Institutional demand for publicity to altcoins has risen to record highs, with altcoin’s market place share now accounting for 35% of the record-locked capital in cryptocurrency investment goods.

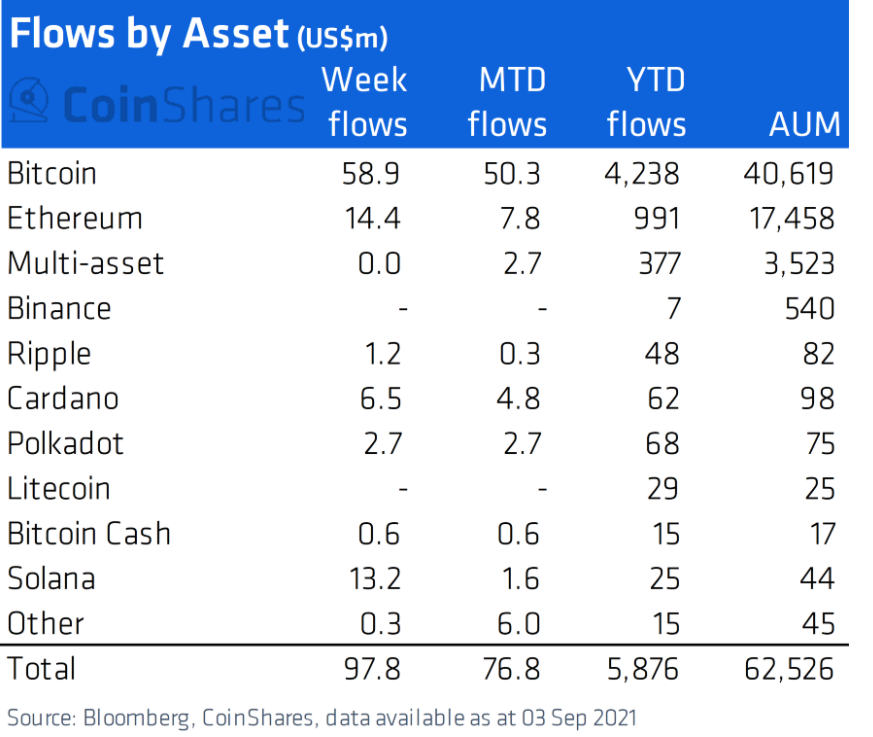

While $ 97.eight million invested in mixed crypto investment goods from August thirty to September three marked the third consecutive optimistic week, $ 38.9 million was invested in altcoin goods.

About 35% of institutional capital is at present locked in asset trackers other than Bitcoin, such as a new check of May’s all-time highs.

Ethereum (ETH) monitoring goods led the altcoin bundle for the 2nd consecutive week, recording inflows of $ 14.four million, down sixteen.two% from $ 17.two million the former week.

Notably, weekly money flows for Solana (SOL) -primarily based goods greater 38%, with SOL goods grossing $ 13.two million. This coincides with a 37% maximize in SOL charges above the exact same time period.

– See extra: Solana reaches a new peak, dethroning Dogecoin as the seventh greatest cryptocurrency

Cash movement in Solana goods doubled yr-above-yr (YTD) final week, with $ 25 million invested in SOL instruments during 2021 to date. SOL-primarily based goods at present signify $ 44 million in complete assets below management (AUM).

Additionally, Bitcoin (BTC) investment goods ended their eight-week outflow trend, the longest ever streak for any crypto asset solution, just after attracting inflows of $ 58.9 million for the week.

– See extra: Bitcoin (BTC) Suddenly “jumped” to USD 52,000 – BTC develop-up is nevertheless incredibly powerful, surprising the offer you

Institutional wealth managers now account for a mixed complete AUM of $ 62.five billion, near to the record of $ 66 billion announced in mid-May. Grayscale continues to dominate the competitors, accounting for 73% of the industry’s mixed AUM of $ 46. two billion.

Synthetic currency 68

Maybe you are interested: