MicroStrategy CEO Michael Saylor is assured that his business will be ready to pass a margin phone on Bitcoin-backed loans devoid of marketing BTC.

Global markets took a hit in early May, and Microstrategy (MSTR) equities are no exception. MSTR seasoned a drop in worth of up to 24% when Bitcoin concurrently plunged to $ 29,000 due to the key causes for the strain to increase curiosity costs by the Fed, the FSO’s de-peg occasion due to a significant LUNA economic downturn and whale circumstance began to come out, the volume of BTC pushed to the ground peaked in three months.

This raises a worrying signal as MacroStrategy, a subsidiary of Microstrategy, obtained a $ 205 million loan from Silvergate Bank in March 2022, with a portion of MicroStrategy’s Bitcoin made use of as collateral. MicroStrategy then made use of the proceeds to acquire back $ 190 million in Bitcoin.

If the BTC price tag falls also minimal, a margin phone on the Silvergate loan will be triggered when the collateral worth falls. This was also the target of Microstrategy’s Q1 2022 earnings report, which was launched just final week, with business Chief Financial Officer (CFO) Phong Le confirming that Microstrategy will need to have to promote some Bitcoin if the BTC charges had dropped beneath $ 21,000.

With a rather detrimental circumstance in terms of BTC charges in the existing market place, CEO Michael Saylor quickly posted on his private webpage on May ten to reassure traders about the company’s skill to shell out off debt. With 115,109 BTC as collateral readily available to commit to the loan, he mentioned that only when Bitcoin’s worth falls beneath $ three,562 will Microstrategy run out of BTC to repay the loan.

Even so, Michael Saylor says the business will not promote any of its Bitcoin holdings if the worst-situation situation takes place, but as an alternative Microstrategy could use some other collateral as collateral.

MicroStrategy has a phrase loan of $ 205 million and will have to hold $ 410 million as collateral. $ STR it has 115,109 BTC that it can pledge. If the price tag of #BTC drops beneath $ three,562, the business may well send other ensures. See slides eleven-twelve in the Q1 2022 Presentation. #HODLhttps://t.co/9WHsIB6Usx

– Michael Saylor⚡️ (@saylor) May 10, 2022

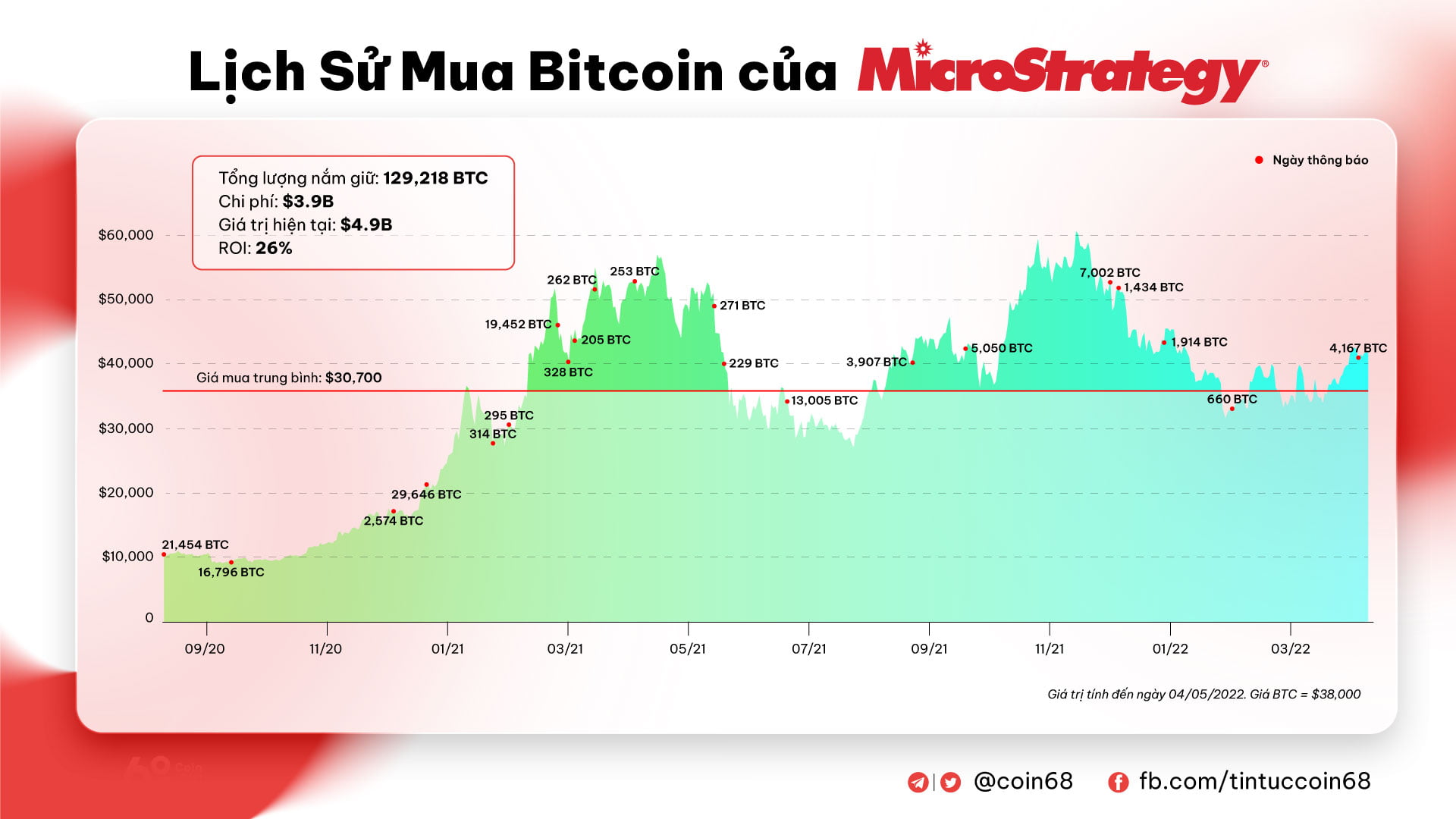

But as of this creating, Bitcoin has slowly recovered somewhat and is trading at all over $ 31,200, which is all over $ 500 off Microstrategy’s buy price tag for BTC. Microstrategy at present owns a complete of 129,218 Bitcoins with a complete buy price of $ three.97 billion and an regular buy price tag of $ thirty,700.

Synthetic currency 68

Maybe you are interested: