The price of Mog Coin (MOG) has struggled to sustain significant gains despite Coinbase tweeting that it has added MOG to its listing pipeline. While this announcement has temporarily created momentum, MOG’s response has not been as strong as expected, especially when compared to other coins such as Moodeng.

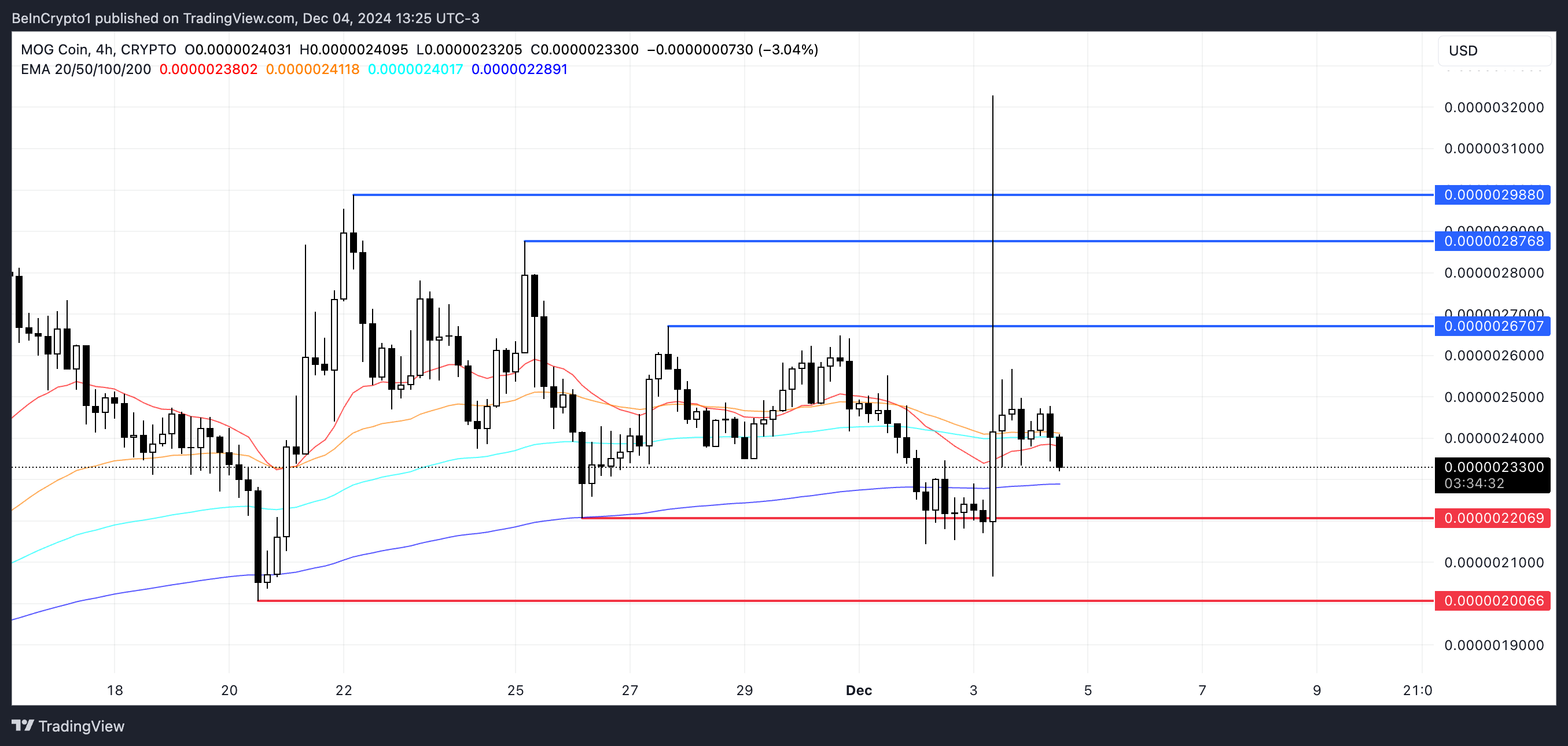

The EMAs are currently showing a negative signal, with the short-term lines crossing below the long-term ones, increasing the possibility of a drop to the support zones. Unless buying interest increases, MOG could continue to face challenges, although if it reverses, it could test resistance levels.

MOG Trend Is Becoming Stronger

MOG’s ADX index has jumped to 29.4, climbing from below 15 in just the past two days. This sudden increase follows Coinbase’s announcement of adding MOG to its listing pipeline, signaling a sharp increase in the strength of the trend.

Current levels suggest that MOG has turned from a weak or unremarkable trend to a strong trend, driven by increased market activity and investor attention.

The ADX (Average Directional Index) measures the strength of a trend, regardless of the direction of movement. Values below 25 indicate a weak or correcting market, while values above 25 imply a strong trend.

MOG ADX at 29.4 suggests the start of a strong trend, likely fueled by the Coinbase listing news. If this momentum continues, it could lead to further price volatility as traders take advantage of the growing interest.

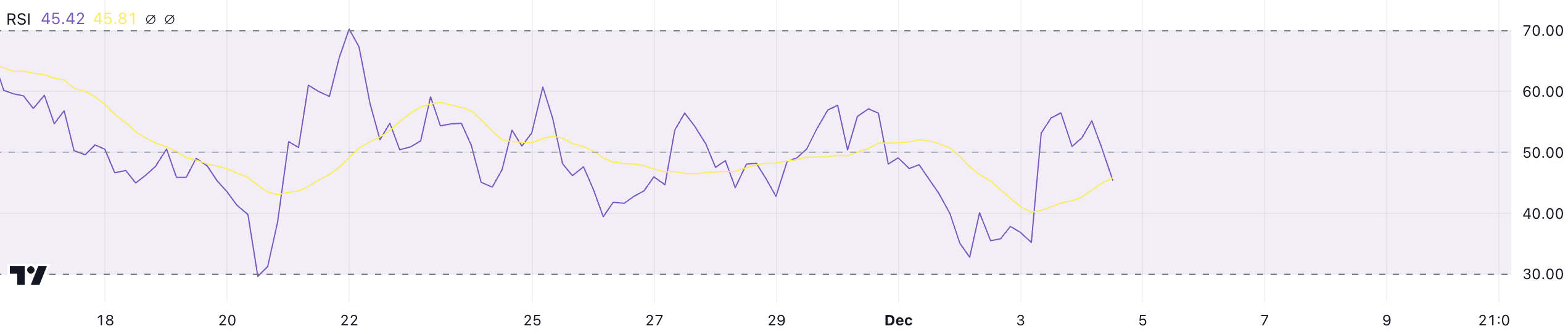

Mog Coin RSI Shows Neutral Area

MOG’s RSI fell to 45, from 55 yesterday, after rising from 35 thanks to Coinbase’s announcement of MOG’s listing.

This decline reflects a cooling in buying momentum after the initial excitement, placing the RSI in neutral territory where neither buyers nor sellers have a clear upper hand.

The RSI (Relative Strength Index) measures the speed and magnitude of price changes, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions.

At 45, MOG’s RSI suggests a balanced market, with the potential for both sides to prevail. If buying interest revives, RSI could continue to rise, potentially pushing prices higher, but if weakness persists, it could lead to a further correction or gentle decline.

MOG Price Prediction: Will It Drop To $0.0000020?

Although Coinbase’s listing news generated some gains for MOG’s price, its reaction was modest compared to coins like Moodeng, which have had much stronger gains.

This muted reaction suggests that market excitement for MOG may not yet be as strong as for its competitors, possibly limiting its near-term upside potential.

Currently, MOG’s EMAs show a negative signal, with the short-term lines crossing below the long-term ones. If this downtrend continues, the price could test the support zones near $0.00000220 and $0.0000020. Although decreasing in the past 24 hours, MOG is still one of the most prominent Meme Coins in the Base ecosystem, with a market capitalization of nearly 1 billion USD.

However, a reversal to the upside could change the momentum, allowing MOG price to test the resistances at $0.0000026 and $0.00000287 and potentially rally to $0.0000030.