After a time period of time in which the industry recovered, it appears that the problem of DCG, Genesis and GUSD (stablecoin formulated by Gemini) has calmed down temporarily. However, earlier this week, new data on the GUSD has traders needing to think about for the foreseeable long term.

Bad information

On the evening of January thirty, the OKX exchange announced the delisting of the stablecoin GUSD. In distinct:

DELISTING UPDATE

Starting at eight:00 on February one (UTC), #OKX will cancel $G USD.

⛔ OKX Convert will no longer be readily available for $G USD goods.

Find out a lot more ️https://t.co/xGxvWVY4cY pic.twitter.com/rOyb3xJDG3

—OKX (@okx) January 30, 2023

“OKX Exchange will start off delisting GUSD from 5pm on February 1st. OKX Convert will no longer help GUSD linked goods.

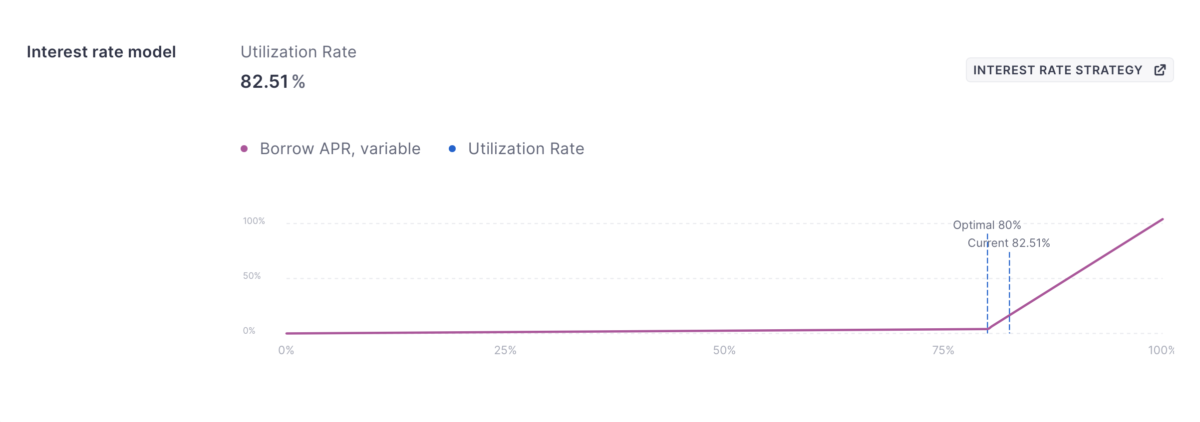

The demand to borrow GUSD on Aave (most most likely for the objective of shorting this stablecoin) has started off to raise. The utilization charge on Aave is presently 82% and has exceeded the optimum threshold of 80%.

However, the GUSD industry dimension on Aave is pretty little, all-around much less than $ten million. The bulk of the GUSD provide is presently deposited in MakerDAO’s PSM for the objective of supporting the DAI anchor.

In addition, the price tag information of the GUSD stablecoin on the two platforms Coinmarketcap and Coingecko has also been frequently fluctuating not too long ago, the motive for this fluctuation is unknown.

#PeckShield alert $G USD at .988 pic.twitter.com/KNMAwvviPZ

— PeckShieldAlert (@PeckShieldAlert) January 31, 2023

Coinmarketcap has occasionally recorded this stablecoin falling under the $.98 threshold. On CoinGecko, there was a minute when the GUSD price tag fluctuated sharply as it hit the $one.08 manage.

Regarding DeFi tasks, MakerDAO has also established DAO voting to progressively lessen the possibility of influence from GUSD.

GUSD was also cited by Gearbox DAO as an illustration to go over the two collateral management options and depeg possibility of this stablecoin.

Positive information

Previously, MakerDAO also created fixes linked to the ensure of GUSD and the partnership among Gemini and MakerDAO.

> See a lot more: MakerDAO explains the latest Gemini Earn incident

Additionally, MakerDAO developer Sam MacPherson also shared data about GUSD payments for MakerDAO (especially PSM pool exercise).

.@Twins sending the initial payment to Maker beneath the GUSD partnership.

I anticipate income to immediately attain one hundred million a 12 months as we monetize the price range.

Revenues that can:

– Be forwarded to DAI holders

– Reward MKR owners with a burn up

– Purchase stETH to raise protocol resilience pic.twitter.com/Nb4z3aHaOh— Sam MacPherson (@hexonaut) December 21, 2022

However, it is nevertheless tough to conclude what will occur with this stablecoin. In the quick phrase, specifically following the publication of numerous statements of organizations that have filed for bankruptcy, it is extremely most likely that a lot more new information will have a enormous affect on the industry in the long term.

Synthetic currency68

Maybe you are interested: