The New York Financial Regulatory Authority’s regulatory framework for the listing and delisting of cryptocurrencies officially goes into impact.

New York problems suggestions for listing and delisting cryptocurrencies. Photo: Every dayCoin

New York problems suggestions for listing and delisting cryptocurrencies. Photo: Every dayCoin

After Two months of getting feedback, the New York State Department of Financial Regulation (NYDFS) launched suggestions on listing cryptocurrencies on exchanges final evening (November 15). The new regulatory framework will come into force straight away.

NEW: DFS Superintendent Adrienne A. Harris Adopts New Regulatory Guidelines Related to the Listing of Virtual Currencies

More right here: https://t.co/F2eyZKzucG pic.twitter.com/p5kfXfUVnO

— NYDFS (@NYDFS) November 15, 2023

According to the regulator’s announcement, crypto companies should submit coin listing policies to the NYDFS for pre-approval. Adrienne Harris, director of NYDFS, explained:

“Once the listing policy is approved by the DFS, the institution will be able to offer and trade the coin in New York or to residents of New York.”

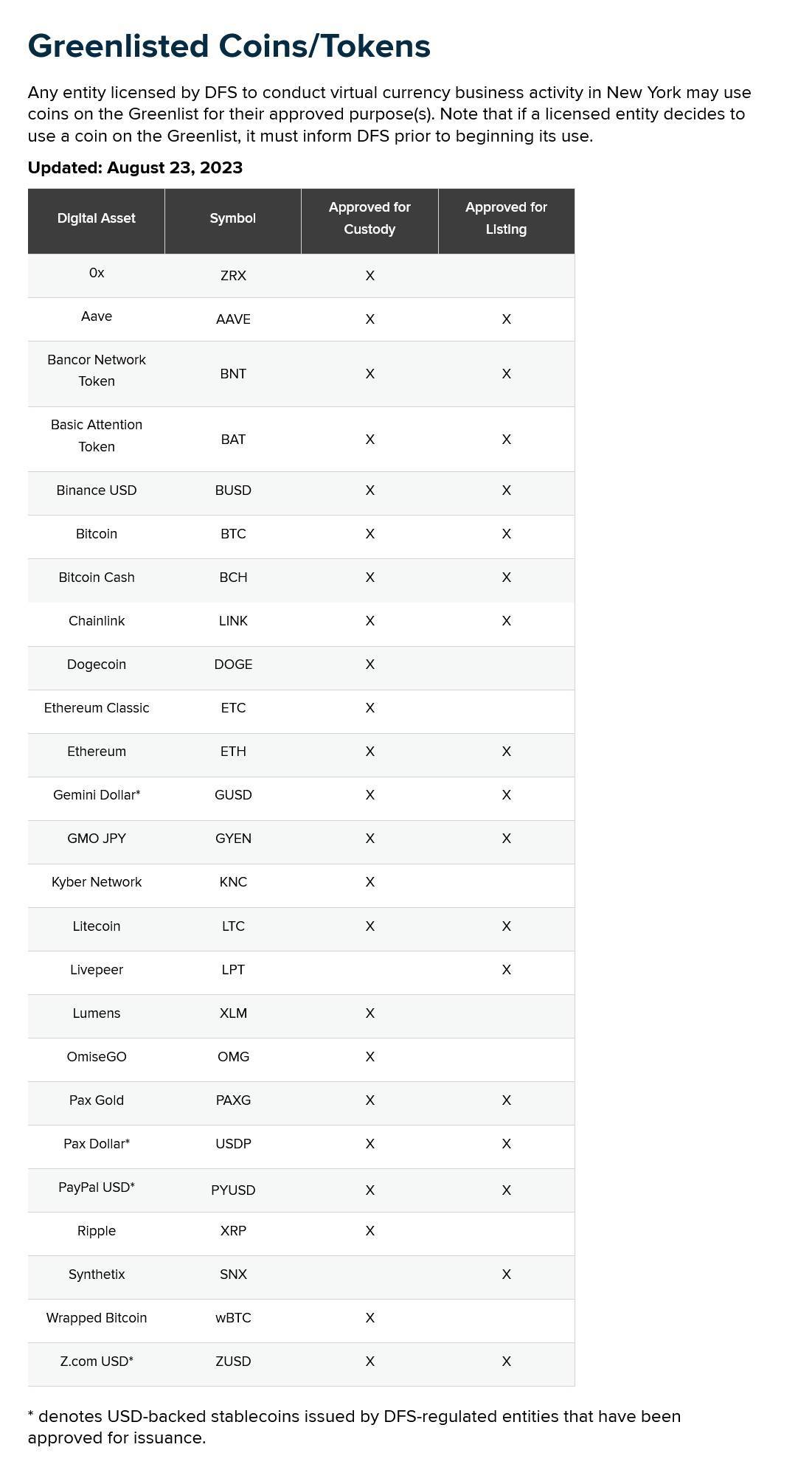

The Department of Finance notes that organizations that do not comply with the over directions can only record tokens “green list” of the NYDFS, unless of course otherwise exclusively authorized.

List of cryptocurrencies authorized for trading and custody by the NYDFS as of June 2023. Source: NYDFS

List of cryptocurrencies authorized for trading and custody by the NYDFS as of June 2023. Source: NYDFS

As Coinlive informed, coin pricing policy It should promise the following three factors:

-

Adapt to the cryptocurrency company’s business enterprise model, prospects, partners, working geographies and support suppliers

-

Potential danger management and evaluation approach

-

Coin monitoring procedures.

For Coin delisting policythe Financial Conduct Authority of New York requested clarification:

-

Reasons for cancellation

-

Events foremost to delisting

-

The anticipated timeframe for delisting should involve prior notification to prospects and affect examination.

The new suggestions also state that in circumstances the place a coin is listed as “high risk,” organizations should take away it straight away. The regulator calls for organizations to have a draft delisting policy ahead of December eight, 2023 and to submit the last model by January 31, 2024.

NYDFS has been actively regulating the cryptocurrency sector for several many years. The company issued Regulation 23 NYCRR Part 200, also recognized as the BitLicense licensing method, in 2015. This is a regulatory framework relating to cryptographic routines inside of the state of New York, which contains comprehensive principles and advice on listing, operations and other prerequisites for entities, organizations and organizations working in the cryptocurrency discipline. BitLicense imposes stringent prerequisites and calls for organizations to comply with stringent rules, guarantee safety, guard customers and protect against dollars laundering.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!