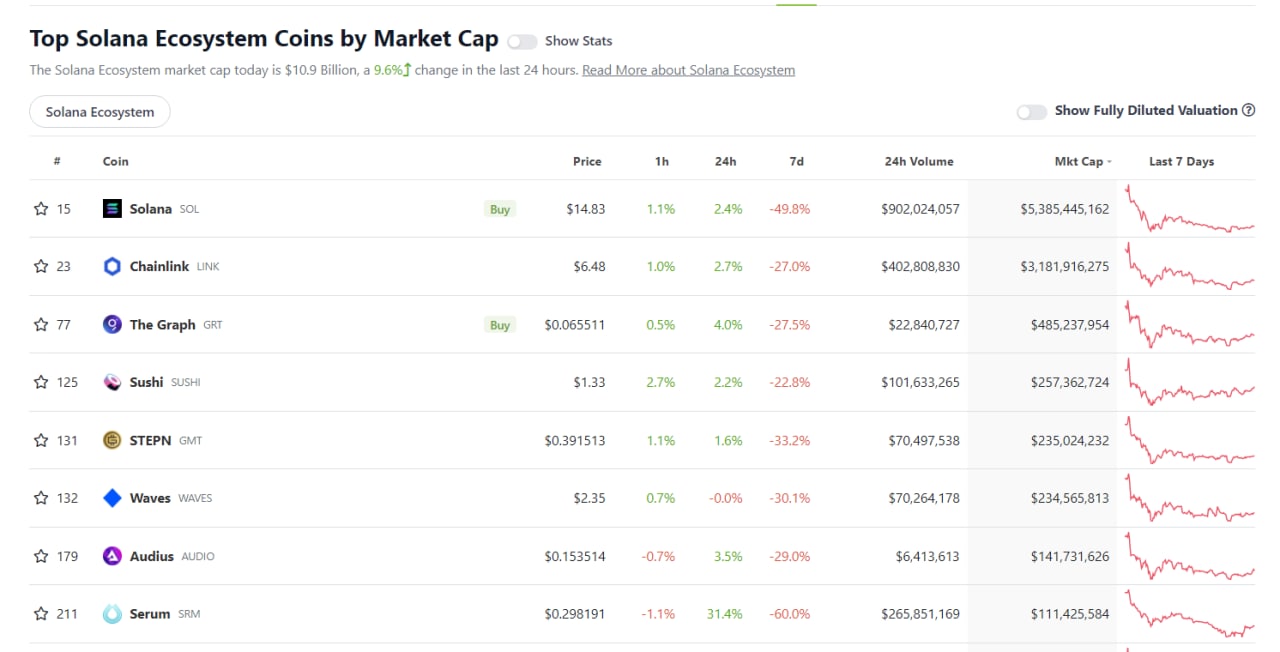

According to statistics, hundreds of hundreds of thousands of bucks disappeared from Solana’s DeFi ecosystem just after the horrible crash of FTX.

In its glory days in November 2021, the DeFi Solana ecosystem is property to more than $ ten billion in assets, also thriving underneath the large leadership of billionaire Sam Bankman-Fried, who is behind the FTX exchange, Multicoin Capital, Sino Global Capital and a bunch of other businesses.

A 12 months later on, the complete worth of frozen assets (TVL) outlined over is just more than $ 400 million. The collapse of FTX has triggered a great number of consequences for the cryptocurrency marketplace and will make lots of persons regret later on on. Multicoin and Sino Global reported losses of hundreds of thousands of bucks, Even the Solana Foundation itself suffered tens of hundreds of thousands of bucks in damages.

Mr. Sam as soon as boldly stated to the CEO of Binance that “I will buy all the SOLs you have, right now, for 3 USD… Then leave”. However, all that is left is a golden previous and sadness.

Not only has it misplaced far more than $ 700 million well worth of TVL shade, but the selling price of SOL also seems to be in problems in latest days. SOL’s selling price totally misplaced 50% and its DeFi token streak failed to recover.

Lending platform Solend was the hardest hit, with just $thirty million remaining, far quick of November’s peak of $280 million.

Data from DeFillama displays that more than forty% of the liquidity on decentralized exchanges (DEX) Raydium and Orca have steadily exited the platform more than the previous week, each holding more than $150 million just a handful of weeks in the past.

“Solana has taken a much harder and more painful blow than other blockchains,” explained Alexei Kulevets, co-founder of Walken.

Synthetic currency 68

Maybe you are interested: