Continuing the developments of the domino chain named FTT, the stablecoin MIM has moved out of the rate selection of one USD. What is the motive for this adjust, let us locate out in the post under!

Since this afternoon (November eight), in accordance to Coingecko information, the MIM stablecoin has dipped deep into the USD .96 region.

MIM is a stablecoin that functions with DAI, with a normal charge minting of ensures.

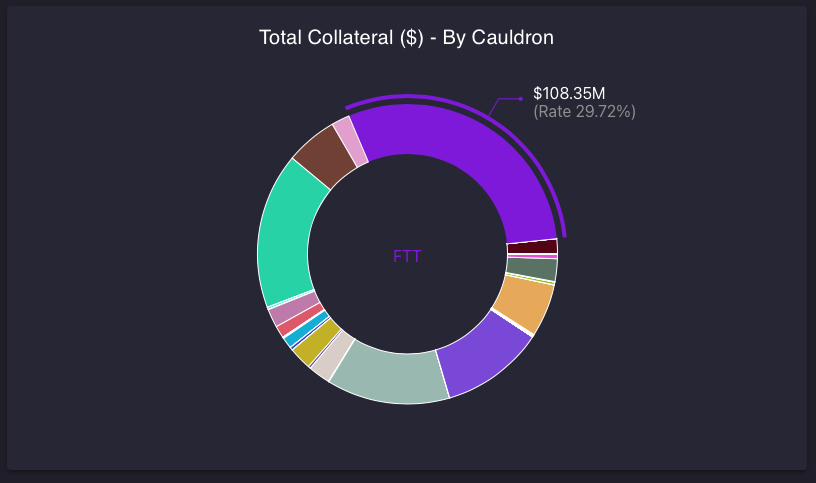

One of the major causes for this volatility is attributed to the FTT. Consequently, most of the collateral for minting MIM is in the kind of FTT.

According to information from MIM Abracadabra’s internet site, the sum of MIM FTT help is really worth about US $ 108 million (~ thirty%).

Previously, on November six, a massive sum of FTT-backed MIM loans have been repaid, bringing FTT’s debt ratio from 35% to 9%. However, extremely quickly, $ 27 million really worth of MIM was minted by FTT.

four/9

Stablecoin MIM is 9% supported by FTT, down from about 35% three hrs in the past

Yesterday the MIM debt was repaid (↓ 35% to 9% assured by FTT) and 27M was once more readily available to be minted working with FTT

At current, only 1M MIM can be minted with energetic FTT https://t.co/o3t2kowHGahttps://t.co/uz6tOb2fU1 pic.twitter.com/FTNdiD08At

– olimpio.eth ⚡️ (@OlimpioCrypto) November 7, 2022

In parallel with the current damaging information and facts relating to FTT, MIM has previously been concerned in disputes above the concern of “write-downs”. Although there have just lately been proposals to partially tackle undesirable debt, MIM has often been a sore stage of the DeFi industry in current instances, when there have been constant deep depegs.

Synthetic currency 68

Maybe you are interested: