MakerDAO, the DeFi protocol on Ethereum that runs the DAI stablecoin, will complement StarkNet’s Tier two alternative to minimize transaction charges and serve as a premise for expanding to several far more tiers one.

MakerDAO integrates StarkNet

MakerDAO, a single of the oldest DeFi tasks on Ethereum and finest identified for its DAI algorithmic stablecoin, has announced that it will use StarkNet’s 2nd degree scaling alternative (layer-two) with the target of decreasing transactions.

As explained by Coinlive, StarkNet is a Tier two alternative created by StarkWare, a single of the leaders in Ethereum scaling. StarkNet is an extended edition of StarkEx, a Layer-two alternative created solely by StarkWare for tasks such as the dYdX derivative exchange, the severalFi spot exchange, and the ImmutableX and Sorare NFT platforms.

Unlike today’s well-liked Layer two scaling answers like Optimism and Arbitrum, which integrate Optimistic Rollups technologies, StarkNet utilizes Zero-Knowledge Rollups to verify transactions without having getting to rely on other events, which guarantees decentralization of the Ethereum network. What’s far more, StarkNet’s withdrawal occasions are also appreciably quicker than Optimism and Arbitrum, thanks to the advantage of Zero-Knowledge Rollups.

The new StarkNet was effectively rolled out in late February and MakerDAO will be the to start with massive title to pick this Tier two transaction processing, getting the most significant check of the project’s serious abilities.

The time to integrate StarkNet was set by MakerDAO on April 28, with the creation of a direct bridge involving the two platforms. The MakerDAO staff says StarkNet will minimize DAI transaction charges by far more than 10x in contrast to making use of Ethereum’s core network.

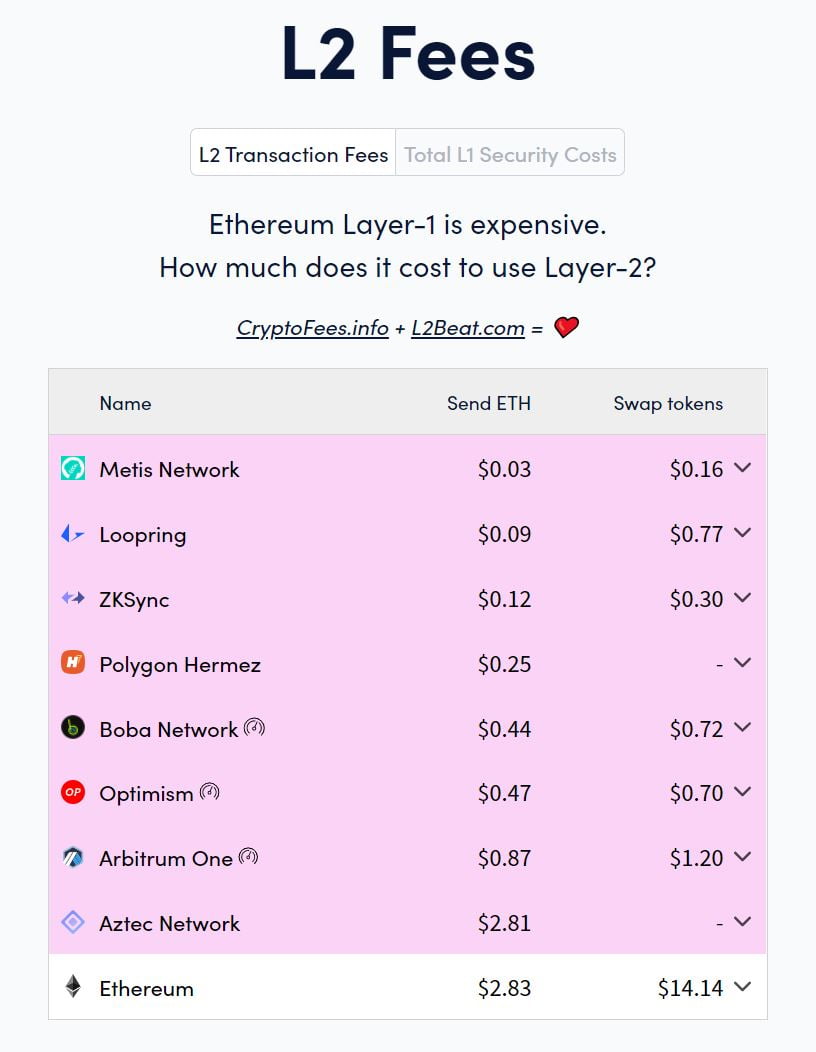

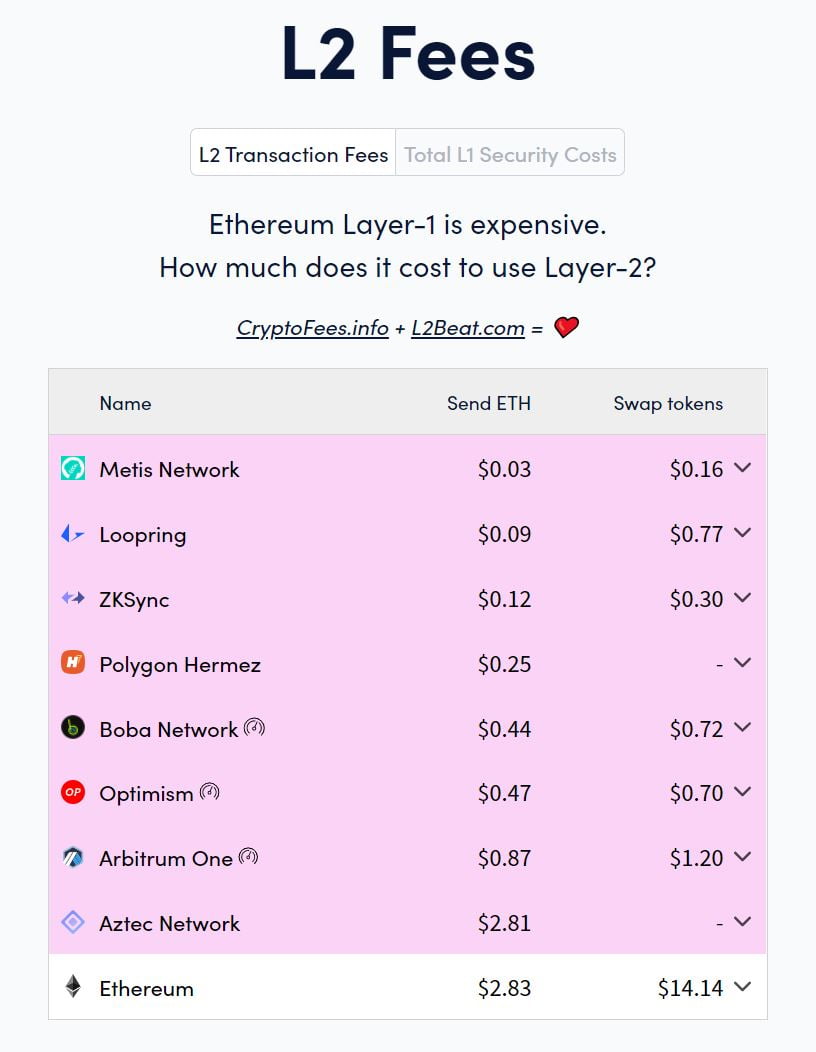

According to information from L2Fees, Tier two answers are gaining far more and far more voice in the Ethereum ecosystem, as they assistance ETH transaction charges and token exchanges that are tens of occasions decrease than the principal ETH network.

Furthermore, the velocity of transactions is also an improvement. Currently, processing an Ethereum transaction can get up to five minutes, based on network congestion and the gasoline fee picked by the consumer. However, with StarkNet, this time will be diminished to one-two minutes. A degree two alternative that sets objectives for following 12 months can minimize that variety to seconds.

MakerDAO desires to make DAI a multichain resource to regain its place

Next, MakerDAO will roll out several new updates to boost comfort for DAI end users, such as: producing a Wormhole mechanism to accelerate token circulation involving MakerDAO and StarkNet connect and allow the transfer of funds involving tiers two and distribute multi-collateralized DAI (MCD) tokens on StarkNet. These alterations will be rolled out slowly from now till early 2023.

Furthermore, MakerDAO aspires to transform into a multichain task, present on several two various ranges that are developed on the Ethereum ecosystem and expands to several other blockchains.

A representative from MakerDAO stated:

“The purpose of this multichain strategy is to take advantage of the speed and transaction fee benefits of layer-2, as well as expand DAI’s influence to make it the most popular stablecoin in the multichain world of money. To code.”

The MakerDAO staff is also conscious of the barriers on the multichain path they have picked, specially the threat of becoming hacked into the bridges that hyperlink blockchains with each other (cross-chains). Currently, the best three most damaging attacks in the DeFi marketplace are all in the cross-chain array and all have occurred in the previous 12 months, such as Poly Network ($ 611 million – August 2021), Wormhole ($ 325 million – February 2022) and most not long ago Ronin ($ 622 million – March 2022).

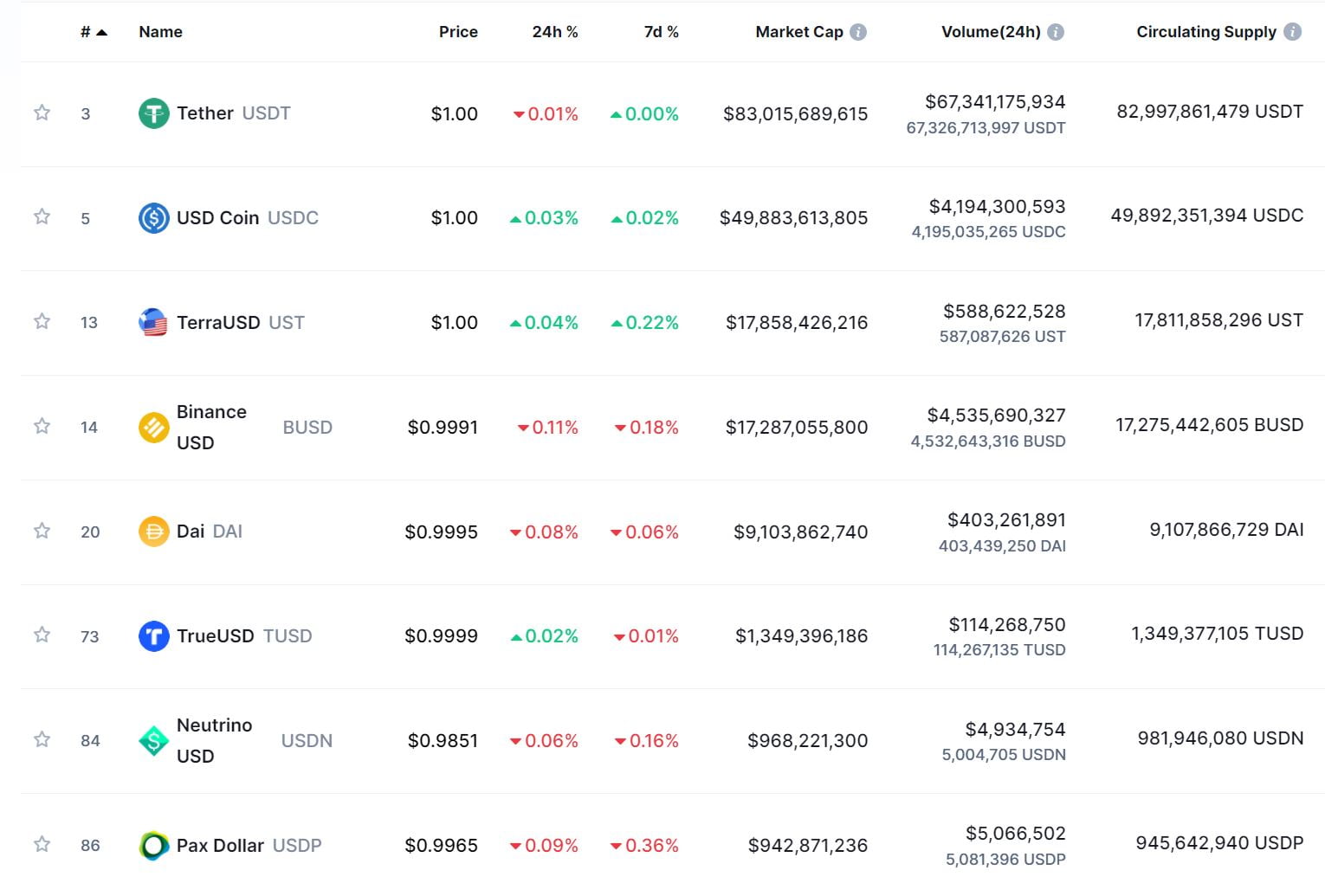

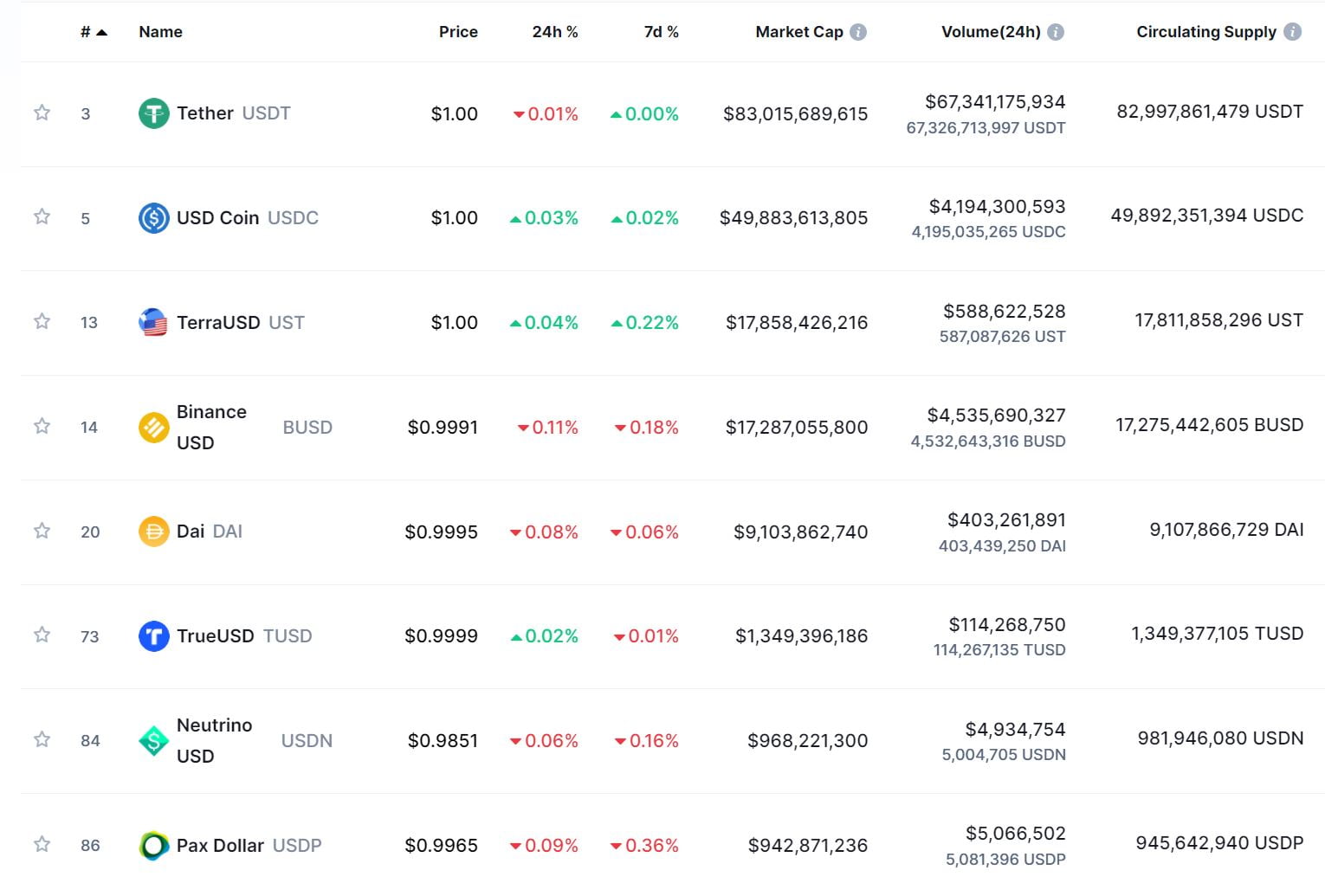

The sudden alter in MakerDAO’s improvement technique is most possible due to the reality that DAI’s place in the DeFi sector is strongly threatened by the emergence of TerraUSD (UST), the stablecoin of the Terra ecosystem. In addition to getting a enormous escrow fund and becoming committed by the Anchor task to having to pay curiosity up to twenty% / 12 months on UST deposits, Terra has not long ago partnered with other stablecoin tasks on Ethereum to kind the “4pool Alliance” “with the target of decreasing DAI’s influence in agricultural wars on Ethereum.

UST not long ago grew to become the cryptocurrency industry’s third-greatest stablecoin by market place capitalization at $ 17.eight billion, just about double DAI’s $ 9 billion.

Synthetic currency 68

Maybe you are interested:

MakerDAO, the DeFi protocol on Ethereum that runs the DAI stablecoin, will complement StarkNet’s Tier two alternative to minimize transaction charges and serve as a premise for expanding to several far more tiers one.

MakerDAO integrates StarkNet

MakerDAO, a single of the oldest DeFi tasks on Ethereum and finest identified for its DAI algorithmic stablecoin, has announced that it will use StarkNet’s 2nd degree scaling alternative (layer-two) with the target of decreasing transactions.

As explained by Coinlive, StarkNet is a Tier two alternative created by StarkWare, a single of the leaders in Ethereum scaling. StarkNet is an extended edition of StarkEx, a Layer-two alternative created solely by StarkWare for tasks such as the dYdX derivative exchange, the severalFi spot exchange, and the ImmutableX and Sorare NFT platforms.

Unlike today’s well-liked Layer two scaling answers like Optimism and Arbitrum, which integrate Optimistic Rollups technologies, StarkNet utilizes Zero-Knowledge Rollups to verify transactions without having getting to rely on other events, which guarantees decentralization of the Ethereum network. What’s far more, StarkNet’s withdrawal occasions are also appreciably quicker than Optimism and Arbitrum, thanks to the advantage of Zero-Knowledge Rollups.

The new StarkNet was effectively rolled out in late February and MakerDAO will be the to start with massive title to pick this Tier two transaction processing, getting the most significant check of the project’s serious abilities.

The time to integrate StarkNet was set by MakerDAO on April 28, with the creation of a direct bridge involving the two platforms. The MakerDAO staff says StarkNet will minimize DAI transaction charges by far more than 10x in contrast to making use of Ethereum’s core network.

According to information from L2Fees, Tier two answers are gaining far more and far more voice in the Ethereum ecosystem, as they assistance ETH transaction charges and token exchanges that are tens of occasions decrease than the principal ETH network.

Furthermore, the velocity of transactions is also an improvement. Currently, processing an Ethereum transaction can get up to five minutes, based on network congestion and the gasoline fee picked by the consumer. However, with StarkNet, this time will be diminished to one-two minutes. A degree two alternative that sets objectives for following 12 months can minimize that variety to seconds.

MakerDAO desires to make DAI a multichain resource to regain its place

Next, MakerDAO will roll out several new updates to boost comfort for DAI end users, such as: producing a Wormhole mechanism to accelerate token circulation involving MakerDAO and StarkNet connect and allow the transfer of funds involving tiers two and distribute multi-collateralized DAI (MCD) tokens on StarkNet. These alterations will be rolled out slowly from now till early 2023.

Furthermore, MakerDAO aspires to transform into a multichain task, present on several two various ranges that are developed on the Ethereum ecosystem and expands to several other blockchains.

A representative from MakerDAO stated:

“The purpose of this multichain strategy is to take advantage of the speed and transaction fee benefits of layer-2, as well as expand DAI’s influence to make it the most popular stablecoin in the multichain world of money. To code.”

The MakerDAO staff is also conscious of the barriers on the multichain path they have picked, specially the threat of becoming hacked into the bridges that hyperlink blockchains with each other (cross-chains). Currently, the best three most damaging attacks in the DeFi marketplace are all in the cross-chain array and all have occurred in the previous 12 months, such as Poly Network ($ 611 million – August 2021), Wormhole ($ 325 million – February 2022) and most not long ago Ronin ($ 622 million – March 2022).

The sudden alter in MakerDAO’s improvement technique is most possible due to the reality that DAI’s place in the DeFi sector is strongly threatened by the emergence of TerraUSD (UST), the stablecoin of the Terra ecosystem. In addition to getting a enormous escrow fund and becoming committed by the Anchor task to having to pay curiosity up to twenty% / 12 months on UST deposits, Terra has not long ago partnered with other stablecoin tasks on Ethereum to kind the “4pool Alliance” “with the target of decreasing DAI’s influence in agricultural wars on Ethereum.

UST not long ago grew to become the cryptocurrency industry’s third-greatest stablecoin by market place capitalization at $ 17.eight billion, just about double DAI’s $ 9 billion.

Synthetic currency 68

Maybe you are interested: