What is the Goldfinch Protocol (GFI)?

Goldfinch protocol is a decentralized credit score protocol with the mission of expanding entry to capital and advertising monetary inclusion. Cryptocurrency Lending Protocol Without Cryptocurrency Guarantee. This is the missing piece that has eventually opened crypto loan to practically all people in the globe. The Goldfinch local community grants loans to companies close to the globe, beginning with emerging markets.

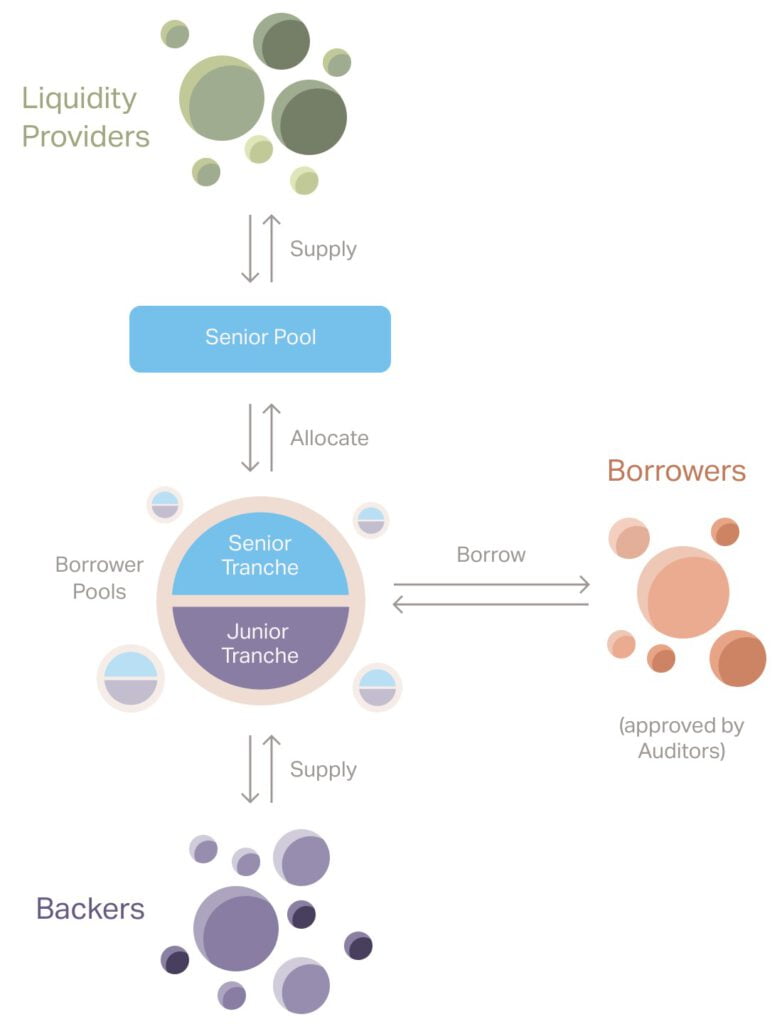

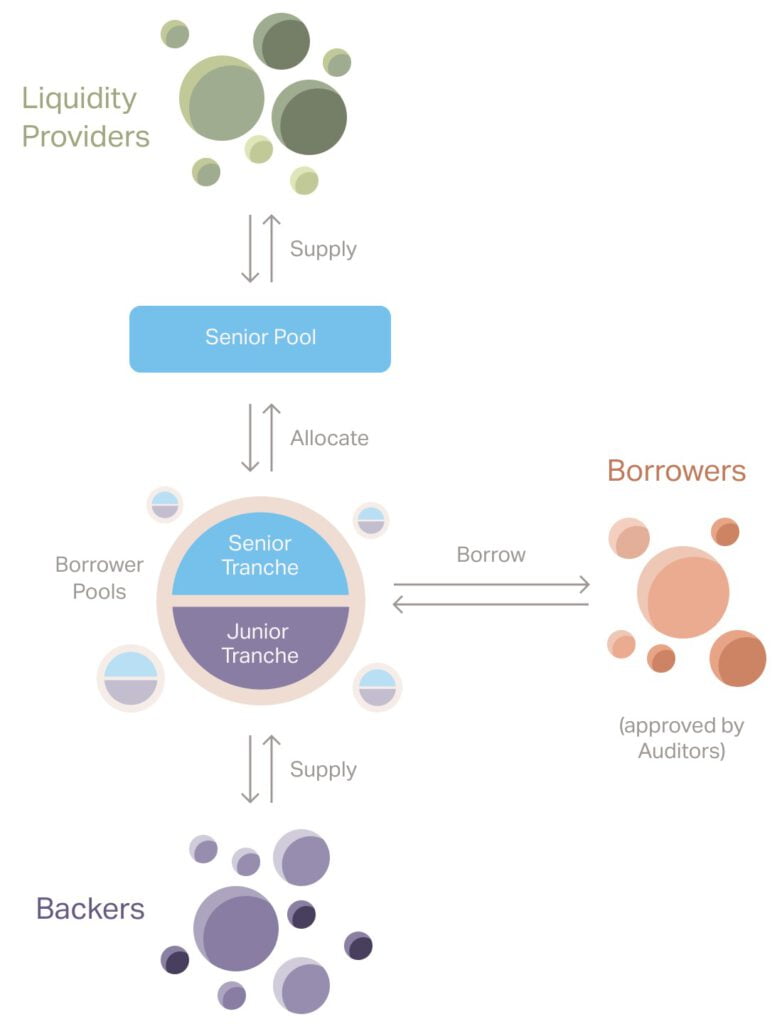

How the Goldfinch protocol functions

The protocol has 4 most important gamers:

- Borrowers are participating in loan seekers and advise the borrower pool for loan company evaluation. The borrower pool includes the terms that the borrower seems to be for, this kind of as curiosity costs and repayment deadlines.

- The loan company evaluates the borrower’s profile and decides no matter whether to supply money. After the Backer gives the principal, the Borrower can borrow and repay by way of the Borrower Pool.

- Liquidity companies supply capital to the Senior Pool to make passive revenue. The Senior Pool utilizes a leverage model to instantly allocate capital to borrowers, primarily based on the variety of lenders participating in it. When the Senior Pool allocates capital, aspect of its revenue will be reallocated to the Backer. This increases Backer’s efficient return, which incentivizes them each to supply initial-reduction capital with larger threat and to do the do the job of evaluating the pool of borrowers.

- Finally, the Auditor votes to approve the Borrower, which is needed in advance of he can borrow. Auditors are randomly chosen by the protocol and supply human-degree scrutiny to secure towards fraudulent action.

Basic details about the GFI token

- Token identify: Goldfinch

- Ticker: GFI

- Blockchain: Ethereum

- Token typical: ERC-twenty

- To contract: 0xdab396ccf3d84cf2d07c4454e10c8a6f5b008d2b

- Token style: Utility, Governance

- Total provide: 114.285.715 GFI

- Circulating provide: five,072,300 GFI

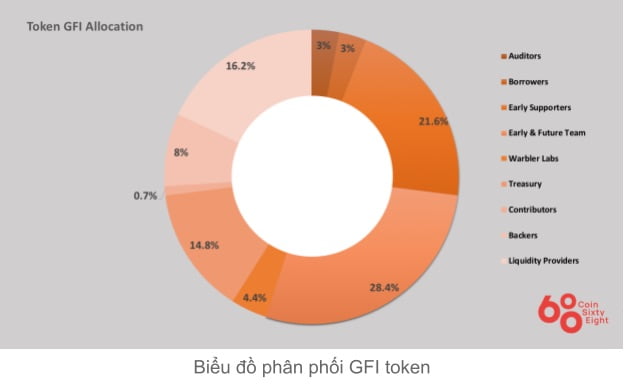

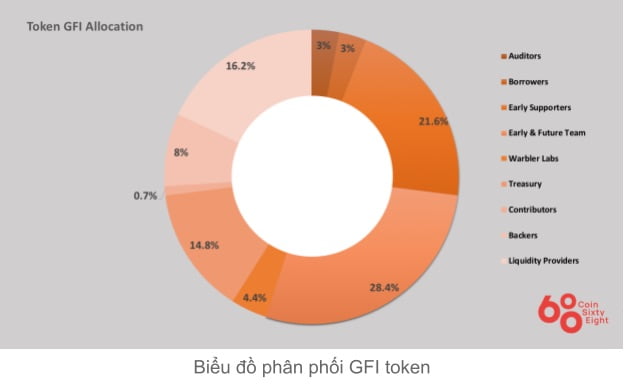

Token allocation

- Verify: three%

- Borrower: three%

- Early stage undertaking facilitators: 21.six%

- Squad: 28.four%

- Warber Laboratories: four.four%

- Treasure: 14.eight%

- Contributors: .seven%

- Investors: eight%

- Liquidity supplier: sixteen.two%

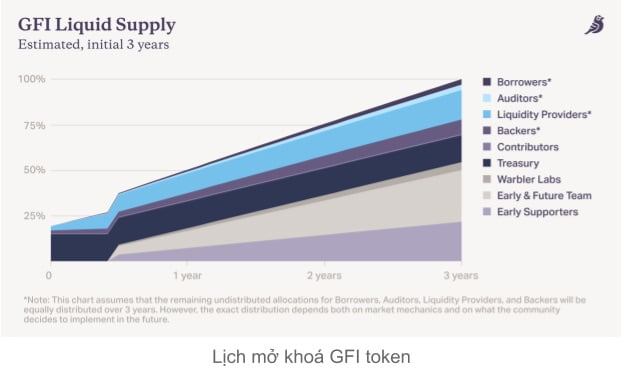

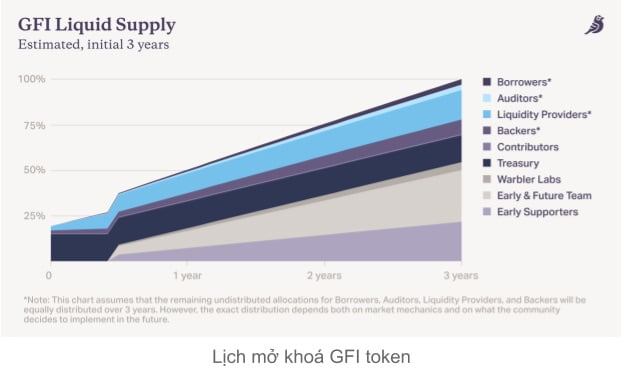

Token release plan

What is the GFI token for?

Community administration: GFI token holders participate in governance to choose the path of the protocol. This attribute is now obtainable on gov.goldfinch.finance.

Supporter staking: Backers can stake their GFI tokens on particular backers to signal consent in advance when people backers join the borrower pool. This GFI also acts as a platform towards possible liabilities.

Review vote: A evaluate vote is needed to grant the Borrower the proper to borrow from the protocol. Borrowers spend for these votes with GFI tokens.

Encourage attendees: All participants acquire prizes to incentivize their participation. Participants consist of: Liquidity Provider Providing the Borrower Pool, Backer Providing the Borrower Pool and Staking for Other Lenders, Auditors Helping to Participate in the Vote, and Borrower Successfully Repaying the Pool to them.

Community sponsorship: The local community may perhaps choose to supply grants to participants who make sizeable contributions to the Goldfinch protocol and ecosystem.

GFI Token Storage Wallet

GFI is an ERC20 token, so you will have several wallet choices to keep this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 Wallet

- Cool wallets: Ledger, Trezor

How to earn and personal GFI tokens

Buy immediately on the stock exchange.

Where to obtain and promote GFI tokens?

Currently, GFI is traded on several unique exchanges with a complete day by day trading volume of somewhere around USD 70.two million. Exchanges listing this token consist of: Coinbase Exchanges, MEXC, Gate.io, Uniswap.

Roadmap

Updating

Investors

Partner of the Goldfinch Protocol undertaking

What is the potential of the Goldfinch Protocol undertaking, need to I invest in GFI tokens or not?

Goldfinch protocol is an unsecured lending protocol, the undertaking has acquired investment from key traders and presently has collaborated with several partners in several unique nations this kind of as PAYJOY, Aspire, QuickCheck, ALMA. Through this write-up, you will have to have by some means grasped the essential details about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a great deal from this possible industry.

What is the Goldfinch Protocol (GFI)?

Goldfinch protocol is a decentralized credit score protocol with the mission of expanding entry to capital and advertising monetary inclusion. Cryptocurrency Lending Protocol Without Cryptocurrency Guarantee. This is the missing piece that has eventually opened crypto loan to practically all people in the globe. The Goldfinch local community grants loans to companies close to the globe, beginning with emerging markets.

How the Goldfinch protocol functions

The protocol has 4 most important gamers:

- Borrowers are participating in loan seekers and advise the borrower pool for loan company evaluation. The borrower pool includes the terms that the borrower seems to be for, this kind of as curiosity costs and repayment deadlines.

- The loan company evaluates the borrower’s profile and decides no matter whether to supply money. After the Backer gives the principal, the Borrower can borrow and repay by way of the Borrower Pool.

- Liquidity companies supply capital to the Senior Pool to make passive revenue. The Senior Pool utilizes a leverage model to instantly allocate capital to borrowers, primarily based on the variety of lenders participating in it. When the Senior Pool allocates capital, aspect of its revenue will be reallocated to the Backer. This increases Backer’s efficient return, which incentivizes them each to supply initial-reduction capital with larger threat and to do the do the job of evaluating the pool of borrowers.

- Finally, the Auditor votes to approve the Borrower, which is needed in advance of he can borrow. Auditors are randomly chosen by the protocol and supply human-degree scrutiny to secure towards fraudulent action.

Basic details about the GFI token

- Token identify: Goldfinch

- Ticker: GFI

- Blockchain: Ethereum

- Token typical: ERC-twenty

- To contract: 0xdab396ccf3d84cf2d07c4454e10c8a6f5b008d2b

- Token style: Utility, Governance

- Total provide: 114.285.715 GFI

- Circulating provide: five,072,300 GFI

Token allocation

- Verify: three%

- Borrower: three%

- Early stage undertaking facilitators: 21.six%

- Squad: 28.four%

- Warber Laboratories: four.four%

- Treasure: 14.eight%

- Contributors: .seven%

- Investors: eight%

- Liquidity supplier: sixteen.two%

Token release plan

What is the GFI token for?

Community administration: GFI token holders participate in governance to choose the path of the protocol. This attribute is now obtainable on gov.goldfinch.finance.

Supporter staking: Backers can stake their GFI tokens on particular backers to signal consent in advance when people backers join the borrower pool. This GFI also acts as a platform towards possible liabilities.

Review vote: A evaluate vote is needed to grant the Borrower the proper to borrow from the protocol. Borrowers spend for these votes with GFI tokens.

Encourage attendees: All participants acquire prizes to incentivize their participation. Participants consist of: Liquidity Provider Providing the Borrower Pool, Backer Providing the Borrower Pool and Staking for Other Lenders, Auditors Helping to Participate in the Vote, and Borrower Successfully Repaying the Pool to them.

Community sponsorship: The local community may perhaps choose to supply grants to participants who make sizeable contributions to the Goldfinch protocol and ecosystem.

GFI Token Storage Wallet

GFI is an ERC20 token, so you will have several wallet choices to keep this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 Wallet

- Cool wallets: Ledger, Trezor

How to earn and personal GFI tokens

Buy immediately on the stock exchange.

Where to obtain and promote GFI tokens?

Currently, GFI is traded on several unique exchanges with a complete day by day trading volume of somewhere around USD 70.two million. Exchanges listing this token consist of: Coinbase Exchanges, MEXC, Gate.io, Uniswap.

Roadmap

Updating

Investors

Partner of the Goldfinch Protocol undertaking

What is the potential of the Goldfinch Protocol undertaking, need to I invest in GFI tokens or not?

Goldfinch protocol is an unsecured lending protocol, the undertaking has acquired investment from key traders and presently has collaborated with several partners in several unique nations this kind of as PAYJOY, Aspire, QuickCheck, ALMA. Through this write-up, you will have to have by some means grasped the essential details about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a great deal from this possible industry.