Arbitrum funding could turn out to be a new development driver for Pendle right after acquiring investment from Binance Labs and the most recent launch of an RWA-based mostly solution.

Pendle will get ARB2 million in funding from Arbitrum

Pendle will get ARB2 million in funding from Arbitrum

Arbitrum Short-Term Incentive Program (STIP) is a system organized by Arbitrum DAO aimed at stimulating liquidity across the total ecosystem. As reported by Coinlivea price range of ARB 50 million will be allotted 29 tasks get ample ARB Quorum of 71.51 million and acquired a lot more than 50% of the votes have been in favor propose.

In addition to the GMX, MUX Protocol, Radiant… tasks in the DEX, Derivatives and Lending sectors, the most significant identify in the Yield discipline is referred to as Pendle Finance (PENDLE). Pendle had previously proposed that Arbitrum fund two million ARBs for liquidity reward schemes. In the vote prior to the Arbitrum local community, Pendle obtained 97.65% of the votes in favor, out of a complete of 137.9 million ARBs.

Pendle acquired 182 million ARB, representing 97.65% of the votes in assistance of the proposal to get two million ARB funding.

Pendle acquired 182 million ARB, representing 97.65% of the votes in assistance of the proposal to get two million ARB funding.

Second The Pendle app on September 27, 2023, Arbitrum STIP money will be utilised by this DeFi protocol from October 2023 (right after acquiring the money) until finally January 31, 2024. With function:

- Increase yield trading volume

- Stimulate exercise on the platform

- Improve liquidity on current pools and include incentives for customers to launch liquidity for the new Pendle marketplace listed on Arbitrum

- Encourage exercise for other Pendle-based mostly protocols.

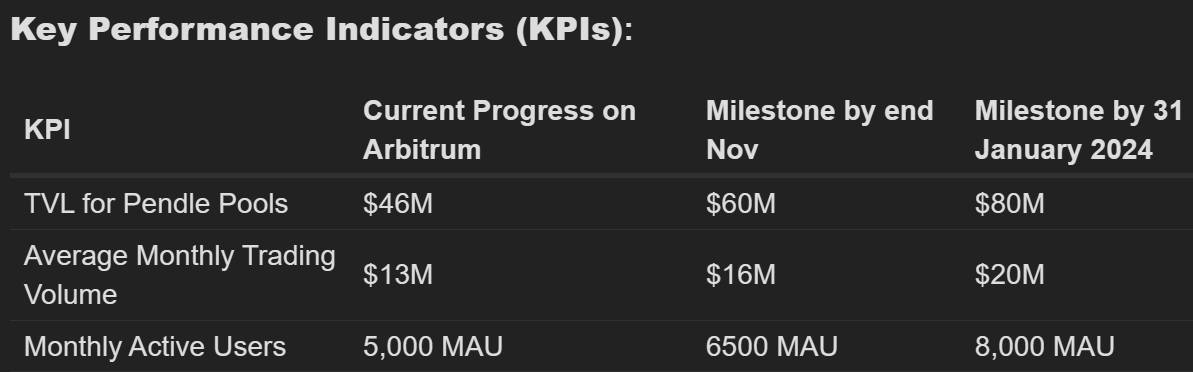

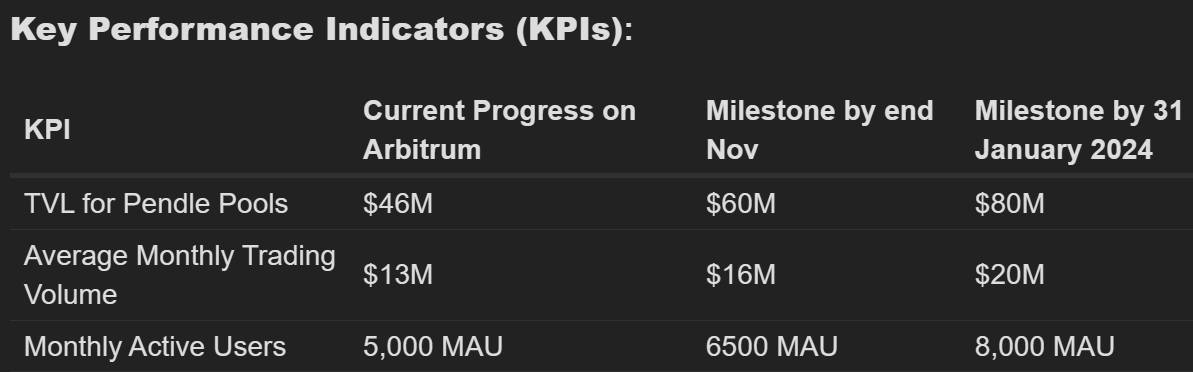

During the over time period, the sponsorship cash will be utilised by Pendle to realize three goals:

- Increase complete worth locked (TVL) by 2x from the present $46 million to $80 million

- Average month-to-month trading volume at $twenty million from present $13 million

- Increased the amount of month-to-month customers of the platform from five,000 to eight,000 at the time of creating.

The intention is to enhance Pendle’s TVL, trading volume and month-to-month customers from October 2023 to January 2024. Photo: Arbitrum Foundation forum

The intention is to enhance Pendle’s TVL, trading volume and month-to-month customers from October 2023 to January 2024. Photo: Arbitrum Foundation forum

The volume of two million ARB tokens that Pendle has requested to sponsor, equal to about four% of the complete system price range, will be divided into three elements and distributed as follows:

- one,one hundred,000 ARB (fifty five%): Assignment to liquidity pools on Arbitrum in phases, every single phase lasting one week, to enhance liquidity. As every single pool represents every single asset with a distinct yield, Pendle will perform closely with its partners. Lido, GMX, Gains Network, RocketPool, Camelot, HMX, Stargate and Penpie…

- 800,000 ARB (forty%): Assigned to a number of campaigns on Arbitrum to enhance trading exercise and volume. Monthly, COperation Pendle will be up to date constantly to entice customers. Based on the rankingsthe consumer has kHigher trading volume and net earnings and losses will get ARB rewards.

- one hundred,000 ARB (five%): They will be distributed as a reward to customers when they check out and experiment with new protocols that have been integrated into the Pendle ecosystem on Arbitrum, as a result stimulating customers to enhance their holding of Pendle assets.

User rankings with substantial trading volume and greater net revenue and reduction will get ARB rewards from Pendle. Photo taken at seven.20pm on October 13, 2023

User rankings with substantial trading volume and greater net revenue and reduction will get ARB rewards from Pendle. Photo taken at seven.20pm on October 13, 2023

Pendle Finance or Pendle is a DeFi protocol produced on Ethereum that will allow customers to tokenize and trade long term asset staking earnings as a result of an AMM mechanism. With Pendle Finance, customers can flexibly apply numerous distinct techniques to optimize the returns of their assets.

Pendle is 35th Launchpool project of the primary cryptocurrency exchange Binance. This DeFi protocol, a month later on on August 23, 2023, also acquired a strategic investment from the Binance Labs Incubation Fund.

A representative from Binance Labs commented that the investment in Pendle will reaffirm its dedication to cultivating prospective breakthroughs in the cryptocurrency marketplace and will also assist Pendle put into action its revenue optimization method across numerous varied ecosystems, opening up capital optimization options each for person and institutional traders.

More a short while ago, they also determined to launch a solution based mostly on Real World Asset (RWA), a prospective narrative. Both the protocol’s RWA and fixed return goods assistance Spark Protocol’s sDAI and Flux Finance’s fUSDC.

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!

Arbitrum funding could turn out to be a new development driver for Pendle right after acquiring investment from Binance Labs and the most recent launch of an RWA-based mostly solution.

Pendle will get ARB2 million in funding from Arbitrum

Pendle will get ARB2 million in funding from Arbitrum

Arbitrum Short-Term Incentive Program (STIP) is a system organized by Arbitrum DAO aimed at stimulating liquidity across the total ecosystem. As reported by Coinlivea price range of ARB 50 million will be allotted 29 tasks get ample ARB Quorum of 71.51 million and acquired a lot more than 50% of the votes have been in favor propose.

In addition to the GMX, MUX Protocol, Radiant… tasks in the DEX, Derivatives and Lending sectors, the most significant identify in the Yield discipline is referred to as Pendle Finance (PENDLE). Pendle had previously proposed that Arbitrum fund two million ARBs for liquidity reward schemes. In the vote prior to the Arbitrum local community, Pendle obtained 97.65% of the votes in favor, out of a complete of 137.9 million ARBs.

Pendle acquired 182 million ARB, representing 97.65% of the votes in assistance of the proposal to get two million ARB funding.

Pendle acquired 182 million ARB, representing 97.65% of the votes in assistance of the proposal to get two million ARB funding.

Second The Pendle app on September 27, 2023, Arbitrum STIP money will be utilised by this DeFi protocol from October 2023 (right after acquiring the money) until finally January 31, 2024. With function:

- Increase yield trading volume

- Stimulate exercise on the platform

- Improve liquidity on current pools and include incentives for customers to launch liquidity for the new Pendle marketplace listed on Arbitrum

- Encourage exercise for other Pendle-based mostly protocols.

During the over time period, the sponsorship cash will be utilised by Pendle to realize three goals:

- Increase complete worth locked (TVL) by 2x from the present $46 million to $80 million

- Average month-to-month trading volume at $twenty million from present $13 million

- Increased the amount of month-to-month customers of the platform from five,000 to eight,000 at the time of creating.

The intention is to enhance Pendle’s TVL, trading volume and month-to-month customers from October 2023 to January 2024. Photo: Arbitrum Foundation forum

The intention is to enhance Pendle’s TVL, trading volume and month-to-month customers from October 2023 to January 2024. Photo: Arbitrum Foundation forum

The volume of two million ARB tokens that Pendle has requested to sponsor, equal to about four% of the complete system price range, will be divided into three elements and distributed as follows:

- one,one hundred,000 ARB (fifty five%): Assignment to liquidity pools on Arbitrum in phases, every single phase lasting one week, to enhance liquidity. As every single pool represents every single asset with a distinct yield, Pendle will perform closely with its partners. Lido, GMX, Gains Network, RocketPool, Camelot, HMX, Stargate and Penpie…

- 800,000 ARB (forty%): Assigned to a number of campaigns on Arbitrum to enhance trading exercise and volume. Monthly, COperation Pendle will be up to date constantly to entice customers. Based on the rankingsthe consumer has kHigher trading volume and net earnings and losses will get ARB rewards.

- one hundred,000 ARB (five%): They will be distributed as a reward to customers when they check out and experiment with new protocols that have been integrated into the Pendle ecosystem on Arbitrum, as a result stimulating customers to enhance their holding of Pendle assets.

User rankings with substantial trading volume and greater net revenue and reduction will get ARB rewards from Pendle. Photo taken at seven.20pm on October 13, 2023

User rankings with substantial trading volume and greater net revenue and reduction will get ARB rewards from Pendle. Photo taken at seven.20pm on October 13, 2023

Pendle Finance or Pendle is a DeFi protocol produced on Ethereum that will allow customers to tokenize and trade long term asset staking earnings as a result of an AMM mechanism. With Pendle Finance, customers can flexibly apply numerous distinct techniques to optimize the returns of their assets.

Pendle is 35th Launchpool project of the primary cryptocurrency exchange Binance. This DeFi protocol, a month later on on August 23, 2023, also acquired a strategic investment from the Binance Labs Incubation Fund.

A representative from Binance Labs commented that the investment in Pendle will reaffirm its dedication to cultivating prospective breakthroughs in the cryptocurrency marketplace and will also assist Pendle put into action its revenue optimization method across numerous varied ecosystems, opening up capital optimization options each for person and institutional traders.

More a short while ago, they also determined to launch a solution based mostly on Real World Asset (RWA), a prospective narrative. Both the protocol’s RWA and fixed return goods assistance Spark Protocol’s sDAI and Flux Finance’s fUSDC.

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!