zkSync is a very anticipated degree two option on Ethereum due to rumors of airdrop tokens. Let’s obtain out which parts of this ecosystem are by now beneath building!

zkSync is a degree two option that belongs to the zk-Rollups group on Ethereum and is produced by the group of Matter Labs. The venture enjoys the believe in and assistance of lots of substantial investment money when it underwent two capital calls totaling up to $ 150 million (with the participation of a16Z, OKEx, Crypto.com, Bybit, Consensys … ).

Recently, zkSync announced the important implementation of the “proof of validity” integration that operates on the zkSync two. testnet and marks the ultimate needed completion in advance of moving to the core network.

After Aptos, zkSync will also be a new and opportunistic ecosystem. In today’s posting I will master an overview of the zkSync ecosystem with you!

Ecosystem overview

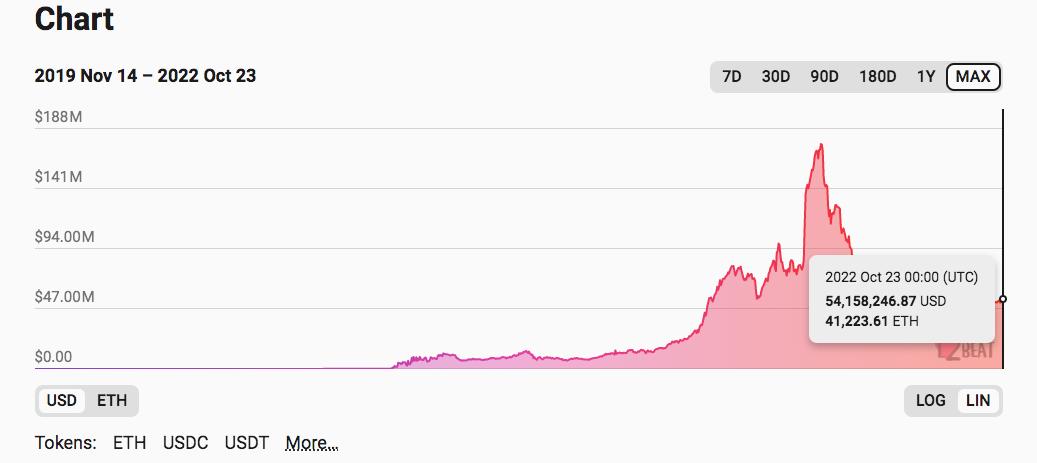

Currently, zkSync has far more than 150 registered tasks to employ with Total Value Locked, reaching roughly $ 54 million. Personally, zkSync-targeted funds movement at the minute comes primarily from tasks and retail revenue with the aim of discovering retroactive options. In the long term, following the mainnet, the venture could launch incentive packages to motivate and appeal to greater funds movement.

Although there are 150 tasks beneath growth, as there is no mainnet, only a number of of them have made and place into operation. Here are the prominent names you can pay out consideration to experiment with or observe.

Featured tasks

DEX (decentralized exchange)

Mute: Being a venture that has solutions and tokens on zkSync, the present transaction volume is all-around 950,000 USD. In addition to enabling decentralized transactions, the venture also has solutions this kind of as Yield Farming, IDO …

Rubicon: it is also a decentralized exchange, the peculiarity of Rubicon is that it supports the purchase-guide perform that makes it possible for traders to “navigate” conveniently. In addition, Rubicon also has a Bridge to transfer sources in between zkSync and Ethereum. Currently the venture does not have a token.

Mes protocol: It is a decentralized exchange with purchase-guide. Mes is now offered with currency pairs this kind of as BTC, ETH, IMX and DOGE. Currently, the venture does not have a token.

Finance without trust: it is also a decentralized exchange on zkSync. Unlike Mute and Rubicon, Trustless is in the testnet stage, you can consider benefit of the solution. In addition, Trustless is also establishing the decentralized HUE stablecoin: this is Trustless’s aggressive benefit in excess of the two former tasks. Of program, the venture does not have a native token still.

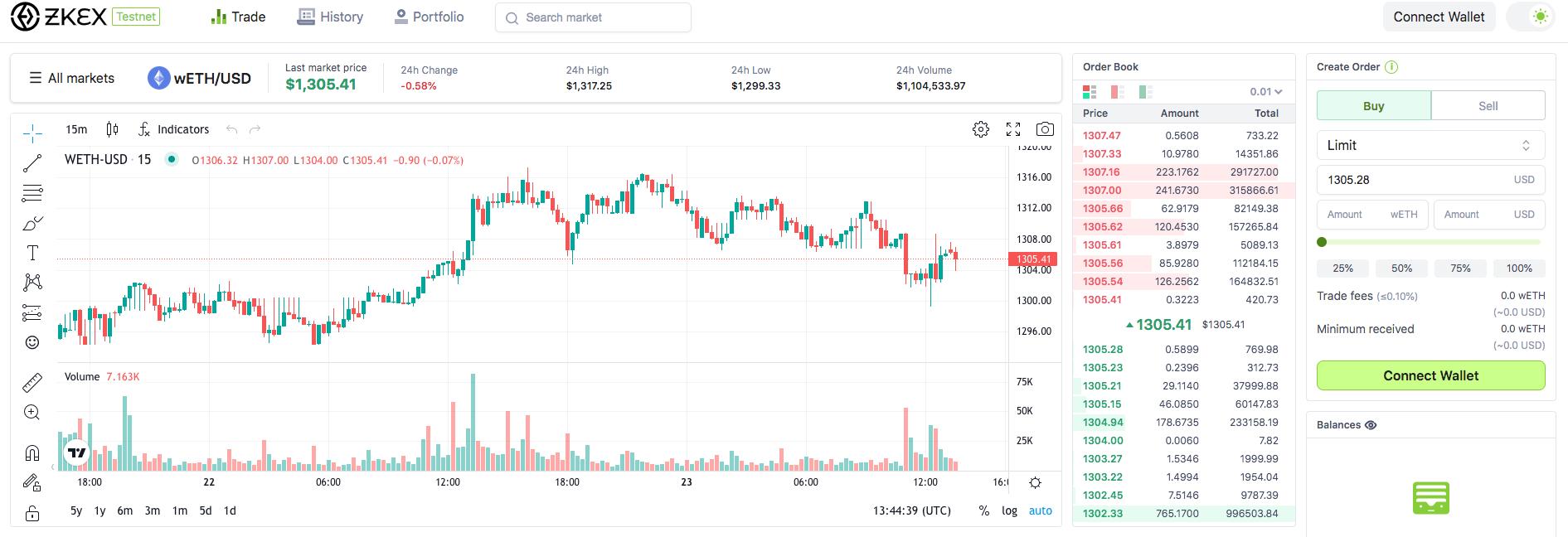

ZKEX: Similar to Rubicon, ZKEX makes it possible for you to trade with charts and orderbooks very similar to centralized exchanges. ZKEX is primarily based on zkSync and StarkWare. Currently the venture is in the testnet phase, even now no tokens.

Loan and loan (loan and loan)

buyer: taker is presented as a venture to support customers present liquidity or lend across a wide variety of crypto assets, together with NFT and metaverse assets. Taker is now in the testnet phase, even now no tokens, you can consider benefit of the knowledge.

Perpetual (long term contract)

Increase finance: Similar to Perpetual Protocol or dYdX, Increment Finance makes it possible for you to “long short” with leverage on zkSync. Indeed, this is a rather desirable solution simply because the commission on zkSync is incredibly low cost, the most significant barrier is customers and liquidity, as nicely as competitors from other exchanges. Increment Finance does not have a solution still, you can observe the venture to join the testnet in the close to long term.

Fezzan: it is also a derivatives exchange that you really should consider time to experiment with. Phezzan now has a testnet edition

Other forms of fiscal solutions

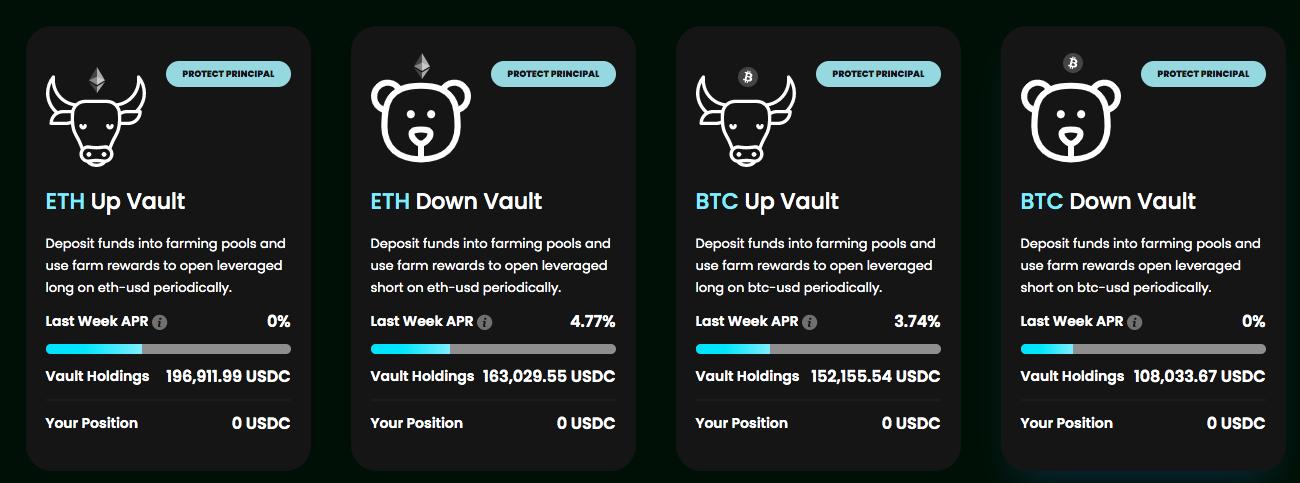

Vovo Finance: is a solution that gives customers with several return methods as a result of fiscal instruments. Depending on the technique, you can present funds to diverse pools to obtain earnings. The solution has been verified by ABDK, PeckShield and HashCloack. You can place some funds to attempt the solution. Vovo Finance does not now have a token.

Springboard

zkSpark: the venture is now beneath growth and has not still launched a solution. I imagine you can observe this venture following zkSync launched mainnet to have far more investment options or join high quality IDO.

finish

Through a series of tasks that I have just listed and analyzed over, you may well have recognized that zkSync even now has lots of incomplete pieces. Currently, most DEX and derivatives exchanges, largely due to the truth that zkSync optimizes excellent commissions, is a breeding ground for establishing and attracting customers of this variety of solutions.

In the long term, in purchase to appeal to funds movement and customers, zkSync definitely should carry on to build solutions in Lending, Yield Farming, NFT, GameFi … far more.

Being a new ecosystem, zkSync even now provides lots of options to experiment, go retro, or invest early. We will update new tasks as quickly as achievable, so will not overlook to observe Coinlive!

Poseidon

See other content articles by the writer of Poseidon: