Nearlend DAO undertaking overview

What is the Nearlend DAO undertaking?

Nearlend DAO is a loan and loan DeFi undertaking created on the Near Protocol ecosystem. The Nearlend DAO undertaking develops open supply code to produce liquidity pools with algorithmically established curiosity charges primarily based on provide and demand.

The Nearlend DAO undertaking connects lenders who want to make a revenue with idle dollars and borrowers who want to use the borrowed money for manufacturing or investment. Additionally, the Nearlend DAO lending platform intends to produce an NFT-Fi, with the NFT utilised as collateral on the Nearlend DAO undertaking.

The peculiarity of the Nearlend DAO undertaking

The Nearlend DAO undertaking develops and generates a spot in which end users can simply accessibility money providers permitting end users to make beautiful earnings without the need of acquiring to trade like the regular market place.

Warranty

The Nearlend DAO undertaking brought with each other the giving from all lenders in a pool to produce much more liquidity and a superior stability for the ecosystem. Lenders can withdraw their assets at any time without the need of waiting for the debt to expire.

The Nearlend DAO undertaking intends to concentrate on generating a protocol for all beneficial assets, which includes NFTs. Nearlend intends to help NFT as a collateralized asset like cryptocurrency.

Assets borrowed

If end users want to borrow assets on Nearlend, they ought to accept nToken tokens as collateral and then with nToken they can borrow any resource on the platform.

Nearlend DAO only demands borrowers to specify loan assets with no necessity for the phrase of the loan. Borrowing will consider spot in actual time and curiosity charges will be immediately adjusted primarily based on market place provide and demand. Different assets have unique curiosity charges and are immediately calculated primarily based on market place provide and demand.

NFT market place

At the finish of 2021, the NFT market place was really worth $ 41 billion. The Nearlend DAO undertaking believes that NFT will increase even much more and has defined a system inside the upcoming two many years to produce an NFT market place that permits end users to use NFT as collateral.

Building the NFT loan market place will assist NFT collectors and traders acquire strengths this kind of as:

- Get immediate liquidity and correct pricing for NFT

- Diversify your investment portfolio

- Open up a new possible market place with other DeFi applications

Government knife

Nearlend was born as a protocol with centralized governance and will slowly transform into a semi-decentralized governance or a DAO – decentralized governance. DAO members will make higher-degree choices with regards to undertaking routines and investments. The permissions that DAO members can use are:

- List of new liquidity pools

- Update the curiosity charge model

- Change the most important parameters of the protocol

- Add or get rid of the protocol perform

- Update the Oracle tackle

- Appointment of a new division manager

- Distribution of protocol income to DAO members and departments.

- Budget approval for new tasks financed by the “Reserve and Treasury Fund”

- Add new permissions for DAO

However, to develop into a member of DAO, end users ought to hold at least one% of the complete tokens or one,000,000 NEL tokens. Every member of the DAO has the suitable to make a proposal and will be accepted if much more than 51% of the members agree with the proposal.

Basic info about the undertaking token

Key metric IN the token

- Token title: Token DAO Nearlend

- Ticker: IN THE

- Blockchain: Close to the protocol

- Token common: NEP-twenty

- To contract: updating…

- Token kind: Government

- Total provide: a hundred,000,000 VND

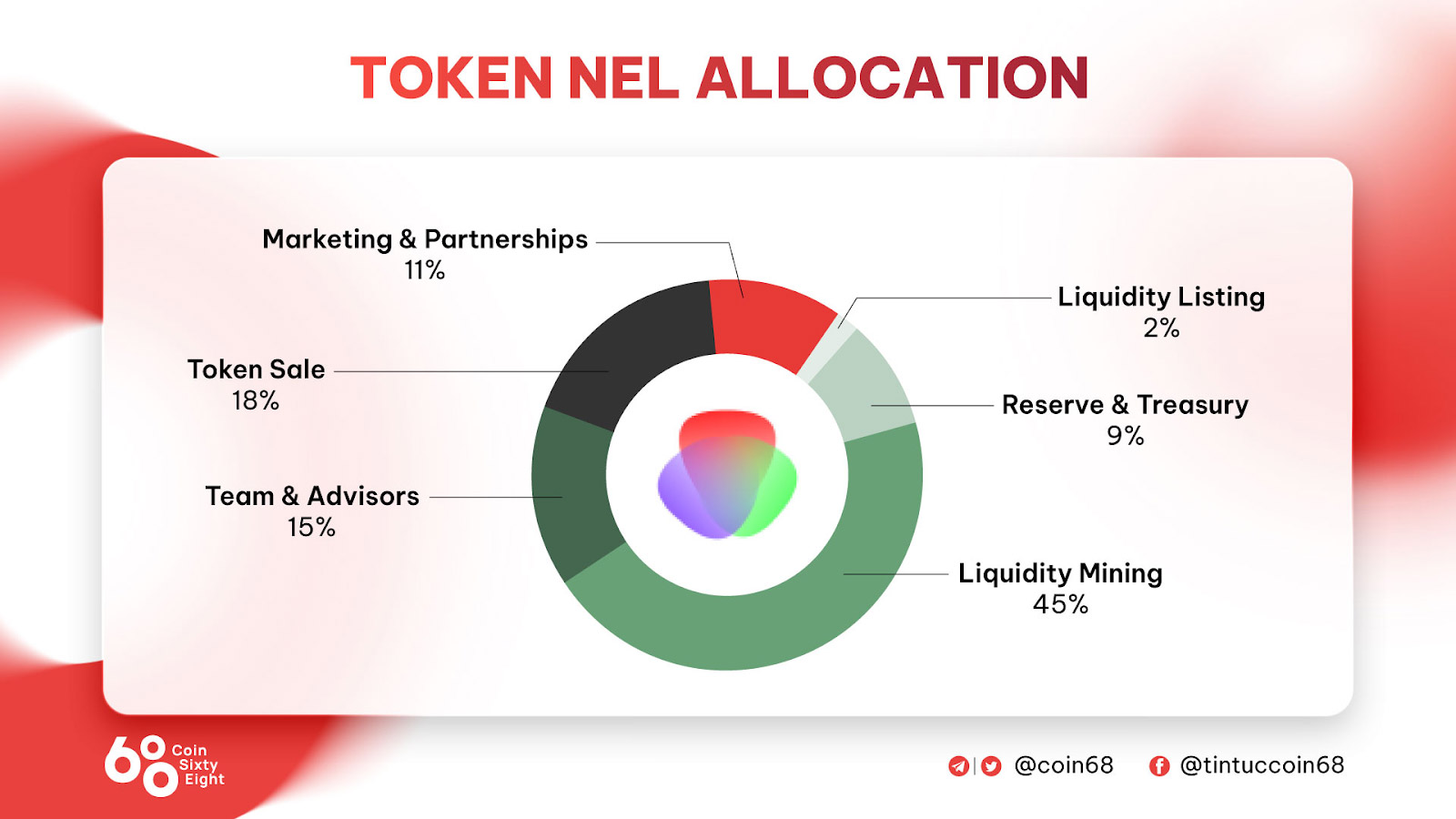

Token IN allocation

- Cash extraction: 45%

- Team and consultants: 15%

- Token Sale: 18%

- Marketing and partnership: eleven%

- Liquidity quote: two%

- Reserve and Treasury: 9%

Use situation of the NEL token

The NEL token of the Nearlend DAO undertaking is a token utilised for governance and participates in the vote on the route of improvement of the undertaking.

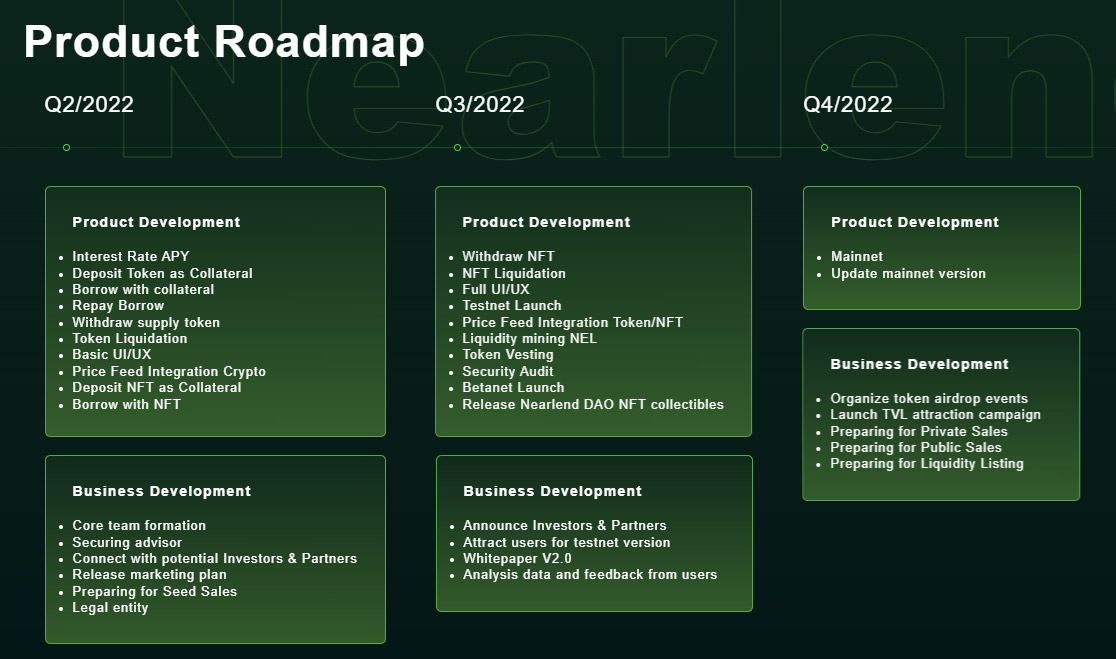

Nearlend DAO undertaking improvement roadmap

Quarter two – 2022

Product improvement

- Interesting APY Profit

- Use the tokens as a assure

- Collateralized loan perform

- Loan repayment perform

- Characteristics of the withdrawal of ensures

- Asset liquidation mechanism

- Price feed integration

- NFTs can be utilised as collateral

- You can borrow equity with NFT

Business improvement

- Formation of the most important improvement group

- Looking for consultants

- Looking for possible traders and partners

- Release the marketing and advertising system

- Preparation for the seed sale round

- Establishment of a legal entity mechanism

3rd quarter – 2022

Product improvement

- NFT withdrawal perform

- Create liquidity for NFT

- Fully up to date UX / UI

- Testnet launched

- Integrated selling price feed for tokens / NFTs

- Development of liquidity mining for the undertaking NEL token

- Dressing of tokens

- Verified undertaking

- Launch of Betanet

- Nearlend DAO NFT launched

Business improvement

- Notice to Investors and Partners

- Engage end users on the testnet

- Whitepaper launched V2.

- Data statistics and consumer suggestions

Fourth quarter – 2022

Product improvement

- Launch of the most important network

- Update the new edition for the products

Business improvement

- Airdrop organization

- Implement a campaign to entice TVL

- Prepare for presale

- Prepare for public sale

- Prepare the liquidity quote

The most important investor in the Nearlend DAO undertaking

Nearlend DAO undertaking overview, should really Nearlend DAO be utilised for revenue optimization functions?

The Nearlend DAO undertaking is a Near Protocol ecosystem loan undertaking with the intention of employing NFT as collateral in the long term. However, at the minute, the Nearlend undertaking has just started out to produce, there are not as well numerous traders and a unique audience, end users have not but professional the undertaking, the undertaking group is nonetheless anonymous and it is not but time to concern tokens, traders want to closely check and make sound choices in the long term.

Through this posting, you have by some means grasped the fundamental info about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a whole lot from this possible market place