Today we open futures positions with CoinEx on 3 cryptocurrency exchanges: Binance, KuCoin and CoinEx, let us see which platform is the ideal. (This posting displays personalized working experience and is for informational functions only.)

Binance

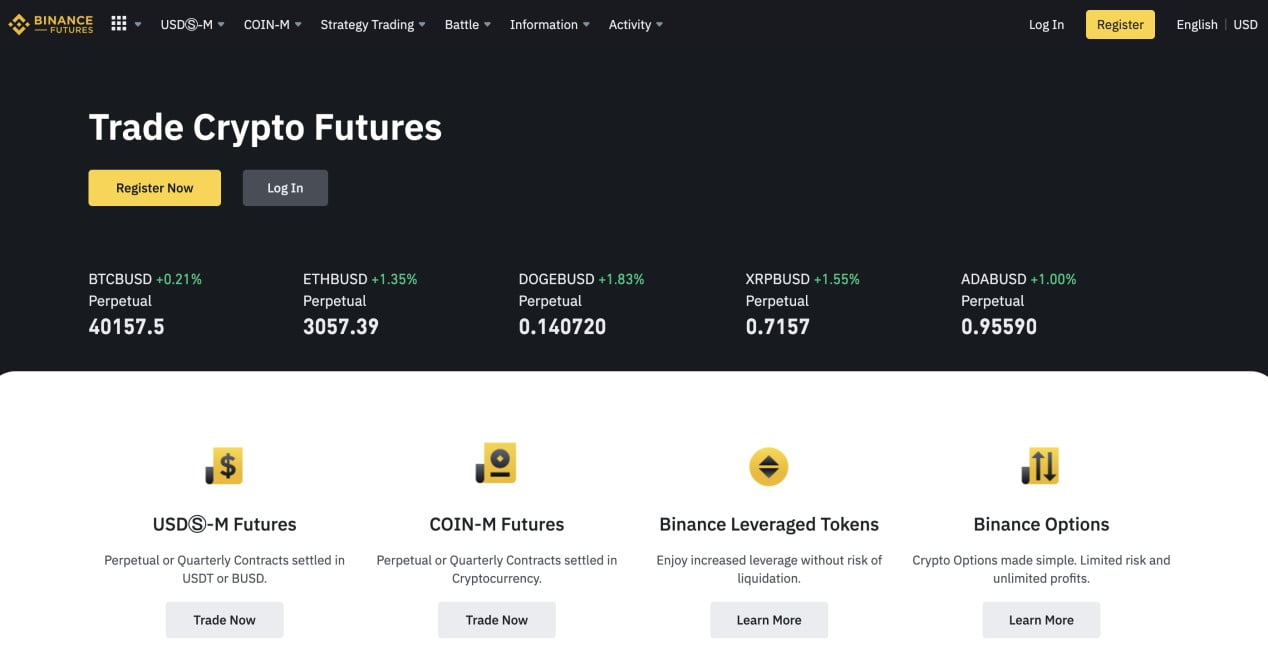

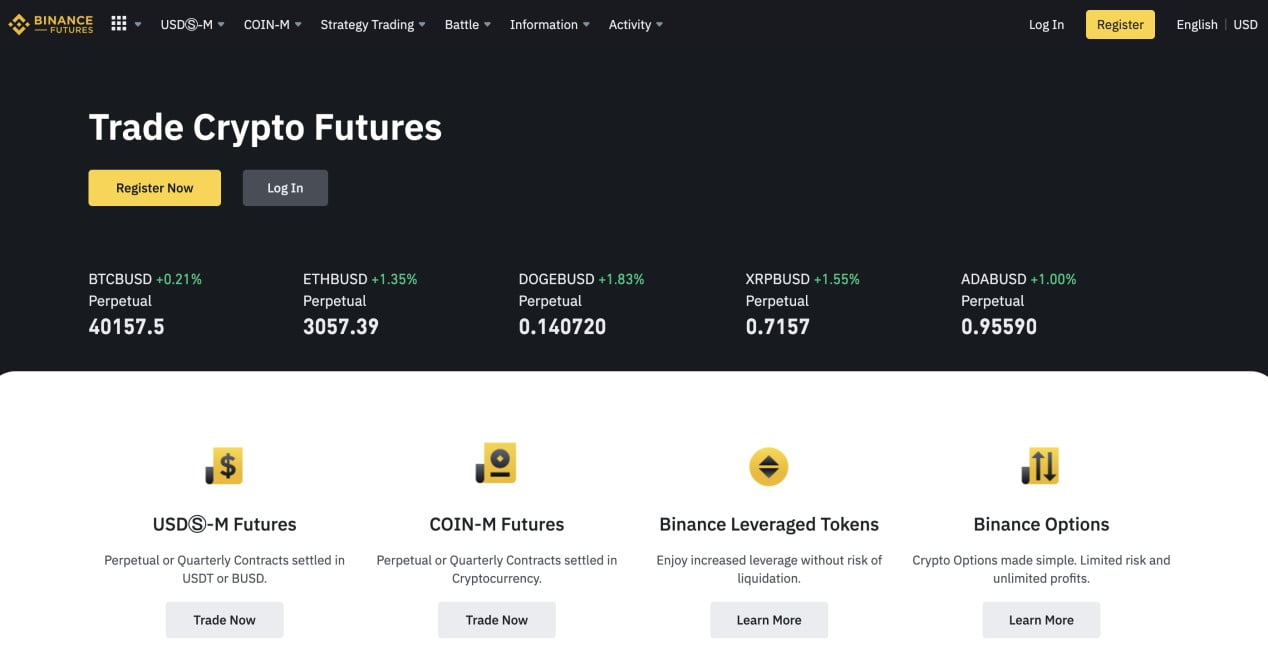

Let’s start out with Binance, which primarily consists of USDT-M Futures (linear contract), Coin-M Futures Contract (reverse contract), Binance Leveraged Token and Binance Option. Specifically, customers can trade USDT-M Futures and Coin-M Futures right on the Binance web page. However, to trade with Binance Option, traders need to have to download the Binance app. As for the Binance leveraged token, as there is no working manual, novices who are generally unfamiliar may possibly at first get baffled.

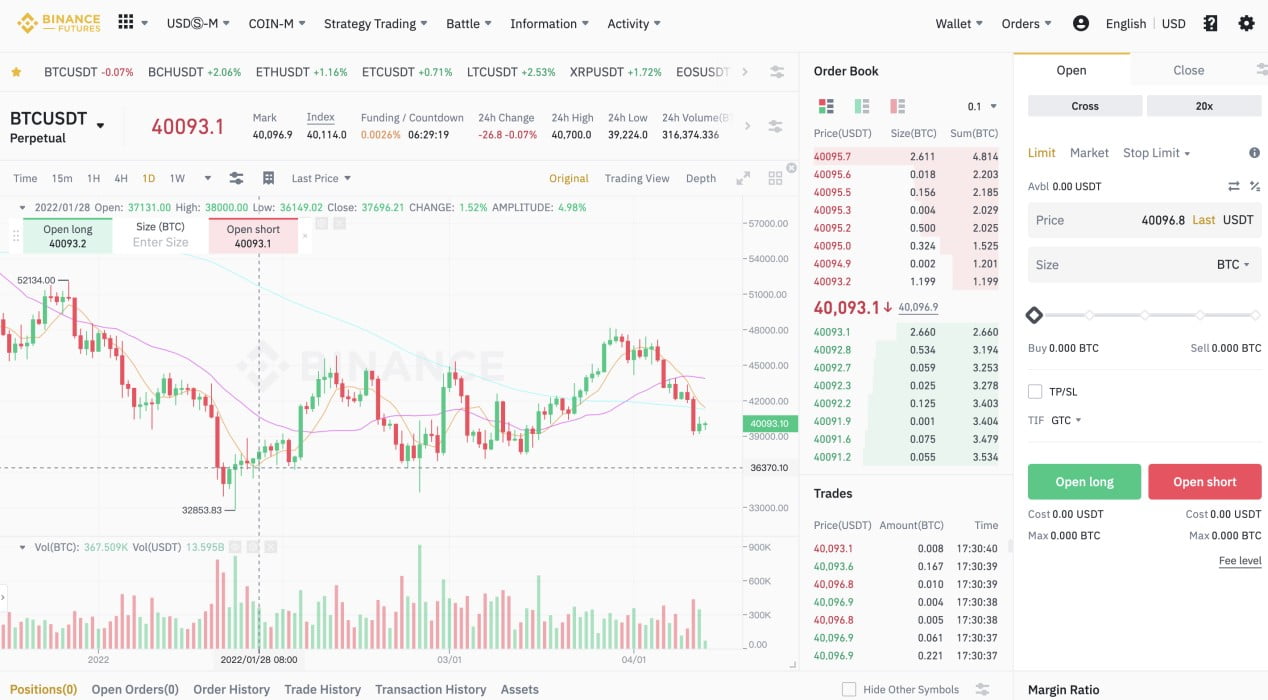

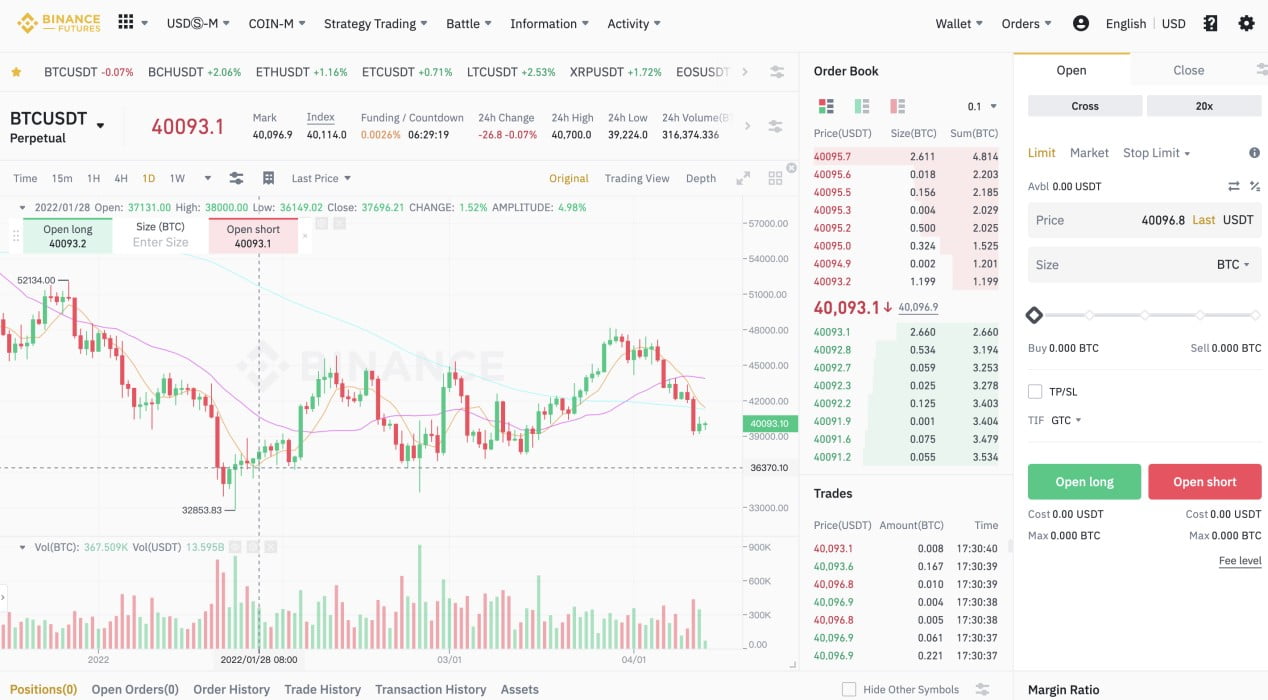

On Binance, customers can location seven varieties of orders, which include Limit, Market, Stop Limit … and select to purchase or promote quick. After opening a place, the consumer can check out the open orders and transaction historical past at the bottom of the webpage.

It ought to be mentioned that customers should full KYC verification in advance of trading futures on Binance. To get started out with Binance’s solutions and providers (e.g. depositing, trading and withdrawing cryptocurrencies), the two outdated and new customers should 1st full the KYC verification.

Overall, with the brand as the major cryptocurrency exchange in the planet, Binance presents a total array of cryptocurrency futures contracts on a rather streamlined world wide web interface. However, there are no working guidelines and customers need to have to devote extra time understanding how to trade futures on the stock exchange. Additionally, to trade futures on Binance, customers should full the KYC verification. Furthermore, customers ought to also be cautious with this platform due to the concern of defending consumer rights, which include manipulating charts and clearing orders.

KuCoin

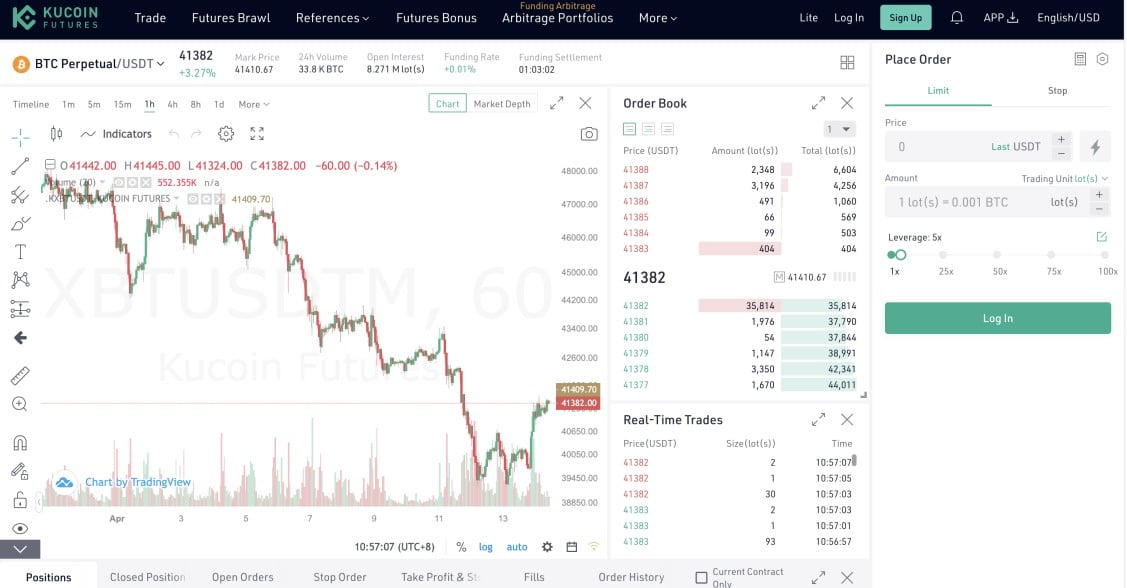

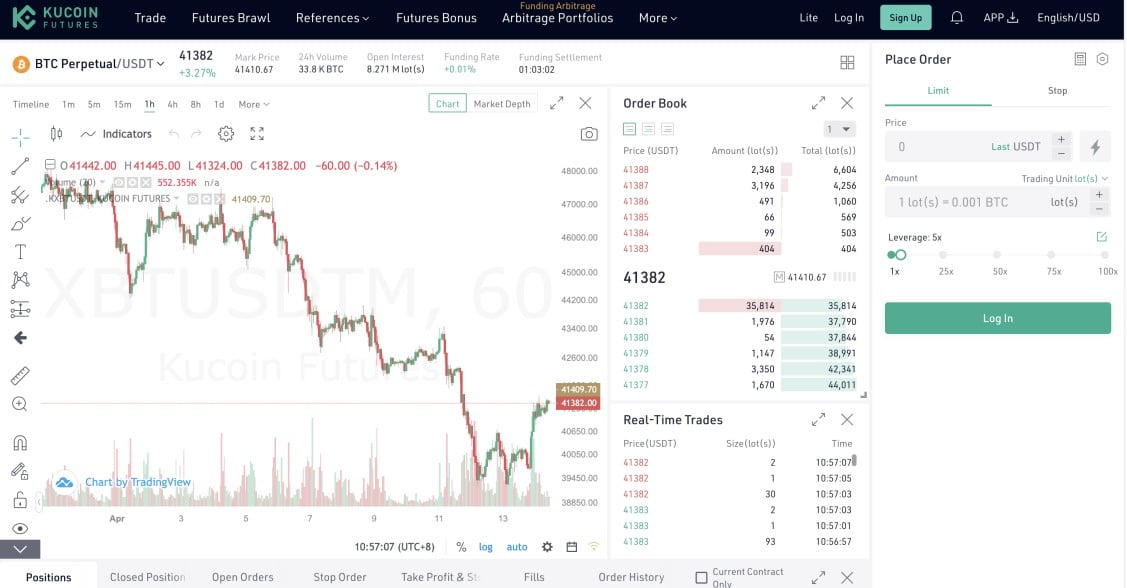

KuCoin’s crypto contracts section at this time presents leveraged tokens and futures. The KuCoin futures interface is very very similar to Binance: the latest market place disorders and buy guide are on the left and the margin pattern and buy variety are on the suitable. KuCoin also presents a broad array of options, from contract calculators to Take Profit & Stop Loss. However, on KuCoin, traders can only location restrict orders.

KuCoin presents no extra than one hundred USDT signed futures markets. Additionally, in historical past, September 2020 also marked the greatest crypto hack of that 12 months, when $ 280 million really worth of assets had been stolen from KuCoin. Therefore, traders ought to meticulously check out the protection of the platform in advance of joining KuCoin.

CoinEx

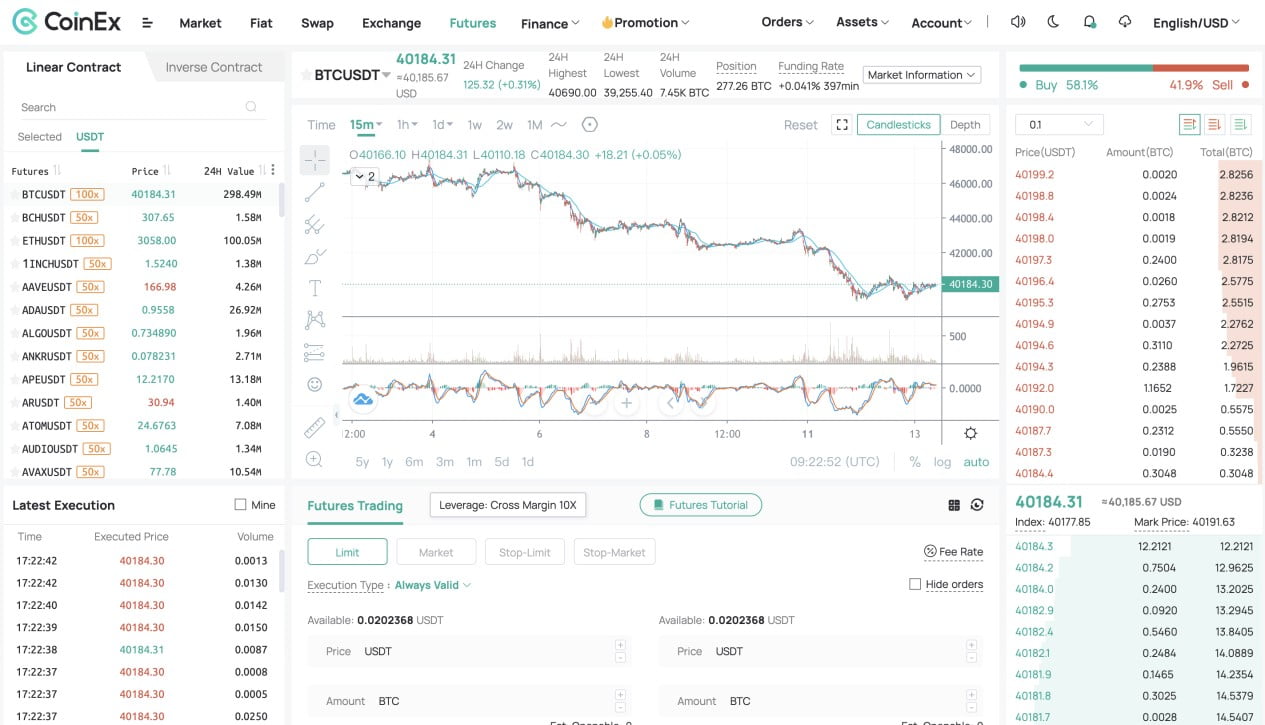

On CoinEx, all crypto contracts are futures contracts. Users can trade linear / reverse contracts (equivalent to USDT-M Futures and Coin-M Futures as on Binance and KuCoin).

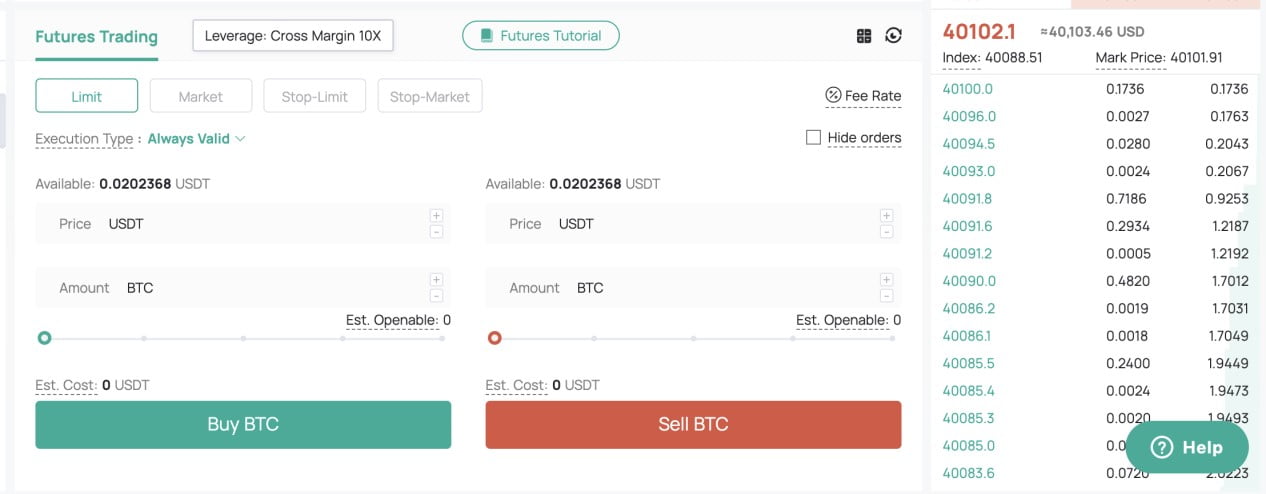

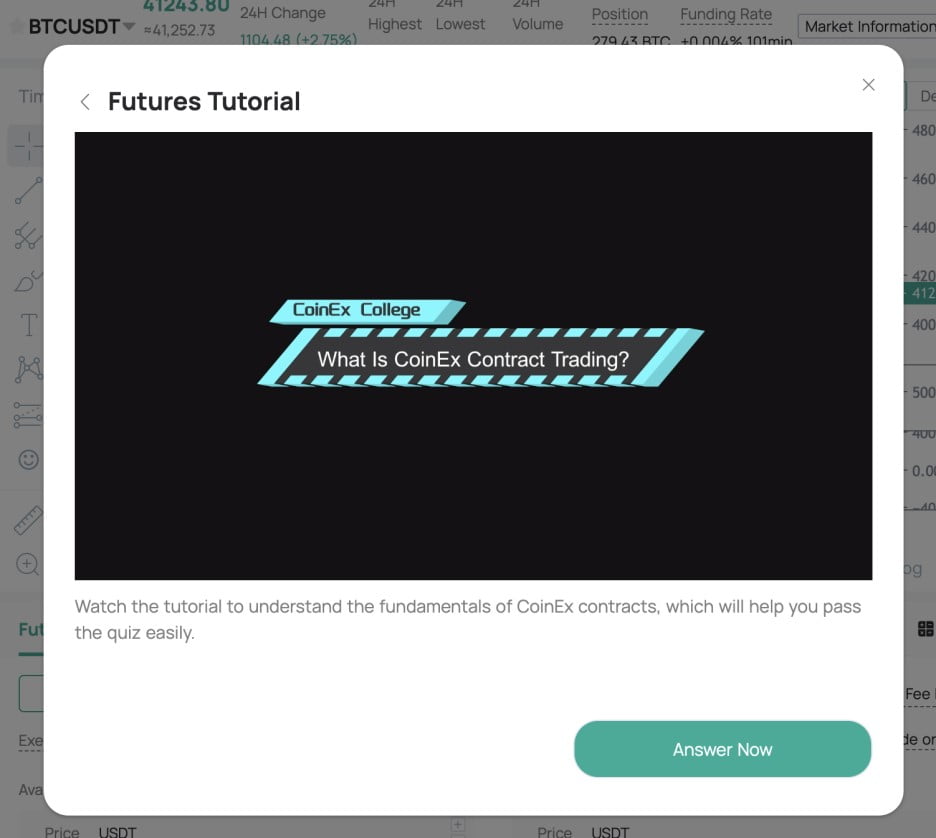

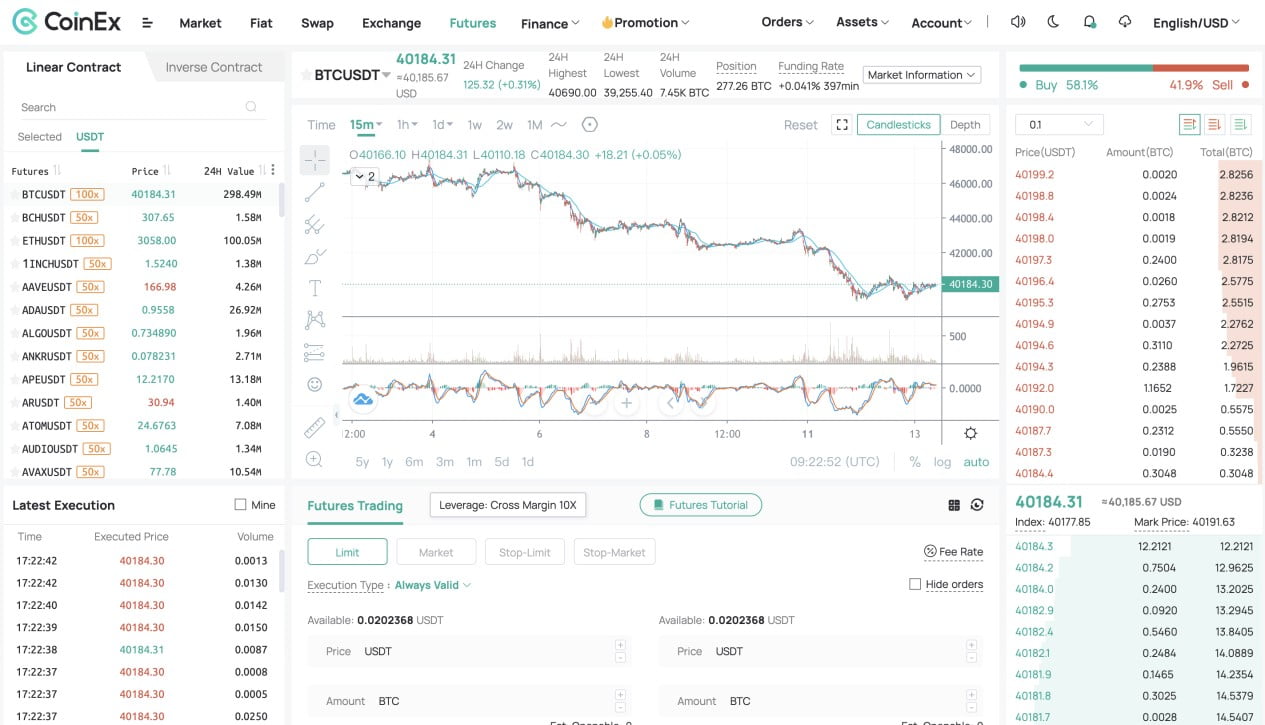

The CoinEx futures webpage is developed to be easy and effortless to have an understanding of with clear segments. CoinEx presents 4 varieties of futures orders: restrict orders, market place orders, restrict quit orders and quit market place orders. CoinEx has integrated an effortless-to-have an understanding of futures guide.

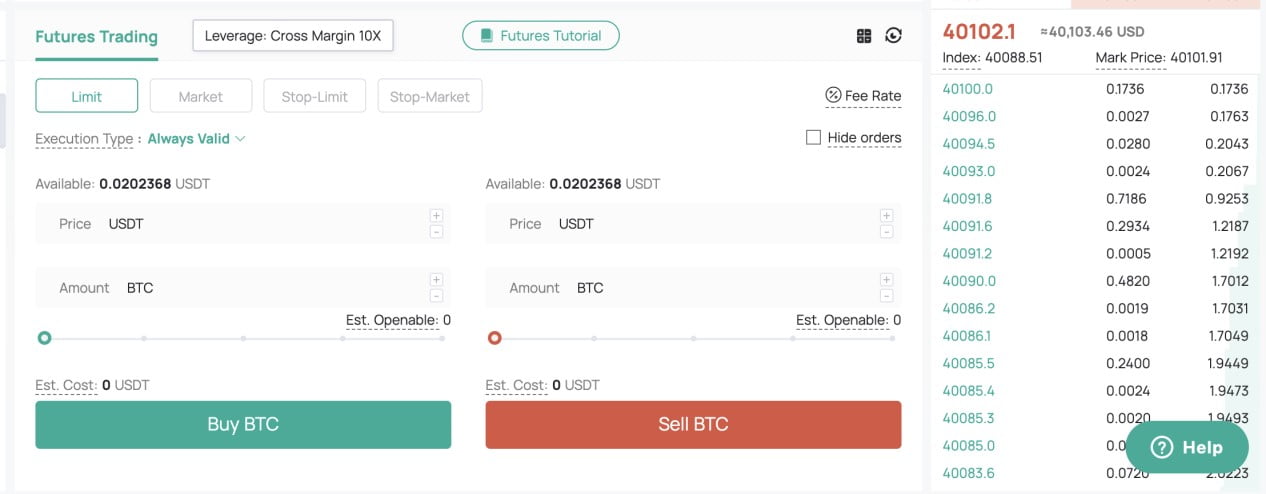

CoinEx also offers functions this kind of as TP&SL and contract calculator. Furthermore, the platform permits customers to shut positions with a single click. Additionally, CoinEx does not need futures traders to full KYC verification. To open a place and start out futures trading on CoinEx, customers only need to have to log into their CoinEx account and transfer assets to the futures account.

Above is an overview of some similarities and variations amongst three standard cryptocurrency exchanges. It is up to the consumer to make an investment choice. Please review meticulously to have an understanding of the platform in advance of depositing funds for an buy.

Information on CoinEx and the ViaBTC ecosystem

CoinEx is a experienced cryptocurrency exchange support supplier with international operations. The CoinEx exchange was established on twelve/2017 and is primarily based in Hong Kong. CoinEx is created by elite workers in numerous fields this kind of as Blockchain, finance and providers. CoinEx is a member of the ViaBTC ecosystem which contains: CoinEx Cryptocurrency Exchange, CoinEx Smart Chain (CSC), OneSwap Decentralized Exchange, ViaBTC Pool, ThroughWallet Wallet, Investment Fund ViaBTC Capital investment.

Follow CoinEx Vietnam on: Fanpage VN | Community Telegram VN

Maybe you are interested:

Note: This is sponsored information, Coinlive does not right endorse any data from the over posting and does not promise the veracity of the posting. Readers ought to carry out their very own analysis in advance of generating selections that impact themselves or their companies and be ready to consider duty for their very own decisions. The over posting is not to be viewed as investment suggestions.

Today we open futures positions with CoinEx on 3 cryptocurrency exchanges: Binance, KuCoin and CoinEx, let us see which platform is the ideal. (This posting displays personalized working experience and is for informational functions only.)

Binance

Let’s start out with Binance, which primarily consists of USDT-M Futures (linear contract), Coin-M Futures Contract (reverse contract), Binance Leveraged Token and Binance Option. Specifically, customers can trade USDT-M Futures and Coin-M Futures right on the Binance web page. However, to trade with Binance Option, traders need to have to download the Binance app. As for the Binance leveraged token, as there is no working manual, novices who are generally unfamiliar may possibly at first get baffled.

On Binance, customers can location seven varieties of orders, which include Limit, Market, Stop Limit … and select to purchase or promote quick. After opening a place, the consumer can check out the open orders and transaction historical past at the bottom of the webpage.

It ought to be mentioned that customers should full KYC verification in advance of trading futures on Binance. To get started out with Binance’s solutions and providers (e.g. depositing, trading and withdrawing cryptocurrencies), the two outdated and new customers should 1st full the KYC verification.

Overall, with the brand as the major cryptocurrency exchange in the planet, Binance presents a total array of cryptocurrency futures contracts on a rather streamlined world wide web interface. However, there are no working guidelines and customers need to have to devote extra time understanding how to trade futures on the stock exchange. Additionally, to trade futures on Binance, customers should full the KYC verification. Furthermore, customers ought to also be cautious with this platform due to the concern of defending consumer rights, which include manipulating charts and clearing orders.

KuCoin

KuCoin’s crypto contracts section at this time presents leveraged tokens and futures. The KuCoin futures interface is very very similar to Binance: the latest market place disorders and buy guide are on the left and the margin pattern and buy variety are on the suitable. KuCoin also presents a broad array of options, from contract calculators to Take Profit & Stop Loss. However, on KuCoin, traders can only location restrict orders.

KuCoin presents no extra than one hundred USDT signed futures markets. Additionally, in historical past, September 2020 also marked the greatest crypto hack of that 12 months, when $ 280 million really worth of assets had been stolen from KuCoin. Therefore, traders ought to meticulously check out the protection of the platform in advance of joining KuCoin.

CoinEx

On CoinEx, all crypto contracts are futures contracts. Users can trade linear / reverse contracts (equivalent to USDT-M Futures and Coin-M Futures as on Binance and KuCoin).

The CoinEx futures webpage is developed to be easy and effortless to have an understanding of with clear segments. CoinEx presents 4 varieties of futures orders: restrict orders, market place orders, restrict quit orders and quit market place orders. CoinEx has integrated an effortless-to-have an understanding of futures guide.

CoinEx also offers functions this kind of as TP&SL and contract calculator. Furthermore, the platform permits customers to shut positions with a single click. Additionally, CoinEx does not need futures traders to full KYC verification. To open a place and start out futures trading on CoinEx, customers only need to have to log into their CoinEx account and transfer assets to the futures account.

Above is an overview of some similarities and variations amongst three standard cryptocurrency exchanges. It is up to the consumer to make an investment choice. Please review meticulously to have an understanding of the platform in advance of depositing funds for an buy.

Information on CoinEx and the ViaBTC ecosystem

CoinEx is a experienced cryptocurrency exchange support supplier with international operations. The CoinEx exchange was established on twelve/2017 and is primarily based in Hong Kong. CoinEx is created by elite workers in numerous fields this kind of as Blockchain, finance and providers. CoinEx is a member of the ViaBTC ecosystem which contains: CoinEx Cryptocurrency Exchange, CoinEx Smart Chain (CSC), OneSwap Decentralized Exchange, ViaBTC Pool, ThroughWallet Wallet, Investment Fund ViaBTC Capital investment.

Follow CoinEx Vietnam on: Fanpage VN | Community Telegram VN

Maybe you are interested:

Note: This is sponsored information, Coinlive does not right endorse any data from the over posting and does not promise the veracity of the posting. Readers ought to carry out their very own analysis in advance of generating selections that impact themselves or their companies and be ready to consider duty for their very own decisions. The over posting is not to be viewed as investment suggestions.