Before beginning to crack down on cryptocurrencies, China captured 50% of the Bitcoin market. According to Michael Saylor, the choice to “deport” this forex was an enormous mistake.

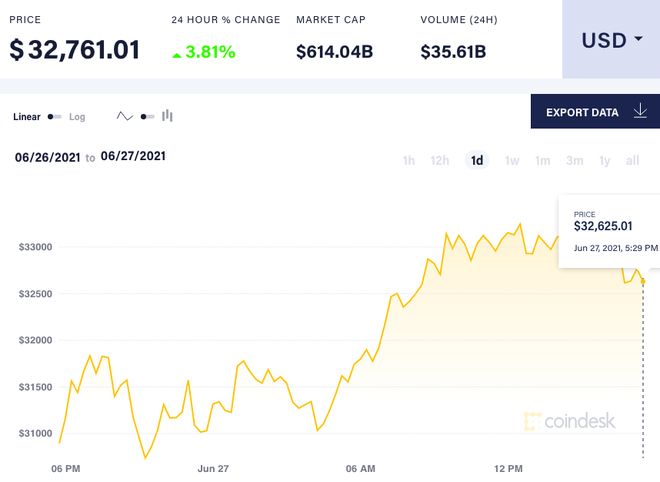

According to CoinDesk, within the June 26 trading session, there was a time when Bitcoin dropped at $ 30,200. On June 27, Bitcoin worth step by step climbed, reaching $ 32,625, up 4.68% previously 24 hours. However, in comparison with the height in April, the Bitcoin worth is now down about 50%.

Since May, China has constantly launched a crackdown on cryptocurrencies, requiring Bitcoin mining to cease working. Bitcoin worth is closely affected after this strict transfer by China.

For Michael Saylor, CEO of enterprise intelligence software program firm Microstrategy, China’s ban on Bitcoin and the expulsion of mining swimming pools is a “trillion-dollar” mistake because the nation of 1.4 billion individuals captures 50% of the market. share Bitcoin and the expansion fee of this cryptocurrency reaches 100% yearly.

The Global Times reported that in China’s latest crackdown, 90% of mining swimming pools in Sichuan province (China) have been compelled to shut on the finish of final week, inflicting the Bitcoin worth to plummet thereafter.

The reason behind the Bitcoin worth drop just isn’t solely resulting from China’s robust ban, Elon Musk can be an element. Tesla CEO as soon as expressed concern that Bitcoin mining impacts the setting and determined to cease accepting electrical car funds with the world’s largest cryptocurrency. Elon Musk’s transfer on the finish of May has “blown away” $1 trillion within the worth of the cryptocurrency market.

“In the near term, the crypto market will continue to be chaotic. A lot of Chinese have had to sell off Bitcoin, find a way out of China and have their loans revoked. However, this is also a great opportunity for Western investors,” Mr. Saylor mentioned.

According to Forbes, the US has emerged as a great location for Bitcoin miners fleeing China. Last week, Francis Suarez – mayor of Miami (USA) – introduced that it was seeking to cut back electrical energy prices to draw cryptocurrency miners to maneuver to Florida.

“The big wind is blowing to crypto miners in North America where electricity costs are cheap, comparable to China. Mining in this region can generate 50-70% more revenue for a time when crypto mining in China is halted,” Microstrategy CEO shared.

On June 21, Microstrategy revealed that it owns a complete of greater than 100,000 Bitcoins. In the final transaction, Microstrategy paid lower than 500 million USD to purchase 13,000 cryptocurrencies.

“Companies like Microstrategy have decided to buy Bitcoin around $30,000 per coin. Without the crypto exodus from China, we would most likely have to pay 2, 3 times the current Bitcoin value,” Forbes quoted Michael Saylor as saying.

Maybe you have an interest:

Join our channel to replace probably the most helpful information and information at:

According to Zingnews

Compiled by ToiYeuBitcoin

.