[ad_1]

The recent drop in PEPE price resulted in a wave of liquidation for traders holding long positions in the Meme Coin futures market. Over the past three days, more than $7 million worth of long positions have been liquidated, creating significant losses for bullish traders.

If the downtrend continues in the short term, PEPE long holders could face further losses. Here’s why.

PEPE Price Drop Leads to $7.7 Million in Liquidation

PEPE prices have decreased continuously in recent days. Meme Coin is trading at $0.000017 at the time of writing, down 14% in the past seven days.

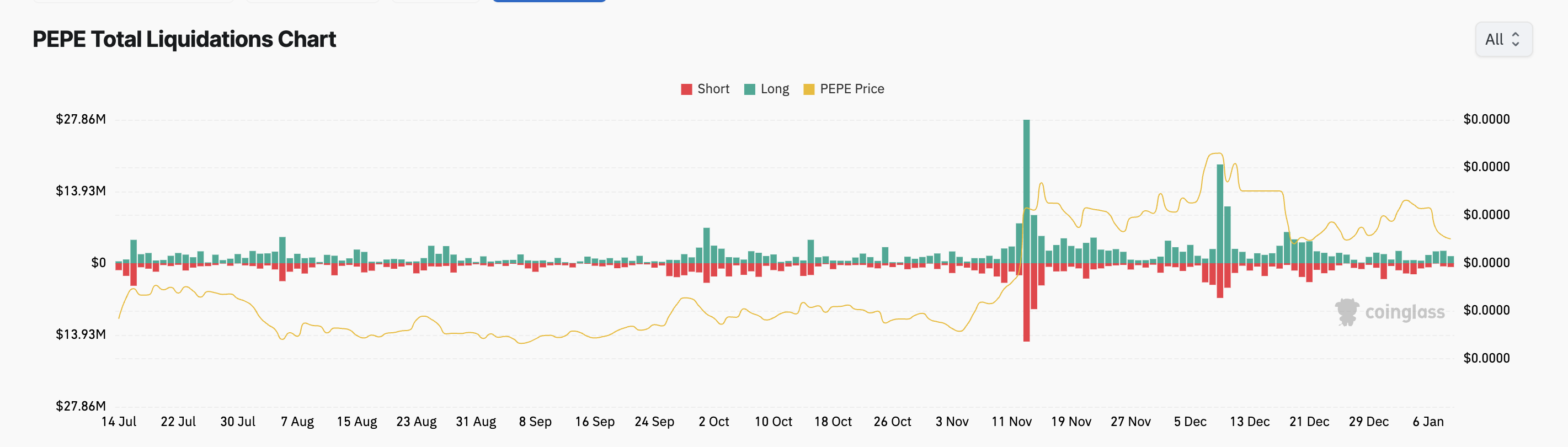

The price drop has triggered a wave of PEPE long position liquidations in the futures market, totaling as much as $7.73 million since January 6, according to data from Coinglass.

Liquidation occurs in the derivatives market of an asset when the price moves against the trader’s position, forcing the position to be closed due to insufficient funds to maintain it.

Liquidation of long positions occurs when traders who bet on price increases are forced to sell assets at lower prices to cover losses. This usually happens when the asset value falls below a key level, forcing long traders out of the market.

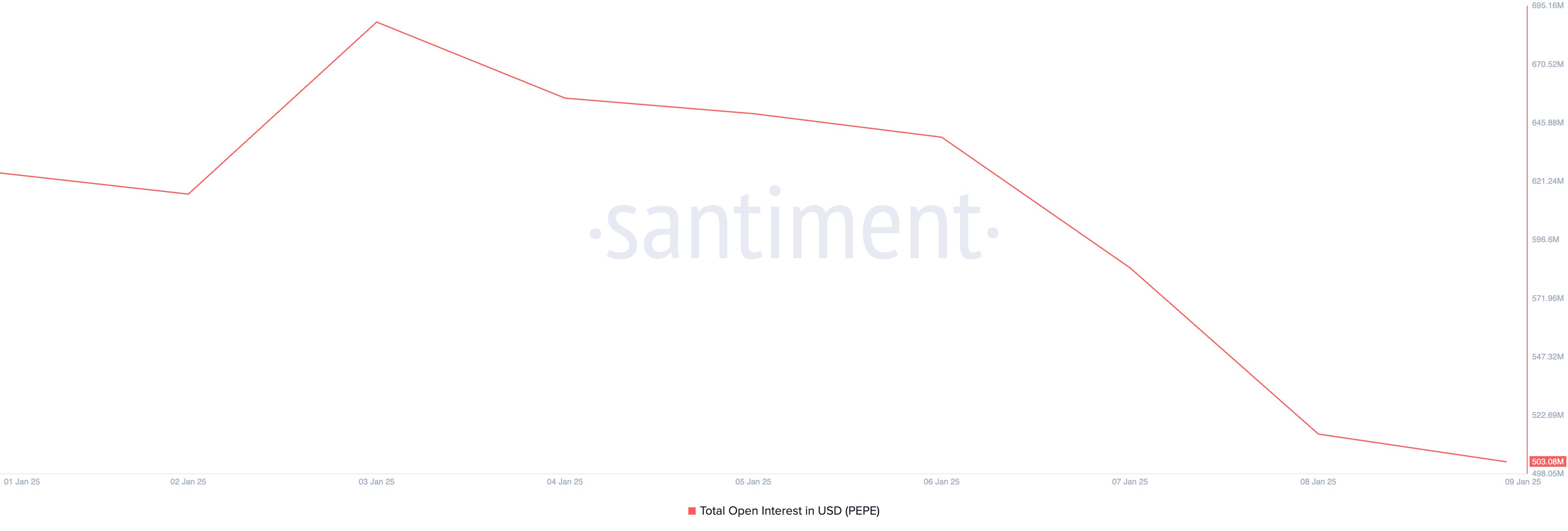

Additionally, PEPE’s open interest has decreased in recent days. This highlights the low trading activity around Meme Coin and contributes to the ongoing price decline. At the time of writing, open interest was $503 million, down 19% over the past week.

Open interest refers to the total number of outstanding contracts or positions in the derivatives market of a particular asset that have not been settled. When it falls, it shows that traders are closing their positions, indicating reduced market participation.

PEPE Price Prediction: Downward Momentum Continues

PEPE continues to trade below a bearish resistance level on the daily chart. This pattern is formed when the asset price makes a series of lower highs, indicating a downtrend.

When an asset trades below this line, it signals sustained bearish momentum and indicates that continued downward pressure is likely. If this trend continues, PEPE price could drop to $0.000015.

Conversely, if buying pressure increases, Meme Coin’s price could break above the downside resistance, creating resistance at $0.000020.

General Bitcoin News

[ad_2]