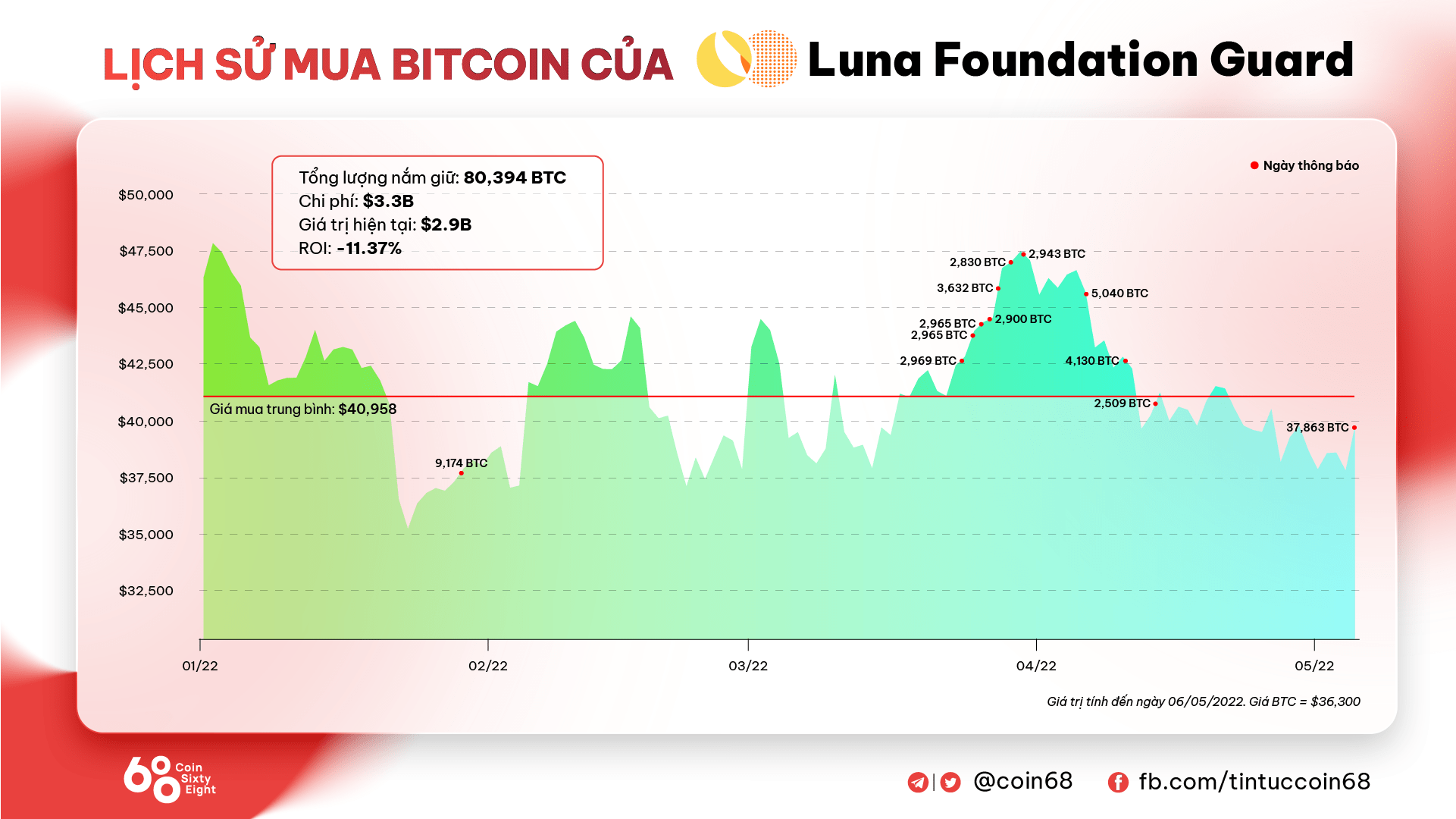

It is really worth noting that on May five, Luna Foundation Guard purchased a further $ one.five billion really worth of Bitcoin from Three Arrows Capital, a properly-acknowledged cryptocurrency investment fund in the local community. The volume of assets that LFG held at the time was around $ three.five billion, such as $ three billion in Bitcoin and $ 500 million in other currencies this kind of as USDT, USDC and AVAX.

This is the 1st time that LFG has offered BTC soon after accumulating constantly in excess of the previous three months.

It does not quit there, LFG’s act of offering Bitcoin is also pretty puzzling mainly because in the mission statement on the web site, Luna Foundation Guard stated that the target of their reserve fund is to provide UST traders a higher selection of regulation. like BTC in the situation of UST de-peg, as an alternative of basically switching to LUNA and dragging the price tag of each down.

The only explanation for this determination is that LFG desires to lessen UST’s provide in the marketplace to assist this stablecoin get back to $ one, and it has no selection but to use its Bitcoin holdings to do so mainly because this is the most. good asset in the fund.

At the time of creating, page of the fund’s balance sheet statistics showed no modify in the asset ratio, but the complete worth dropped to $ two.9 billion soon after the current cryptocurrency marketplace correction, even the volume of Bitcoin held is only $ two.seven billion.

BTC and LUNA rates in excess of the previous twelve hrs continued to plummet to $ 33,267 and $ 59.forty, when UST was nonetheless struggling all over the $ .995 threshold.

Synthetic currency 68

Maybe you are interested: