In addition to big investments in lots of crypto tasks, FTX and Alameda Research have also spread funds in investment money and providers with “shadow” indications.

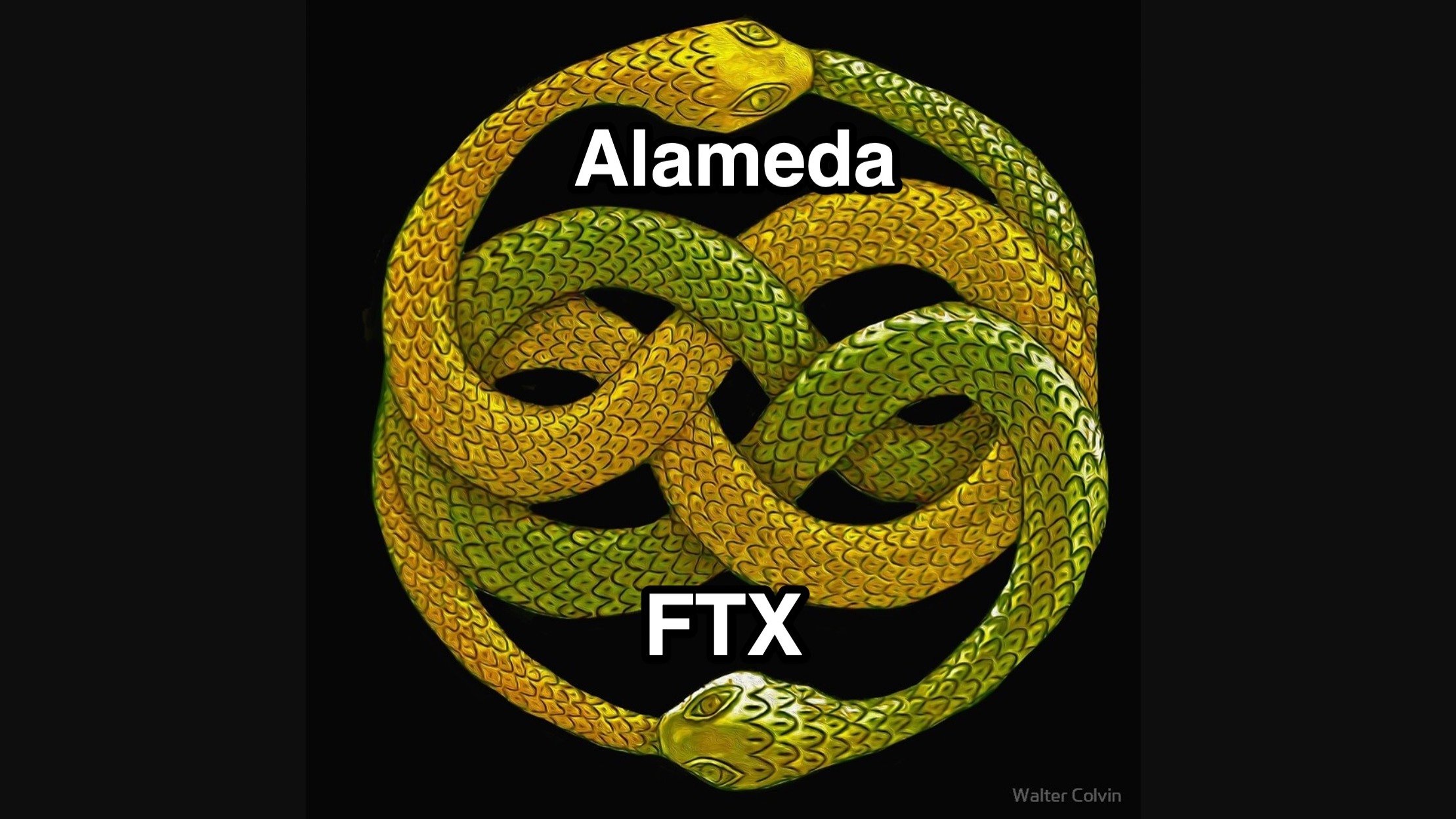

On the evening of December six, newspaper Financial Times has launched the total portfolio of Alameda Research, the cryptocurrency fund that went bankrupt with its “sister” FTX. Both had been founded by Sam Bankman-Fried, the most controversial figure in the cryptocurrency industry lately.

Full sheet right here: https://t.co/u85HLNGJIv

— Larry Cermak (@lawmaster) December 6, 2022

Financial Times launched eleven screenshots of the spreadsheet summarizing extra than 470 investments Alameda Research and FTX had been generating at the time of the bankruptcy, well worth just about $five.four billion in complete. This is a document compiled by former CEO Sam Bankman-Fried himself in early November, when he was striving to locate new traders to “bail out” his ailing exchange.

The crypto tasks and providers spread by Alameda Research are in all fields, from degree one, DeFi, degree two, NFT, GameFi, crypto infrastructure to cryptocurrency mining providers and other investment money. .

Major investments contain $one.15 billion in mining company Genesis Digital Assets, $500 million in AI improvement company Athropic, and $320 million in obtaining Digital Assets DA AG and renaming it FTX Europe, $300 million in investment fund K5, …

However, lots of Twitter consumers pointed out that Alameda Research has poured a whole lot of funds into famed investment money like K5, Sequoia, Skybridge Capital, Paradigm, and so forth.

All money to which FTX/Alameda has paid funds.

I wonder what variety of quid professional quo connection has been established.

I give you: consumer funds

You give me: continual hero worship and echo of Shill SolanaYou see at least some fund managers there who have heralded Bankman as Jesus Christ himself. pic.twitter.com/kqEJJIZOcb

— Hsaka (@HsakaTrades) December 6, 2022

They also uncovered that lots of of the names had been “blacked out” when Modulo Capital, which acquired $400 million from Alameda, was based mostly in the Bahamas as FTX-Alameda, raising suspicions that this was the situation once more. funds movement. The Toy Ventures fund (which acquired $25 million) was allegedly linked to FTX’s Chief Product Officer.

Virtually anything at all over 25 million deserves scrutiny, for illustration who is this module capital that acquired 400 million?

It seems to have a legal handle at 127 S Ocean Road

Albany, Tetris Unit 2E, Bahamas.Want to bet this is SBF? https://t.co/pxODsLmbia pic.twitter.com/pXWOOm0hrv

— Faith Crypto Night (@crypto_notte) December 6, 2022

Financial Times commented that the over info will support bankrupt FTX’s obtaining unit aggregate other sources of the exchange’s assets to compensate traders, as properly as present the regulator regardless of whether FTX and Alameda operate independently, as the two affirm or not.

In current media interviews, Mr. Sam Bankman-Fried has repeatedly denied allegations that FTX lent funds to Alameda Research consumers to cover losses, that every little thing that occurred started out with the supply from his negligence and carelessness management, not fraud.

Synthetic currency68

Maybe you are interested: