On the 26th, Rune Christensen, co-founder of MakerDAO (MKR), the undertaking behind the greatest decentralized stablecoin in the cryptocurrency industry, Dai (DAI), posted a proposal for a “falling” floating long term DAI on the MakerDAO forum.

Immediately, this proposal it sparked a good deal of controversy and also unveiled a good deal of deep stories behind it. The following write-up aims to sequence essential occasions to enable readers superior realize the total image of the conflicting debates surrounding DAI’s long term in the previous couple of days.

An overview of all the occasions that preceded the “Fluttuosa DAI” proposal.

Maker’s End Game Plan

End game plan is a proposal to absolutely reform MakerDAO launched by Rune Christensen from June 2022 to divide the responsibilities of MakerDAO among every single specialized MetaDAO.

The centerpiece of Endgame Plan is the MetaDAO, which can be understood as MakerDAO “subDAOs” (subDAOs), are specialized organizations with a “realistic, profitable, sustainable and fully decentralized” company model. Each MetaDAO will get on a unique perform in Maker, e.g. MetaDAO manages Maker Ethereum (MATH, it is a synthetic ETH coin on Maker), MetaDAO manages RWA, MetaDAO manages Maker’s Node Network (MANO), and so forth.

The founder of the undertaking thinks that if “specialization” thanks to MetaDAO and its tokens, Maker can fix the issues that the undertaking is dealing with at the second, like:

– slows development

– the total protocol depends only on a couple of huge pools

– ambiguity on the allocation of working budgets

– no sustainable company model

– complicated administrative pursuits

– decreased dependence on MKR

– lower degree of participation in the polls.

The long term of Maker and DAI

Come back to Rune’s suggestion.

According to Rune, there are two attainable developments for DAI and MakerDAO:

One isassisting DAI to be extensively employed, supported by law, employed to encourage fiscal inclusion (Financial Inclusion), integration with true assets (true planet assets, abbreviated to RWA) although preserving the spirit of decentralization

Two isgenerating DAI a thoroughly decentralized currency that has absolutely nothing to do with government institutions or regular fiscal assets by the The worth of DAI is “fluctuating”, it is no longer pegged to the USD one mark nonetheless.

So far, the initial advancement route is not possible for lots of causes, the most essential of which is that the blockchain field has not still designed any substantial true worth for the mainstream industry. And although Maker obtained a good deal of assistance in realizing the “Clean Money” aim for DAI – generating it a decentralized and unquestionably honest currency – that aim nonetheless stays right now. operate with the DAO method generating every little thing operate in a quite slow and hard way. Furthermore, the disappearance of Earth – MOON, Centigrade, Traveler, Three capital arrows and a variety of other scams in the cryptocurrency industry have broken the picture of this asset class in the eyes of mainstream traders, so it will now be hard to persuade them that cryptocurrency ought to be “treated in a different way than existing financial services.”

However, right up until now, Rune has usually needed to produce DAI in the initial route, mainly because connecting DAI with the regular fiscal planet will be a sound basis for its superior advancement in the long term. But in August an essential occasion occurred that manufactured Rune consider once more: the US government’s “ban” occasion for Cash Tornado.

Tornado Cash – the occasion that altered Maker’s route

In the previous, when true-daily life assets had been integrated by loans with Huntingdon Valley Bank wonderful General Companythe MakerDAO neighborhood has tacitly accepted two most important assumptions, like:

- Regulatory attacks on RWAs will be notified in advance to give customers time to react

- Even if a resource lockdown happens, innocent customers nonetheless have a way to get their funds back (as in the situation of E-Gold a lot more than 10 many years in the past, following the user’s assets had been frozen, the US government ultimately agreed with the directors of this business that the gold that the business nonetheless owes customers will be refunded (beneath the supervision of the judge Hollander).

In reality, from the Tornado Cash incident, it seems that the two hypotheses outlined over are not genuine. The imposition of sanctions by the government by RWA is nonetheless probably to take place all of a sudden and without having warning, leading to harm to innocent folks. Not only that, Circle also freezes USDC of all wallet addresses that have ever interacted totally with Tornado Cash without having warning about how other USDCs will be returned to innocent customers. Subsequently, important DeFi tasks boycotted Tornado Cash for dread of finding concerned, generating cryptocurrency customers truly feel the gravity of a true assault towards the decentralized nature of the field.

Unlike the USDC, DAI’s layout does not permit it to “freeze”. It’s like a “knife” hanging in excess of MakerDAO’s head, mainly because if this organization will get orders from the government, it can not modify that rule. And as a result, decentralization is the only way for DAI to exist, mainly because then, if MakerDAO itself does not “save” DAI, it can nonetheless reside.

The “floating DAI” roadmap.

Before the occasions that just occurred with Tornado Cash, Rune Christensen had to include the “Future of DAI” part to the Endgame Plan, which concerned a “floating DAI”, ie no longer letting the stablecoin hang on the USD. Rune recommended two resources to enable create the DAI mobile roadmap, like:

- MetaDAO and MetaDAO Tokens: Create new MetaDAO tokens to inspire customers to hold DAI, mainly because in exchange for Rune, this is a “powerful” device to entice customers to use DAI.

- Protocol Owned Vault: In this approach, MakerDAO will accumulate a good deal of ETH to right manage the minting of DAI.

When the demand for yield farming for DAI is also large, it will lead to provide and demand asymmetry, so unfavorable curiosity charges will be employed to enable coin a lot more DAI as they have come to be less expensive than the collateral worth is ETH.

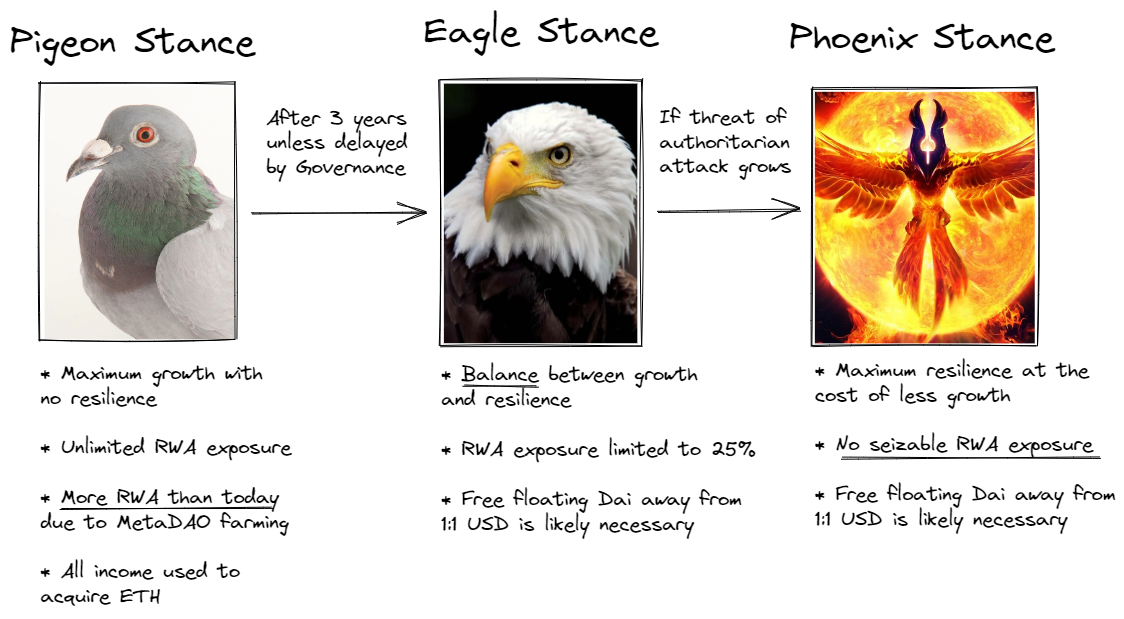

The 3 phases of DAI floating will get location as follows:

Stage one: Pigeon Position

- Chronology: at the existing time

- MakerDAO will leverage RWA to maximize revenue and acquire a lot more ETH

- There will be no limits to the use of RWA as a promise

- The most important goal of this phase is to encourage the advancement of DAI as far as attainable regardless of the dangers posed by RWAs.

Phase two: Position of the Eagle

- Chronology: following three many years from Pigeon, but can be delayed if vital

- Rebalance the dangers from RWA with a lengthy-phrase advancement orientation for DAI

- RWA is constrained to 25% of the complete collateral deposit

- DAI can begin floating.

Phase three: Location of the Phoenix

- Timeline: following Eagle, taken when the possibility of DAI assault is evident

- Development may possibly have stalled, but DAI has as a result been a lot more resistant to government sanctions (if any)

- No a lot more RWAs in the collateral deposit

- DAI can be floated.

Questions for the long term of DAI

No phrases could clarify the magnitude of the new statement manufactured by Rune. Basically, this is a full modify of heart and Maker’s imminent orientation with DAI. Perhaps Rune noticed the reality that DAI will not be capable to attain decentralization as lengthy as it is concerned in assets that can be censored at any time by a centralized institution, even if it is not, be it true estate or bonds or bucks. in a financial institution account. All can be effortlessly censored, frozen or confiscated, for pennies by officials seated in the White House.

So what about the other alternatives? DAI can nonetheless be backed by a crypto asset, this kind of as ETH. This is also a resolution promoted by lots of Ethereum supporters, mainly because in essence Maker will use USDC to purchase ETH on the industry, pushing up the price tag of ETH. The ETH itself is also a coin that has a use as nicely as a sturdy foothold in the crypto ecosystem, so there is no possibility of collapse and getting caught in a death spiral as occurred with the LUNA – UST model. in May. anchoring DAI to ETH carries a tangible possibility that DAI is a lot more vulnerable to depegs, affecting the most important perform of a stablecoin which is to continue to be steady in worth at all occasions.

Floating DAI, on the other hand, will more make this stablecoin no longer a stablecoin. This can be in contrast to USD abandons the gold regular in the 70s of the final century. Similar to the USD, the worth of DAI will be absolutely established by the law of provide and demand and financial policy. But not like the USD, DAI is not still the dominant currency of an economic system, it nonetheless has its rivals and limitations. No a single can predict no matter whether DAI will depeg and crash following floating, but it will be the true check of Maker and DAI’s ambitions in their quest for decentralization. If this stage is passed, it can be mentioned that DAI is a genuine decentralized stablecoin.

Luca Prosperi’s stage of see

The method of transforming Rune Christensen’s standpoint from “shaking hands” to “leaving” the regular fiscal planet by a turning stage identified as the Tornado …