Metaplanet announced plans to drastically increase its Bitcoin holdings, targeting 10K BTC by the end of 2025.

This plan reinforces Metaplanet’s commitment to strengthening its Bitcoin Treasury strategy and enhancing its position as a key player in the enterprise cryptocurrency sector.

Simon Gerovich, CEO of Metaplanet, announced the company’s strategic goals on January 5. Looking back on a successful 2024, Gerovich said the company has achieved record milestones, significantly strengthening its forecasts. Bitcoin and establish yourself as a leader in the Bitcoin-focused corporate landscape in Asia.

Building on this momentum, Metaplanet intends to accelerate growth by using capital market tools such as equity issuance and borrowing to fund Bitcoin purchases.

“In 2025, we aim to increase our Bitcoin holdings to 10K BTC using the most efficient capital market tools possible,” Gerovich stated.

Metaplanet chose the leading cryptocurrency as a reserve asset last year to hedge against economic turmoil in Japan. The company’s accumulation strategy is comparable to MicroStrategy’s approach, which includes leveraging debt and issuing bonds. MicroStrategy is currently the largest Bitcoin holding company with 446,400 BTC, worth about $44 billion.

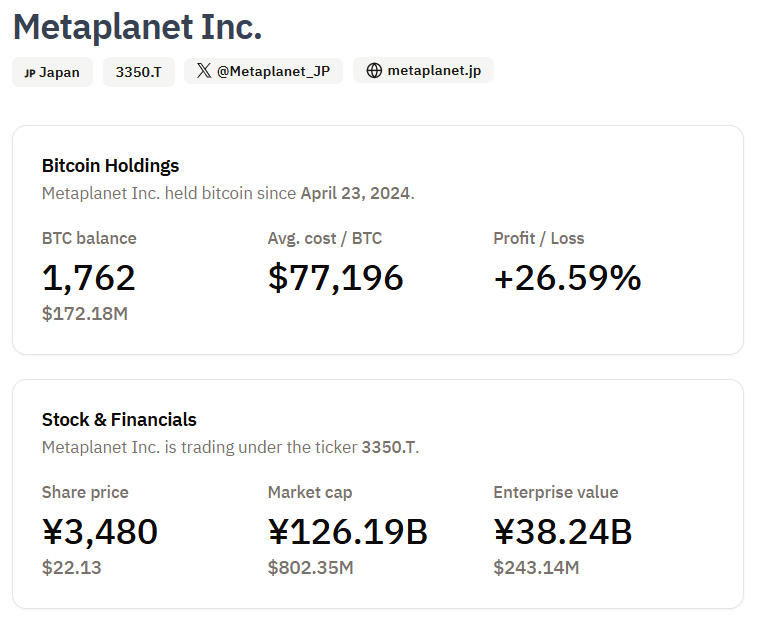

The Japan-based company currently holds about 1,762 BTC, ranking 15th in the world in terms of Bitcoin ownership according to data from Bitcoin Treasuries. With a profit margin of nearly 30% on its current Bitcoin holdings, the company is well positioned for further expansion.

However, to reach its 10K BTC target, Metaplanet needs to buy more than 8K BTC this year—a feat that would put Metaplanet at the top of the world’s Bitcoin holdings.

Besides strengthening Bitcoin reserves, Metaplanet intends to improve shareholder engagement and transparency through new initiatives. The company also aims to promote Bitcoin adoption in Japan and globally by leveraging strategic partnerships.

Gerovich emphasized that these efforts are not only about business growth but also about promoting a larger movement to elevate Bitcoin’s role in the global economy.

“Your belief in our vision fuels our commitment to excellence. Together, we’re not just building a company, we’re fueling a movement. Stay tuned — 2025 will be another year full of big changes. Cheers to the year of progress, innovation and success,” he concluded.