On the final evening and early this morning, other “clues of contact” appeared in between some significant males and the “seismic” named FTX.

Wintermute has dollars on FTX, but not a whole lot

Cryptocurrency market place maker Wintermute has money trapped in the FTX exchange that are insignificant and consider hazards, the business stated.

one / We uncover the current occasions all around Alameda and FTX disappointing and unfortunate for the field. Wintermute is committed to accomplishing all the things in our energy to assistance the field recover and come out more powerful.

– Wintermute (@wintermute_t) November 9, 2022

Wintermute has no publicity to FTT: “As a market neutral company, we have no exposure to FTT tokens or related ecosystem assets.”

“We have funds on FTX, but this amount is within our risk tolerance and is unlikely to have a significant impact on our overall financial position.”

Amber Group is “immune” to Alameda and FTT, blocked ten% of trading money

Also yesterday, Amber Group confirmed that it is not exposed to Alameda or FTT, but has actively participated in the transactions and has about ten% of the complete trading capital “tight” on the floor.

one) We have professional numerous market place cycles above the previous five many years and our target has been and continues to be the identical: to present an field-main support for trading, archiving, hedging and management of digital assets with a concentrate on critical on these basic pillars.

– Ambra Group (@ambergroup_io) November 9, 2022

“While we have significantly reduced our exposure over the past week, there are still pending withdrawals. However, this does not pose a major threat to our business or liquidity.”

Chain Protocol puts believe in “in the wrong place”

About one hour in the past, the CEO of Chain Protocol spoke and reassured the neighborhood.

In the curiosity of transparency:

Alameda was the primary producer of $ XCN, nevertheless, we terminated the connection in the summertime of this yr due to market place irregularities. So we termed up the loan and they have been no longer our principal market place makers.

(one/eight)

– Deepak.eth ⛓ (@dt_chain) November 10, 2022

By telling what the CEO has to supply, Alameda was the main market place maker XCN, nevertheless, Chain ended its connection with them this summertime, due to market place fluctuations. Chain revoked the loan and stopped doing work with Alameda.

However, Chain continues to use FTX for OTC and trading. Chain also continued trading right here quickly just after the tweet pledged to even now have sufficient dollars from the proprietor of the FTX exchange. The undertaking believed that statement and left the dollars on the stock exchange, an eight-digit volume locked in and waiting to be withdrawn.

As of 2020, when Chain was acquired by Stellar / Lightyear, just after marketing any treasure token, “we are actually net positive from the start”.

Chain insists there is even now a substantial treasury to handle. But he even now sucks, due to the fact they depend on FTX and SBF.

“Our deposit and recent transactions were lost after he pledged to keep his assets on the stock exchange.”

In conclusion, the undertaking will entrust the over incident to attorneys and is wanting to increase dollars for Chain and proceed to establish and put into action strategic adjustments for the prolonged way to come.

“Lost” sequence

Sequoia Capital investment fund agreed to reduce $ 213.five million invested in FTX. In a statement launched on the morning of November ten, Sequoia Capital stated that due to the current occasions with FTX and as the total nature of the situation is unknown, Sequoia will record the worth of its FTX investment at zero.

Here is the note we sent to our LPs in GGFIII with regards to FTX. pic.twitter.com/Cgp1Yxk1pz

– Sequoia Capital (@sequoia) November 10, 2022

Sequoia also exposed that its Global Growth Fund III invested $ 150 million in FTX and FTX US, though the SCGE Fund invested $ 63.five million. These investments are created in 2021.

In the final evening, as reported by Coinlive, “giants” Digital galaxy also exposed publicity to $ 76.eight million of assets with FTX e Multi-currency capital ten% of the aforementioned assets are “held”.

The info over is staying completed as providers in the field seem for strategies to do this calm public viewpoint and reassure the neighborhoodjust after the announcement of FTX prepare to “sell you” for Binance due to the liquidity crisis. However, not too long ago, Binance announced its withdrawal from the repurchase agreement, “FTX is incurable”, the market place continues to be engulfed in flames and is anticipated to deteriorate.

———————————————

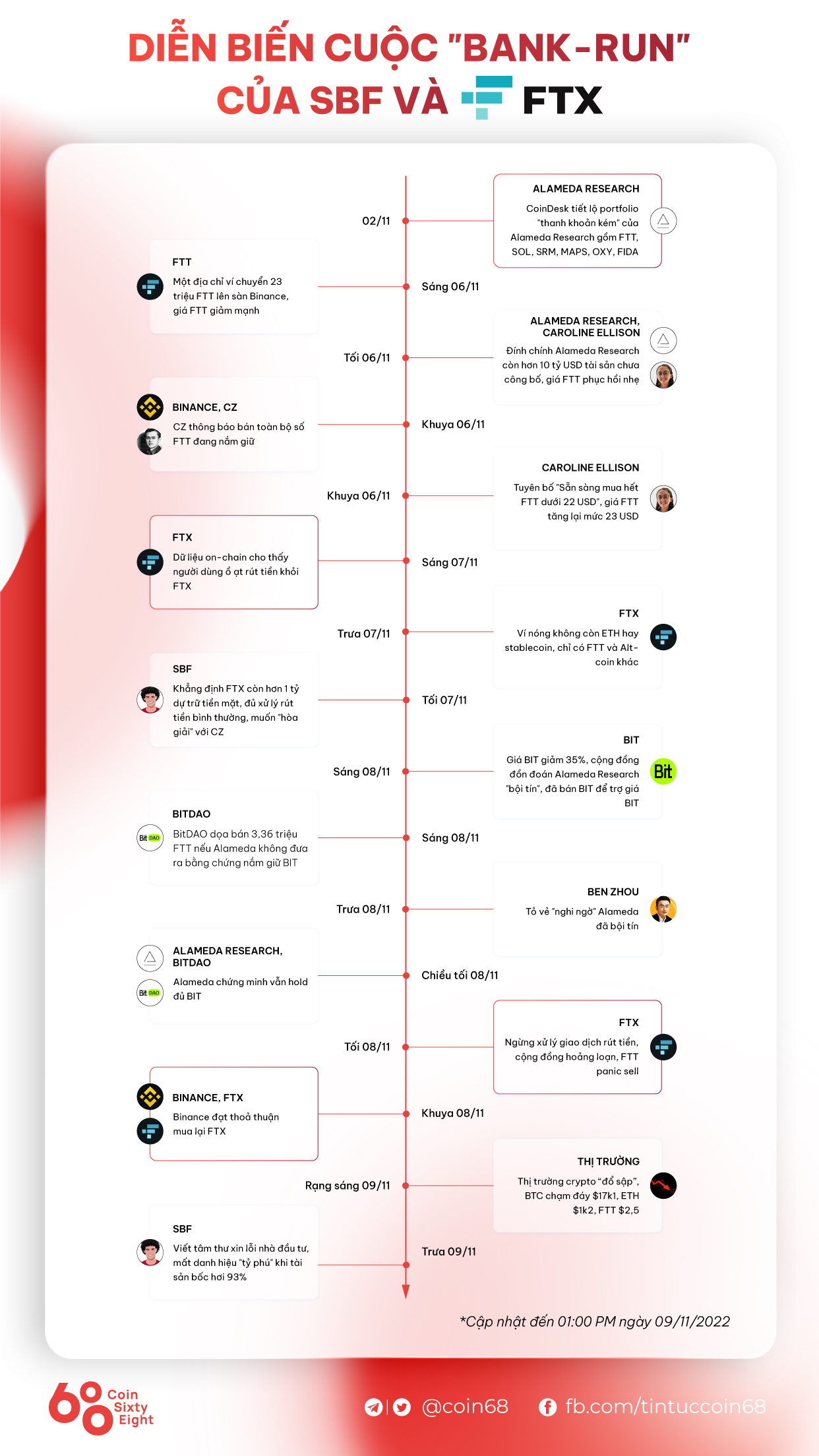

Summary of the Binance drama – FTX

– Binance liquidates its complete $ 580 million investment in FTX tokens

– Users massively withdraw from FTX

– The entire market place was heavily dumped, FTT misplaced 22 USD

– Binance has reached an agreement to invest in back FTX

– FTX CEO’s equity fell by $ 14.six billion, wrote a letter apologizing to traders

– CZ urges exchanges to present evidence of client deposit

– The Solana method “bears the battle”

– Binance cancels the acquisition of FTX