President Joe Biden assured his citizens that the US banking procedure remained harmless right after the speedy collapse of Signature Bank and Silicon Valley Bank.

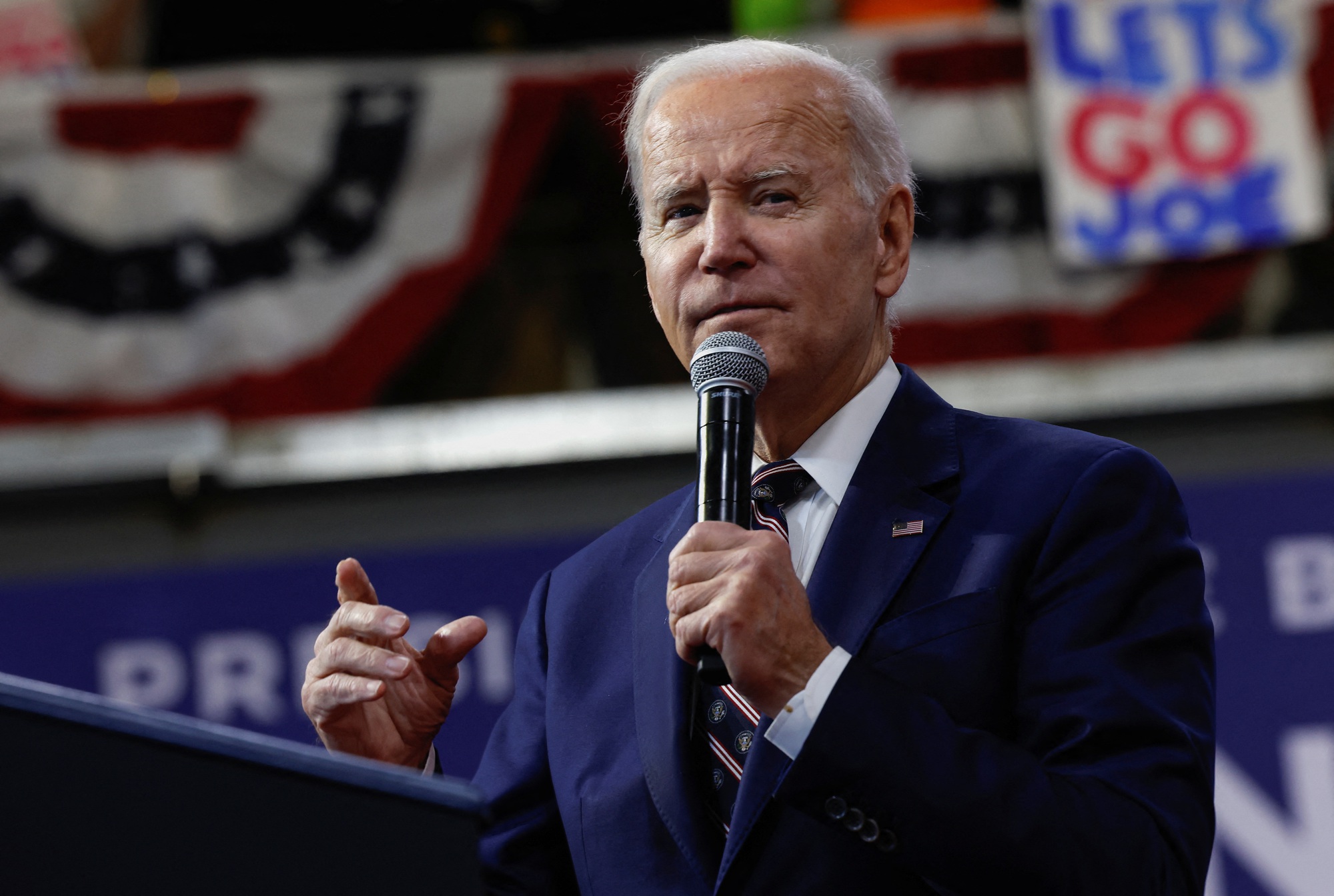

On the morning of March 13 (neighborhood time), President Joe Biden informed the White House that:

“People can rest assured that our American banking procedure is harmless. All shoppers who have deposited funds in these banking institutions will be protected and will get their funds back from now. I assure you that we will carry on to do what ever is needed to carry the circumstance beneath management.”

“The management of these banks will be fired,” President Biden says right after consecutive financial institution failures. https://t.co/hsB37sB2uC pic.twitter.com/AoSvc0ZaLM

—CNN (@CNN) March 13, 2023

Mr. Biden also repeated his earlier statement that US officials will induce no harm to impacted staff and little firms, though refusing to bail out US Silicon Valley Bank (SVB) traders and bondholders. This remedy also guarantees that taxpayers’ funds is not at possibility.

The US president also pledged to hold people concerned accountable and accountable for previous scandals and to strengthen oversight of the money procedure to avoid this circumstance from taking place once again.

“The management of Signature Bank and Silicon Valley Bank will be fired, and investors in these banks will not receive government support.”

Mr. Biden’s remarks, US Treasury Secretary Yellen and other brief moves announced by officials above the weekend, all aimed at stopping the collapse of Silicon Valley Bank.

Though small regarded outdoors of Silicon Valley, SVB is a industrial financial institution that gives loans to virtually half of US tech startups and healthcare firms. Currently, this financial institution manages above $200 billion in assets it grew to become the greatest US financial institution to fail right after the 2008 money crisis. Thus, the collapse of SVB drew worldwide awareness to the scale and knock-on result it could have on the banking and technologies sectors.

California officials and the Federal Deposit Insurance Corporation (FDIC) had to do this intervene, shut down SVB, confiscate and liquidate assets exactly on March 10th, right after the mass withdrawal of traders. Many individuals are hoping that a billionaire or some other organization will attain out to assistance SVB, a financial institution that has been devoted to serving the tech marketplace for a lot more than forty many years.

On the morning of March twelve, the New York State Administration had to do it Signature Bank (SB) Closing Orderproducing this the third greatest financial institution failure in US background.

Synthetic currency68

Maybe you are interested: