Although 2021 has observed Bitcoin (BTC), Ethereum (ETH) and quite a few other tier one blockchains demonstrate their dominance with amazing ATH, it seems that Polkadot (DOT) is nonetheless really modest.

Over the previous twelve months, though BTC has posted a acquire of close to 25%, the DOT has surpassed 160%, commencing with the value that was traded at press time. Not only that, a expanding quantity of not long ago published research have proven that institutions and retail operators have continued to diversify their DOT investment packages.

Previously, quite a few classic monetary institutions, such as total banking institutions, hedge money and some others engaged in the “investment war” by means of Bitcoin, will assessment it in 2021. Number of firms over exploring the cryptocurrency business utilizing Polkadot.

These include things like Dubai-based mostly investment fund FD7, which offered in excess of $ 750 million really worth of Bitcoin to acquire ADA and DOT, Swiss financial institution SEBA launched a DOT staking products, and Europe’s biggest telecommunications group. also bought a substantial quantity of DOTs, joining blockchain assistance as a validator for technique provisioning, safe operation, and upkeep.

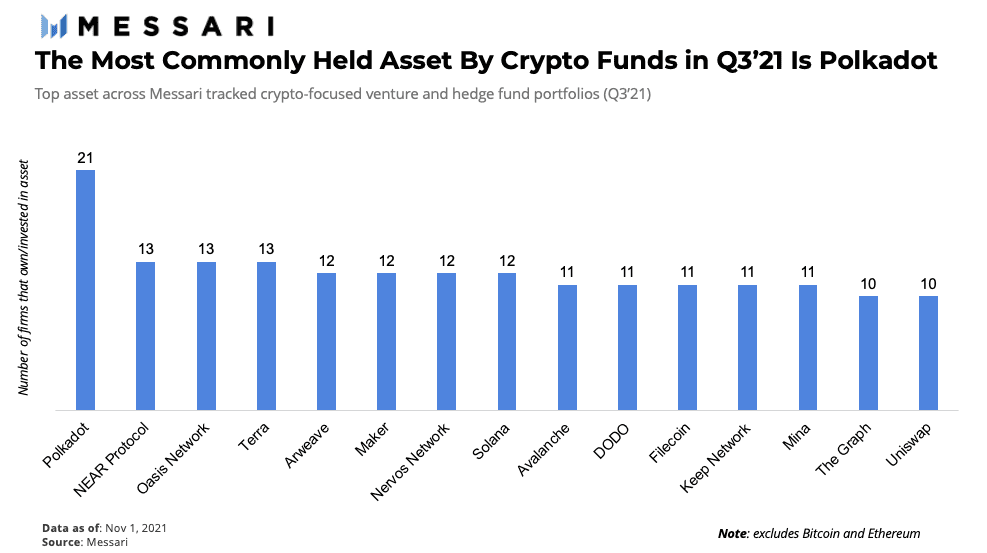

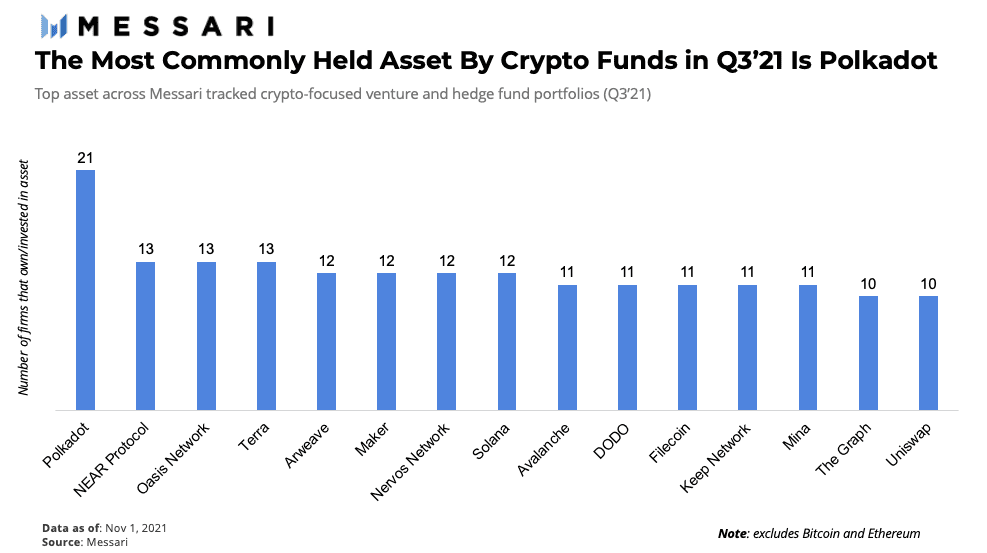

In this regard, a report by the effectively-acknowledged blockchain evaluation company Messari unveiled that 21 of the 53 most renowned fund managers in the globe actively invested in DOT in the third quarter of 2021, generating trading awareness a single of the most sought just after assets. from other well-known platforms this kind of as Near Protocol (Close to), Terra (LUNA) and Oasis Network (ROSE).

One of the most important motives behind Polkadot’s expanding development is the large relevance of cross-chain interoperability, an facet of cryptocurrency technological innovation that most specialists feel will carry on to define the long term of this quickly expanding room.

Regarding Polkadot’s first operational design and style, the undertaking makes use of a exclusive idea, termed “Parachain”, which enables a multilayer blockchain one assistance platform to operate with each other with DOT’s core blockchain. To get an overview of how Polkadot operates, go through the comprehensive reference in the posting under:

The over setup can mitigate quite a few of the transaction bottlenecks encountered by big tasks like Ethereum, whose fuel charges carry on to continue to be really large at close to $ forty even however the platform has gone by means of some challenging occasions. significant EIP-1559.

Not only that, with the implementation of ETH2. nonetheless really far away, in the recent iteration Ethereum can only manage close to thirty transactions per 2nd (tps), which is substantially reduce than Polkadot’s recent working capability of 170 tps.

– See far more:Polkadot (DOT) founder guarantees an era of technological innovation that surpasses Ethereum (ETH)

Another facet of getting ready to gauge Polkadot’s extended-phrase probable is that the ever-expanding pool of large-good quality developers has continued to switch to DOT on behalf of other large-title tasks. A review by Electric Capital demonstrates that Polkadot presently has a single of the biggest developer ecosystems in the Web3 room.

Furthermore, Polkadot’s development charge is a lot a lot quicker than Ethereum’s when evaluating the historical similarities of each platforms. Not only that, the project’s network growth has outpaced other ecosystems, with load productivity remaining at six,700%.

Emerging tasks this kind of as Avalanche (AVAX), Binance Smart Chain (BSC) or Solana (SOL) are also operating challenging to market DeFi, generating the sector a lot far more desirable to traders.Normally, it would not be feasible to garner the traction of a quantity. better than developers like Polkadot.

The initially parachain auction officially closed with five tasks, Acala, Moonbeam (GLMR), Astar Network, Parallel Finance (PARA) and Clover (CLV), all of which had been distributed to the Polkadot network, with somewhere around 106 million DOTs, they signify 9% of the complete give. Currently, the Polkadot chain guard rod has just returned with its 2nd set of types and Efinity (EFI) is the initially winner.

At the similar time, somewhere around $ two.72 billion of DOT was frozen in two many years, or far more than ten% of DOT’s complete capitalization. Assuming the trend continues, there is a chance that the quantity will improve to involving $ four and $ four.five billion, therefore assisting DOT to lower the marketing strain and to some extent restrict the provide circulating in the industry.

This not only demonstrates investor self confidence in DOT in the course of that time, but also encourages hundreds of 1000’s of supporters to turn into energetic consumers of the ecosystem in their very best interests. However, the springboard is also meticulously ready for the new brand identity launched by DOT in January 2022.

Coin Summary 68

Maybe you are interested:

Although 2021 has observed Bitcoin (BTC), Ethereum (ETH) and quite a few other tier one blockchains demonstrate their dominance with amazing ATH, it seems that Polkadot (DOT) is nonetheless really modest.

Over the previous twelve months, though BTC has posted a acquire of close to 25%, the DOT has surpassed 160%, commencing with the value that was traded at press time. Not only that, a expanding quantity of not long ago published research have proven that institutions and retail operators have continued to diversify their DOT investment packages.

Previously, quite a few classic monetary institutions, such as total banking institutions, hedge money and some others engaged in the “investment war” by means of Bitcoin, will assessment it in 2021. Number of firms over exploring the cryptocurrency business utilizing Polkadot.

These include things like Dubai-based mostly investment fund FD7, which offered in excess of $ 750 million really worth of Bitcoin to acquire ADA and DOT, Swiss financial institution SEBA launched a DOT staking products, and Europe’s biggest telecommunications group. also bought a substantial quantity of DOTs, joining blockchain assistance as a validator for technique provisioning, safe operation, and upkeep.

In this regard, a report by the effectively-acknowledged blockchain evaluation company Messari unveiled that 21 of the 53 most renowned fund managers in the globe actively invested in DOT in the third quarter of 2021, generating trading awareness a single of the most sought just after assets. from other well-known platforms this kind of as Near Protocol (Close to), Terra (LUNA) and Oasis Network (ROSE).

One of the most important motives behind Polkadot’s expanding development is the large relevance of cross-chain interoperability, an facet of cryptocurrency technological innovation that most specialists feel will carry on to define the long term of this quickly expanding room.

Regarding Polkadot’s first operational design and style, the undertaking makes use of a exclusive idea, termed “Parachain”, which enables a multilayer blockchain one assistance platform to operate with each other with DOT’s core blockchain. To get an overview of how Polkadot operates, go through the comprehensive reference in the posting under:

The over setup can mitigate quite a few of the transaction bottlenecks encountered by big tasks like Ethereum, whose fuel charges carry on to continue to be really large at close to $ forty even however the platform has gone by means of some challenging occasions. significant EIP-1559.

Not only that, with the implementation of ETH2. nonetheless really far away, in the recent iteration Ethereum can only manage close to thirty transactions per 2nd (tps), which is substantially reduce than Polkadot’s recent working capability of 170 tps.

– See far more:Polkadot (DOT) founder guarantees an era of technological innovation that surpasses Ethereum (ETH)

Another facet of getting ready to gauge Polkadot’s extended-phrase probable is that the ever-expanding pool of large-good quality developers has continued to switch to DOT on behalf of other large-title tasks. A review by Electric Capital demonstrates that Polkadot presently has a single of the biggest developer ecosystems in the Web3 room.

Furthermore, Polkadot’s development charge is a lot a lot quicker than Ethereum’s when evaluating the historical similarities of each platforms. Not only that, the project’s network growth has outpaced other ecosystems, with load productivity remaining at six,700%.

Emerging tasks this kind of as Avalanche (AVAX), Binance Smart Chain (BSC) or Solana (SOL) are also operating challenging to market DeFi, generating the sector a lot far more desirable to traders.Normally, it would not be feasible to garner the traction of a quantity. better than developers like Polkadot.

The initially parachain auction officially closed with five tasks, Acala, Moonbeam (GLMR), Astar Network, Parallel Finance (PARA) and Clover (CLV), all of which had been distributed to the Polkadot network, with somewhere around 106 million DOTs, they signify 9% of the complete give. Currently, the Polkadot chain guard rod has just returned with its 2nd set of types and Efinity (EFI) is the initially winner.

At the similar time, somewhere around $ two.72 billion of DOT was frozen in two many years, or far more than ten% of DOT’s complete capitalization. Assuming the trend continues, there is a chance that the quantity will improve to involving $ four and $ four.five billion, therefore assisting DOT to lower the marketing strain and to some extent restrict the provide circulating in the industry.

This not only demonstrates investor self confidence in DOT in the course of that time, but also encourages hundreds of 1000’s of supporters to turn into energetic consumers of the ecosystem in their very best interests. However, the springboard is also meticulously ready for the new brand identity launched by DOT in January 2022.

Coin Summary 68

Maybe you are interested: