What is the IPOR protocol (IPOR)?

IPOR is a lending platform that presents end users the means to customize their loans at reduced curiosity prices than existing fixed charge merchandise.

The core IPOR infrastructure consists of 3 key elements:

- IPOR Index (Index),

- ADM

- Resource management of clever contracts.

Components of the IPOR protocol

IPOR index

The IPOR index is a benchmark curiosity charge derived from several DeFi credit score protocols. These metrics underpin the IPOR protocol. There will be a number of IPOR indices representing the chance-totally free charge for a respective asset this kind of as IPOR USDT, IPOR USDC, IPOR DAI, IPOR ETH, and so forth. There will also be time based mostly reviews like IPOR USDC 1M, 3M, 6M, and so forth. for every asset to the evolution of the yield curve.

The chance-totally free charge in credit score markets has prolonged been the cornerstone of fiscal markets. This is why IPOR can be witnessed as a critical element of DeFi. “The benchmark curiosity charge worth derives not only from its means to aggregate credit score markets into a single measure, but also as an asset. on which derivatives, fiscal instruments and transactions can be structured. The worth of the IPOR will rely on each the amount and good quality of index-based mostly assets and the IPOR DAO will govern the advancement of indices this kind of as public products which deliver transparency and utility to industry.

ADM

Liquidity Pool and AMM join forces to kind a widespread trading companion. Depositors can revenue from deposits by giving liquidity to industry participants. In return, liquidity companies obtain a professional rata share of the net contract payments, contractual charges and leveraged chance-totally free returns from funds markets.

The AMM is a dynamic pricing mechanism that will take into account the existing IPOR index charge of a offered asset and specified industry-driven information to worth instruments. The perform of AMM’s dynamic pricing is to deal with the LP chance.

In addition to the over functions, AMM also supports curiosity charge swaps.

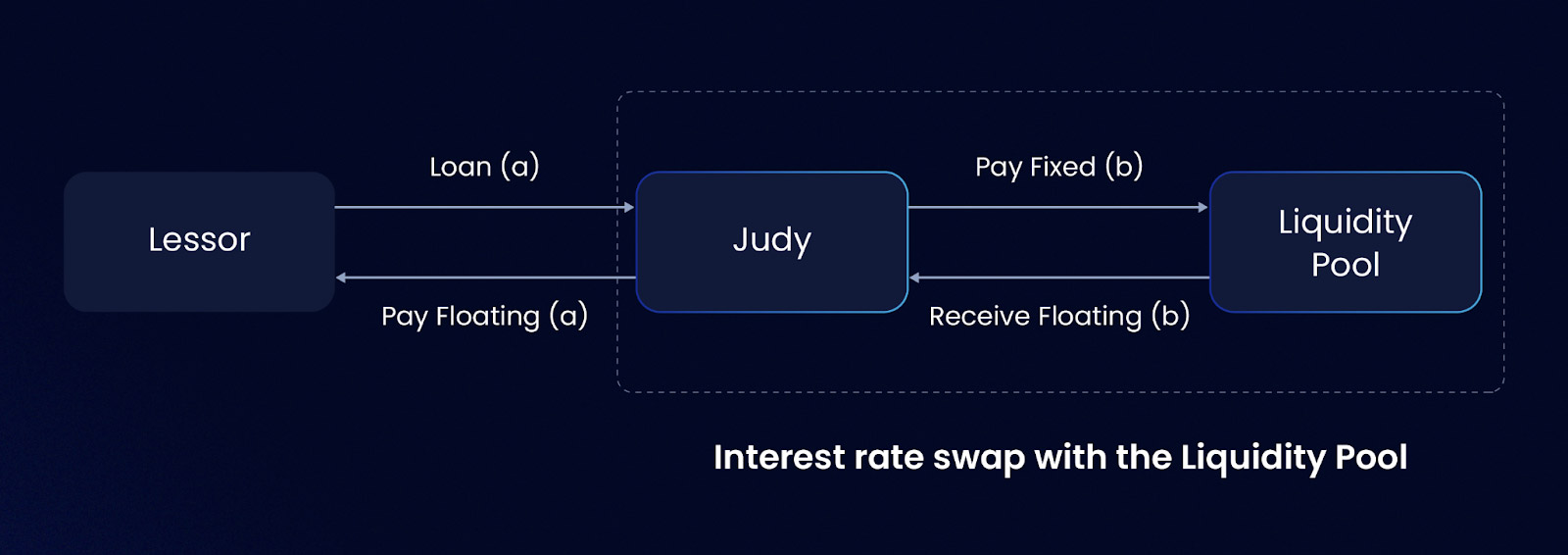

What is the exchange of interests?

IPOR Interest Rate Swaps (IRS) are the underlying derivative item of IPOR. The IRS lets industry participants to turn out to be Payers or Receivers and execute a contract towards the liquidity pool.

Once the payer or recipient has accepted the contract quoted by AMM, they will pay out the quantity of margin (escrow), contractual charge and network charge applicable to enter into the contract by means of derivatives. The liquidity pool will set aside an equal quantity of collateral to cover all payment obligations. Over time the contract will deal with positions and salaries. Once closed, it will pay out the respective quantity (s) to the events.

Smart contract for resource management

When liquidity companies and traders use the IPOR protocol, AMM keeps the stablecoins managed. This incorporates each the LP stablecoin and the ensure made available by traders. These money are made use of to make payments among liquidity pools and swap recipients. The money will have to be held to guarantee the solvency of the contracts. However, this is only needed when the money are transferred among the events.

Ipor knife

The IPOR DAO is built to be a totally on-chain governance mechanism that lets local community token holders to make protocol choices relating to advancement, upkeep, upgrades, proceeds and funding.

Basic facts about the IPOR token

- Token title: IPOR protocol

- Ticker: IPOR

- Blockchain: Ethereum

- Token typical: ERC-twenty

- To contract: Updating

- Token kind: Utility, Governance

- Total provide: Updating

- Circulating provide: Updating

Token allocation

Updating

Token release system

Updating

What is the IPOR token made use of for?

Administration

IPOR Token Storage Wallet

IPOR is an ERC20 token, so you will have lots of wallet selections to retail outlet this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 Wallet

- Cool wallets: Ledger, Trezor

How to earn and personal IPOR tokens

Updating

Where to purchase and promote IPOR tokens?

Updating

Roadmap

Updating

Investors

What is the potential of the IPOR Protocol undertaking, do I have to invest in IPOR tokens?

IPOR Protocol is a protocol that lets end users to borrow funds at a reduced curiosity charge than fixed-charge merchandise on the industry. Through this write-up, you will have to have by some means grasped the primary facts about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you good results and earn a great deal from this possible industry.

What is the IPOR protocol (IPOR)?

IPOR is a lending platform that presents end users the means to customize their loans at reduced curiosity prices than existing fixed charge merchandise.

The core IPOR infrastructure consists of 3 key elements:

- IPOR Index (Index),

- ADM

- Resource management of clever contracts.

Components of the IPOR protocol

IPOR index

The IPOR index is a benchmark curiosity charge derived from several DeFi credit score protocols. These metrics underpin the IPOR protocol. There will be a number of IPOR indices representing the chance-totally free charge for a respective asset this kind of as IPOR USDT, IPOR USDC, IPOR DAI, IPOR ETH, and so forth. There will also be time based mostly reviews like IPOR USDC 1M, 3M, 6M, and so forth. for every asset to the evolution of the yield curve.

The chance-totally free charge in credit score markets has prolonged been the cornerstone of fiscal markets. This is why IPOR can be witnessed as a critical element of DeFi. “The benchmark curiosity charge worth derives not only from its means to aggregate credit score markets into a single measure, but also as an asset. on which derivatives, fiscal instruments and transactions can be structured. The worth of the IPOR will rely on each the amount and good quality of index-based mostly assets and the IPOR DAO will govern the advancement of indices this kind of as public products which deliver transparency and utility to industry.

ADM

Liquidity Pool and AMM join forces to kind a widespread trading companion. Depositors can revenue from deposits by giving liquidity to industry participants. In return, liquidity companies obtain a professional rata share of the net contract payments, contractual charges and leveraged chance-totally free returns from funds markets.

The AMM is a dynamic pricing mechanism that will take into account the existing IPOR index charge of a offered asset and specified industry-driven information to worth instruments. The perform of AMM’s dynamic pricing is to deal with the LP chance.

In addition to the over functions, AMM also supports curiosity charge swaps.

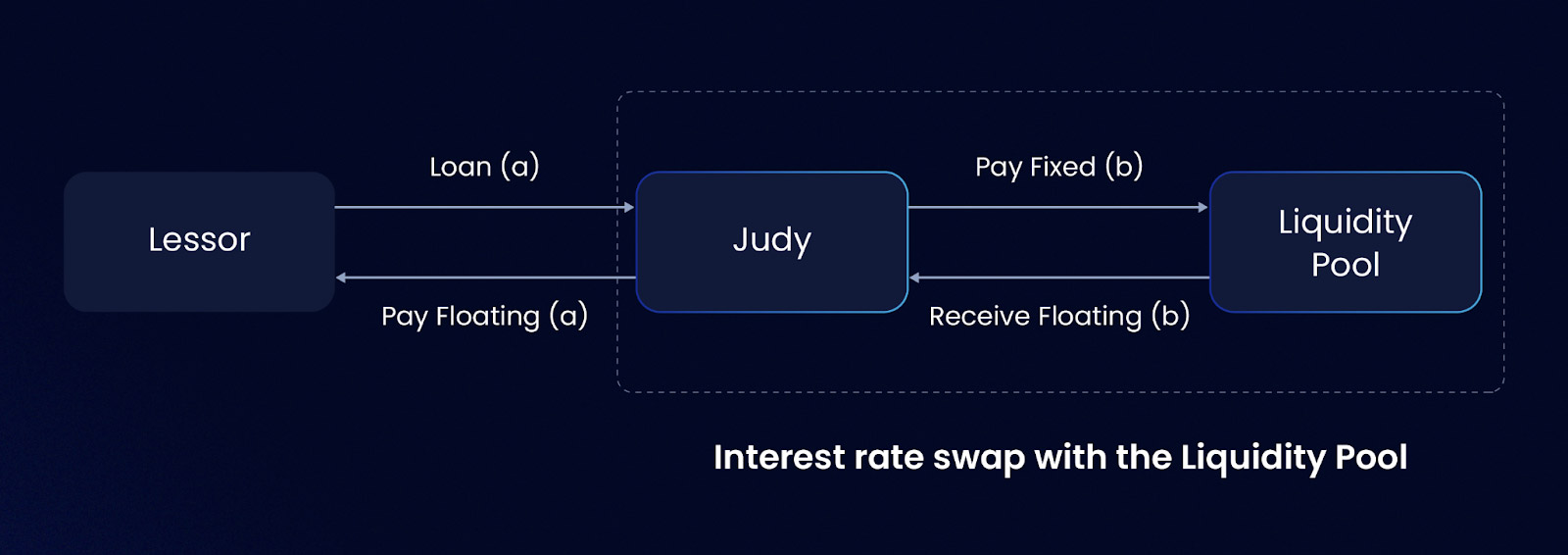

What is the exchange of interests?

IPOR Interest Rate Swaps (IRS) are the underlying derivative item of IPOR. The IRS lets industry participants to turn out to be Payers or Receivers and execute a contract towards the liquidity pool.

Once the payer or recipient has accepted the contract quoted by AMM, they will pay out the quantity of margin (escrow), contractual charge and network charge applicable to enter into the contract by means of derivatives. The liquidity pool will set aside an equal quantity of collateral to cover all payment obligations. Over time the contract will deal with positions and salaries. Once closed, it will pay out the respective quantity (s) to the events.

Smart contract for resource management

When liquidity companies and traders use the IPOR protocol, AMM keeps the stablecoins managed. This incorporates each the LP stablecoin and the ensure made available by traders. These money are made use of to make payments among liquidity pools and swap recipients. The money will have to be held to guarantee the solvency of the contracts. However, this is only needed when the money are transferred among the events.

Ipor knife

The IPOR DAO is built to be a totally on-chain governance mechanism that lets local community token holders to make protocol choices relating to advancement, upkeep, upgrades, proceeds and funding.

Basic facts about the IPOR token

- Token title: IPOR protocol

- Ticker: IPOR

- Blockchain: Ethereum

- Token typical: ERC-twenty

- To contract: Updating

- Token kind: Utility, Governance

- Total provide: Updating

- Circulating provide: Updating

Token allocation

Updating

Token release system

Updating

What is the IPOR token made use of for?

Administration

IPOR Token Storage Wallet

IPOR is an ERC20 token, so you will have lots of wallet selections to retail outlet this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 Wallet

- Cool wallets: Ledger, Trezor

How to earn and personal IPOR tokens

Updating

Where to purchase and promote IPOR tokens?

Updating

Roadmap

Updating

Investors

What is the potential of the IPOR Protocol undertaking, do I have to invest in IPOR tokens?

IPOR Protocol is a protocol that lets end users to borrow funds at a reduced curiosity charge than fixed-charge merchandise on the industry. Through this write-up, you will have to have by some means grasped the primary facts about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you good results and earn a great deal from this possible industry.