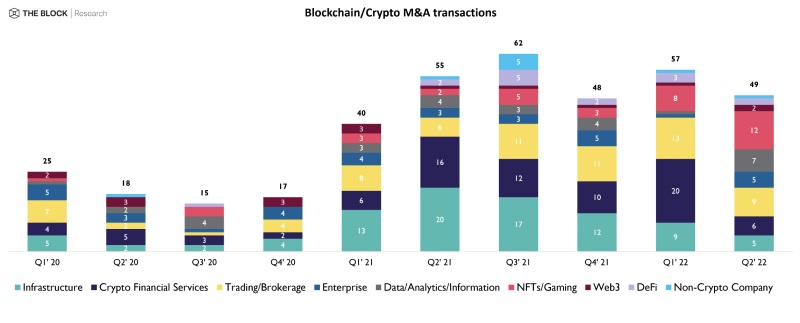

Twenty of the 53 M&A transactions involving NFT and GameFi because 2013 occurred in the very first half of 2022.

Merger and acquisition actions in the NFT and GameFi segments are growing the 2nd “spill” The block. About 38% of the merger and acquisition agreements concerning NFT and GameFi corporations have taken spot in the previous two quarters. Notably, the very first six months of the 12 months alone noticed twelve transactions, in spite of the industry currently being surrounded by tons of poor information.

Since 2013, 53 NFT and GameFi mergers and acquisitions have been carried out. The very first and 2nd quarters of 2022 noticed eight and twelve specials respectively, which are also the most significant “records” in this business so far.

Specifically, the final Q2 was the time when the NFT industry began cooling down, the base selling price collapsed devoid of brakes And The volume of transactions on significant marketplaces also decreased by 94%.

At the start off of the 12 months, NFT was generally a protected haven when the industry was in difficulties. However, this reversal seems to be no longer “sustained” and it seems that NFT companies are even now the most important M&A targets for the recent industry.

The greatest M&A deal in the 2nd quarter of 2022 also belongs to the NFT and GameFi sector, with the deal OpenSea acquires Gem.xyz, a $ 238 million NFT aggregation answer.

Synthetic currency 68

Maybe you are interested: