MicroStrategy CEO Michael Saylor has no ideas to promote Bitcoin from the company’s almost $ five billion holdings in spite of BTC falling far more than forty% from its $ 69,000 ATH.

In an interview with Bloomberg on January twenty, Michael Saylor after yet again reiterated his company stance that he is a incredibly “optimistic” particular person about Bitcoin’s long term. MicroStrategy’s CEO firmly refuses to promote the BTC the enterprise holds in spite of the market place currently being in a extended-phrase bearish cycle.

The latest cryptocurrency winter isn’t going to make Michael Saylor truly feel so cold. He says @emilychangtv due to the fact in Studio one. https://t.co/EsUlY5sscN pic.twitter.com/zWStdl5qsF

– Bloomberg Television (@BloombergTelevision) January 20, 2022

“We have never sold Bitcoin. We only buy and hold BTC. This is MicroStrategy’s strategy ”.

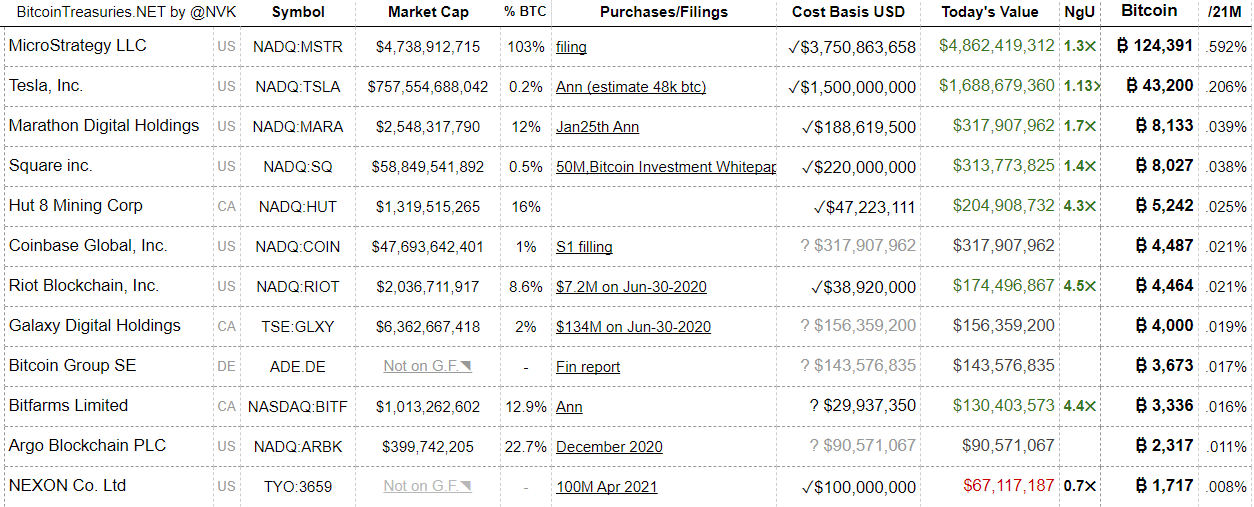

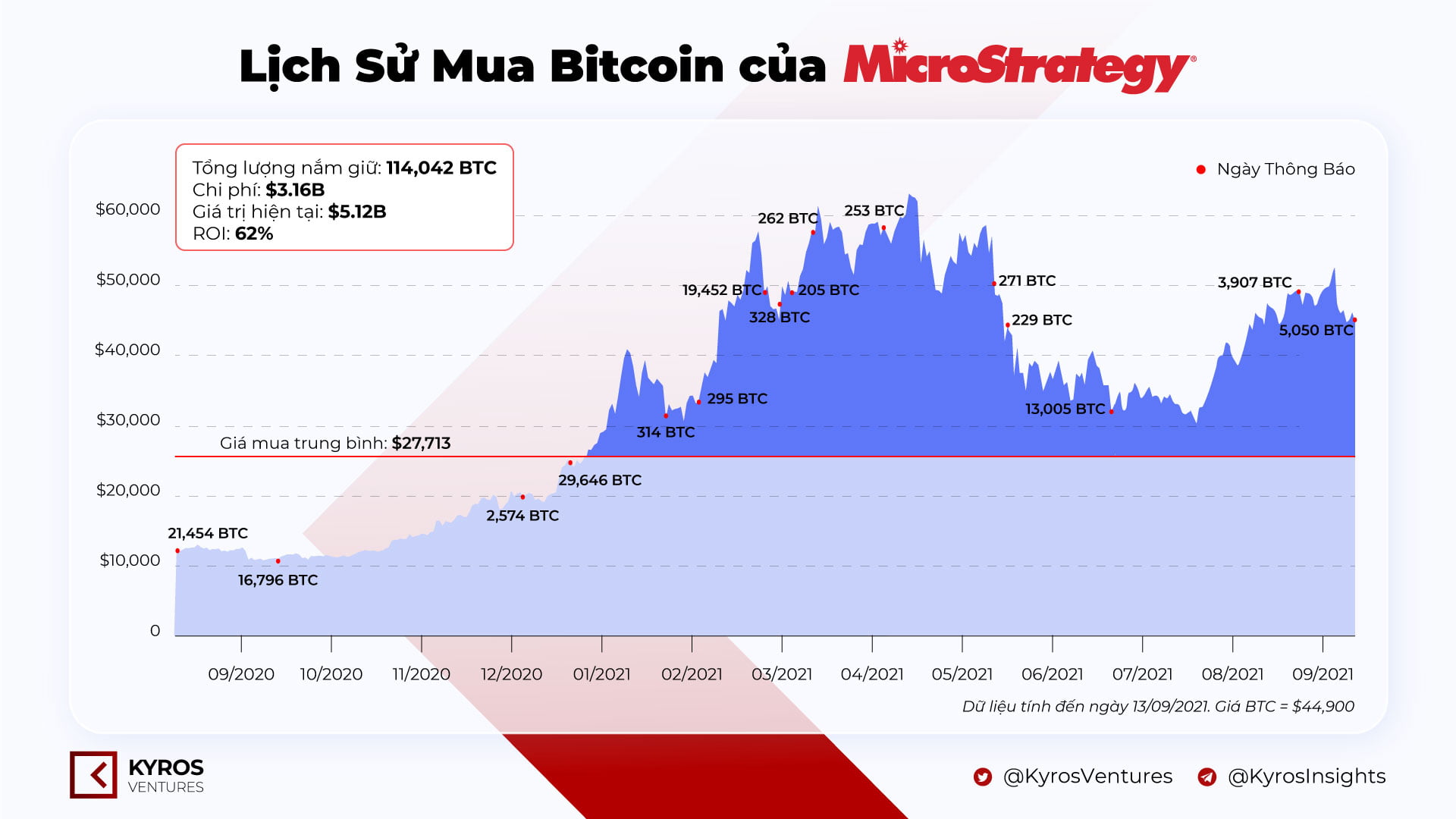

MicroStrategy grew to become the 1st publicly traded enterprise in the United States to very own Bitcoin as component of its stability sheet in August 2020. Since then, the trading software program maker has amassed 124,391 BTC. , is really worth about $ four.86 billion at latest market place charges, with an common value of $ thirty,159 per BTC.

Since most of MicroStrategy’s reserves are in Bitcoin, the company’s stock has turn into a indicates of near publicity to “digital gold”. After announcing its presence in BTC, MicroStrategy stock skyrocketed 900% at one particular stage. Recently, even so, corporate collateral has stopped right after currently being exposed to in excess of-purchasing occasions of BTC partially financed by borrowed money.

“Bitcoin is the only ethical, technical and legal safe haven in the entire crypto ecosystem.”

Despite current market place promote-offs, Saylor nevertheless sees BTC as one particular of the hedges towards inflation. Beyond that, he had ideas to leverage the company’s large Bitcoin fund. Even the CEO of MicroStrategy is assured that Bitcoin will turn into an asset with a market place capitalization of $ a hundred trillion, personally holding about 17,732 BTC.

“By the end of the decade, Bitcoin will beat gold, then flip currency indices, affect some bonds, real estate, stocks, and emerge as a valuable asset class. A total market capitalization of $ 100 trillion.”

However, his over declare is regarded to be thoroughly founded. Because, for all of 2021, MicroStrategy produced no income on Bitcoin, even however the enterprise “won big” in the course of BTC peaking at $ 69,000 in November. Michael Saylor, on the other hand, will take each and every chance to boost your place.

Synthetic currency 68

Maybe you are interested: