For the initial time considering the fact that May twelve, the cryptocurrency market’s Fear and Greed index is in the neutral zone. Previously, the index only floated in a state of prolonged dread or intense dread.

It is undeniable that the cryptocurrency marketplace (as effectively as other markets) has normally been “emotionally rich”. Whenever the rate goes up, persons have a tendency to be greedy and, on the contrary, they start off to plummet, they get frightened.

Therefore, marketplace sentiment is an exceptionally vital issue to keep track of and retain in thoughts when building investment or trading selections. At the time of creating, the index is neutral, which has not occurred considering the fact that May twelve this yr, the start off of Bitcoin’s collapse from its ATH close to $ 65,000.

The Fear and Greed Index measures sentiment only for Bitcoin and not for the rest of the cryptocurrency marketplace. However, Bitcoin is the backbone of the marketplace, so BTC’s influence is nevertheless large.

And the sentiment is now neutral, which is a indicator of indecision. In other phrases, the index exhibits that traders are nevertheless searching for a clearer path at the minute.

As for the index itself, when in intense dread, this typically signals a very good obtaining chance and when intense greed is reached, it is frequently time to promote. However, as neutral, possibly the finest choice is to wait for confirmation of the approaching trend.

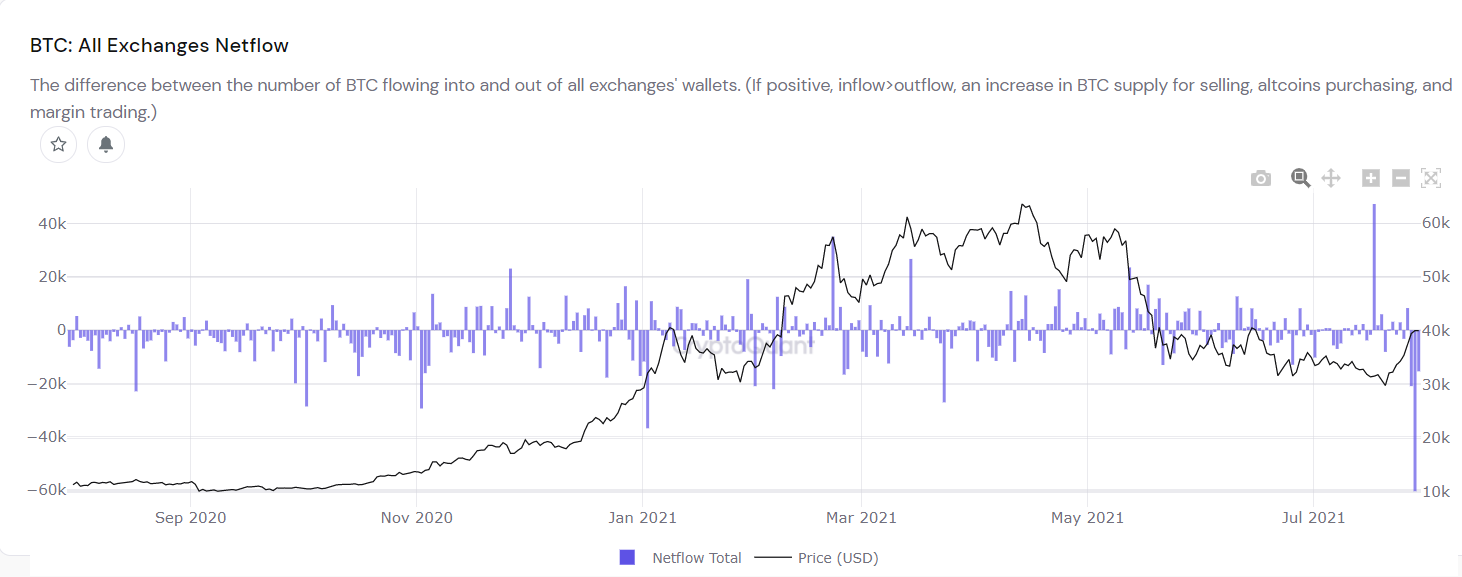

However, yet another piece of information that signals that the beneficial signal is steadily recovering is that Bitcoin is steadily getting purchased a lot more and the quantity of BTC flowing out of the exchanges above the previous handful of days has been exceptionally spectacular.

Based on the CryptoQuant chart, the quantity of BTC withdrawn from the exchanges in the final two days was equal to one hundred,000 BTC, entirely exceeding the quantity of BTC sent to the exchange (which would typically develop offering strain). Even historically speaking, the present information surpasses BTC withdrawals in January 2021, the start off of Bitcoin’s bullish cycle.

Synthetic currency 68

Maybe you are interested: