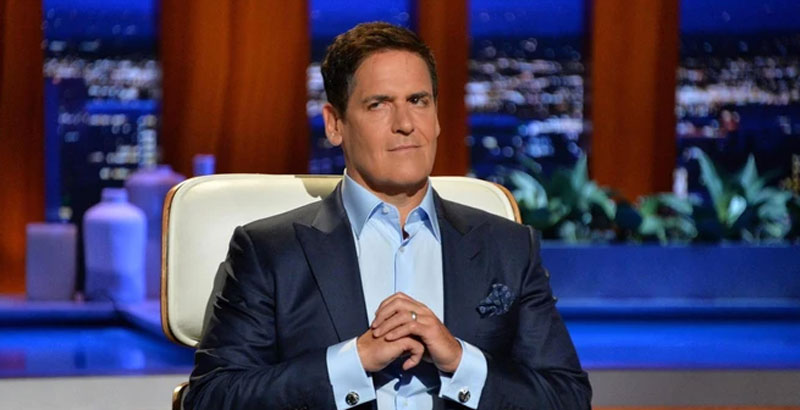

Mark Cuban is accused of falsely marketing Voyager’s encryption solutions and leveraging his seniority for the advantage of clients.

Mark Cuban, a billionaire entrepreneur and star of the American demonstrate Shark Tank, is dealing with a class action lawsuit in excess of what he promoted on Voyager Digital, the lending platform that filed for bankruptcy final month.

Consequently, the business Moskowitz’s law previously to apply filed a civil action in the United States District Court in South Florida towards Cuban for marketing unlawful Voyager cryptocurrency goods.

The lawsuit also accuses Cuban of misrepresenting information and facts on numerous events, of generating dubious claims that Voyager is more cost-effective than rivals, and of giving commission-no cost exchanges. Cuban, along with Voyager Digital CEO Stephen Ehrlich, utilized many years of encounter to make a revenue, enticing youthful customers to invest their lifelong cost savings in the Ponzi scheme.

An extract from the situation reads:

“Cuban and Ehrlich have used their years of experience as savvy investors to trick millions of Americans into putting their money – in many situations, their life savings – into the fraudulent Voyager platform and into purchasing a Voyager Earning Program (EPA) account. ), which is unregistered security “.

The lawsuit also accuses Cuban of repeatedly promoting Voyager’s merchandise and luring retail traders into it. Cuban after boasted that Voyager was “near zero risk”. The petition reads:

“The Voyager platform relies on the reputation of Cuban and Dallas Maverick to continue to maintain the platform until it is on the verge of bankruptcy.”

As up to date by Coinlive, Voyager is a single of the lending platforms that has fallen into a “critical” bankruptcy state mainly because affiliated with Three Arrows Capital (3AC) in the midst of a liquidity crisis wave that hit the market place in mid-June, Voyager has suspend withdrawals from two July And sadly declare bankruptcy underneath chapter eleven only three days later on. Nearly $ five billion well worth of cryptocurrencies from in excess of three.five million US clients have been frozen in bankruptcy proceedings.

But just lately, Voyager has The court permitted $ 270 million in income to be returned to customers will be held at the Metropolitan Commercial Bank (MCB). One day later on, This lending platform has announced that it will do so restore accessibility to income deposits on 08/elevenand on cryptocurrencies and stablecoins they will carry on to wait for the court to make your mind up.

Synthetic currency 68

Maybe you are interested: