MakerDAO has begun voting on a series of governance proposals developed to restrict the DAI stablecoin’s publicity to Gemini due to the recent liquidity crunch dealing with the exchange.

The Gemini GUSD stablecoin is one particular of the collateral applied to mint the DAI stablecoin issued by the Maker Protocol. Gemini and Maker partnered final yr as a result of the PSM solution.

PSM is in essence a solution module that makes it possible for consumers to trade straight with one:one ratio concerning DAI and USDC, GUSD and USDP, it has a doing work mechanism that assists to deliver DAI peg to one USD more rapidly by possibility creation of arbitration for consumers. The GUSD collateral in Maker is now $489 million towards a debt ceiling of $500 million, the greatest quantity of DAI that can be minted by GUSD.

The MakerDAO local community has expressed concern about DAI’s publicity to Gemini by means of GUSD and the possible default possibility connected with $900 million frozen on the Gemini Earn solution due to the direct results of ailing cryptocurrency loan company Genesis. Recently, items appeared to get a flip for the worse when Genesis started discussing bankruptcy terms with creditors.

Faced with the over problem, Gemini CEO Tyler Winklevoss acted promptly to allay worries by saying in a post on the Maker forum that MakerDAO’s publicity to Gemini is restricted to GUSD to PSM. Winklevoss insists that the GUSD-backed DAI reserve is not owned by the corporation, so it will not be portion of any bankruptcy proceedings.

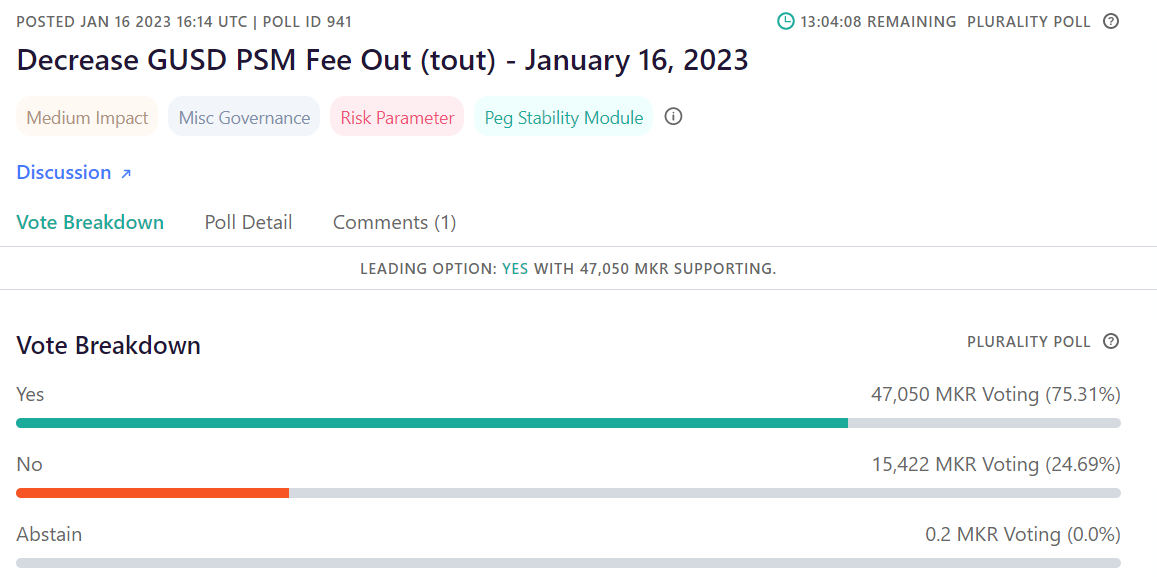

Despite this belief, the possible danger prompted the birth of two governance proposals on MakerDAO. The initially suggestion is to zero the percentage charge charged to trade collateralized DAI towards GUSD, which implies that consumers can trade DAI for GUSD at no value.

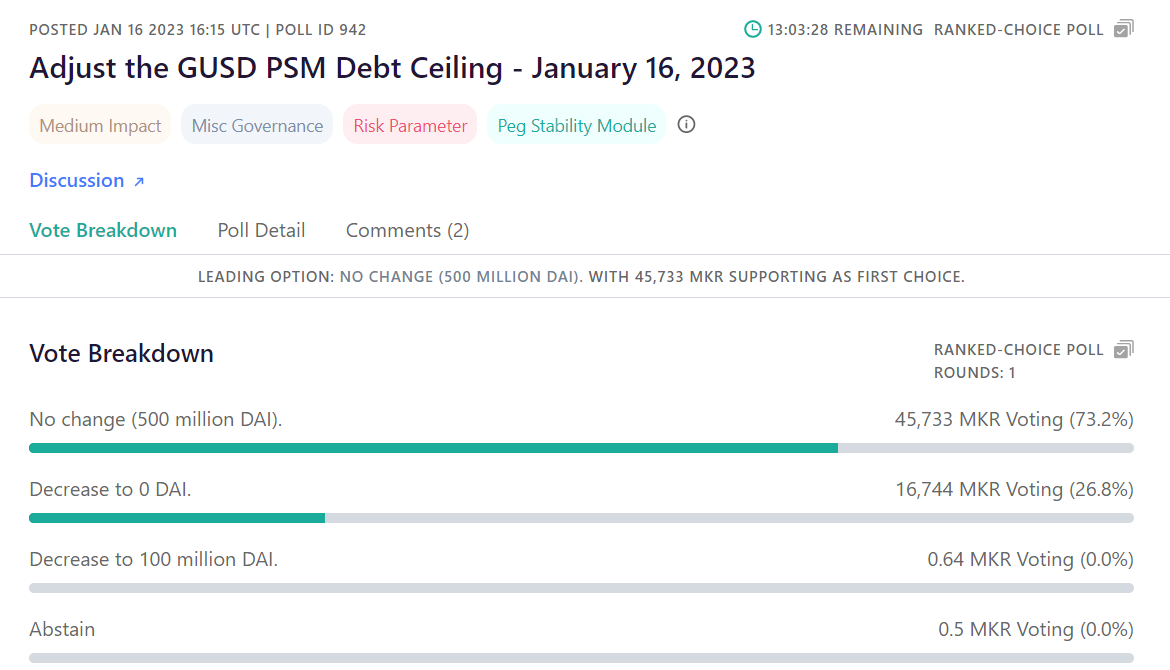

The 2nd proposal is to decrease the debt ceiling now to $500 million.

Both proposals near on January 19, 2022. Current voting information for the initially proposal exhibits that the DAO is in favor of setting the commission price at zero. However, the 2nd proposal stays a great deal tighter competitors amid individuals in favor of the servicing of the recent debt ceiling and individuals who want it diminished to zero.

Synthetic currency68

Maybe you are interested: