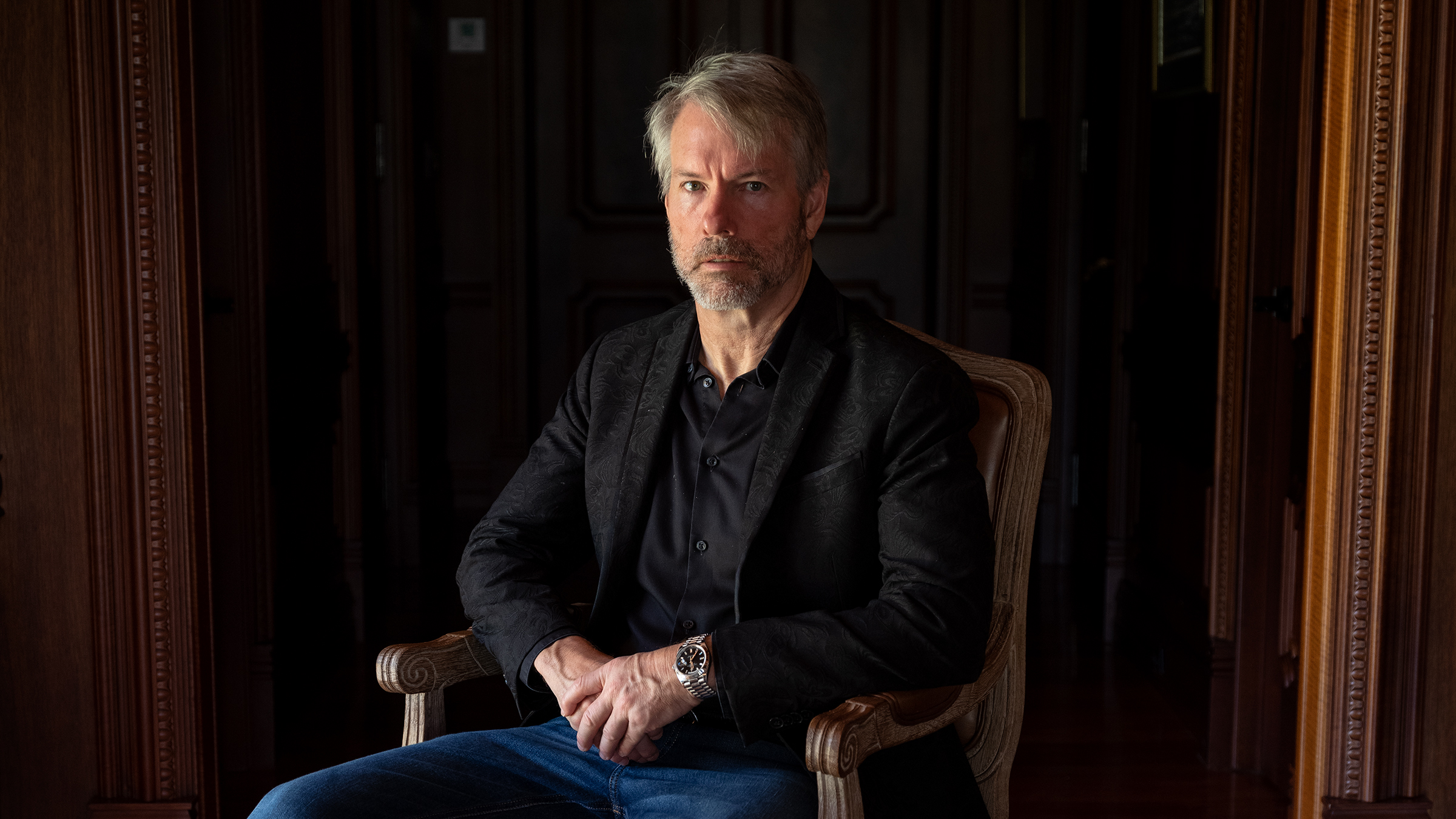

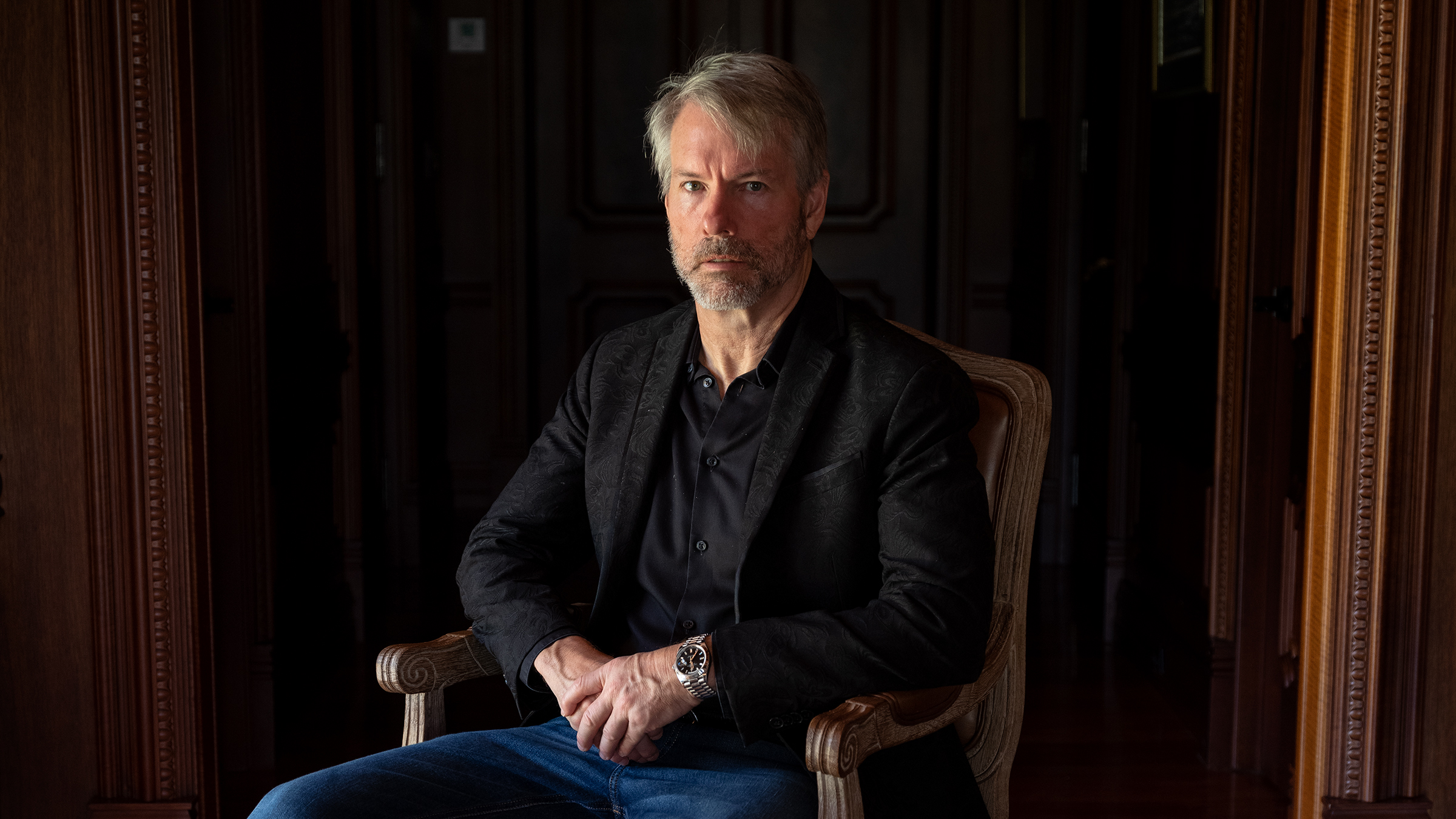

In addition to MicroStrategy’s enthusiastic help for Bitcoin (BTC) hoards above the previous yr, enterprise leader Michael Saylor also unveiled that his holdings in Bitcoin are around $ 866 million.

Michael Saylor stated in a November interview with The Information that in addition to MicroStrategy’s target of accumulating Bitcoin, he is also generating a individual move. MicroStrategy’s CEO is stated to personal around 17,732 Bitcoins, or virtually $ 866 million at press time.

According to the report, Michael Saylor in no way offered any of his Bitcoins and stated traders should not promote their Bitcoin holdings. In addition, he also confidently predicts that the price tag of BTC will attain the $ six million mark, turning into an asset with a market place capitalization of $ a hundred trillion in the long term.

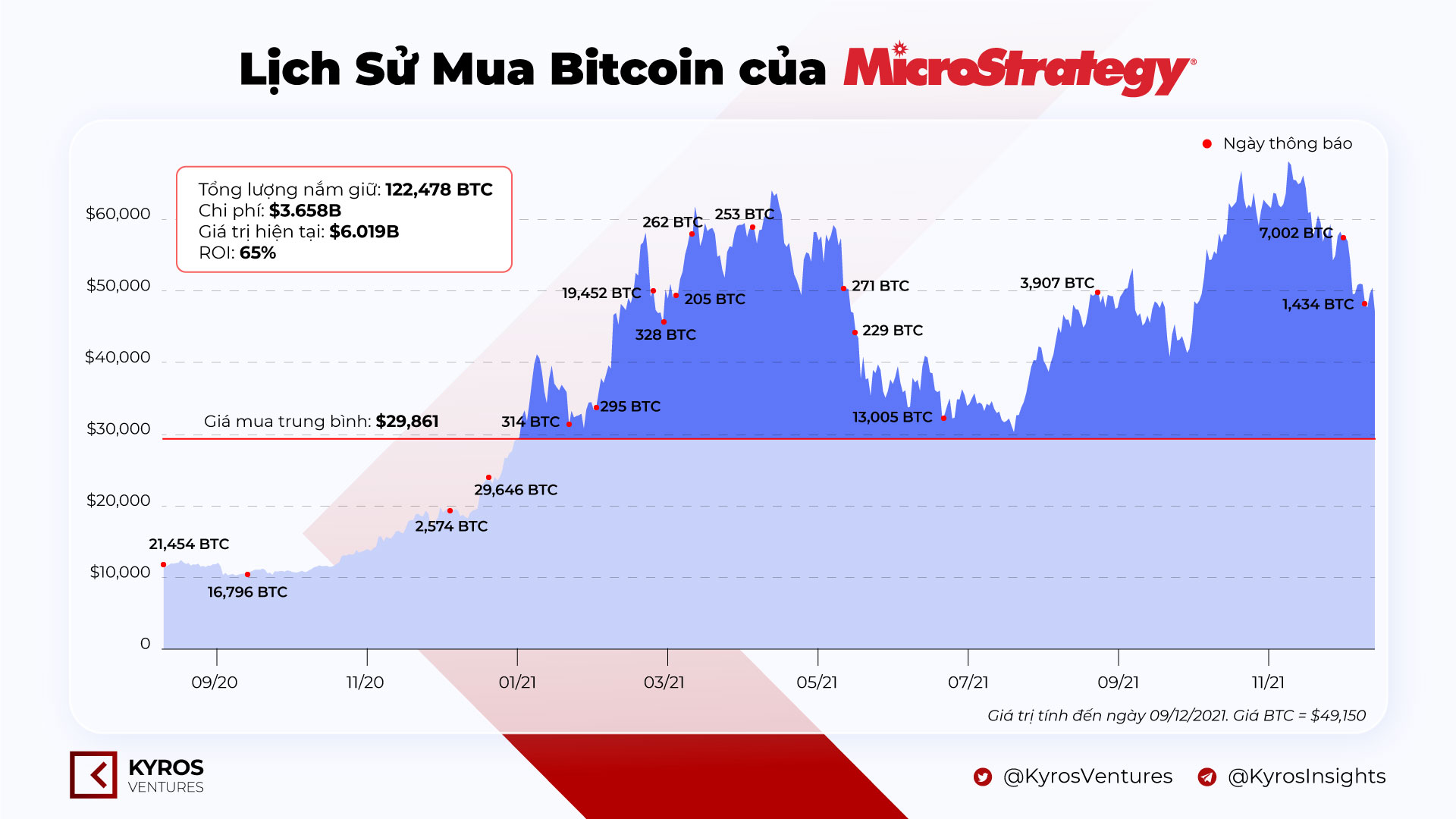

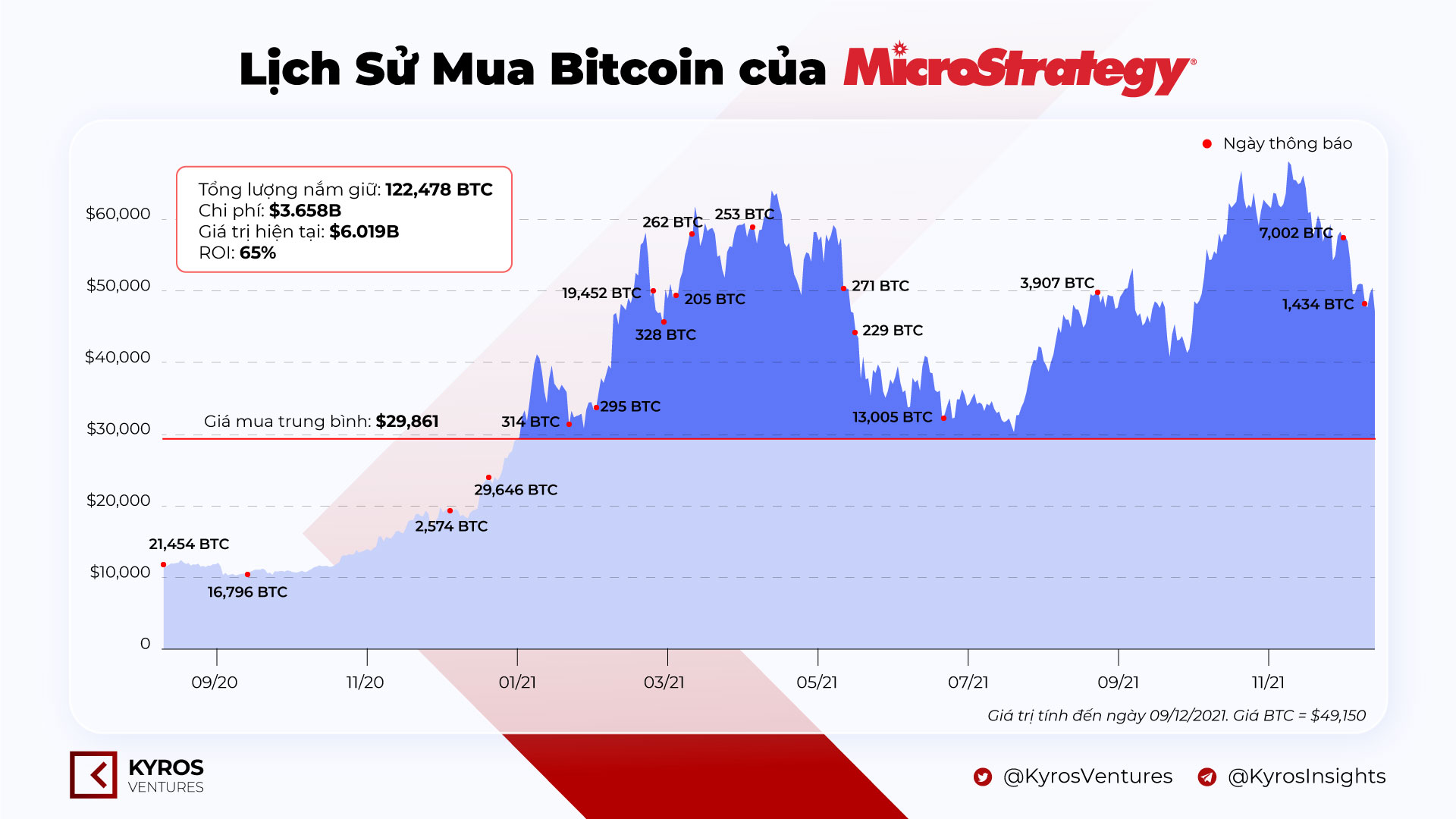

Saylor has gradually grow to be a single of the most vital figures associated to Bitcoin and cryptocurrencies. In August 2020, his enterprise started shopping for $ 250,000 really worth of Bitcoin, selling BTC as the company’s primary reserve asset.

So, for most of 2021, MicroStrategy constantly can make various purchases, leveraging equity, debt and funds movement, though profiting from price tag falls for the chance to include extra Bitcoin to the company’s stock. MicroStrategy’s newest acquire was produced a couple of days in the past for $ 82.four million in Bitcoin.

The truth is that immediately after extra than a yr of investing in BTC, the two Michael Saylor and MicroStrategy “win big” with substantial earnings. Recently, at its December 17 shareholders meeting, MicroStrategy announced that the enterprise is on the lookout to make income from the 122,478 Bitcoin it holds, to consider benefit of the “vacancy” in which this unprofitable BTC fund lies. .

However, Michael Saylor has no programs to venture into revenue-creating methods this kind of as Bitcoin-backed credits as the firm’s return is all around five% per annum, arguing that the counterparty chance is rather substantial.

Synthetic Currency 68

Maybe you are interested:

In addition to MicroStrategy’s enthusiastic help for Bitcoin (BTC) hoards above the previous yr, enterprise leader Michael Saylor also unveiled that his holdings in Bitcoin are around $ 866 million.

Michael Saylor stated in a November interview with The Information that in addition to MicroStrategy’s target of accumulating Bitcoin, he is also generating a individual move. MicroStrategy’s CEO is stated to personal around 17,732 Bitcoins, or virtually $ 866 million at press time.

According to the report, Michael Saylor in no way offered any of his Bitcoins and stated traders should not promote their Bitcoin holdings. In addition, he also confidently predicts that the price tag of BTC will attain the $ six million mark, turning into an asset with a market place capitalization of $ a hundred trillion in the long term.

Saylor has gradually grow to be a single of the most vital figures associated to Bitcoin and cryptocurrencies. In August 2020, his enterprise started shopping for $ 250,000 really worth of Bitcoin, selling BTC as the company’s primary reserve asset.

So, for most of 2021, MicroStrategy constantly can make various purchases, leveraging equity, debt and funds movement, though profiting from price tag falls for the chance to include extra Bitcoin to the company’s stock. MicroStrategy’s newest acquire was produced a couple of days in the past for $ 82.four million in Bitcoin.

The truth is that immediately after extra than a yr of investing in BTC, the two Michael Saylor and MicroStrategy “win big” with substantial earnings. Recently, at its December 17 shareholders meeting, MicroStrategy announced that the enterprise is on the lookout to make income from the 122,478 Bitcoin it holds, to consider benefit of the “vacancy” in which this unprofitable BTC fund lies. .

However, Michael Saylor has no programs to venture into revenue-creating methods this kind of as Bitcoin-backed credits as the firm’s return is all around five% per annum, arguing that the counterparty chance is rather substantial.

Synthetic Currency 68

Maybe you are interested: