The cryptocurrency marketplace has a cyclical background based mostly on Bitcoin halving occasions. The Bitcoin halving comes about each and every 210,000 blocks are mined — about each and every 4 many years. The most latest halvings occurred in 2012, 2016 and 2020.

Between each and every halving, a bull marketplace emerged just after a halving. Due to the transparent nature of most blockchain networks, it is doable to appear at on-chain information to recognize patterns and similarities from earlier cycles.

CryptoSlate’s The staff looked at information from Glassnode and recognized numerous prospective bear marketplace bottom signals.

Supply selection P/L

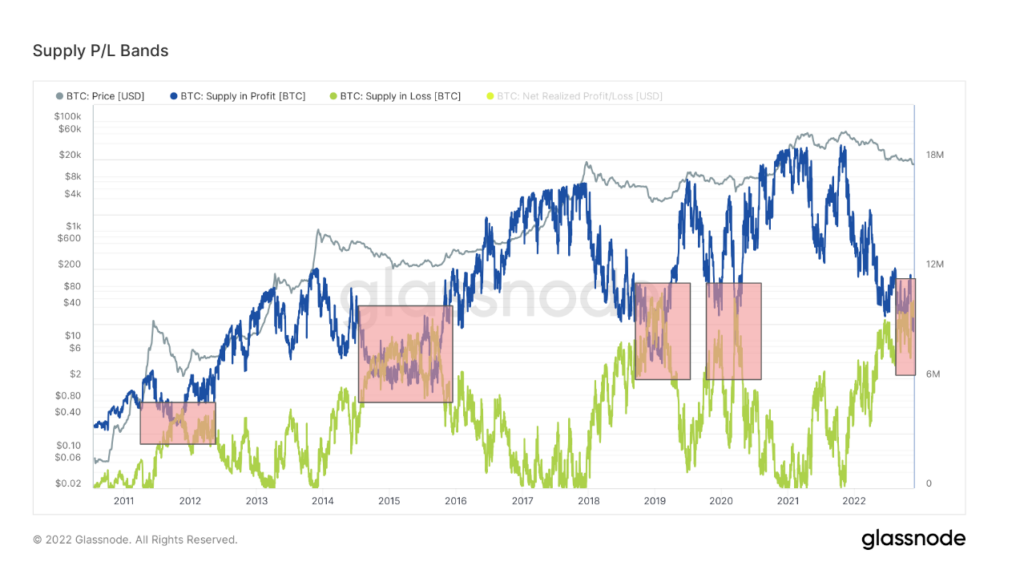

Supply P/L Bands describe the complete provide of Bitcoin in the kind of revenue or reduction. The blue line displays the complete variety of Bitcoins profited The green line displays the variety that is now at a reduction.

The values represent unrealized gains and losses as the information tracks the worth from the rate at the time of coin redemption by means of trading or mining.

The blue and green lines not too long ago converged for the fifth time in Bitcoin background. The earlier occasions took area in the course of a bear marketplace, shut to the cycle lows.

The exception was in May 2020 in the course of the worldwide COVID marketplace crash. In addition to the COVID black swan, convergence occurred in 2012, 2014 and 2019. While the overlaps lasted from 6 months to a yr, each and every time the Bitcoin rate recovered to hit a new all-time substantial in the previous yr. 3 many years.

The P/L provide band is not a surefire indicator of a bear marketplace bottom, but though background does not usually repeat itself, it normally rhymes.

MVRV Long Term & Short Term

MVRV is a phrase associated to the ratio among the real capitalization and marketplace capitalization of Bitcoin. MVRV only will take into account UTXOs with a lifespan of at least 155 days and serves as an indicator to gauge the habits of prolonged-phrase traders.

Similar to the P/L Supply Band, the MVRV of prolonged-phrase holders fell only 5 occasions decrease than that of quick-phrase holders. The time intervals closely resemble the provide chart that appeared in each and every of the earlier bear markets and the COVID crash.

Supply for quick-phrase holders

The complete provide of Bitcoin held by quick-phrase holders has surpassed 3 million coins from the cycle reduced. Short-phrase holders are ordinarily most delicate to rate movements and the sum of income they hold hits a historical bottom at the base of a cycle.

Scaling displays other occasions when quick-phrase holders’ provide has reached a related degree. Unlike other metrics, even so, the phenomenon has occurred 6 occasions due to the fact 2011. Four occasions it matches other information, though quick-phrase holders bottomed out in 2016 and 2021.

An off-chain signal of a bear marketplace bottom has also emerged in latest weeks. As Bitcoin fell from previous all-time highs, the minute when big publications declared ‘cryptocurrency dead’ marked the bottom of the marketplace.

2018 Bitcoin Was Claimed died 90 occasions in accordance to big publications and 125 occasions in 2017, in accordance to 99 Bitcoin. Currently, the cryptocurrency has only obtained 22 obituaries in 2022, so we are far from this signal, which adds excess weight to the marketplace bottom concept.

Just two weeks in the past Sam Bankman-Fried was in the stratosphere. But FTX’s substantial-pace boom has dealt a catastrophic blow to an business with a background of failures and scandals. Is this the finish of crypto? https://t.co/bwynnCeCZ3 pic.twitter.com/NWyqHCZzXm

– The Economist (@TheEconomist) November 17, 2022