The third week of November, Coinlive invites readers to observe some on-chain occasions pertaining to income movement in the market place, notable factors when Avalanche (AVAX) rose, and constructive information for GameFi.

Outstanding on-chain occasions final week (November 13 – November 18)

Outstanding on-chain occasions final week (November 13 – November 18)

one. Update your income movement

When the market place recovers, we will spend far more awareness to how funds flows into the market place. In this segment, we will search at information on the quantity of funds flowing into the cryptocurrency sector analyzed by CoinShares.

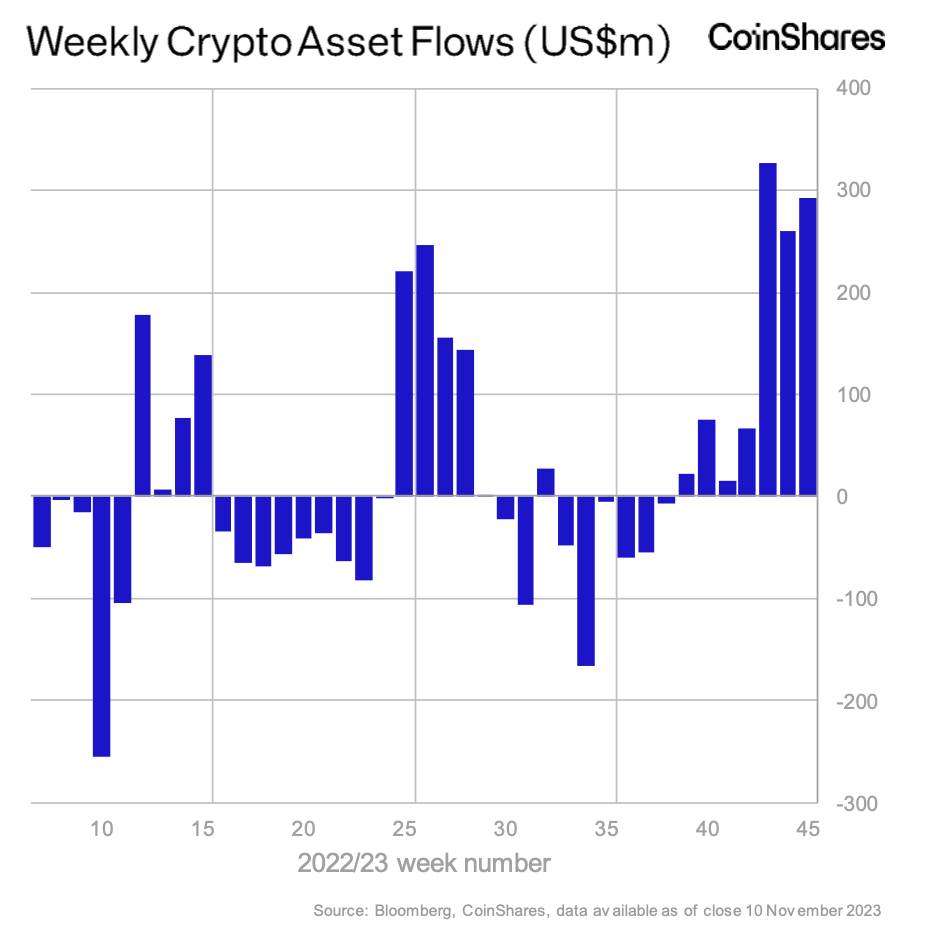

As a consequence, from the starting of the 12 months right up until now, the income movement in the ETP has exceeded the mark one billion buckswith Inflow of 293 million bucks in this week. An ETP (Exchange Traded Product) is a variety of investment car normally backed by an asset this kind of as gold, a commodity or a token. For instance, Fidelity Physical Bitcoin (FBTC) and 21Shares Bitcoin (ABTC) are crypto ETPs. ETPs are a broader class that also involves ETFs.

Weekly cryptocurrency inflows. Source: CoinShares

Weekly cryptocurrency inflows. Source: CoinShares

Digital asset investment merchandise acquired a complete of 293 million bucks final week, bringing to market place a seven-week streak of income movement surpassing the $one billion mark. Therefore, 12 months-to-date income movement has elevated total one.14 billion bucks. So far, this is the 12 months with the third highest movement of investment capital into the cryptocurrency market place in historical past.

Also complete assets beneath management (AUM). elevated by 9.six% in one week and 99% given that the starting of the 12 months. To date the worth of the assets managed is 44.three billion bucksreaching the highest degree given that May 2022.

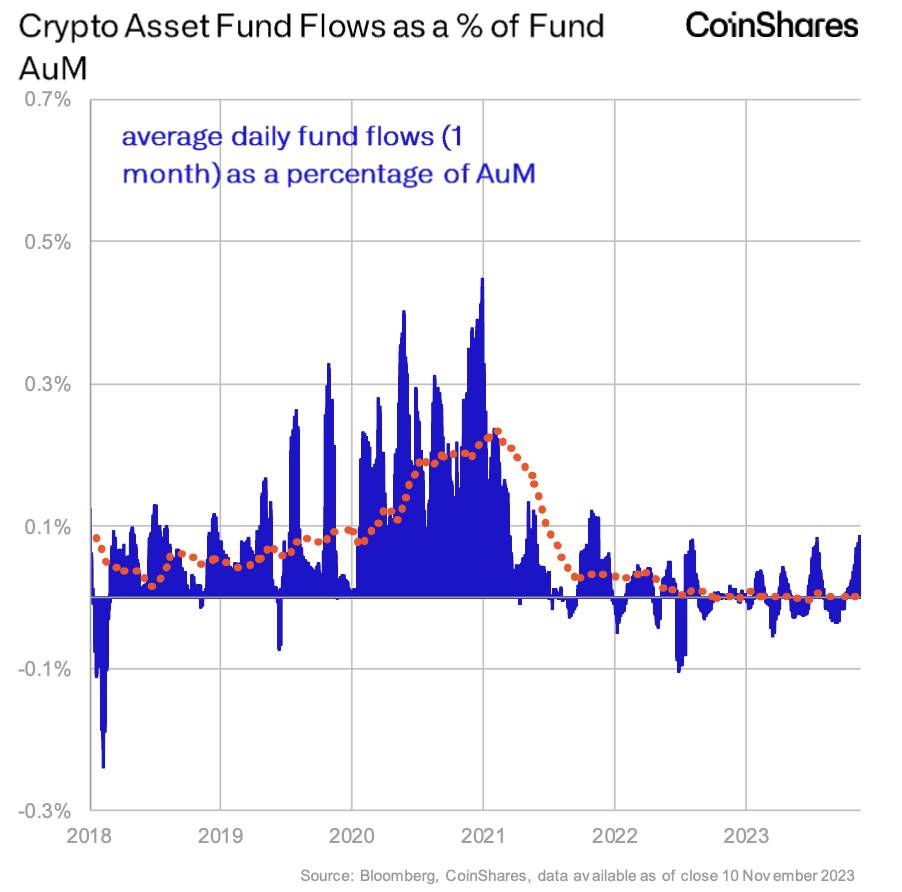

The inflow of cryptocurrencies is primarily based on the AUM ratio. Source: CoinShares

The inflow of cryptocurrencies is primarily based on the AUM ratio. Source: CoinShares

According to CoinShares, the trading volume of ETP Bitcoin represents 19.five% complete Bitcoin trading volume on exchanges. This exhibits that ETP traders are far more engaged than in 2020/21.

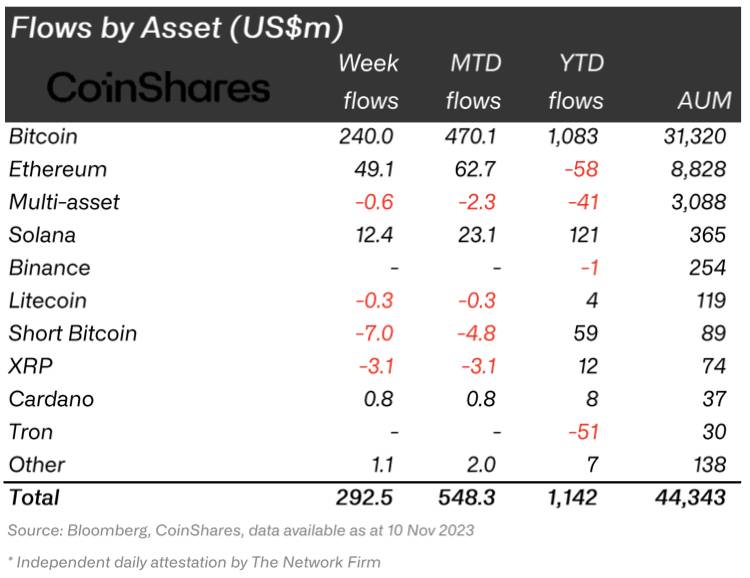

Specifically, search at Bitcoin inflow 240 million bucks final week, pushing up 12 months-to-date income movement one.08 billion buckswhen the income movement worth for brief Bitcoin positions is only seven million bucks. This variation exhibits constructive indicators and investor self-assurance in the market place in basic and in Bitcoin in individual.

Cash movement for every variety of organization. Source: CoinShares

In addition to BTC, Ethereum has also noticed inflows 49 million bucks, the greatest given that August 2022. The inflow of funds into ETH above the previous two weeks could be linked to Ethereum ETF Spot Registration information from substantial institutions like BlackRock. This occasion assists adjust the psychology of investing, attracting far more funds to Ethereum.

Not only that, in accordance to “stock magnate” Cathie Wood, Ethereum and Solana are critical pieces for the blockchain ecosystem, calling them an crucial infrastructure layer capable of sensible applications in contrast to Bitcoin. Joining the constructive environment of the cryptocurrency market place, SOL recorded spectacular increases following the statement from female CEO Ark Invest. Solana also noticed continued income inflow reaching a complete of $twelve million.

Solana has carried out greater than other important coins, primarily just lately. SOL is up far more than 53% in the final week, the improve for the month and 12 months is 197% and 350% respectively. Meanwhile, BTC and ETH corrected only by a margin of 32% and 28% all through the month.

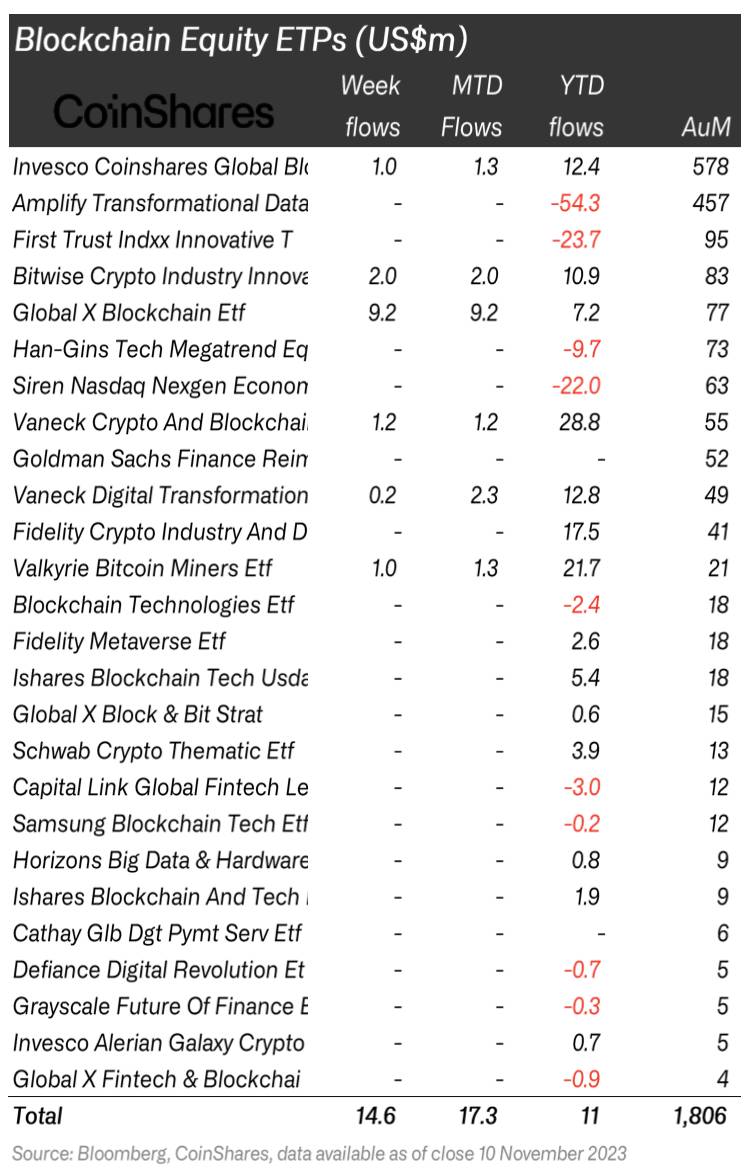

Testimonial of Blockchain Equity ETPs 14 million bucks pour into the market place. This is the highest degree given that July 2022, bringing 12 months-to-date income inflows to a degree constructive eleven million bucks.

Blockchain Equity ETPs. Source: CoinShares

two. Has the avalanche ecosystem been reborn?

In early November, we acquired information that Ava Labs CEO Emin Gun Sirer had announced that the layoff was due to a “down market” to aid Avalanche’s improvement unit concentrate sources on that have to have far more awareness.

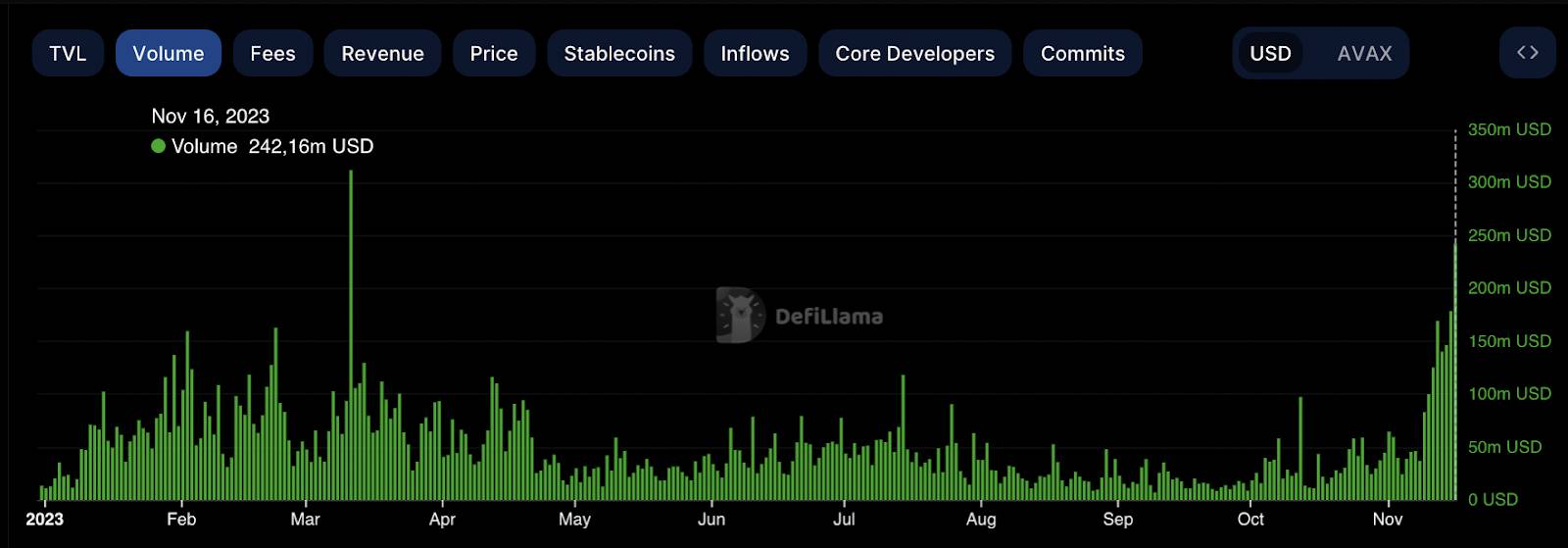

However, this week, the Avalanche ecosystem has thrived as the value of the Avalanche token has elevated by far more than 50%. The network’s day by day transaction volume has elevated, demonstrating that the organization is exhibiting constructive indicators. However, transaction charges did not improve substantially and remained at a balanced degree.

Volume on Avalanche. Source: DeFiLlama (November 18, 2023)

Volume on Avalanche. Source: DeFiLlama (November 18, 2023)

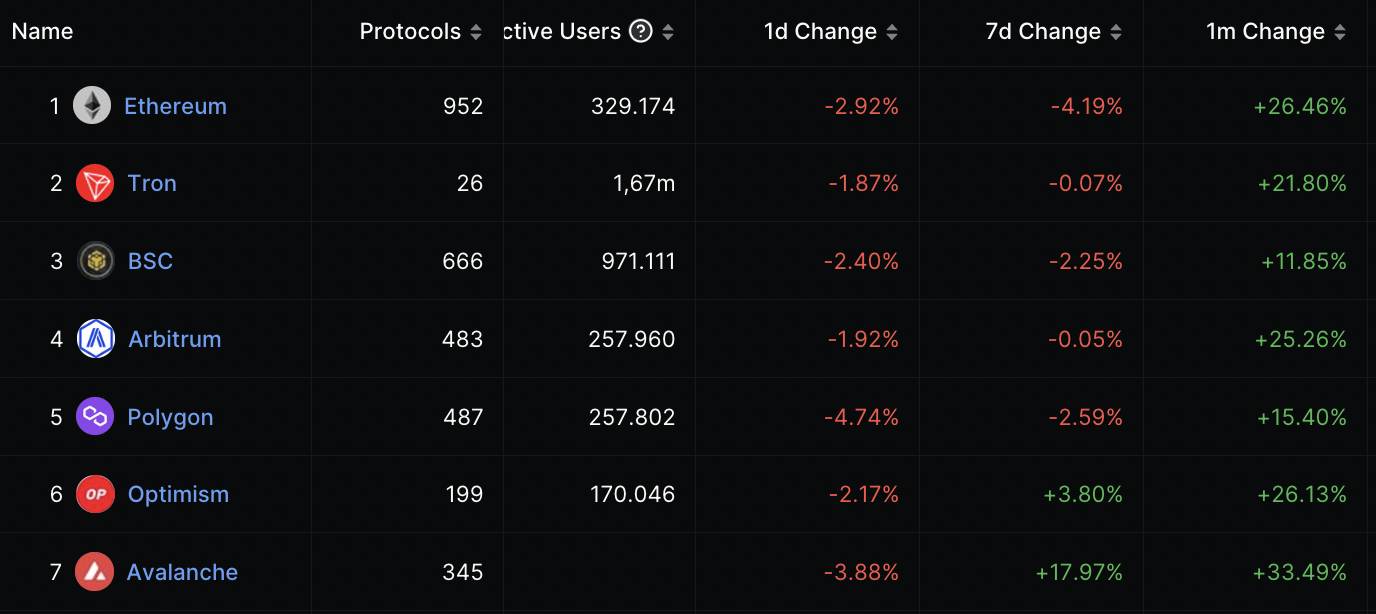

The highlight is TVL Avalanche for a time period of seven days elevated by pretty much 18%, surpasses the Arbitrum. However, if you determine the market place cap/complete worth locked (market place cap/TVL), AVAX is reaching eleven.63it is thought of “overpriced”.

TVL Avalanche seven days. Source: DeFiLlama (November 18, 2023)

TVL Avalanche seven days. Source: DeFiLlama (November 18, 2023)

So is this sustainable development or a value manipulation tactic?

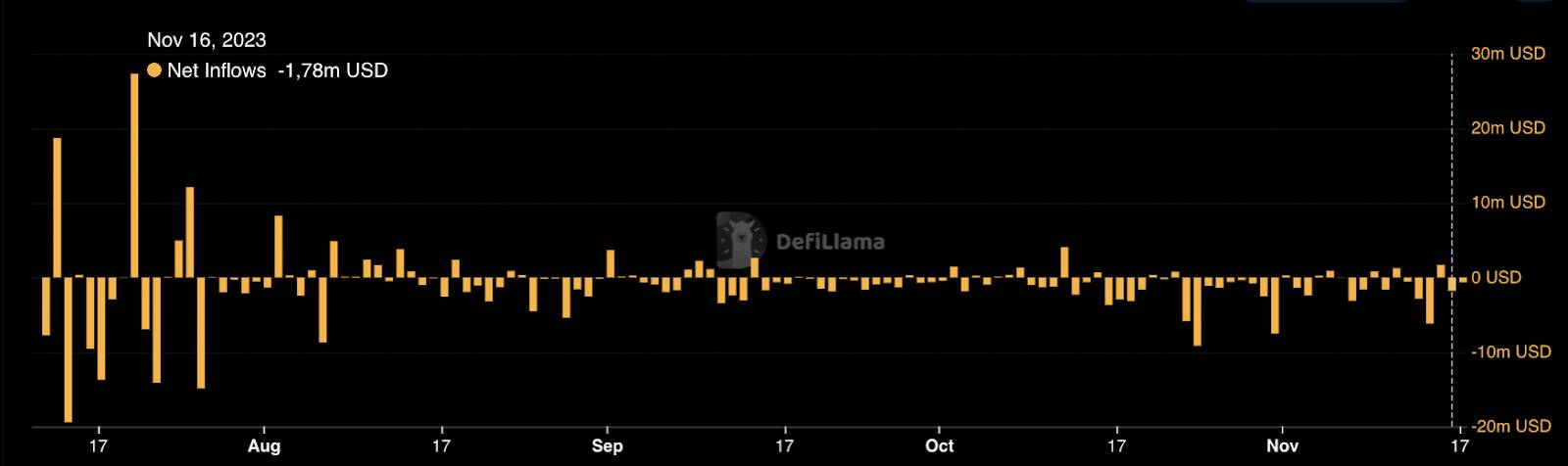

As the value rose from $sixteen to virtually $24, DefiLlama inflow information showed no major net inflows into the ecosystem. This can be anticipated to be “price push” habits, perhaps by whales or substantial investment organizations to tap into the fomo psychology of the crowd, growing liquidity to make it a lot easier to promote assets.

Avalanche influx seven days. Source: DeFiLlama

Avalanche influx seven days. Source: DeFiLlama

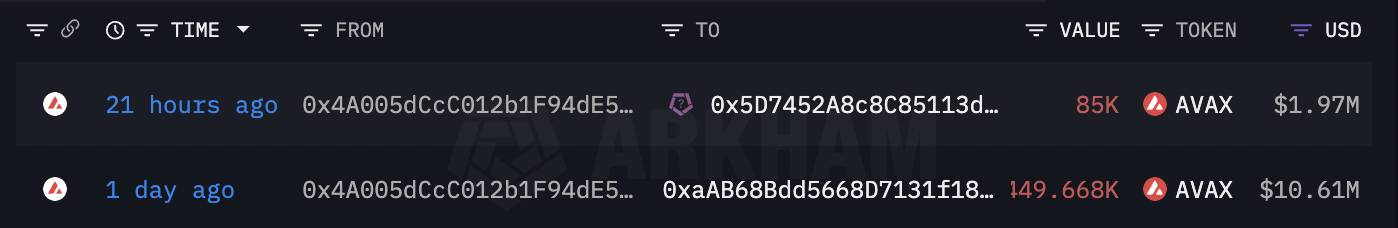

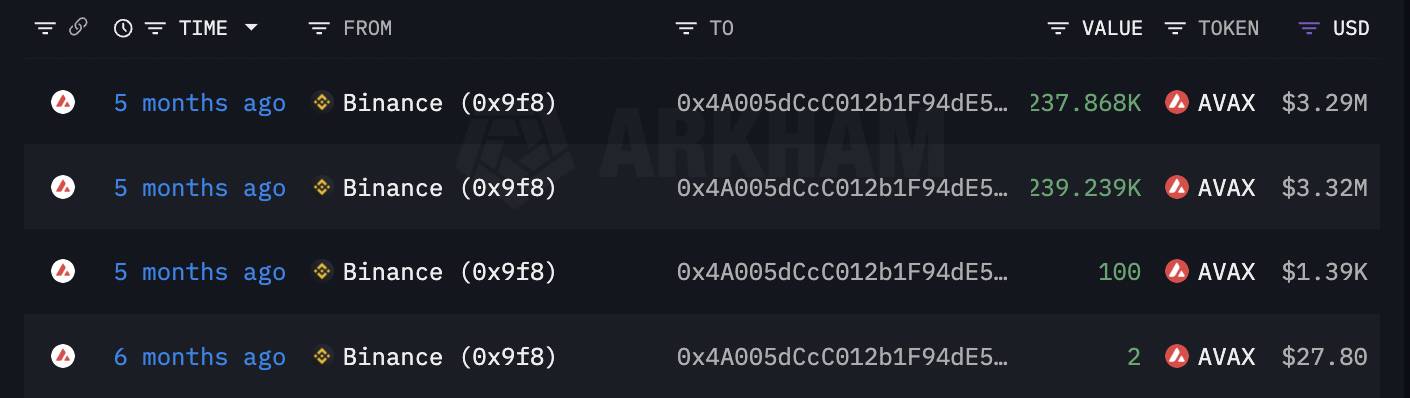

In reality, when checking on-chain transactions, taking benefit of the AVAX value improve, a whale wallet believed to be from Digital Galaxy sent the whole 534,668 AVAX (equivalent to $twelve.58 million) in Binance wallet, the revenue is approx three.eight million bucks.

Digital Galaxy sends AVAX to Binance. Source: Arkham Intelligence

Digital Galaxy sends AVAX to Binance. Source: Arkham Intelligence

Based on your transaction historical past, this whale wallet has been retired 534,669 AVAX ($seven.72 million) at USD 14.45 from Binance on November 23-24, 2022.

Digital Galaxy obtained AVAX on Binance five months in the past. Source: Arkham Intelligence

Digital Galaxy obtained AVAX on Binance five months in the past. Source: Arkham Intelligence

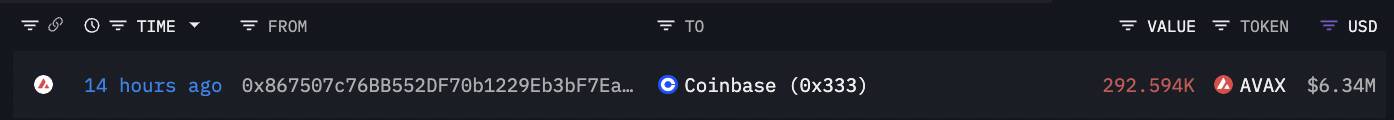

In addition to Digital Galaxy, one more whale wallet 0x867 loaded 292,600 AVAX (roughly $six.25 million) on Coinbase at 23.six USD.

Whales deposit AVAX on Coinbase. Source: Arkham Intelligence

Whales deposit AVAX on Coinbase. Source: Arkham Intelligence

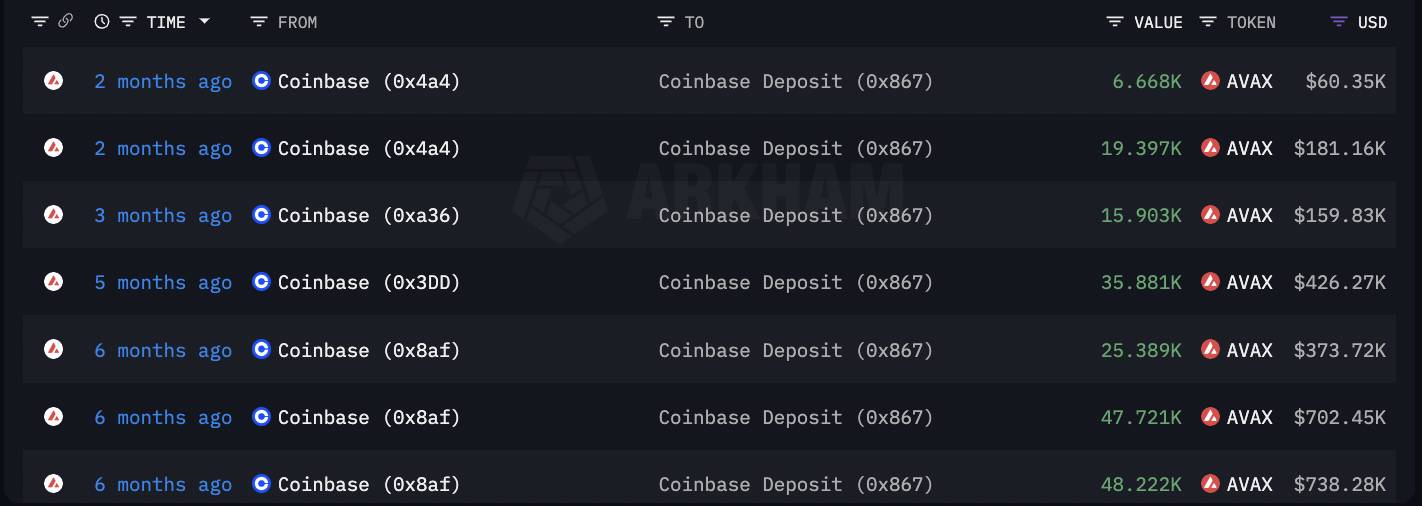

This portfolio is recognized to have accumulated AVAX from May to September with an regular entry of $14. The revenue from this whale is estimated to be approx 68% ($two.17 million).

Whales purchase AVAX from Coinbase. Source: Arkham Intelligence

Whales purchase AVAX from Coinbase. Source: Arkham Intelligence

three. Will GameFi return?

Lately we have been hearing rumors about the likelihood of a GameFi return. So are the numbers for this discipline constructive? Below is some data from the Game7 DAO investigate report.

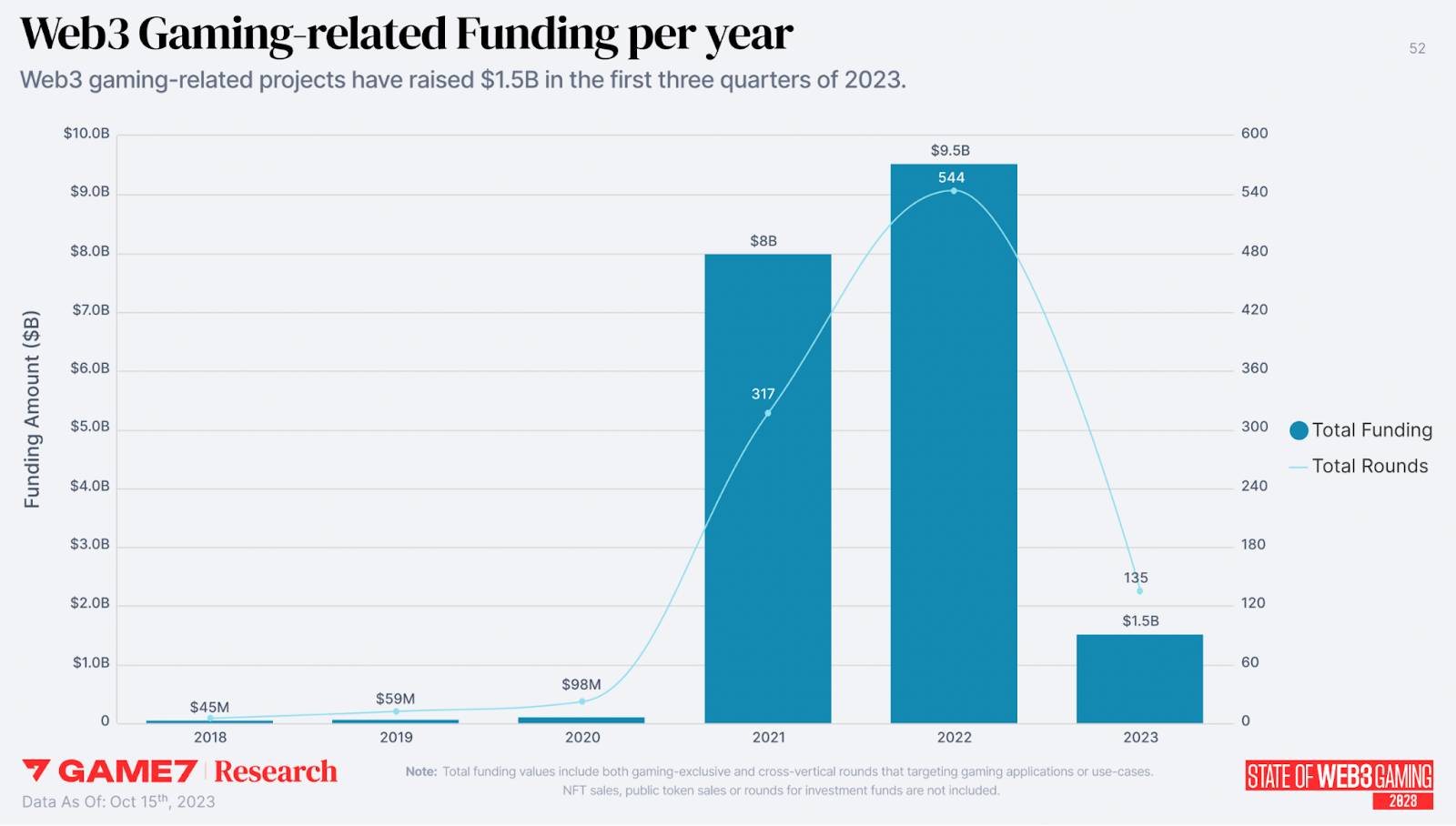

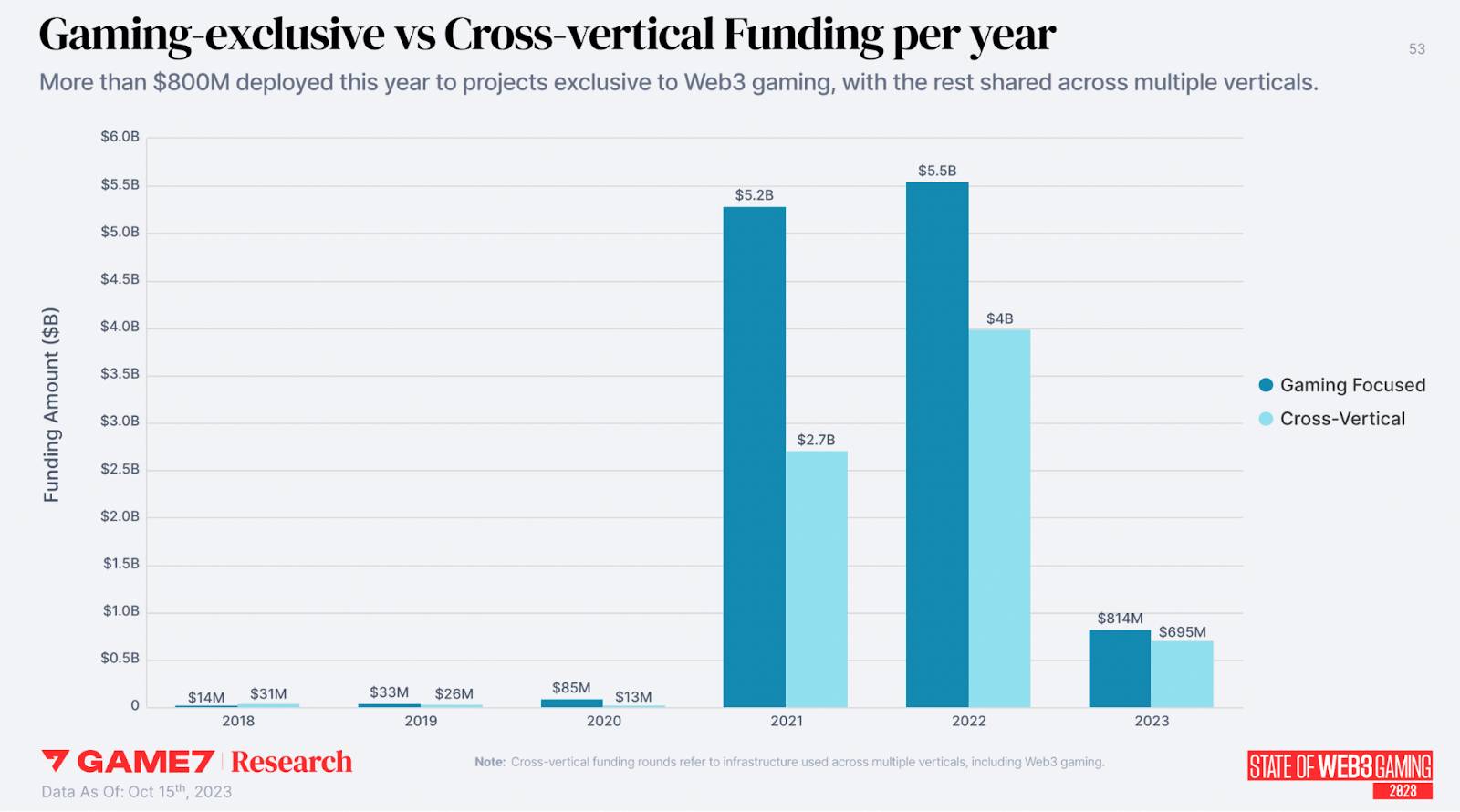

According to survey information, investment in the Web3 gaming marketplace elevated substantially in 2021. Compared to 2021 and 2023, investments in the gaming marketplace are very modest. But this signal is also thought of constructive, getting ready for the subsequent “bullish” season.

Funding for Web3 video games by 12 months. Source: Game7 DAO

Funding for Web3 video games by 12 months. Source: Game7 DAO

Estimates from 2018 to these days, yes roughly 19 billion bucks has been poured into tasks linked to the discipline of Web3 gaming. The Web3 gaming market place continues to develop, albeit far more gradually than in 2022, a 12 months that noticed a market place correction. By the third quarter of 2023, blockchain gaming-linked investment rounds have been reached one.five billion buckssuch as far more 800 million bucks Exclusively for pure gaming tasks.

Investment Capital for Web3 Games. Source: Game7 DAO

Investment Capital for Web3 Games. Source: Game7 DAO

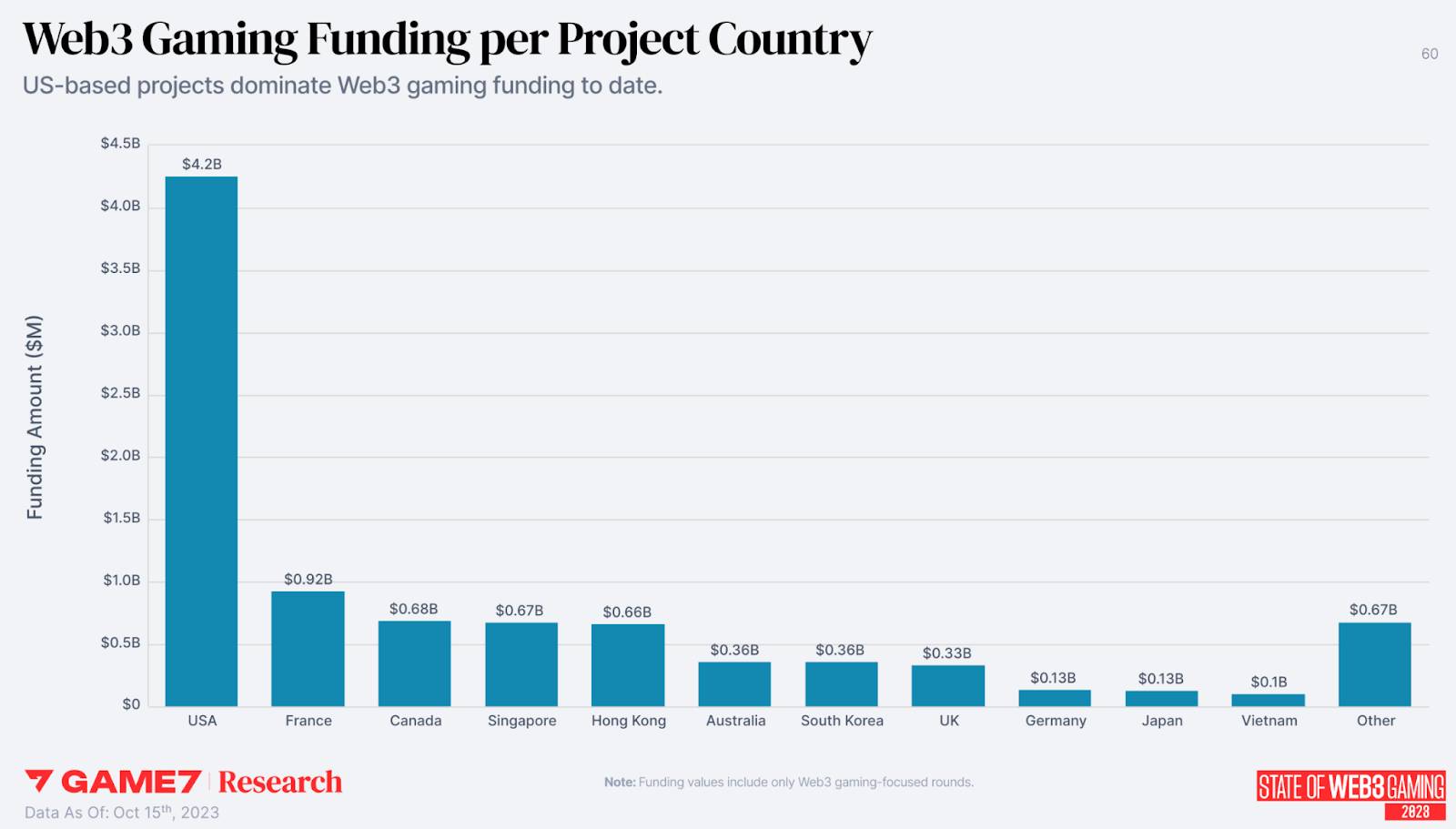

Web3 game tasks appeal to a good deal of investment capital, such as several tasks from the United States (far more than four billion bucks), France (.9 billion bucks), Canada (.67 billion bucks), Singapore (, 67 billion bucks) and Hong Kong (.66 billion bucks).

Investment capital in Web3 video games by nation. Source: Game7 DAO

Investment capital in Web3 video games by nation. Source: Game7 DAO

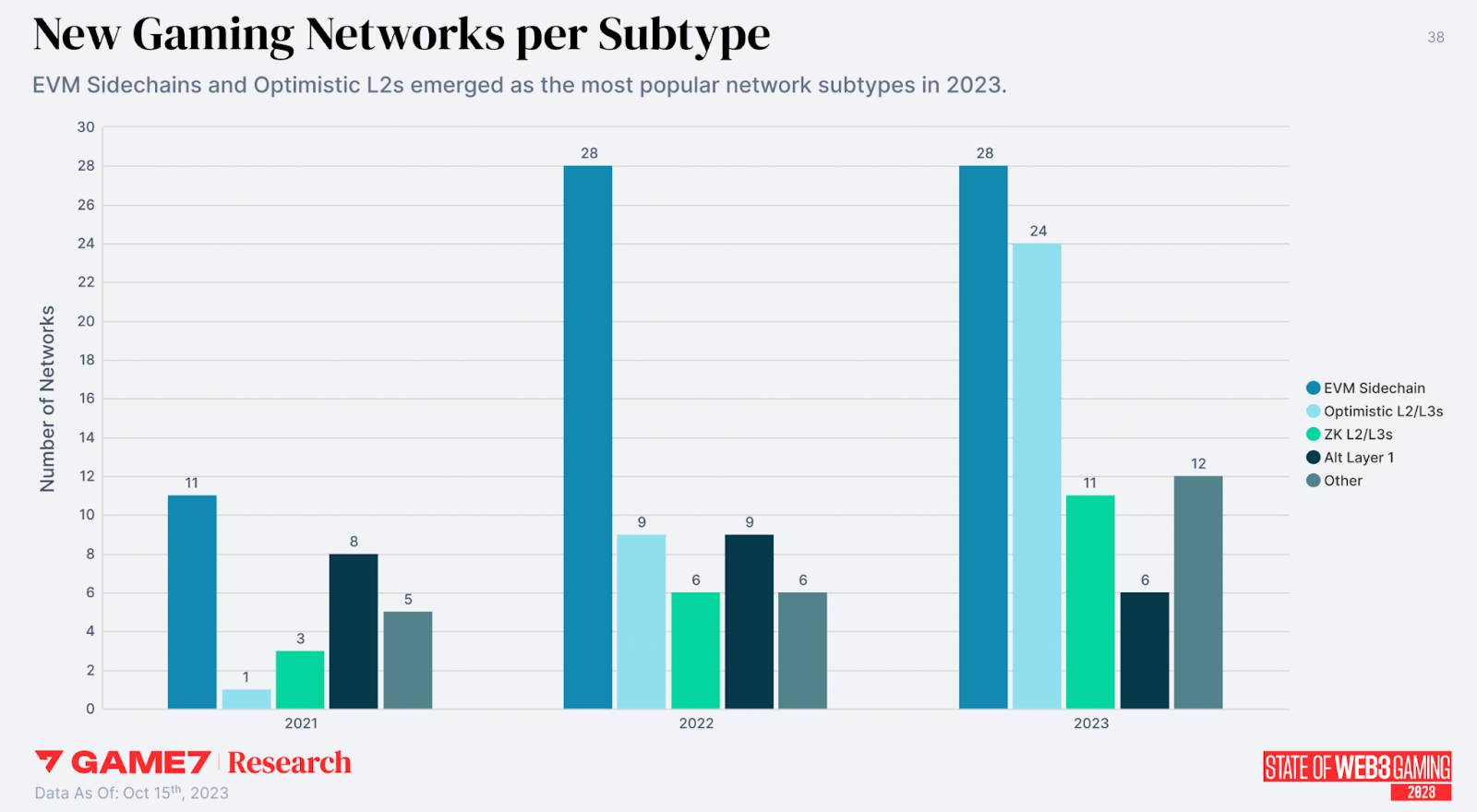

More than 81 new blockchain networks for gaming will be announced in 2023, elevated by forty% in contrast to 2022.

Web3 gaming network by 12 months. Source: Game7 DAO

Web3 gaming network by 12 months. Source: Game7 DAO

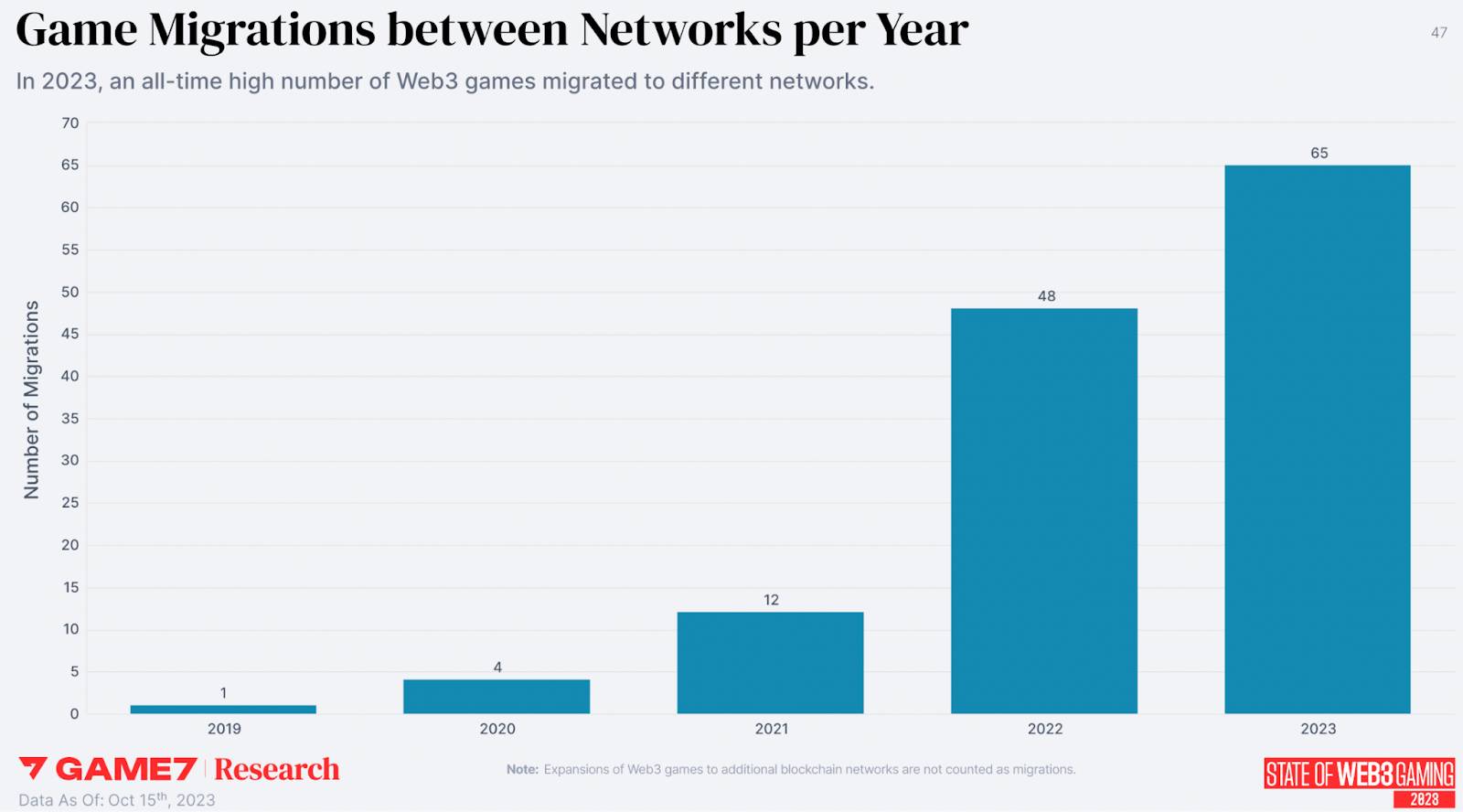

This suggests that game developers have far more alternatives, and game tasks will also be encouraged to move from the recent chain to one more chain, so as to exploit optimum factors, ideal for far more blockchain game tasks. In reality, 65 blockchain video games have moved to other chains in 2023, up from 48 in 2022. Most have moved to Layer-two options like Polygon, Immutable, and Arbitrum.

Web3 game migration by 12 months. Source: Game7 DAO

Web3 game migration by 12 months. Source: Game7 DAO

four. Update FTX

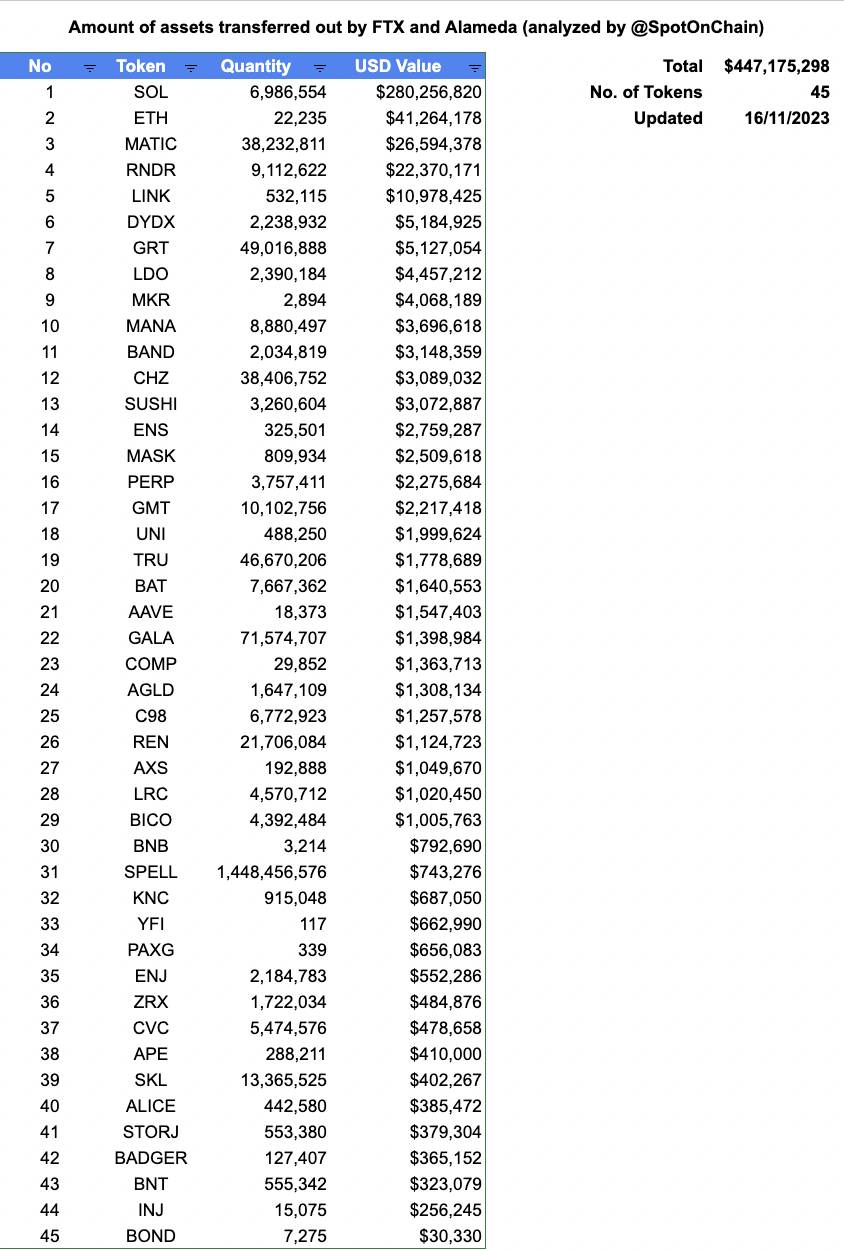

By November 17, FTX and Alameda Research had submitted approx $447 million of 41 token styles enter the trading floor.

Statistics on tokens liquidated by FTX. Source: SpotOnChain (November 17, 2023)

Statistics on tokens liquidated by FTX. Source: SpotOnChain (November 17, 2023)

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!