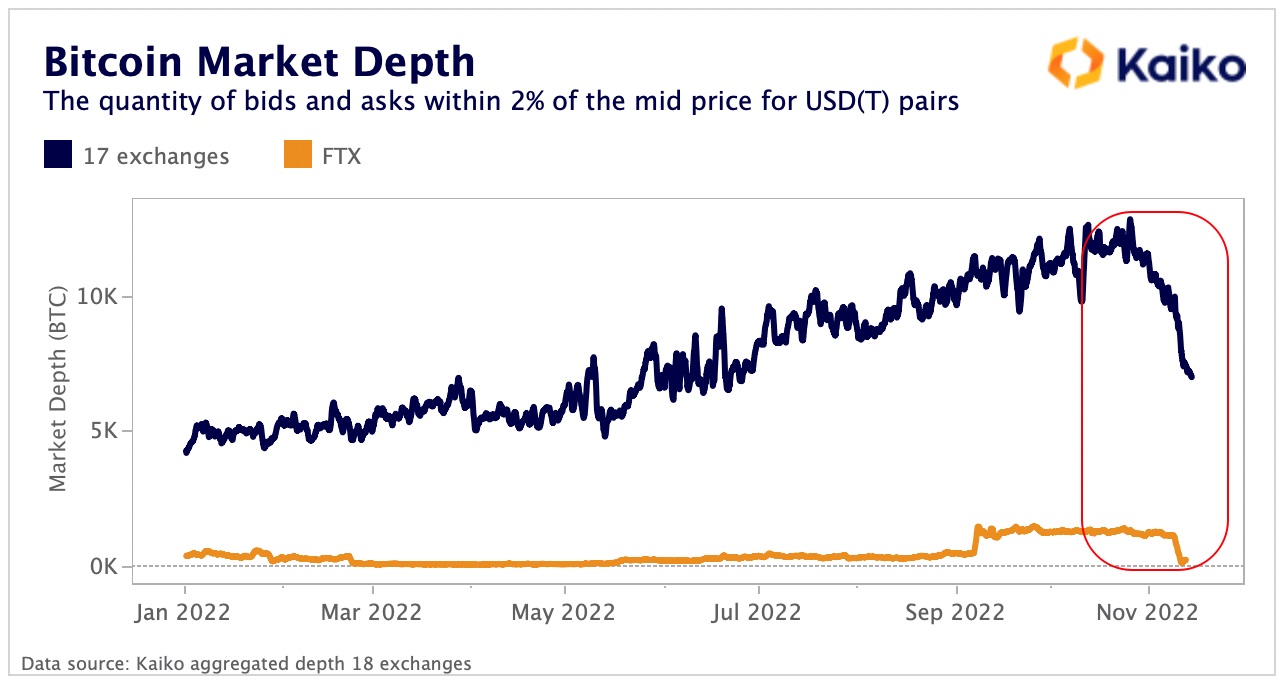

According to economic information evaluation unit Kaiko, the aftermath of the FTX crisis has made a liquidity gap in the cryptocurrency market place.

The cryptocurrency market place is working out of liquidity following the collapse of FTX exchange and subsidiary Alameda Research, in accordance to information analyst Kaiko.

A vibrant spot in the FTX contagion: #BTC liquidity has enhanced

Since final week, the two% market place depth is back to ~10k BTC.

Our hottest evaluation: https://t.co/vSAc8wvN68 pic.twitter.com/fVsnFYrw2d

— Kaiko (@KaikoInformation) November 21, 2022

Both units have been founded by former billionaire Sam Bankman-Fried, who was a significant player in the market place until eventually FTX filed for bankruptcy, Sam Bankman-Fried stepped down as CEO.

“Cryptocurrency liquidity is dominated by a handful of exchanges, which include Wintermute, Amber Group, B2C2, Genesis, Cumberland and Alameda. The departure of a single of the important market place makers has led to a substantial drop in liquidity, what we will phone the Alameda void.

Kaiko additional that Bitcoin’s market place depth – which refers to the market’s capacity to soak up massive orders in a unique time time period – has also plummeted, with Kraken’s buy guide down 57% as Binance and Coinbase declined. 25% and 18% respectively.

Bitcoin’s capacity to fill a massive buy inside of two% of the cost has dropped to its lowest degree considering that early June. Exposure to the FTX crisis is a component draining latest liquidity.

Wintermute CEO Evgeny Gaevoy mentioned:

“This liquidity crisis can be explained by two things. On the a single hand, MMs have much less entry to BTC loans as most lenders are also cautious or out of business enterprise. In parallel, MMs are actively lowering their publicity to most centralized exchanges.”

Synthetic currency68

Maybe you are interested: