At a December 17 shareholders meeting, MicroStrategy’s CEO Michael Saylor presented means the corporation can leverage its large Bitcoin fund “for free”.

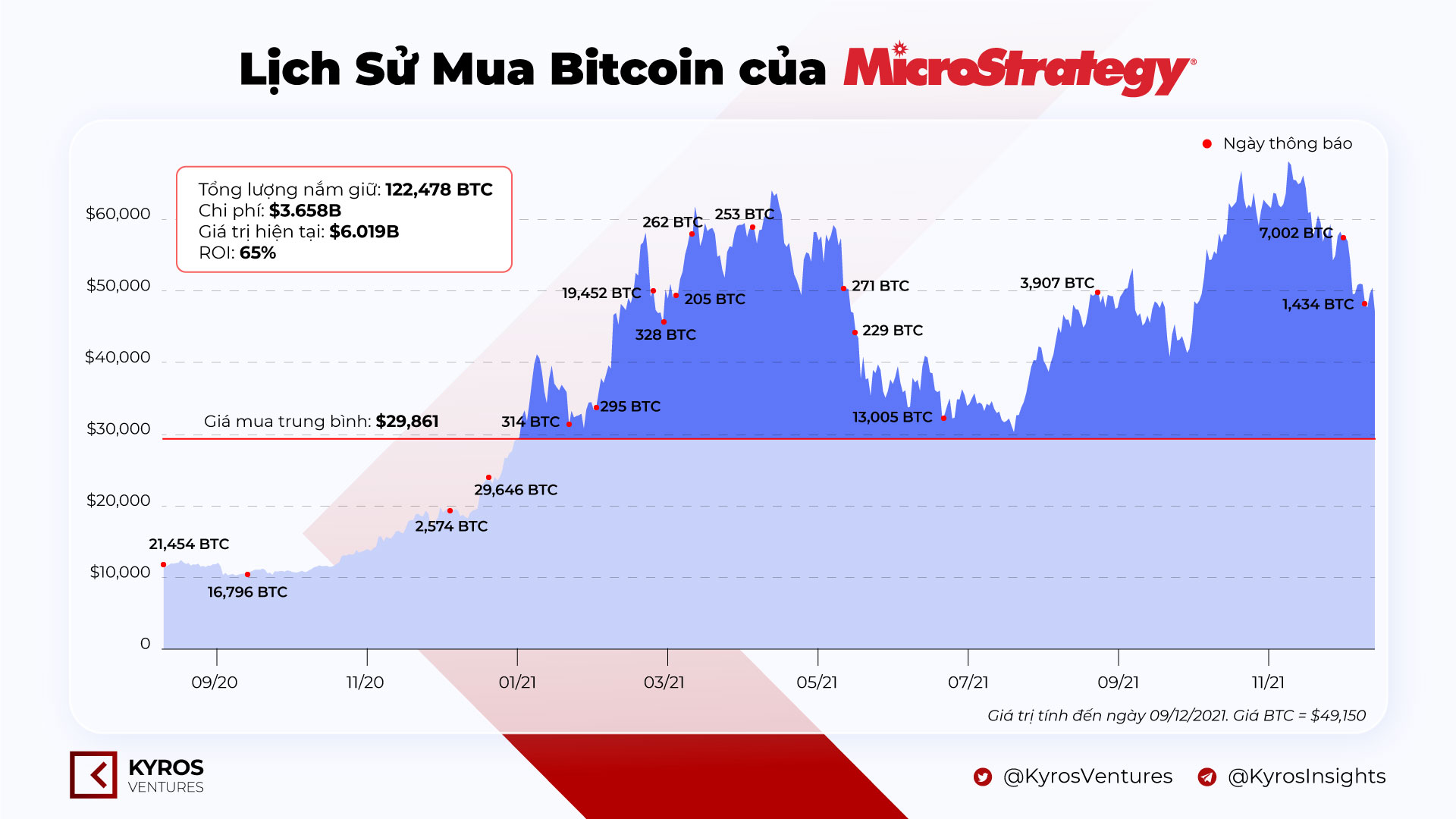

As reported by Coinlive, MicroStrategy in early December 2021 owns 122,478 BTC, well worth somewhere around $ six billion. With an regular investment value of just $ 29,867 / BTC, MicroStrategy’s equity is just $ three.66 billion, which usually means the corporation is nonetheless receiving a 64% return on its investment.

However, the issue that everybody can see is that this large BTC fund is at this time “empty”, no longer making earnings for the corporation. This is a single way for MicroStrategy to guard this revenue, but it also generates further storage fees for the corporation to cover. Since MicroStrategy keeps Bitcoins in cold wallets, it will not be quick for them to engage Bitcoin in the DeFi ecosystem of the cryptocurrency marketplace.

Additionally, as MicroStrategy’s revenue invested in Bitcoin comes principally from the sale of corporate bonds, the corporation should really also get ways to earn income to meet its obligation to pay out curiosity to traders in situation of earnings. . Since late 2020, MicroStrategy has issued above $ two billion in debt bonds to have revenue to purchase Bitcoin, pay out curiosity twice a 12 months, and have a maturity date of 2025-2027.

MicroStrategy, the corporation led by Bitcoin backer Michael Saylor that induced a sensation for amassing a cryptocurrency stash, may perhaps start lending its treasury to create yield https://t.co/eZfXLx7cj7 by way of @markets

– Bloomberg Crypto (@crypto) December 17, 2021

Answering issues from shareholders at Friday’s meeting, CEO Michael Saylor did not rule out the probability that the corporation would hypothesize its Bitcoins to borrow revenue or “lend part of its Bitcoin holdings to worthy third parties.” However, this is only his prepare, there is no unique prepare. He mentioned:

“There may perhaps be possibilities to collateralise it for extended-phrase loans, or we could lend Bitcoin to highly regarded third events. This could be a productive supply of cash flow for the corporation, or we could make an exciting application for this Bitcoin. “

Asked if MicroStrategy is ready to enable establish a Bitcoin mortgage loan bond market place, Saylor mentioned:

“I think it is still too early for a Bitcoin bond market to form, but I am open to exploring this possibility in the future.”

In the brief phrase, MicroStrategy will nonetheless stick to the system of marketing stock in the corporation or raising capital with bonds to proceed shopping for additional Bitcoin.

Synthetic Currency 68

Maybe you are interested: