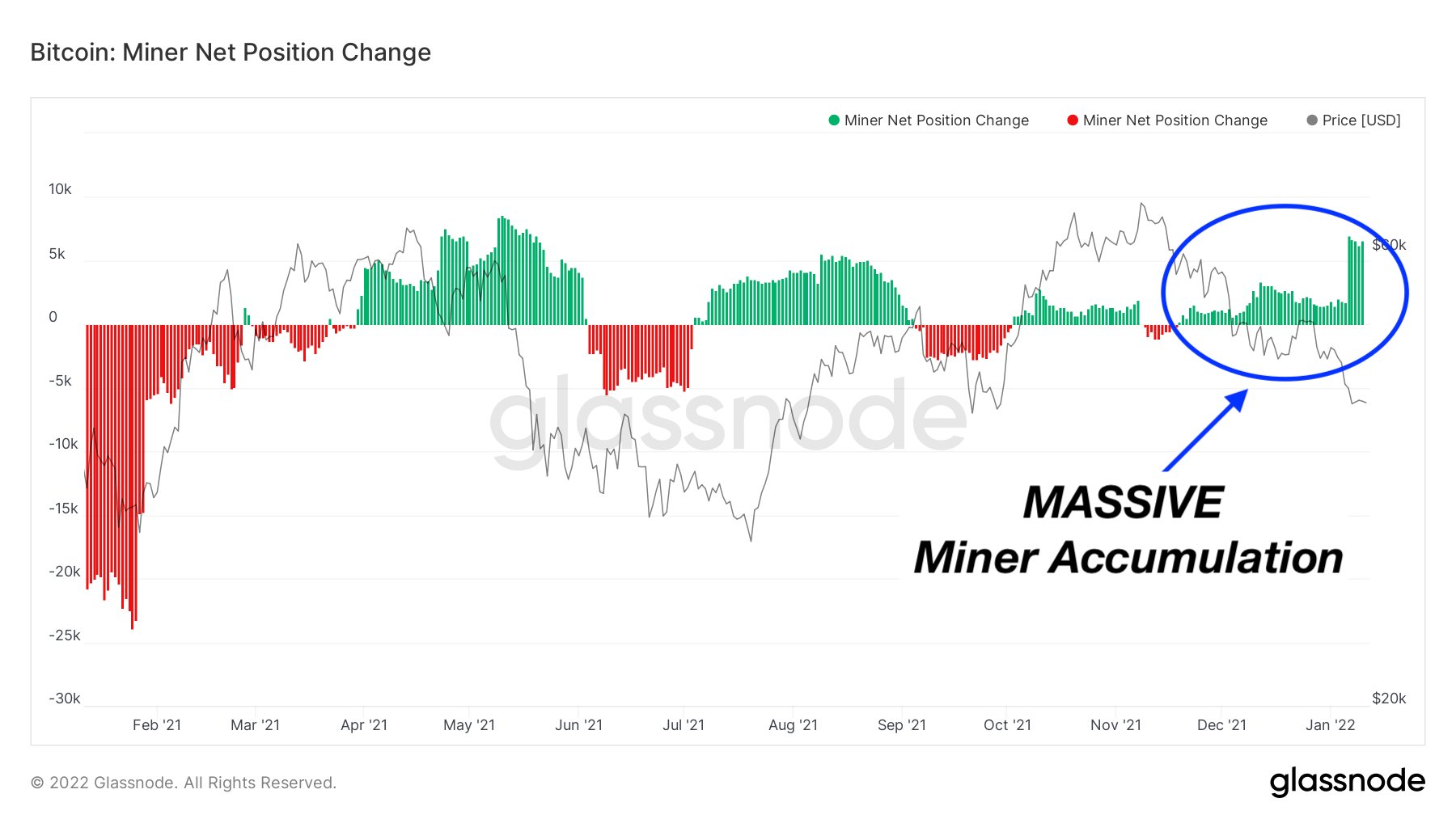

Most Bitcoin miners are now accumulating far more BTC than at any time in the previous 5 months, but the derivatives marketplace game even now carries substantial hazards, which could have a important influence on Bitcoin’s rate response.

The rate of bitcoin may perhaps have disappointed traders in the previous couple of months, but it has barely had a substantial influence on extended-time marketplace participants. Skilled miners are no exception, they drastically improved their holdings in BTC in the to start with two weeks of 2022.

Over the previous week, more than five,000 BTC per day has been extra to the miners’ provide, with an real make that has been more powerful given that prior to Bitcoin’s ATH at $ 69,000 was set in September.

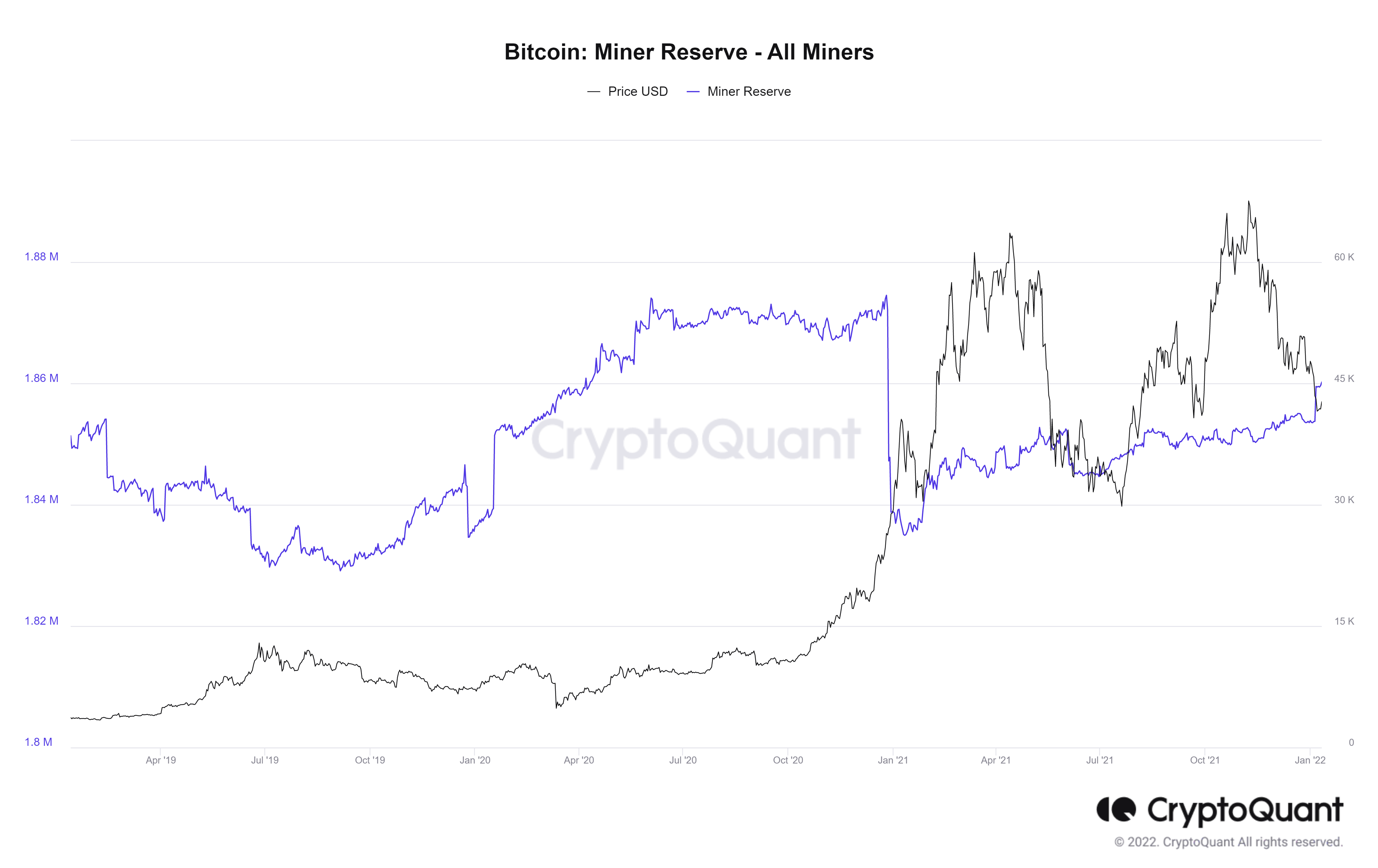

Another CryptoQuant information also highlights the extent to which miners have regained their BTC just after China’s crackdown on the cryptocurrency mining and trading sector that started in May. Reserves are one,859 million BTC as of January twelve, a record for the finish of 2020 just after BTC passed its previous 2017 peak.

– See far more: Bitcoin hashrate established ATH, is it robust sufficient to support BTC bounce back strongly?

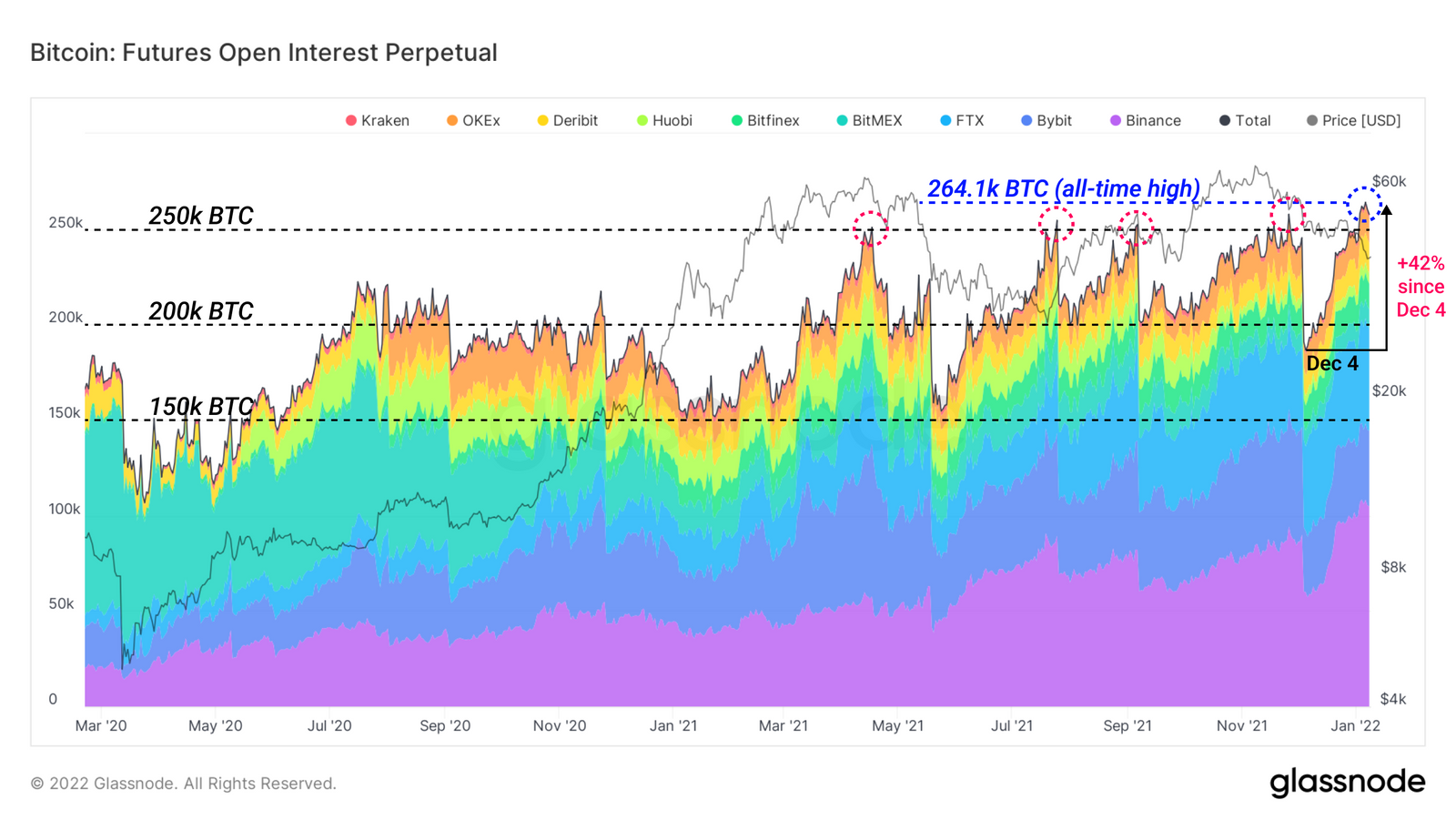

Furthermore, the leverage ratio in the Bitcoin derivatives marketplace is expanding at a breakneck velocity. This represents intense pleasure for Bitcoin’s rate action as a bet, rather than extended-phrase regular demand for BTC in the spot marketplace.

Open curiosity is the complete worth of all open contracts on the futures marketplace, displayed in terms of BTC. Open curiosity reached an all-time large of 264,000 BTC in the encounter of current rate falls, up 42% given that December 4th and exceeding 258,000 BTC set on November 26th.

Furthermore, the dominance of Bitcoin extended settlement contracts reached 69%, the highest degree in a yr. In 2021 alone, far more than $ a hundred billion was liquidated in the derivatives marketplace and 3 distinctive major “pitfalls”, which includes the $ eight,000 “breakout” of Bitcoin in just one hour in April, phase two collapsed. from $ 52,000 to $ 48,000 in September and the sale-off at $ 42,000 in early December.

#Bitcoin extended liquidation dominance reached 69%, the highest degree given that the deleveraging occasion in May 2021.

This suggests that most of the liquidations in the futures markets in current weeks have been extended traders trying to get the knife.

Real Time Charts: https://t.co/FM03prCgrV pic.twitter.com/5I6uyEutx8

– glassnode (@glassnode) January 10, 2022

However, no matter how huge the assistance from the accumulation of miners or huge international investment institutions, the development index in futures contracts inevitably poses a selected risk and could sink Bitcoin at any second.

Synthetic currency 68

Maybe you are interested: