After that the gigantic sell-off crash on the Iron Finance protocol cost him dearly, Mark Cuban is calling for regulation to specify “what a stablecoin is and what collateral is acceptable.”

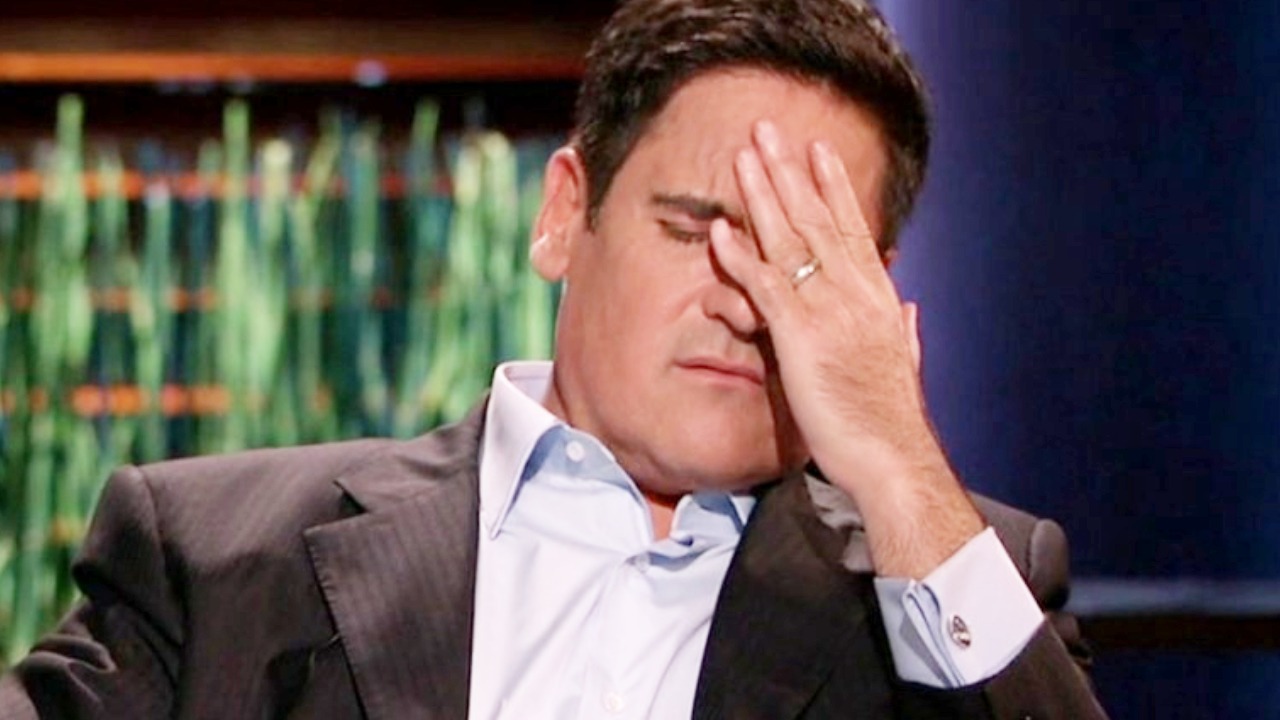

Billionaire investor and DeFi proponent Mark Cuban has called for stablecoin law after losing money on the Iron Finance protocol.

According to Iron Finance, the partially collateralized stablecoin job was the subject of a “historic sell-off” which led to the purchase price of stablecoin IRON falling. As a result, the purchase price of Iron’s native token TITAN has dropped by nearly 100 percent in 2 days from its all-time high of $64.04.

Speaking to Bloomberg on June 17, Cuban blamed himself to be “lazy” rather than doing enough research, and raised questions about stablecoin law:

“Regulation is needed to define what is stablecoin and what is acceptable collateral. If we ask for US$1 per dollar, or identify acceptable mortgage options, like US treasuries.”

“Although I have a hard time with this, it’s really because I’m lazy. What DeFi is like is all about revenue and math, and I’m too lazy to do the math to determine what the key metrics are.”

Why is it that everytime we win an influencer, they turn around and move complete wack

Cuban went Degen to “Let’s have the US Regulate smart contracts from anon devs”

Elon went from BTC is cash to surround nightmare

All we have left is @tobi and he simply verified his bitclout:'( https://t.co/Mn6rVqFOcB

— DCF GOD (@dcfgod) June 17, 2021

Kraken CEO Jesse Powell criticized Cuban on Twitter, highlighting that the absence of regulation of stablecoins isn’t a problem:

“Not doing your own research and getting into a terrible investment because your time is worth more than your money is your problem.”

Regulations on Stablecoins

The stablecoin industry is now in the spotlight of US lawmakers, as they consider how to regulate the rapidly growing industry.

In December 2020, a bill known as the “STABLE Act” was introduced requiring stablecoin issuers to have bank graphs and comply with conventional banking regulations.

Following last month’s crypto downturn, Federal Reserve Chairman Jerome Powell highlighted on May 20 which “as stablecoin usage increases, so must we pay attention to the regulatory framework appropriate management and supervision”.

Iron Finance highlights fractional reserve issues

In a blog post titled “Iron Finance Post-Mortem June 17, 2021,” the project notes it is planning to employ a third party to run an in-depth analysis of this protocol so that it may “understand all all cases lead to an outcome.”

IRON is a partially collateralized stablecoin meant to be pegged at $1. The stablecoin is collateralized by a mixture of the native token TITAN and stablecoin USDC. The ratio of USDC into the complete supply of IRON is referred to as the Collateral Ratio (CR).

After the mass sell-off from whales that brought the cost of TITAN down to about $30, stablecoin IRON also fell below the $1 peg.

Since the protocol depends on a Time Weighted Average Price (TWAP) to ascertain CR, market action overwhelms CR since it can’t maintain volatility.

Whales managed to purchase IRON for 0.90 USD and swap them for 0.25 USD TITAN and 0.75 USDC, which briefly pushed the cost of TITAN to approximately 50 USD. They then continued to cash out their gains, which sent the price down.

This caused a “panic event” or “escape” from other shareholders, who also begun withdrawing, pushing the purchase price of TITAN to near zero now.

“Remember that Iron.finance is a partially collateralized stablecoin, similar to the fractional reserve banking of the modern world. When people panic and run to the bank to withdraw their money in short order, the bank can and will collapse.”

I got hit like everybody else. Crazy part is that I got out, thought they were raising their TVL enough. Than Bam.

— Mark Cuban (@mcuban) June 16, 2021

Synthetic

Maybe you’re interested: