November 2022 was 1 of the worst months for the two most well-known cryptocurrencies — Bitcoin (BTC) and Ethereum (ETH).

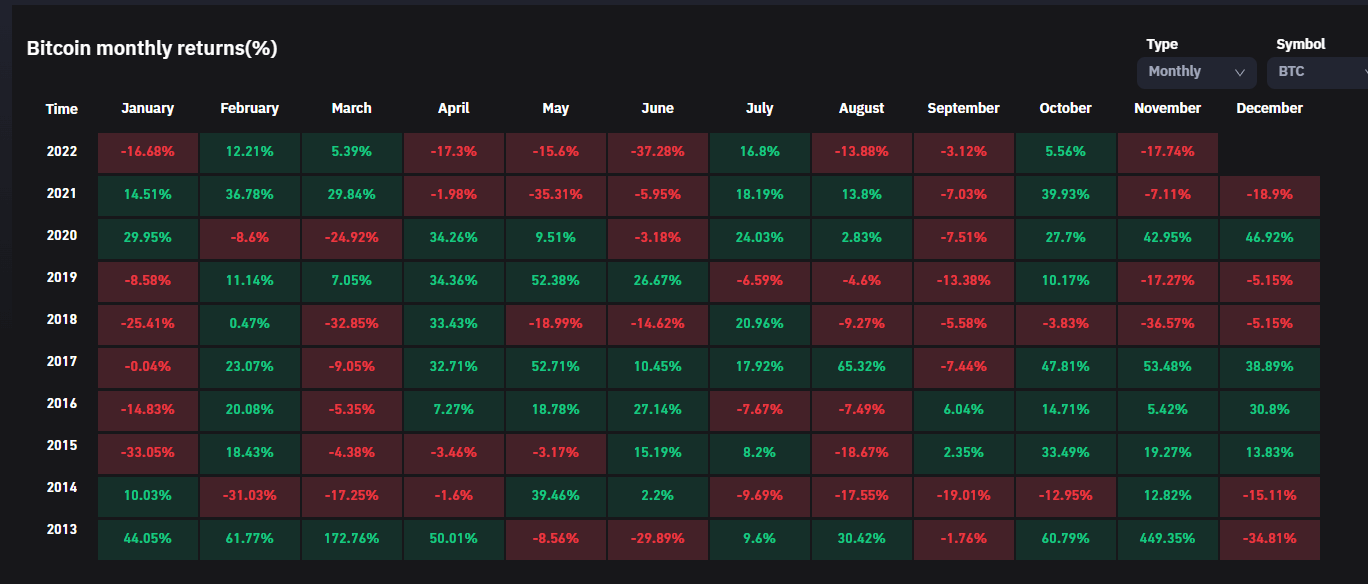

November is Bitcoin’s 2nd worst month of 2022

According to CryptoSlate information, Bitcoin has misplaced about 18% of its worth in the previous thirty days – producing November the 2nd-worst month of the 12 months and the greatest regular monthly reduction in the previous 5 months.

While the worth of Bitcoin recovered somewhat in the direction of the finish of the month, the capitulation of FTX shattered retail traders’ self-confidence in the process. Glassnode reviews that crypto traders noticed the fourth greatest investment on record with a seven-day real reduction of $ten.sixteen billion.

More than 50% of BTC Holders are at a loss immediately after the asset’s worth dropped to about $15,600 — the lowest return because March 2020.

Additionally, Bitcoin miners have wiped out their 2022 balances as the volume of assets offered exceeds the volume they accumulated through the 12 months. Miners are beneath rising marketing stress as the worth of the primary digital asset struggles beneath the $sixteen,000 mark.

Bitcoin miners like Iris Energy defaulted on $108 million in debt and shut down operations at two of their services in November. An unnamed Bitcoin mining enterprise also failed to pay out lease in Dallas. and depart all his units behind.

#Bitcoin Shrimp ($BTC to their holdings because FTX crash, all-time substantial stability attain.

This cohort at the moment holds in excess of one.21 million $BTCequivalent to six.three% of the circulating provide.

Professional Dashboard: https://t.co/HpXwoav6wO pic.twitter.com/7U4oPAAakD

– glass node (@glassnode) November 28, 2022

Meanwhile, in spite of all these losses and surrenders, Glassnode has reported that BTC Shrimp and Crab has powerful accumulation because the FTX crash, primary to an all-time substantial stability.

Ethereum has its fourth worst month

Meanwhile, November was the fourth worst month of the 12 months for Ethereum as it dropped just about twenty%.

After the crash of FTX, the worth of ETH dropped to as lower as $one,110 on November ten from in excess of $one,600. The cryptocurrency has recovered somewhat because hitting in excess of $one,200. As of press time, ETH has dropped 18% in the previous thirty days.

Poor cost overall performance appears to have prompted Ethereum whales and shrimp to accumulate. Analysis of CryptoSlate’s Glassnode information displays that traders in these pools have been accumulating Ethereum at breakneck pace.

Despite the late-month rally, crypto analysts’ bias for the asset stays bearish. Popular crypto trader Capo of Crypto tweeted on November 28 that he expects a capitulation that will quickly deliver the ETH cost to about $600 to $700.

I have invested hundreds of hrs analyzing the marketplace to come to the conclusion that:

Surrender is a matter of time. $BTC need to attain 12ks, $ETH 600-700, altcoins will drop forty-50% and shitcoins 50%+.

I will not submit much more right here till confirmed or cancelled.

Good luck!

— il Capo of crypto (@CryptoCapo_) November 28, 2022

Meanwhile, this is not the very first time Bitcoin and ETH have had a terrible November. In truth, historically, this month has been a rough 1 for BTC. 2018 BTC lost 37% of its value in November.